For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

eToro Editor’s Verdict

eToro established itself among the top 5 social trading brokers. With more than 17 million registered users, eToro provides one of the largest and most active trading communities. I reviewed this company to determine if the trading conditions offered are truly as beneficial as claimed. Is the eToro commission-free stock trading offer as good as it sounds?

Overview

eToro Markets Overview - A Leading Social and Cryptocurrency Broker,This content is not intended for US users. eToro USA LLC does not offer CFDs, only real crypto assets are available.

Headquarters | Israel |

|---|---|

Regulators | ASIC, CySEC, FCA, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2007 |

Execution Type(s) | Market Maker |

Minimum Deposit | $50 - $10,000 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Average Trading Cost GBP/USD | 2.2 pips |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.45 |

Average Trading Cost Bitcoin | $574 |

Retail Loss Rate | 74% |

Minimum Raw Spreads | 0.8 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $0.00 |

Funding Methods | 10(bank wires, credit/debit cards, PayPal, Neteller, Skrill, Rapid Transfer, iDEAL, Klarna/Sofort, Trustly) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

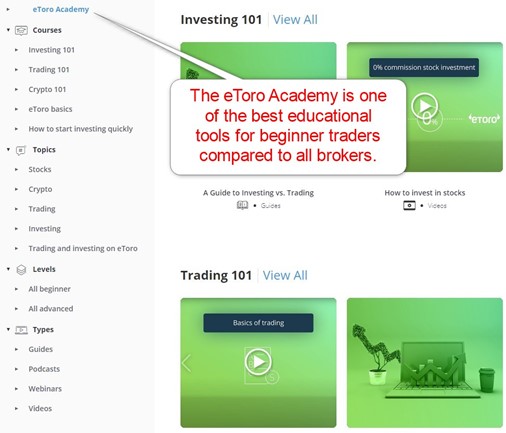

One of the things I like most about eToro is that it started to work on an educational section for beginner traders. I also appreciate its active push into the cryptocurrency sector with the acquisitions of Dutch blockchain company Firmo and Belgian crypto portfolio tracker developer Delta in 2019.

eToro Regulation And Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. eToro presents clients with four regulated entities.

Country of the Regulator | Australia, Cyprus, Seychelles, United Kingdom |

|---|---|

Name of the Regulator | ASIC, CySEC, FCA, FSA |

Regulatory License Number | 491139, 109/10, 583263, SD076 |

eToro segregates client deposits from corporate funds and offers negative balance protection. it will comply with another layer of regulation and financial standards, strengthening its overall security environment.

(1).jpg)

eToro Fees

Average Trading Cost GBP/USD | 2.2 pips |

|---|---|

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.45 |

Average Trading Cost Bitcoin | $574 |

Minimum Raw Spreads | 0.8 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $0.00 |

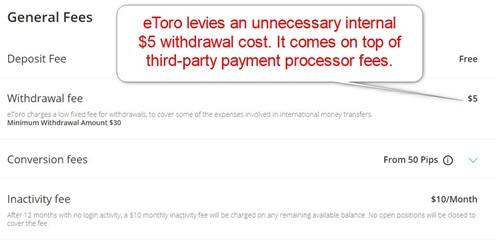

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $10 monthly after 12 monthd |

.jpg)

eToro fees shows Forex spreads as low as 0.8 pips or $8.00 per round lot, but the average is above 1.3 pips or $13.00.

Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.8 pips (minimum) | $0.00 | $8.00 |

1.3 pips (average) | $0.00 | $13.00 |

The tightest spread for the EUR/USD that I uncovered in this review was 0.9 pips or $9.00 per 1.0 standard lot. While eToro advertised commission-free stock trading, I urge traders not to confuse it with CFD trading, where a 0.09% commission applies. Only unleveraged buy positions in shares remain commission-free. The absence of trading commissions at eToro results in higher spreads, and each trader must evaluate the cost structure based on their trading and investing requirements.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the eToro account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.9 pips | $0.00 | $5.80 | X | $14.80 |

0.9 pips | $0.00 | X | $0.90 | $9.90 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.9 pips | $0.00 | $40.60 | X | $49.60 |

0.9 pips | $0.00 | X | $6.30 | $15.30 |

A fee of 1% is added to the spread when buying or selling crypto assets on eToro. This fee is included in the price shown when users open or close a position.

