Capital.com Editor’s Verdict

Capital.com offers traders cutting-edge trading tools, AI-assisted trade analysis, a competitively priced commission-free pricing environment, and a well-balanced asset selection. The key question I have focused on answering in this review is whether the Capital.com’s trading environment delivers an edge with its advertised tight spreads and fast order execution.Capital.com has successfully expanded its trading platform ecosystem to include TradingView, further enhancing its appeal to both manual and algorithmic traders. Is Capital.com the right broker for you?

Overview

Capital.com - A global CFD broker with good trading conditions

Cyprus ASIC, CySEC, FCA, SCB 2016 Market Maker $10 Other, MetaTrader 4, Proprietary platform, Web-based, Trading View 0.6 pips 1.3 pips $0.03 $0.30 $106

I like that Capital.com does not ignore the benefits of MT4, the market leader in algorithmic trading and used by millions of traders globally, despite offering a cutting-edge proprietary trading platform.

Capital.com – Key Takeaways

- Excellent Forex and cryptocurrency CFDs selection, ranking among the best industry.

- Competitive commission-free pricing environment, deep liquidity, and fast order execution.

- Cutting-edge proprietary trading platform alongside MT4 and now TradingView.

- In-depth analytics, market commentary, and Capital.com TV.

Capital.com Main Features

Retail Loss Rate | 64.00% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for ForexCFD | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | Not applicable |

Minimum Deposit | $10 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | No |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 65 (availability dependent on location) |

Capital.com Regulation and Reliability

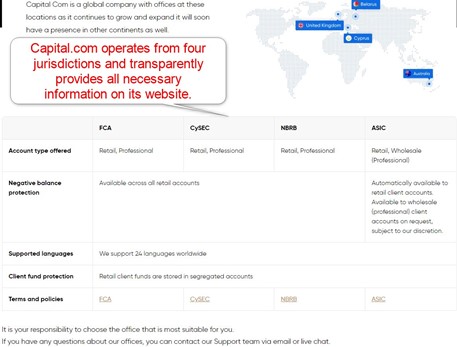

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Capital.com presents clients with four well-regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | 319/17 |

UK | Financial Conduct Authority | 793714 |

Australia | Australian Securities and Investments Commission | 513393 |

Bahamas | Securities Commission of The Bahamas | SIA-F245 |

Reasons I prefer the Cyprus subsidiary:

- Broadest deposit and withdrawal options.

- Negative balance protection.

- Segregation of retail client deposits from corporate funds, namely with RBS in the UK and Raiffeisen Bank in Austria.

- Accounts audited by Big Four accountancy Deloitte.

- All transactions adhere to the PCI Data Security Standards.

Note that several of these benefits are also available through other subsidiaries.

What is missing?

- Third-party insurance.

- Details about the core management team.

Noteworthy:

- The Cyprus subsidiary offers a retail investor compensation fund up to 90% or €20,000 of deposits but more restrictive trading conditions.

- The UK subsidiary offers an £85,000 compensation fund plus an option to return its regulatory environment to the pre-ESMA crackdown on leverage and bonuses.

- Capital.com has a clean regulatory track record.

- Transparent broker with all necessary documents published on its website, including Pillar 3 disclosures and Key Information Documents (KID).

More than half a million traders trust the Capital Group with their deposits and portfolios, and Capital.com remains highly ranked on Trustpilot, Google Play, and the Apple App Store.

Capital.com Fees

Average Trading Cost EUR/USD | 0.6 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $106 |

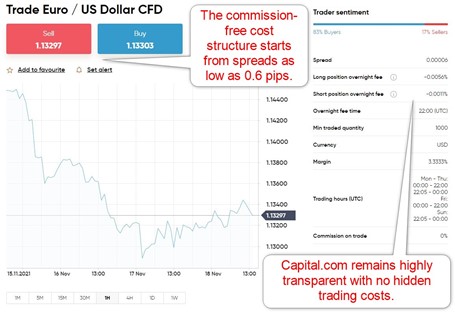

I rank trading costs among the most defining aspects when evaluating a global CFD broker, as they directly impact profitability.

