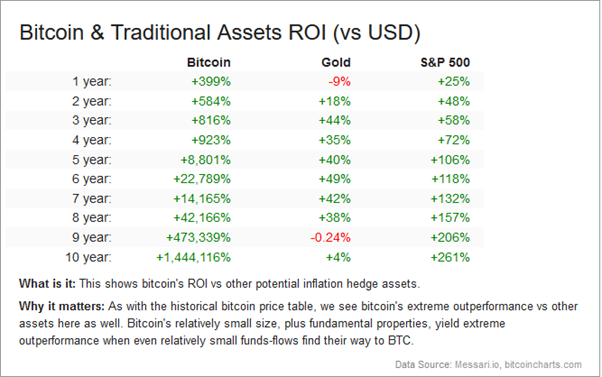

Since Bitcoin was launched as the first cryptocurrency (a cryptographic medium of exchange) in 2009, and even more so since its astonishing huge increase in value in 2017, Bitcoin has captured the imagination of traders and investors. Its volatile price movements have meant that potential profits – and losses – for traders are enormous. Bitcoin has reached a $1 trillion market capitalization (surpassing Facebook) and the 10-year return on Bitcoin outperformed almost all other assets between 2011 and 2021 with an astonishing +1,444,116% return.

As Bitcoin has become an established part of the capital markets ecosystem with dedicated futures and ETF vehicles, the time has come for uninvolved traders to consider how to get involved in this asset class. This article explains how to get started trading Bitcoin, the range of Bitcoin trading strategies, where to trade Bitcoin, and how to analyze Bitcoin’s price action using technical and other analytical tools.

Bitcoin vs Gold & S&P 500 Index, 2011 – 2021 ROI

How to Trade Bitcoin for Beginners

Seeing that Bitcoin’s price is volatile and the return on investment in recent years has been remarkable, Bitcoin is now traded and invested in not only by crypto-enthusiasts but by institutional traders and investors. There are two main markets in which to trade Bitcoin, spot and derivatives. The main difference is that, in a spot market, you actually own Bitcoin, whereas in a derivatives market, you can buy or sell (long or short) an instrument based on Bitcoin to profit from its price movement without directly owning the asset.

While derivatives trading sounds superficially more attractive, I highly recommend beginners to start their trading journey in the spot Bitcoin market. This can be done by opening an account with a crypto exchange such as Coinbase or Gemini. When opening an account with an exchange, the exchange will create a dedicated personal Bitcoin wallet for you, and all your Bitcoin purchases will be stored in that wallet which is linked to your account. After setting up an account, you can deposit Bitcoin or purchase Bitcoin with your bank card and buy Bitcoin right away. For beginners and those who are just starting their journey, I recommend starting with a demo account and “paper trading” (trade the demo without depositing any real funds).

In demo trading, always choose an initial balance where possible equal to the amount you are planning to deposit to make the paper trading experience more realistic. Do not open positions with an amount which is higher than the funds you are ready to risk with real money. This will help stop you getting dangerously greedy when you begin trading with real money.

The Bitcoin derivatives market has multiple Bitcoin derived instruments, such as futures, swaps, options, inverse futures, perpetual futures, CFDs etc. There are many crypto-exchanges, brokers and platforms which offer derivatives trading, some granting very high leverage. High leverage can maximize your profits and could be a reason for severe losses and liquidation of your whole balance, requiring training, knowledge and skills.

How Does Leverage Work With Bitcoin Trading?

Let’s assume you have $500 in your account available as margin and open a long position (buy) on Bitcoin. In this example, let's say Bitcoin’s price is $50,000, and you are expecting the price to go up to $51,000, so you open a new long trade with a position size of 0.01 Bitcoins. When the price reaches $51,000, your gross profit will be $10.

In another example, you open the same trade but using 10X leverage, in which you “borrow” $4,500 from the exchange or broker, and the Bitcoin exposure of your position is now equal to 0.1 Bitcoins. When the price hits your target at $51,000, your gross profit will be 10X higher compared to a trade taken without leverage, which is $100.