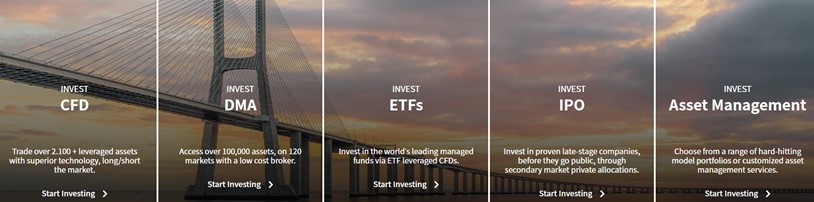

What Can I Trade

eToro offers Forex traders a below-average 49 currency pairs but shines with its 93 cryptocurrency pairs. Other assets include 31 commodity CFDs, 13 index CFDs, 2,000+ equity CFDs, and 258 ETFs. The overall asset selection at eToro is excellent, especially for cryptocurrency and equity CFD traders.

(1).jpg)

eToro Crypto Coins

eToro became a leading cryptocurrency broker over the past few years amid a combination of in-house developments and acquisitions. It launched a stand-alone cryptocurrency wallet in the US and is a leading cryptocurrency broker globally.

Cryptocurrency traders get a user-friendly web-based platform and mobile app from a leading copy trading broker with an active community of 30M+ traders. During our eToro crypto coins review, eToro listed 88 cryptocurrency assets. It also features Delta, the eToro NFT explorer.

Besides cryptocurrency pairs, eToro offers 14 crypto-to-crypto crosses, 1 Bitcoin-gold cross, and 63 crypto currency cross-pairs quoted against non-USD fiat currencies. It allows cryptocurrency traders to deal in EUR, GBP, CHF, CAD, AUD, NZD, and JPY crypto coins, adding another layer of depth and complexity and providing advanced traders with an opportunity for in-depth portfolio diversification, mixing crypto coins and fiat currencies.

Traders get sentiment indicators, showing the trend among eToro clients for all crypto coins. A competitive charting package assists traders with technical analysis, while beginners can access research via the “Analysis” tab. As a leading copy trading provider, eToro reminds cryptocurrency traders that they can copy other traders from the community.

Complementing the superb choice of eToro crypto coins are 17 crypto-focused Smart Portfolios, allowing traders to diversify their capital passively from a minimum commitment of $500. Smart Portfolios are in-house managed portfolios by eToro, enabling crypto traders to focus on specific trends within the vibrant cryptocurrency sector.

The versatility of the eToro crypto coins and crypto-related asset selection elevated eToro among the leading cryptocurrency brokers.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

eToro Leverage

eToro offers retail traders maximum leverage on Forex of 1:30 through all its entities, as per regulations, except for Seychelles, which allows for higher leverage. However, it seems that eToro is only willing to open a Seychelles account for residents of certain restricted geographical areas.

Trading with leverage is risky, as leverage magnifies loss as well as profit.

eToro Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 21:05 | Friday 20:30 |

Commodities | Sunday 22:00 | Friday 20:30 |

Crude Oil | Sunday 22:00 | Friday 20:30 |

Gold | Sunday 22:00 | Friday 20:30 |

Metals | Sunday 22:00 | Friday 20:30 |

Equity Indices | Monday 07:00 | Friday 20:00 |

Stocks | Monday 07:00 | Friday 20:00 |

ETFs | Monday 15:30 | Friday 22:00 |

Please note that equity and index CFDs do not trade continuously but open and close each day at the above specified times.

eToro Account Types

I like that eToro treats all retail traders to the same account type. The main difference is the regulatory environment, its restrictions, and its protections. I am curious about its newly acquired Seychelles license, from where eToro can provide more competitive trading conditions. Regrettably, little information is yet forthcoming about eToro’s Seychelles offering, but we hope to offer an update on this soon.

Professional traders may request an account upgrade if they qualify. eToro also provides an Islamic account where the minimum deposit is $1,000, while most traders can open it between $50 and $200. Depending on the geographic location, eToro offers its eToro Money Account, which comes with a debit card for swift financial transactions.