Capital.com offers traders one cost structure:

- Commission-free trading costs on the benchmark EUR/USD currency pair average 0.6 pips or $6 per 1 standard lot.

- Capital.com levies swap rates on leveraged overnight positions only on the borrowed amount for cryptocurrencies and shares CFDs, and thematic investments, resulting in a competitive pricing advantage.

- Swap rates apply on the entire position value for CFDs on Forex, commodities, and indices.

Noteworthy:

- Capital.com offers tight spreads and fast order execution, making overall trading costs cheaper versus most competitors.

Here is a screenshot of Capital.com live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads:

How does the Capital.com pricing environment benefit traders?

I recommend traders consider the following:

- The 0.6 pips commission-free average EUR/USD spread at Capital.com ranks on par with most of the competitive commission-based offers.

- Swap rates remain lower than the industry average and apply only on the borrowed amount for select asset classes, making longer-term trading less expensive.

- The absence of currency conversion fees makes trades quoted in a currency other than the account base currency cheaper, a notable benefit when trading Forex CFDs.

What is missing at Capital.com?

- More clarity concerning its volume-based rebate program.

The average trading costs for the EUR/USD in the commission-free Capital.com account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

Noteworthy:

- Spreads at Capital.com are tight, confirming the availability of deep liquidity, ideal for scalpers and high-frequency traders.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Capital.com levies swap rates only on the borrowed amount for cryptocurrencies but the entire position value for Forex trading.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free Capital.com account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$6.440 | X | $12.440 |

0.6 pips | $0.00 | X | $1.265 | $7.265 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$45.080 | X | $51.080 |

0.6 pips | $0.00 | X | $8.855 | $14.855 |

My additional comments concerning trading costs at Capital.com:

- Capital.com does not list currency conversions costs

- An inactivity fee does not exist

What Can I Trade on Capital.com

I like the well-balanced asset selection at Capital.com, especially its exposure to the Forex and cryptocurrency markets, where traders get 138 and 454 assets, respectively. Capital.com also offers exotic currency pairs like the Mexican Peso, Belarusian Ruble, Hungarian Forint, and Thai Bhat, to name a few. It makes Capital.com a market leader in both sectors as a duo.

Capital.com offers most traders an excellent equity CFD selection of 5,550+ large-cap and mid-cap companies. The 43 commodity assets and 28 index CFDs ensure traders have in-depth cross-asset opportunities and 6,200+ overall trading instruments

What is missing?

- I would like small-cap alternatives and ETFs, but the overall asset selection remains notably more diversified versus most competitors.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Capital.com Leverage

Retail traders at Capital.com get maximum leverage between 1:20 and 1:30 at all operating subsidiaries, dependent on the geographic location of traders.

Also noteworthy about Capital.com leverage:

- Negative balance protection is given, ensuring traders never lose more than their deposit, applicable to all retail trading accounts.

Capital.com Trading Hours (UCT Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Sunday 22:05 | Friday 22:00 |

Commodities | Sunday 23:05 | Friday 22:00 |

European CFDs | Monday 08:00 | Friday 16:30 |

US CFDs | Monday 14:30 | Friday 21:00 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Capital.com Account Types

Capital.com offers the same CFD trading account type to all traders. A professional account upgrade is available to qualifying traders, and UK-based clients may opt for a tax-free spread betting account. A share investing option is also available, ideal for long-term strategies without using leverage.

My observations concerning the Capital.com account types:

- Most traders will trade in CFDs at Capital.com, available from a minimum deposit of only $20 by card, making it one of the most accessible accounts across the industry.

- Algorithmic trading and copy trading are available in the MT4 trading platform.

- MAM/PAMM accounts for traditional account management is not available.

- Capital.com offers spread betting to eligible traders resident in the UK.

- Long-term investor will benefit from the share investing account, where 1,000+ assets await.

- Real stocks are only available for residents of the UK and some EU countries.

- Retail accounts get 100% negative balance protection, but not more than 1:30 leverage.

- Capital.com does not offer Islamic accounts.

