Editor’s Verdict

Forex traders require an efficient, stable, reliable trading platform supportive of algorithmic trading solutions as data flows in microseconds, and algorithms handle 80%+ of daily trading volumes. cTrader is one of the top three Forex trading platforms, used by 8M+ traders, developed by Spotware Systems, a FinTech company with 15 years experience and 150+ in-house developers globally. It was designed with ECN trading at its core, embracing the Traders First™ principles and comes with the most user-friendly out-of-the-box interface. Its Open Trading Platform™ approach offers a wealth of customization options, allowing seamless integration with over 100 different third-party solutions and enabling developers to create tailored trading applications. My cTrader review will introduce this cutting-edge trading platform to traders and help them understand why cTrader ranks as one of the best Forex trading platforms in the industry.

Overall Rating | 4.6 out of 5.0 |

User-interface | 5.0 out of 5.0 |

Broker Availability | 2.5 out of 5.0 |

Algorithmic Capabilities | 5.0 out of 5.0 |

Customizability | 4.0 out of 5.0 |

Ease of Trading | 4.5 out of 5.0 |

Overview

cTrader is a cutting-edge multi-asset trading platform with ECN at its core. It is renowned for its intuitive interface, offering a seamless trading experience for both novice and experienced traders. Traders love cTrader for its vast range of trading tools that allow them to execute their trading with the utmost precision and efficiency. Excellent security features, full transparency, scam-free trading, and pros such as advanced risk management, transparency and accountability to traders, powerful tools for IBs and mobile leadership in trading set cTrader apart, making it the trusted choice for traders worldwide.

cTrader: Five Main Highlights

- 150+ in-house developers catering to 8M+ traders

- Free algo hosting and cloud execution for trading robots

- API trading for advanced algorithmic traders

- $40M+ Invested in Infrastructure

- 3 milliseconds internal processing time

Headquarters | Cyprus |

|---|---|

Year Established | 2011 |

Minimum Deposit | None |

US Persons Accepted? |

Features | cTrader | |

General | Release date | 2011 |

Apps | iOS, Android, Windows, Mac, Web, Amazon, APK | |

Pricing for traders | Free via brokers | |

Interface | Dark mode | Yes |

App languages | 23 | |

In-app user guide | Yes | |

Workspaces cloud syncing | Yes | |

Instant modification of UI scale | Yes | |

At-glance symbol info | Yes | |

Multiple chart view | Yes | |

Multiple indicator panels | Yes | |

Trading history | Yes | |

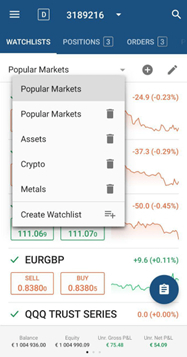

Customizable watchlists | Yes | |

Trading | Quick chart trading | Yes |

Order types | 4 | |

Quick stop-loss and take-profit options | Yes | |

Advanced stop-loss and take-profit levels | Yes | |

Trailing stop loss | Yes | |

Smart stop out | Yes | |

Charting | Chart objects | 31 |

Chart drawing | Yes | |

Supported instruments | Forex, cryptocurrencies, indices, cash indices, metals, energies, soft commodities, equities, ETFs, bonds, futures | |

Chart types | 6 (bar, candlestick, line, dot, line, and HLC) | |

Changing symbols on the chart | Yes | |

Periods for time-based charts | 26 | |

Period types | 5 | |

Detachable charts | Yes | |

Standard indicators | 86 | |

Depth of Market | Yes | |

Market sentiment | Yes | |

Trade receipts | Yes | |

Symbol search by asset name | Yes | |

Lots/units toggle | Yes | |

Risk-reward tool | Yes | |

Algo trading | Cloud algo hosting | Yes |

Cloud execution for trading robots | Yes | |

Backtesting for trading robots | Yes | |

Opening algo files on mobile | Yes | |

Programming language | C# | |

Built-in code editor | Yes | |

Copy trading | Expansive strategy catalog | Yes |

Strategy performance stats | Yes | |

Automatic equity-to-equity copying | Yes | |

Profile page with strategies | Yes | |

Equity stop-loss protection | Yes | |

IB tools | Attribution toolkit/app | Yes |

Shared access for money managers | Yes | |

Signal links | Yes | |

Sharing copy strategies as links | Yes | |

Sharing algos as links | Yes | |

Sharing deals | Yes | |

Sharing symbols | Yes | |

Sharing price alerts | Yes | |

Integrations | News feed | Yes |

Economic calendar | Yes | |

TradingView | Yes | |

Trading Central | Yes | |

Autochartist | Yes | |

Plugins for third-party integrations | Yes | |

APIs | Open API | Yes |

FIX API | Yes |

Understanding the cTrader Trading Platform: Key Features

cTrader, developed by Cyprus-based Spotware Systems LTD, launched in 2011, and UK-based FXPro was its first broker. Today, cTrader serves 250+ enterprise clients with an expanding trader base. The cTrader platform excels at order execution, charting, and algorithmic trading. With 15 years experience and 150+ developers globally, it continues to advance and adapt to ensure its 8M+ traders have the most cutting-edge trading platform. While MT4/MT5 support market makers besides ECN, STP, and NDD brokers, cTrader does not cater to the special needs of market makers, which results in lower trading fees.

