For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

BlackBull Markets Editor’s Verdict

BlackBull Markets is among the best in the industry at delivering a true institutional-style trading experience for advanced and high-frequency traders. With raw spreads from 0.0 pips, VPS hosting, FIX API access, and support for algorithmic and social trading, it provides impressive infrastructure to its global client base. The professional-grade conditions of the ECN Prime account are tough to beat In brief, BlackBull is a premium broker designed for speed, scale, and strategy, but not for passive investing or casual trading.

BlackBull Video Review

BlackBull Markets Overview

BlackBull Markets, founded in 2014 and headquartered in New Zealand, offers a no-dealing-desk (NDD) ECN environment through platforms like MetaTrader 4, MetaTrader 5, cTrader, and TradingView. FMA and FSA regulated, BlackBull combines ultra-fast execution (under 75ms), access to 26,000+ tradable instruments, and raw-spread pricing with a professional trading experience that’s typically reserved for institutional clients. In addition to integrating social and copy trading tools, the broker offers deep liquidity feeds and flexible API access, positioning it at the forefront of serious retail and professional trading.

Headquarters | New Zealand |

|---|---|

Regulators | FMA, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2014 |

Execution Type(s) | ECN/STP, No Dealing Desk |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader, Trading View |

Average Trading Cost EUR/USD | 1.1 pips |

Average Trading Cost GBP/USD | 1.55 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | 0.12 pips |

Average Trading Cost Bitcoin | $24 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $4.00 per round lot |

Funding Methods | 6 (bank wires, credit/debit cards, Skrill, Neteller, Union Pay, FasaPay, selected cryptocurrencies) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Three requirements any successful trader needs from an ECN/NDD trading environment are deep liquidity, institution-level pricing, and high leverage. BlackBull Markets delivers all three, and I especially like the underlying technology they utilize to achieve this. It ensures high-speed trading and offers scalpers and other high-frequency traders the precision trading they require.

Who Should Trade with BlackBull Markets?

Trader Type | Rating | Summary |

Newer Traders | 3/5 | Basic educational materials are provided, but the platform is better suited to experienced traders |

Copy Traders | 4.5/5 | ZuluTrade, Myfxbook, and TradingView integration offer strong copy tools |

Swing Traders | 4.5/5 | BlackBull offers a wide asset selection, tight spreads, and stable execution |

News Traders | 4/5 | Execution speeds are excellent, though macro tools are limited |

Automated Traders | 5/5 | FIX API, MT4/5, cTrader, and VPS hosting are ideal forautomated traders |

Investors | 3.5/5 | BlackBull Invest adds value |

Day Traders | 5/5 | Ultra-fast execution and razor-thin spreads are perfect for intraday trades |

Scalpers | 5/5 | Sub-75ms execution latency and raw accounts are built for scalping |

BlackBull Markets Highlights for 2025

- Equinix servers in New York (NY4) and London (LD5) for institutional-grade trading conditions

- Average order execution speeds of under 75 milliseconds

- Data feeds from 66+ third-party providers for ultra-deep liquidity

- Raw spread trading for commissions between $4.00 and $6.00 per 1.0 standard round lot

- VPS hosting for low-latency 24/5 Forex trading

- Industry-leading asset selection of 26,000+ trading instruments

- API trading for advanced algorithmic trading solutions

- Only tier-1 regulated Forex broker with competitive leverage for retail traders, offering 1:500 with negative balance protection and auto-liquidation

- MT4, MT5, and cTrader trading platforms for algorithmic traders

- BlackBull Invest for unleveraged long-term buy-and-hold investments

- BlackBull Markets CopyTrader, ZuluTrade, and Myfxbook Autotrade for copy trading

- TradingView for social trading

- Quality education and actionable trading signals for beginner traders

- A choice of payment processors, inducing e-wallets and cryptocurrency transactions

BlackBull Markets Regulation & Security

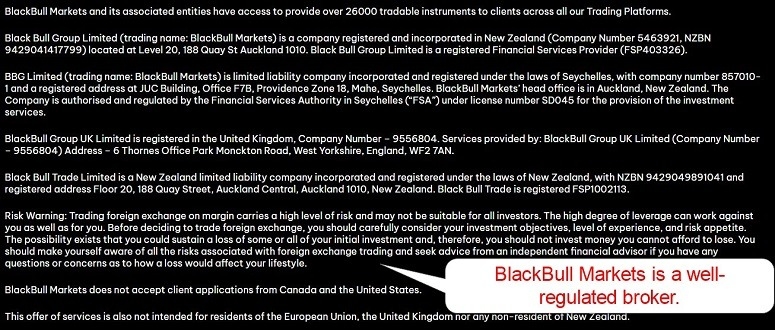

BlackBull is authorized to provide financial services by tier-1 regulator, the New Zealand Financial Markets Authority (FMA).

