What Is the London Breakout Strategy?

The London Breakout Strategy aims to capitalize on the price of a Forex pair breaking out in the London session following the end of the Asian session, which historically has been quieter. The trade entry can trigger anytime during the day but typically happens sometime in the morning, London time.

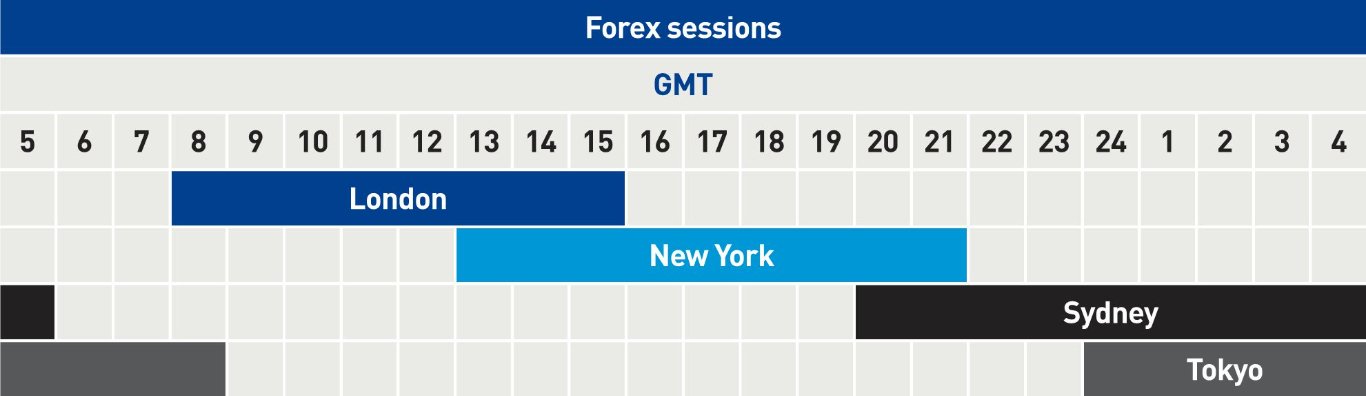

To understand the strategy, we first must understand the different Forex sessions.

Top Forex Brokers

Forex Session Times

The Forex market is open 24 hours a day, from Sunday evening until Friday night. Each day is comprised of three main periods, known as "Forex sessions," based on the world's largest Forex centres: London, New York, and Sydney & Tokyo. These create the London, New York, and Asian sessions, respectively.

Why the London Open Breakout Strategy Works

The Asian session is the quietest and is usually relatively range-bound for non-Asian currency pairs (e.g., JPY, AUD) compared to the London session. When the market transitions from the Asian to the London session, there is usually a sudden rush of orders. So, the price naturally breaks out of the “Asian range.” This gets further impetus when the other European financial centres opened shortly after London.

The dynamic of the Forex sessions creates a predictable breakout most days, from which we can build a strategy.

How to Trade the London Breakout Strategy

This strategy has many versions—some use indicators, and some do not. There are versions with different targets, timeframes, and order types. I’ve traded several versions, and I will teach the version that has remained the most effective over the years, which also happens to be one of the simplest.

My version trades on a 5-minute GBP/USD chart with a 1.5 to 1 reward/risk ratio.

Steps to Implementing the London Breakout Strategy

Step 1: Mark the Range on a 5-minute GBPUSD chart from 12 a.m. to 7 a.m. GMT.

This is not the exact Asian session but covers the core of the Asian range, and the volatility in GBP/USD is typically low during this time. I like to use the rectangle tool on a charting platform as it gives me the clearest visual.

Step 2: Wait for a 5-minute candlestick about to close above or below the range.

There is no time limit for waiting for this candlestick, but it will usually appear before 11 a.m. GMT.

Step 3: Enter at the close of the candlestick that closes above or below the range.

Step 3: Enter at the close of the candlestick that closes above or below the range.

If the candle closes above the range, it’s a long market order entry. If it closes below the range, it's a short market order trade. The entry should be made 1-2 seconds before the candle closes or immediately at the opening of the next candle.

Step 4: Place a stop loss 1-2 pips above or below the most recent swing low or high.

The most recent low or high is usually clear, but occasionally, it requires a subjective judgment to identify. The stop loss usually lands within the range.

Step 5: Place a take profit level with a 1.5 Reward/ Risk ratio.