The key features of cTrader for traders include the following:

- Ultra-fast order execution due to sub-millisecond processing

- Advanced stop loss and take profit, server-side and trailing protections

- Depth of market (Level 2) and market sentiment

- Detailed trade receipts with chronological events, slippage and execution time

- Free algo hosting with cross-device accessibility

- 24/7 cloud execution for trading robots without a VPS

- Accurate backtesting of trading robots on historical data

- 86 built-in and thousands of custom indicators for technical analysis

- Versatile plugins for third-party services and UI customisation

- Broad collection of algo trading tools in cTrader Store

- Built-in copy trading with successful cross-broker strategies

- Outstanding tools for IBs to maximise conversion

- Best-in-class mobile trading apps for iOS and Android

- Powerful desktop apps for Windows and Mac

- Stunning interface and user-centric design

- Growing community of 8M+ traders, developers, partners

- 99.99999% average uptime

- $40M+ invested in infrastructure

Snapshot of the cTrader trading platform

cTrader Order Execution

cTrader supports four order types: market order, limit order, stop order, and stop-limit order. The internal processing times are ultra-fast, and since cTrader is only available at ECN/STP brokers, Forex traders can rest assured that their orders get filled promptly.

cTrader Order Ticket

Traders can use these methods to place orders:

- From the “QuickLinks” tab to the top of the screen (or in the “TradeWatch” panel) by clicking “New Order.”

- From the “Symbols List” in the left sidebar by right-clicking on the desired symbol and selecting “Create New Order” from the sub-menu.

- From the chart by using the “QuickTrade buttons” located in the top-left corner of the charts.

- From the “Active Symbol Panel (ASP)” in the right sidebar by using the “New Order Form” in the “Order Tab.”

- From their keyboard by pressing F9.

Note: Methods vary across apps

cTrader Charting Package

The cTrader charting package offers extensive tools and indicators and supports multi-screen charting and chart trading.

Here are the core features of the cTrader charting package:

- 6 chart types (candlesticks, bars, line, dots, area and HLC)

- 5 period types (standard, tick, Renko, range and Heikin Ashi)

- 86 standard indicators and thousands of custom indicators

- Versatile technical analysis and drawing tools

- Intuitive risk-reward tool for calculating deal volume in all apps

- Customisable workspaces, chart templates and multi-chart mode

cTrader Chart Trading

cTrader Trading Experience

cTrader offers the most comprehensive out-of-the-box trading platform. Traders can use it without upgrading via extension and benefit from its cutting-edge features. As cTrader is a feature-rich trading platform, beginners will learn some new functions. With plenty of educational tutorials and videos, they will swiftly learn how to unlock and use the cTrader features.

Whether you're a manual trader, algo developer or part of a brokerage team, cTrader delivers a robust and transparent ecosystem designed to meet diverse trading needs. Its professional-grade tools, seamless cross-device functionality, and ethical infrastructure make it a top-tier choice for modern trading.

cTrader Desktop Apps

I recommend cTrader Desktop apps for power users, algorithmic traders, and traders who desire a genuine ECN/STP trading experience in a professional trading environment. It is also ideal for portfolio managers, high-frequency-high-volume traders, and scalpers.

cTrader Windows

cTrader Desktop core features include the following:

- Multi-screen support and detachable charts

- Full support for high-resolution screens with scalable user interfaces up to 200%

- Market sentiment, Level 2 data, DoM order book, and VWAP depth of market

- Built-in executable signals, including Trading Central and Autochartist

- News feed by FXStreet and economic calendar

- Dark and light theme

- Feature-rich customisable UI

- Quick Trade for chart trading

- Algo trading with local and cloud execution

- Algo development, backtesting and optimisation

- Plugins for UI personalisation and service integrations

- Copy trading

- Order execution transparency

- Extensive charting package

- Market Replay function

cTrader Web

cTrader Web is a lightweight, HTML5-developed, web-based trading platform. I recommend it for casual traders and those who trade from multiple locations, as cTrader Web ensures traders can log into their trading platform and pick up from where they left off.

cTrader Web core features include the following:

- cTrader Web works on most HTML5 browsers, including Google Chrome, Safari, and Mozilla Firefox

- cTrader Web can incorporate technologies, including JavaScript and CSS, to ensure a comprehensive, responsive, and seamless experience

- Traders receive a custom DNS, accessible as a subdomain of their website

- A native web-based trading platform that works as a SaaS trading platform without needing third-party tools

- Widgets to embed the trading terminal and other cTrader products into any website and easy sharing functionalities.

cTrader Mobile

cTrader Mobile is well known for an intuitive and user-friendly interface. The apps for iOS and Android offer advanced charting tools with a choice of chart types, periods, and technical indicators, enabling full analysis from a mobile device. cTrader mobile offers seamless cloud synchronization, so your data will always be consistent across your devices.

cTrader also offers bespoke watchlists, real-time market news, and an economic calendar, ensuring you can stay informed about what’s going on today.