Although it can multiply profits, higher leverage exposes you to higher risk, as it amplifies losses the same as profits. If the price reverses and goes against your desired direction and reaches the liquidation (margin call) price which all leveraged trading involves, your position will be liquidated and your margin will be lost.

Strategies for Trading Bitcoin

A major factor in deciding what kind of trading strategies you should use to trade Bitcoin will depend upon your availability and how much time you are ready to devote to trading. Strategies can firstly be categorized by time outlook, whether short-term, medium-term, long-term, or scalping which is very short term. All have their individual pros and cons.

A Long-term trade is a trade with an estimated time of reaching the target price of more than one year. A trader, or in this case an investor, can buy Bitcoin and hold it for a period of one to ten years. This strategy is best for a someone with patience who is not looking for rapid profits. The long-term strategy is a more conservative style and considered to be less risky. Buying Bitcoin in a spot market for long-term investment would be the best option as it eliminates the operational risk, whereas an exchange or a broker may suddenly halt their operations.

A Medium-term trade is a trade where it is hoped profit will be taken within one week to one year. This style is suitable for traders who cannot afford to spend most of their time behind the monitor tracking price action. Such traders perform their analysis based not only on technical but fundamental data. Medium-term traders often use Bitcoin futures contracts, such as CME: BTCZ1, BTCX1 etc. to get exposure to Bitcoin.

A Short-term trade has an expected time frame lasting between two days to one week. In traditional financial markets, for example in securities and bonds investment, short term may last up to one year. However, for Bitcoin trading I think it is legitimate to classify a trade which lasts up to one year as mid-term, as Bitcoin is very volatile. Short-term traders often use a combination of technical analysis, news analysis, and fundamental analysis as the foundations for their trading decisions.

Scalping is a trading strategy which is expected to last between several minutes and one day day. This is the primary strategy used to day trade Bitcoin. Scalping is more time-intensive than any other type of strategy as trades need to be continually monitored minute by minute and possibly even second by second. Day traders often use high leverage to try to maximize their gains from intraday price movements, and usually their stop loss orders do not exceed 15% of the position exposure. In rare cases when the Bitcoin market is expected to be highly volatile the stop loss can reach 40% but should never be higher than the percentage exposure of a take-profit order. In simple terms, if the stop-loss is at 40%, the take-profit should be set at 50% or higher, ideally at least 80%.

Trading Bitcoin with Technical Analysis

Analyzing historical market prices as a basis for making a forecast of future prices – the science of technical analysis - is an essential part of trading for almost everyone. Cryptocurrency markets are no exception. For beginner Bitcoin traders, I highly recommend you become familiar with the basic aspects of technical analysis to help you make better trades, beginning with studying the Dow Theory and Elliott Wave theory.

An essential element of trading Bitcoin with technical analysis is the ability to understand a candlestick or bar price chart. An example of a Bitcoin candlestick price chart is shown below.

Bitcoin 4-Hour Candlestick Price Chart

In this 4-hour price chart, each candlestick represents Bitcoin’s price movement over a 4-hour period, showing you the opening, high, low, and closing prices (OHLC) of the period.

Depending upon whether the candlestick closes above or below its opening price, the candlestick is colored red (if lower) or green or blue (if higher).

Trend can be hard to define as it can vary between different time frames, but trading in the same direction as the trend (if there is one) in the time frame in which you are trading will certainly improve your results. An asset is in uptrend when it continuously moves upwards over time (this is also called a bull market), an asset is in a downtrend when it continuously moves downwards, (this is also called a bear market).

After having identified a trend if one is present, the next most important task for a technical analyst is to identify support and resistance zones and levels. Support is an accumulation zone, where an asset is more likely to halt and possibly reverse from a downtrend, while resistance is a distribution zone, is more likely to halt and possibly reverse from a downtrend. Traders seek to open new long or short positions from reversals at or close to these zones as these areas are likely to contain the most successful trade entry points, offering strong, high risk reward ratios.