- Corporate accounts are available via Capital.com

Capital.com Demo Account

Unlimited demo accounts are available at Capital.com. MT4 offers more flexibility and is ideal for testing EAs or different trading strategies. I want to caution that demo trading may promote wrong trading behaviour for beginner traders, especially if the account balance is excessive. It can also create unrealistic trading expectations.

My recommendation:

- MT4 offers flexible deposits, and traders should select one of a similarly sized balance to what they plan to deposit in a live trading account.

Capital.com Trading Platform

Capital.com developed its proprietary web-based trading platform, an innovative solution for manual traders, also available as a highly rated mobile app. Algorithmic traders get the trusted MT4 trading platform, which also comes with an embedded copy trading service. Traders may use MT4 as a desktop client, a web-based alternative, and a mobile app. Social traders can connect their Capital.com accounts to TradingView, where 50M+ traders discuss and share ideas. Advanced algorithmic traders can connect their custom trading solutions to the Capital.com infrastructure via the Capital.com API.

The cutting-edge features of the proprietary Capital.com web-based trading platform are:

- In-depth technical analysis

- Actionable trading ideas

- Financial articles

- Seamless multi-chart toggling

- Personalized watchlists

- Hedging and risk management tools

- TradingView

- AI-powered post-trade behavioral analysis

What is missing?

- MT4 add-ons are unavailable, leaving traders with the core MT4 version and a sub-standard trading solution.

- VPS hosting is not available.

My observations:

- Manual traders should use the proprietary Capital.com trading platform, as it presents a superior solution to MT4.

- Algorithmic and copy traders must trade with the MT4 desktop client, as it remains the only one supporting both trading styles.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Capital.com does exceptionally well within its core trading environment. I rate this as a feature worth noting.

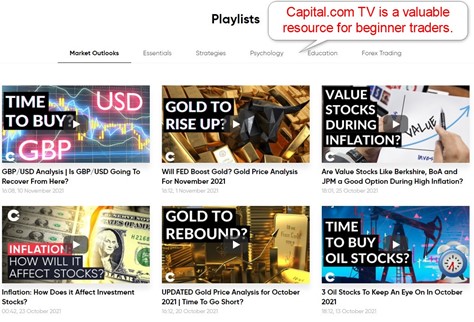

Research and Education

Capital.com offers trading signals embedded within its proprietary trading platform. Chief Market Strategist David Jones leads the in-house research team with market commentary and trading ideas on Capital.com TV.

Investmate is at the core of the educational platform at Capital.com, available for Android and iOS devices. I also recommend the five lessons presented on the website, consisting of numerous sub-categories, with a quiz to conclude each topic.

Another high-quality educational resource is the Capital.com official YouTube channel. Traders get 1,000+ videos, updated regularly, with 188K+ subscribers, including free 30-minute webinars hosted by David Jones.

My takeaways:

- Capital.com delivers quality content and comprehensive analytics and includes educational value within the research sector for a competitive trading service available to clients and non-clients alike.

- Beginner traders get quality content from the News section, divided into numerous sub-categories.

- Investmate remains one of the best educational platforms industry-wide, with 30+ interactive courses.

My recommendations:

- Traders may rely on the quality research at Capital.com to confirm their trading signals.

- MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style.

- Traders should seek additional information from trusted third parties free of charge for a more comprehensive overall educational approach.

- The glossary provides a valuable list of terminology.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |               |

Customer support is available via live chat, e-mail, phone, or web form. Capital.com states it offers 24/7 customer support.

Capital.com explains its products and services well, ensures flawless operations, and notes its system status. I doubt traders will require customer support, but it I readily available.

My recommendations:

- Traders should read the FAQ section before reaching out to a customer service representative.

- Capital.com provides phone support, ideal for urgent matters.

- Live chat is the most convenient option for non-critical issues.

Bonuses and Promotions

At the time of this review, Capital.com neither offered bonuses nor promotions.

Capital.com Opening an Account

I like the initial step of opening a Capital.com, taking less than ten seconds to complete.

It requires only an e-mail address and password, and traders may use their Facebook, Google, or Apple accounts to sign-up.

Capital.com conducts a source of funds check, which many brokers do not require. Traders may also have to fill out an unnecessary questionnaire, all due to regulatory requirements. It may discourage some traders, but limits exist, which require no proof.

