I have looked at various entry methodologies and have tended to favor entering after pull backs which then return to the prevailing trend. However, I would like to present new research which suggests that a breakout entry style can be even more effective.

Identifying a Trend

All kinds of weird and wonderful methods exist for identifying trends, but it does not have to be complicated to be effective. I have found that simply determining whether the price is above or below its levels from 1, 3 or 6 months previously is enough to provide a statistical edge that the price will continue in that direction. The best results are obtained by using both 3 months and 6 months, although using 3 months alone has been very successful over recent years.

Pullback Entries

Continuing to keep things as simple as possible, I found that identifying pullbacks as occurring when the price makes a new 1 day low price in an upwards trend, or new 1 day high price in a downwards trend, can be very effective. I defined trend as above both the prices of 3 months and 6 months, or below both. The 4-hour Japanese candlestick making the price should have a range greater than the 30-period average true range (ATR), to show momentum in the direction of a prevailing trend. An entry is triggered if the price reaches 1 pip beyond the trend end of the candlestick during the next 4 hours. A stop loss is placed 1 pip beyond the other end of the candlestick.

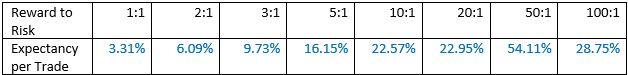

Back testing this entry method against the four major Forex currency pairs over the last fifteen and a half years and considering a reasonable broker’s spread, showed it had a profitable expectancy per trade at all profit targets based upon reward to risk ratios. This is a good indication of a solid strategy:

Breakout Entries

I have always felt as a Forex trader that breakouts do not tend to work very well in trading Forex, compared to the way they work when trading stocks and commodities. It also always seemed logical to me that the pullbacks in trends would have the most profitable entries, as the price logically travels the furthest from these areas in a trend. What I was not properly appreciating was the fact that there are many “false starts” from pullbacks. Once I constructed a breakout system with a lot of filters to find entries within a trend, I was surprised to find that the results were better than those for the pullback entries shown above.

The breakout system is as follows:

Trade in the direction of the trend only using a 4-hour candlestick chart.

The 18 period SMA (simple moving average) must be the trend side of the 60 period SMA.

The candlestick must have a high or low beyond the trend side of the previous candlestick.

When the candlestick closes, the 10 period RSI (relative strength index) must be greater than 50 in an uptrend or less than 50 in a downtrend.

The range from high to low of the closed candlestick must be greater than the 30-period average true range (ATR).

This might seem like a lot of filtering, but all it really does is make sure that the short-term and medium-term trends are aligned with the long-term trend when the trade is entered. The significance of the moving averages lies only in that they give a very similar result to the 10-day RSI. In fact, this strategy is truly based upon the RSI – which I consider to be “the king of indicators” – being aligned on all time frames over 10 periods, from the daily time frame down to the 1 minute time frame, at the point of entry.

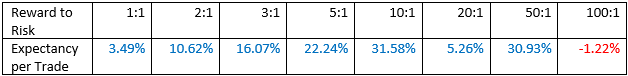

Performing the same back test as described previously using this entry method, surprisingly, produced a better positive expectancy at every reward to risk level below 20 to 1:

Conclusion

What these back-test results seem to show is that the breakout method is superior at achieving better results with smaller targets, while the very big moves are better caught very early in the pull-back’s turn back into the trend. In deciding which is a better approach to take in picking trend trade entries, don’t forget that taking more frequent profits should result in a compounding effect which magnifies overall profit.