Let’s see an example of an uptrend and the best areas within it for buying or selling Bitcoin.

Bitcoin Weekly Price Chart – Support and Resistance

On the weekly Bitcoin chart above, I have indicated the most important static strong support and resistance zones as well as a rising price channel, the boundaries of which identify dynamic support and resistance points. As you can see on the chart, each previous resistance tends to flip to become new support after getting broken by the price, and vice versa. These levels are the best areas in which to open a trade. Go long or buy when Bitcoin rejects support and sell or go short when it rejects resistance.

Bitcoin Weekly Price Chart – Buys and Sells

If you are going to use a take profit order, place it near (below) a resistance level when going long, or near (above) a support level when going short. Place your hard stop loss order (which should always be used when trading Bitcoin due to its extremely high volatility) below a support level when going long, or above a resistance level when going short.

There was a time when Bitcoin had very low correlation to any other asset or market sector. The price was driven almost purely by supply and demand. Nowadays, since Bitcoin instruments have become more widely integrated into various Bitcoin trading platforms and the introduction of Bitcoin futures by the CME, more institutional traders, large cap investors, and whales, are diving into Bitcoin trading. Bitcoin’s price is now influenced by general economic data and by its common counterparties, mainly the US Dollar and its index.

What Drives Bitcoin’s Price?

Economic Data and the US Dollar Index

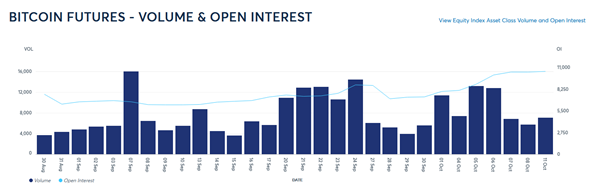

Since the United States has more large cap investors and institutional traders which follow macroeconomic data, they tend to open short and long positions based on these points. The fact that these investors have a larger exposure, their positions and orders play a significant role in Bitcoin’s price movement. The best analytical tool available here is Bitcoin’s volume and open interest available on cryptocurrency metrics websites and at the CME.

CME Bitcoin Volume & Open Interest

Market Sentiment

Bitcoin’s price is also affected by the news and social buzz created around it. Remember Elon Musk’s crypto tweets and how they dramatically moved crypto market pries? The best tools to track market sentiment about Bitcoin are Trading Central’s Market Buzz and LunarCrush. Both platforms use AI which crawls around the web to identify and quantify mentions of Bitcoin with positive or negative spin.

Bitcoin’s Hashrate

Bitcoin’s hashrate is a crucial part of the operation of Bitcoin’s network. The hashrate is an indicator of Bitcoin mining activity and the overall well-being of the network. When the hashrate turns negative, Bitcoin’s price typically falls.

Bitcoin CME Futures Settlements

Bitcoin futures contracts provided by the US-based CME (Chicago Mercantile Exchange) have an expiry date. As a general rule, when the expiry date on a futures contract nears, investors need to sell their contracts and buy new contracts with later dates to maintain their profitable position, which can cause market volatility. Bitcoin traders should be aware of this when trading close to the end of any calendar month.

Where Can I Trade Bitcoin?

Traders have three main options regarding where to trade Bitcoin.

Bitcoin CFD Brokers – many Forex brokers now offer Bitcoin, although the UK regulator banned it which means you will have to deposit with a broker outside the UK. The main advantage is ease as you are trading a CFD as a simple derivative, so you do not need to worry about storage or security issues such as a wallet. The major disadvantage is that you will almost certainly have to pay a significant fee for holding a Bitcoin trade open overnight, whether long or short, so this may only be a good option for more short-term traders,

Stockbrokers offering Bitcoin Futures / ETFs – it is now possible to trade and invest in Bitcoin using a regular brokerage, although many restrict futures trading to clients with relatively high liquid net worth. At the time of writing, a Bitcoin micro future is available which requires $2,300 worth of margin deposited in your account per contract. BITO, the first Bitcoin ETF which was launched on 19th October 2021, costs only $42 per share and offers exposure to the price of Bitcoin futures which are extremely closely correlated with the price of Bitcoin itself.