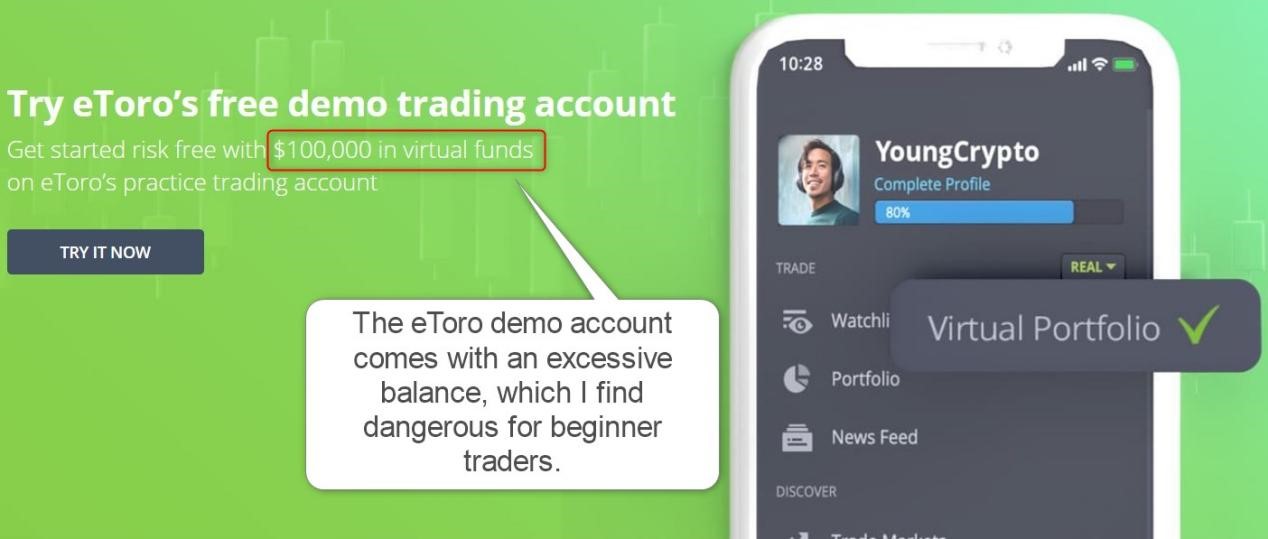

eToro Demo Account

eToro offers a $100,000 demo account, and I could not find a time limit. There is nothing inherently wrong with offering any nominal amount in a demo account, but I feel it would be more considerate to newer traders to use a lower figure as a starting balance.

eToro Trading Platforms

The pride of eToro is its proprietary trading platform, with its clean user interface and social trading tools CopyTrader and CopyPortfolios.

The web-based trading platform supports social trading well, and ProCharts allows manual traders to analyze markets. It does lack advanced features, and algorithmic and API trading are not available. I want to stress the difference between social and algorithmic trading, which are not interchangeable, where the absence of the MT4 trading platform is notable.

.jpg)

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

eToro offers third-party analytics from TipRanks, a valuable tool for equity traders. Beginner traders, particularly millennials and GenZ who desire social trading, have a platform catering to their needs. eToro focuses on social trading, but I do find a minor inconvenience in how clicking on an asset opens the feed section instead of the chart. Also, ProCharts requires a separate login and is unavailable from the trading platform, where traders have no analytics tools.

Unique Features

The three unique features I found are CopyTrader, CopyPortfolios, and the missing MT4 trading platform. The first two offer social traders the tools they require and using them requires just a few clicks. Some of the thematic CopyPortfolios are from third-party financial firms, and others remain managed by eToro. Portfolios from traders in the popular investor program are equally available. As an algorithmic trader, I cannot ignore the absence of the MT4 trading platform.

Research and Education

While eToro does not offer in-house research, it provides analytics from third-party TipRanks, which I find an excellent choice. There is so much quality research online that the absence of an in-house team is not a negative.

One of the developments I value most at eToro is its new eToro Academy. Until recently, eToro did not offer beginner traders any assistance, relying solely on its community. It now provides a well-structured platform consisting of videos, webinars, and guides. I rate eToro Academy as one of the best educational tools and recommend beginner traders take full advantage of it.