The cTrader mobile app displays raw spreads and commission costs transparently, and offers cTrader’s social trading feature, cTrader Copy.

cTrader Mobile

The core features of cTrader Mobile include:

- Full-screen charting mode and fluid charting, featuring pinch-to-zoom, fling to scroll forward or backward, and a double-tap action to re-center and reset the chart to the closest pre-set zoom level

- Chart trading via the Quick Trade buttons

- A comprehensive symbol overview screen

- Trading history and transparency, including a complete history of executed deals, closed positions, and orders

- Cloud functionality via cTrader ID or with Facebook or Google authentication

- In-app notifications, including order execution statuses, price alerts, and symbol status info

- 1-second app launch time enables users to react instantly to market moves

- Availability in the Huawei Store

cTrader Algo

cTrader Algo enables algorithmic trading, and developers can code any trading strategy using C# rather than learning a platform-specific language. Algorithmic traders can connect advanced algorithmic trading solutions to the cTrader infrastructure via Open API and FIX API.

Another addition to the algorithmic trading environment is cTrader Automate.API, designed for margin trading using a human-readable format.

cTrader Algo core features include the following:

- In-built code editor

- cTrader Algo API to simplify development via human-readable format

- Plug-and-play automated trading allowing traders to add cBots and run them instantly

- Visual backtesting with chart monitoring and speed adjustments

- Historical data, including raw tick data

- Backtesting history with detailed statistics to evaluate performance

- Optimization function to allow developers to find optimal configurations for cBots

- Trade statistics provide relevant data for backtesting results

- Deal map that shows each trade on the chart for visual confirmation

Partner Tools: cTrader Copy & cTrader Invite

cTrader offers a powerful set of partner tools to boost engagement, drive referrals and support social trading. cTrader Copy is a core component of cTrader and caters to both investors and strategy providers.

Copy trading is the most popular approach among retail traders, and demand continues to surge with more providers emerging with copy trading as their primary focus. cTrader Copy is a trader-friendly solution that works well with cTrader Mobile.

cTrader Copy core features include the following:

- Advanced Analytics visually display Time Weighted ROI, Balance vs. Equity, Breakdown of Traded Symbols, and History of Followers

- Strategy Profile to help signal providers attract copy traders

- Equity-to-equity Copying, including an Equity Stop Loss to stop following a strategy when the account equity breaches a specified limit

- Favorites allow copy traders to bookmark signal providers

- Volume-based commissions for signal providers using the High Water Mark method

- No introduction period for signal providers

- Signal providers can choose how much to charge copy traders

- Copy traders receive complete control over when and how to follow signal providers

- Advanced risk management features for copy traders

- Detailed analytics of each signal provider and their strategies

- Transparent history of each trading strategy

cTrader Invite is an essential tool for IBs and brokers looking to optimise their referral programs. It enables IBs to share personalised invite links through a custom profile page and track referral performance with detailed analytics, all within the cTrader platform. The system integrates smoothly with a broker’s CRM via webhooks, automating user registration and referral tracking. IBs simply share their invite links and the platform takes care of the rest making it easier than ever to onboard and monitor new referrals.

Together, these tools enhance the effectiveness of partner programs and lead to higher conversions from leads to active traders.

Criticism

I rank cTrader as the best out-of-the-box trading platform and have no criticism directed at this cutting-edge trading solution. I want to note that cTrader is a feature-rich algorithmic trading platform designed for demanding and professional trading requirements. Therefore, beginners will face a learning curve, but educational resources, tutorials, and videos exist to help with that.

Conclusion

Three themes dominate today’s trading scene: high-frequency-high-speed, algorithmic, and copy trading. Therefore, traders require a trading infrastructure and platform that can excel at the above. cTrader is one of three options for the retail sector and it shines in all three categories. Its learning curve is reasonable, and cTrader remains the best out-of-the-box trading platform industry-wide with a feature-packed solution that appeals to demanding traders. They include an excellent algorithmic trading infrastructure, free cloud-based execution of algorithms that eliminates the need for costly VPS hosting, a growing copy trading environment for copy traders and signal providers, a skilled in-house development team, excellent security features, including OTP and 2FA, all provided by a trusted FinTech company with 15 years experience. cTrader is a platform you can trust, and one which ensures full transparency and scam-free trading.