Cryptocurrency Exchanges – these are dedicated platforms for trading cryptocurrency and as such have more detailed and advanced features which suit crypto enthusiasts. They offer direct ownership of cryptocurrencies including Bitcoin. Yet as Bitcoin is now widely available, cryptocurrency exchanges arguably offer the biggest niche advantage to people looking to trade the smaller cryptocurrencies.

When choosing a crypto exchange to use for trading Bitcoin, there are several key points you should examine:

Security. An exchange should have a traceable record of secure and smooth operation. Avoid exchanges which do not provide insurance for your deposit.

Validity. An exchange should have a traceable legal name and address. Beware of crypto-exchanges which claim to have licenses which are not openly traceable and available. The cryptocurrency market is not yet as strongly regulated as it ideally should be, so beware of any declarations which include “a regulated exchange” without providing any further details.

Commissions. The lower the trading fees, the higher your net profit.

Liquidity and Spreads. I combined these two attributes as one drives the other. When there is no liquidity there is no price action. Your trade could stall and force you to accept a loss after you already want to get out, if the liquidity in the instrument you are trading is really bad. The higher the liquidity, the lower the spread. Spread is a difference between bid and ask (buy and sell) prices, the higher the spread, the greater the chance of slippage, which means the greater the risk of opening a position at a larger loss.

Final Thoughts

It has become increasingly clear that Bitcoin and cryptocurrency are here to stay, and that they represent an exciting new asset class. Investors and traders tend to do better when they are prepared to get involved in diverse opportunities across markets. Many who initially dismissed crypto as a fad which would not last are now realizing that it is worth getting involved, and there are now better tools available to use which can limit your risk in trading Bitcoin.

There is nothing wrong with investing in Bitcoin instead of trading it. A good Bitcoin trader will probably be able to achieve greater profit than an investor but will also probably take on greater risk. Also, an incompetent Bitcoin trader will probably lose money while as a simple investor, they may have been more likely to gain.

If you are going to be a Bitcoin trader, it is vital that you take it seriously, limit your maximum risk by trading relatively small position sizes, and work to trade to a high standard. The price of Bitcoin can be extremely volatile. Make sure you are honest with yourself about your time and financial resources and adopt the correct strategy for your circumstances. Analyze historical Bitcoin price data and thoroughly back test how your potential trading strategies would have performed over many years. Practice trading with a demo account without risking any real funds, and make sure you are profitable over many months in a range of market conditions before you risk any real money trading Bitcoin.

Bitcoin traders may also wish to try making long-term investments in Bitcoin on the side, although this can be psychologically challenging.

FAQs

Can I Invest $100 in Bitcoin?

Yes, you can invest $100 in Bitcoin and buy a small fraction of it, several Satoshis. You would need to hold it for a relatively long time to be able to make a significant profit.

What is Bitcoin Trading and How Does it Work?

Bitcoin trading is taking a bet on Bitcoin’s price movement, either up or down. You exchange one currency for Bitcoin when you begin the trade, then reverse the transaction when you want to exit.

What is the Best Bitcoin Trading Site?

The best Bitcoin trading site is Coinbase for spot trading, as the exchange is referred to as the safest and the most valid exchange, FTX for derivatives trading for a broad variety of derivatives contracts, while Bittrex by far has the best Bitcoin trading platform.

Is Bitcoin Good to Trade?

Bitcoin’s high price volatility makes it a very tempting asset to trade, yet it also makes it risky. Bitcoin is good to trade if you know what you are doing, so use a demo account and take learning seriously before you even think about risking any real money trading Bitcoin.