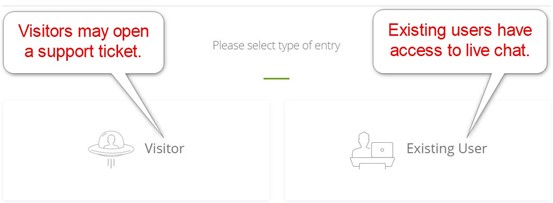

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                    |

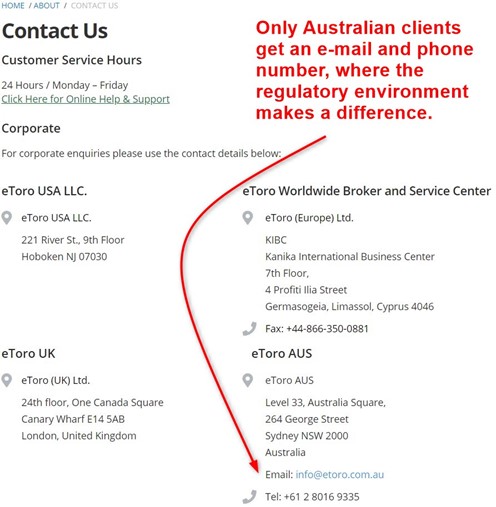

Customer service is available 24/5, but live chat is only available for existing users. Visitors with questions for eToro may open a support ticket via the website. An e-mail and phone number are available for clients for the eToro Australian subsidiary. The Help Center attempts to answer most questions. I think most clients may not require customer support, but eToro remains readily available for existing clients.

Bonuses and Promotions

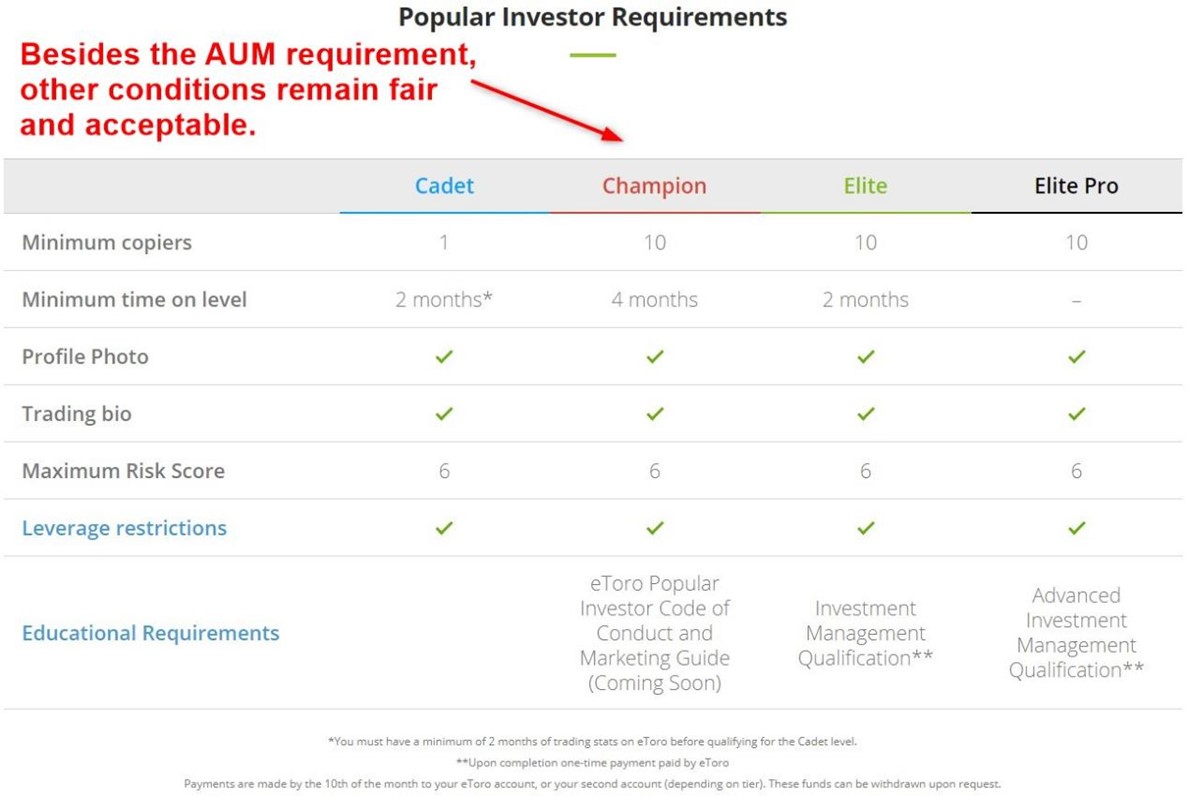

There is no deposit bonus or volume-based cash rebate program at eToro, but a Popular Investor Program exists. It rewards traders for having followers, assets under management, and minimum average monthly equity. Most traders will qualify for payouts between $400 and $800. Terms and conditions apply, and I urge all interested traders to read and understand them carefully before getting involved.