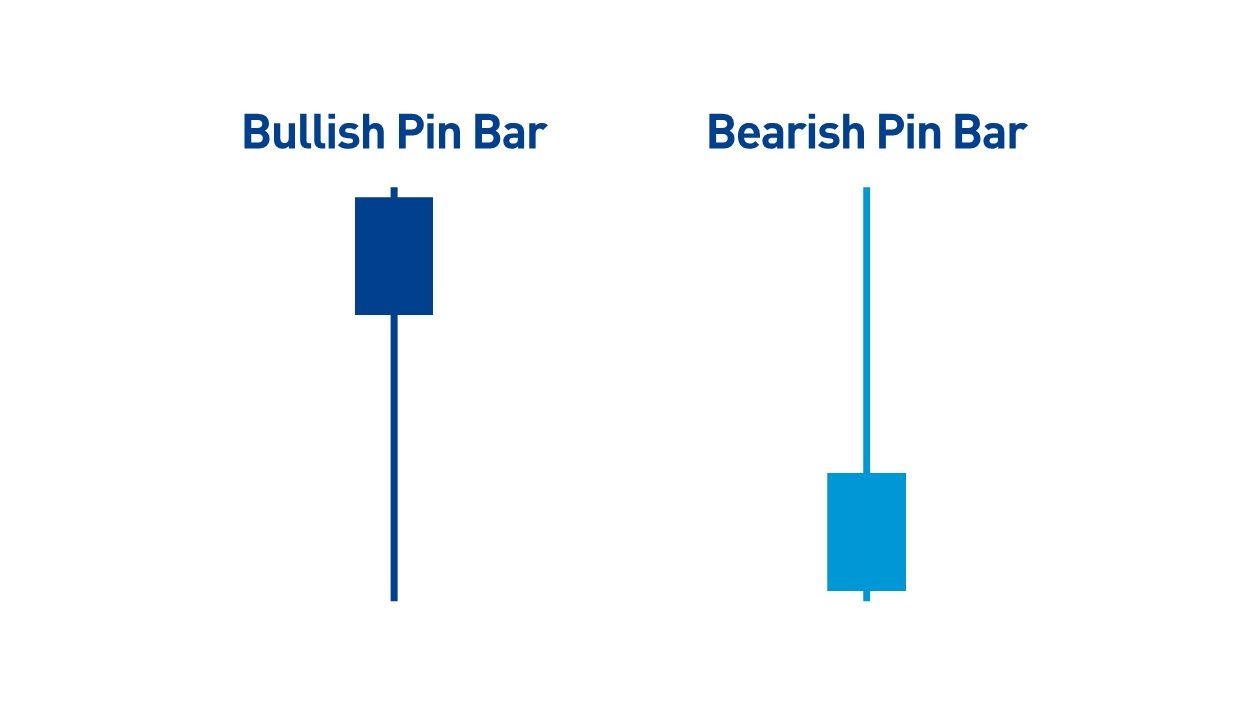

Key exception: Do not take the trade if the candle that closes above or below the range is a pin bar in the opposite direction.

A pin bar has a body that occupies the bottom or top third of the candle and, therefore, has a wick that is two-thirds of the candle's length.

Recommendation: Set the risk at 1% or 2% per trade.

Recommendation: Set the risk at 1% or 2% per trade.

Keep the risk per trade consistent and manageable.

What Is the London Breakout Strategy’s Performance?

Expect a 50-55% Win Rate

I’ve found this strategy's long-term performance to give a 50-55% win rate. This may sound low, but it’s decent, given that each winning trade produces a profit of 1.5 R.

Trading the strategy with a 1:1 Reward to Risk ratio improves the win rate.

Aiming for a higher win rate with a lower reward-to-risk ratio is tempting but does not make the strategy more profitable. The 1.5 reward targets are much more profitable than 1 R trades because the win rate does not decrease much from 1.5 R to 1 R.

Some Tips for Trading the London Breakout Strategy

Tip 1: Use alerts. The price can take some time to reach the high or low of the range. I use alerts to let me know the price has touched the edge of the range, and I can then monitor for the entry.

Tip 2: Stay away from the screen once the trade is live.

The price may go halfway to the stop-loss or stay around the entry area before hitting the target. It’s tempting to exit prematurely to prevent taking a loss or losing a partial profit, but this often reduces the strategy’s profitability. Stay away from the screen after the entry to avoid overmanaging the trade.

Other Ways to Trade the London Breakout Strategy

Take Profit or Ride the Trend?

I generally use the London Breakout Strategy to capture a pre-determined profit target. However, there may be opportunities to ride out a longer trend in the day or over several days—for example, if I enter long in the London Breakout, and the higher timeframe is in an uptrend, or I entered near a long-term support level. Here are some ways to capitalize on that:

- When my trade goes to 1:1 reward to risk, I move the stop-loss to break even. I can continue to trail my stop-loss if the trade goes deeper into profit instead of taking full profits at 1.5 reward to risk.

- When the trade gets to 1:5 R, I can take 50% of the profits and take further profits if the price keeps moving in my direction. I can also move the stop-loss to breakeven when I take 50% of the profits to help manage risk.

Ideal Currency Pairs for the London Breakout Strategy

GBP/USD has given me the best results for this strategy. Other traders trade this strategy with USD/CHF and EUR/USD, which can be profitable, too. It is a good idea to back-test the results over 2-3 months' data if switching currency pairs.

Pros and Cons of the London Breakout Strategy

Pros

- The strategy produces a trade most days.

- A 1:5 R provides good profits with a reasonable win rate.

- It’s simple to learn and easy to back-test.

- It’s objective—most discretionary is the stop-loss placement, but that’s usually clear.

- I don’t need to monitor the trade after I’ve entered my position.

- There are opportunities to ride a larger trend.

Cons

- The stop-loss placement can be subjective.

- The London Open must suit my time zone.

- There can be a lot of waiting around for the trade to trigger.

- The London breakout strategy only works with a few currencies.

Bottom Line

The London Breakout Strategy is reliable, easy to learn, and objective. It relies on a specific currency pair breaking out of the Asian session range when the London session opens. Different versions of the strategy exist, and the version I recommend in this article uses no indicators with a 1.5 reward-to-risk profit target on 5-minute GBP/USD candles. These settings produce a decent win rate of over 50%, which is excellent when combined with a positive 1.5 reward-to-risk ratio.