Account verification is mandatory, and most traders will complete it after sending a copy of their ID and one proof of residency document.

Capital.com Minimum Deposit

The minimum deposit for the Capital.com account is only $20 by card.

Payment Methods

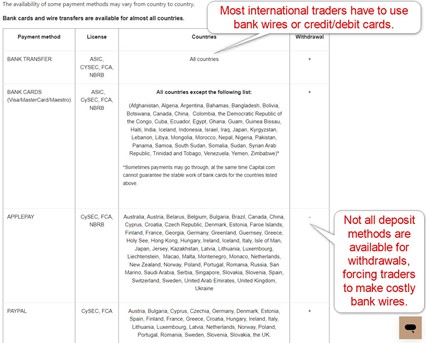

Capital.com offers bank wires and credit/debit cards to most international traders. Depending on the geographic location, localized options exist. EU/EEA traders also have access to ApplePay, PayPal, 2C2P, Sofort, Ideal, Giropay, Multibanco, Prezelewy, Qiwi, Webmoney, and Trustly.

Accepted Countries

Capital.com caters to most international traders and does not list restrictions on its website. Like almost all international brokers, US-person clients cannot open trading accounts at Capital.com.

Capital.com Deposits and Withdrawals

All financial transactions take place in the secure back office of Capital.com or via the mobile trading app.

My observations:

- Most deposits and withdrawals remain free of charge, but third-party processing fees may apply.

- Capital.com does not list a currency conversion fee.

- Capital.com processes all withdrawals within 24 hours with 99% being processed within this timeframe, but it may take up to five business days for funds to arrive, depending on the payment processor.

- Most international traders can only deposit via costly bank wires or credit/debit cards.

- EU/EEA traders have access to many online payment processors.

- Not all deposit and withdrawal methods are available to all traders, dependent on the location.

- Capital.com offers more deposit methods than withdrawal options, resulting in costly bank withdrawals.

- The minimum deposit is $20 by card or a currency equivalent (or as low as $10 by using Apple pay).

My recommendations:

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

Bottom Line

I like the trading environment at Capital.com, especially for Forex and cryptocurrency traders, as the asset selection and trading costs remain particularly good. Beginner traders get a superb educational platform and Capital.com’s valuable in-house research. Capital.com also caters to asset management firms via its Prime Capital division. The competitive commission-free Capital.com trading environment deserves serious consideration by committed traders. Capital.com is a legit broker operating with oversight from four regulators. In its relatively short history, Capital.com has established itself as a reliable brokerage. Traders can either download the proprietary mobile app, use the webtrader, or the MT4 desktop client. Beginner traders get a high-quality educational platform, making Capital.com ideal for new traders. Capital.com offers a selection of more than 1,000 stocks for share trading. Traders with the CySEC or ASIC-regulated entities may use PayPal with Capital.com. The minimum deposit is $20, but the minimum trade size begins from 0.01 lots. Capital.com does not levy internal withdrawal fees, but traders may face third-party processing costs and currency conversion fees. Yes, clients should consider their money safe at Capital.com, as Capital.com segregates all client deposits from corporate funds. It complies with five regulators, maintains a clean record, and enjoys high ratings from traders. Capital.com neither operates in the USA nor accepts clients resident in the USA. While Capital.com offers 65 payment processors, most remains geographically restricted. All traders can use bank wires and credit/debit cards, and the back office will list all alternative methods. Capital.com usually processes all valid withdrawal requests within 24 hours, but it can take several business days for traders to receive their funds, dependent on the payment processor and their geographical location. Yes, Capital.com complies with five regulators, where it maintains a clean record.FAQs

Is Capital.com legit?

How do you trade on Capital.com?

Is Capital.com suitable for new traders?

Can you trade shares at Capital.com?

Can I use PayPal with Capital.com?

What is the minimum investment at Capital.com?

How much does Capital.com charge for withdrawal?

Is my money safe with Capital.com?

Is Capital Com legal in the USA?

How do I withdraw money from Capital.com?

How long does it take to withdraw money from Capital.com?

Is Capital.com a regulated broker?