The five-tier eToro club offers additional benefits, including the absence of currency conversion fees and free withdrawals. The lowest tier requires an account balance of $5,000, while the most beneficial rewards are available above $25,000.

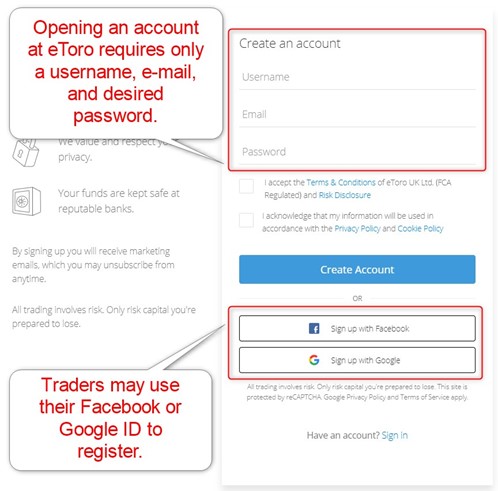

Opening an Account

Opening an account at eToro only requires a username, valid e-mail, and password. Traders may use their Facebook or Google ID to register. Account verification remains a mandatory step, satisfied by ending a copy of an ID and one proof of residency document. I find the process very efficient and hassle-free, ranking it among the best industry wide.

Minimum Deposit

The minimum deposit at eToro ranges between $50 and $10,000, depending on the geographic location. Most follow-on deposits can be as low as $50.

eToro Payment Methods

eToro offers bank wires, credit/debit cards, PayPal, Neteller, Skrill, Rapid Transfer, iDEAL, Klarna/Sofort, Trustly. Please note that not all options are available to all traders.

Credit Cards and PayPal are not available for deposits to the eToro balances of users under the FCA regulation.

Withdrawal options |       |

|---|---|

Deposit options |       |

eToro Accepted Countries

eToro accepts traders from the UK, Australia and the Netherlands. It also caters to US traders from its US-based subsidiary, which presently only offers cryptocurrency trading.

Deposits and Withdrawals

I like the range of deposit and withdrawal methods at eToro but dislike the unnecessary internal $5 withdrawal cost. Traders will also pay third-party processor costs and potential currency conversion fees. The withdrawal process follows well-established industry practices.

Bottom Line

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro eToro ranks among the most trusted brokers and will become a publicly traded company. While traders can make money on eToro, 68% of traders lose money. Despite the high percentage, it ranks among the best industry wide. eToro does not charge administration fees, but traders will pay a range of costs, which are a little on the high side but may be a worthwhile cost given the several benefits offered by eToro in other areas. Yes, eToro is legal and regulated company - eToro USA LLC regulated by US FinCEN eToro presents clients with four regulated entities EU by CySEC, UK by FCA, AUS by ASIC and Seychelles by the Seychelles Financial Services Authority. eToro also provides an Islamic account where the minimum deposit is $1,000, while most traders can open it between $50 and $200. The minimum deposit at eToro ranges between $50 and $10,000, depending on the geographic location. Yes, $5 per withdrawal + Third-party fees eToro charge $10 monthly after 12 months of inactivity eToro keeps physical cryptocurrency assets from the trading platform mostly in cold storage, while those in the eToro Money crypto wallets remain on the blockchain in hot storage. Security features for the eToro Money crypto wallets include advanced signature mechanisms and analytic behavior machine learning. eToro covers 100% of the funds held in the eToro Money app in the unlikely case of insolvency. Therefore, traders should feel safe and secure in keeping crypto on eToro. Users can send and receive cryptocurrencies to and from other wallets if the eToro Money crypto wallet supports them. Terms and conditions apply. eToro became a leading cryptocurrency broker for physical and CFD cryptocurrency trading. eToro developed its in-house wallet and made several acquisitions in the cryptocurrency sector to improve its product and services portfolio. During our eToro crypto coins review, eToro listed 88 liquid cryptocurrencies on its web-based trading platform. They included the top crypto and meme coins by market capitalization, plus a few crypto-to-crypto pairs and non-USD crypto crosses.FAQs

Is eToro trustworthy?

Can you make money with eToro?

Is eToro really free?

Is eToro regulated in USA?

Is eToro a regulated company?

Does eToro have Islamic accounts?

What is the minimum deposit amount on eToro?

Does eToro charge withdrawal fees?

Does eToro charge for inactivity?

Is it safe to keep crypto on eToro?

Can I receive crypto on eToro?

Is eToro good for crypto?

What crypto coins are available on eToro?