How Does BlackBull Regulation Measure Up to the Competition?

At DailyForex we appreciate just how critical it is for you that you are placing your hard-earned cash in the hands of a well-regulated broker.

Brokers with at least one tier-1 entity will have a reputation to protect and will be more likely to provide the highest levels of oversight, transparency, and investor protection, across their entire operation.

Regulators like the FCA (UK), ASIC (Australia), or CFTC/NFA (US) impose strict rules relating to capital requirements, client fund segregation, and fair-trading practices. These are designed to minimize the risk of fraud and malpractice, while creating a trusted framework for traders. Tier-1 regulation gives you confidence that your funds are safe with a forex broker that is reliable, well-capitalized, and committed to operating under the most stringent global regulatory standards.

Number of Tier 1 Regulators:

BlackBull | Think Markets | IC Markets |

|---|---|---|

1 | 4 | 2 |

BlackBull Markets presents clients with two well-regulated subsidiaries.

The primary regulator of BlackBull Markets is the FMA. It also maintains a subsidiary, BBG Limited, authorized by the Seychelles Financial Services Authority (FSA). BlackBull Group UK Limited provides payment clearing services.

Country of the Regulator | New Zealand, Seychelles |

|---|---|

Name of the Regulator | FMA, FSA |

Regulatory License Number | 403326, SD045 |

All client deposits remain segregated from corporate funds, and the custodian bank is the ANZ Bank. BlackBull Markets is also a member of the New Zealand Financial Services Complaints Limited (FSCL) dispute resolution scheme.

When it comes to trust and security, BlackBull Markets is a well-regulated and compliant Forex broker.

BlackBull Markets Fees

HOW WE TEST BROKER FEES

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

Average Trading Cost EUR/USD | 1.1 pips |

|---|---|

Average Trading Cost GBP/USD | 1.55 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | 0.12 pips |

Average Trading Cost Bitcoin | $24 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $4.00 per round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.8 pips | $0.00 | $8.00 |

In BlackBull Market’s Prime Account, average spreads and commissions are:

- EUR/USD = 0.53 pips total cost (0.23 pips spread and $3 per lot commission)

- GBP/USD = 0.58 pips total (0.28 pips spread and $3 per lot commission)

- XAU/USD = 0.42 pips total (0.12 pips spread and $3 per lot commission)

How Do BlackBull Fees Stack Up to Competitors?

Competitive trading costs are hugely important when choosing a forex broker, directly impacting your bottom line, especially if you are someone who trades frequently.

The EUR/USD pair is the most liquid and heavily traded currency pair, making it the best benchmark for spreads and commissions. Any forex broker that offers consistently low costs on EUR/USD will typically provide competitive pricing across other major, minor and exotic pairs as well. Lower costs mean that more of your profits stay in your pocket, and over time this can lead to significant savings, as less of your earnings are lost to fees.

Average Trading Cost EUR/USD:

BlackBull | Think Markets | IC Markets |

|---|---|---|

1.1 | 1.2 | 0.8 |

Here is a screenshot of the BlackBull Markets MT4 trading account during the most liquid overlap session, London-New York, where traders usually get the lowest spreads.

.jpg)

I like the spreads available at BlackBull Markets, which confirm the existence of institution-level pricing for retail traders. A typical raw spread of only 0.0 pips during the London/New York overlap is very competitive and an excellent offer from BlackBull.High volume traders are now eligible to gain rebates via access to Prime Plus account, which is open to clients who trade the following volumes:

- 200-500 lots (monthly) - US $1.00 back (FX & Metals)

- 500-1000 lots (monthly) - US $1.50 back (FX & Metals)

- 1,000 lots + (monthly) - US $2.00 back (FX & Metals)

Eligible Clients

This will only apply to clients who are trading on a Prime or Standard account with no existing special conditions or referrals from other partners.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend checking them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based BlackBull Markets trading account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $6.00 | -$2.912 | X | $9.912 |

0.0 pips | $6.00 | X | -$0.265 | $7.265 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $6.00 | -$20.384 | X | $27.384 |

0.0 pips | $6.00 | X | -$1.855 | $8.855 |

What Can I Trade at BlackBull Markets?

BlackBull Markets offers traders an excellent asset selection, positioning it among the top five brokers in the industry. Forex traders get 60+ currency pairs, but the bulk consists of 23,000+ equity CFDs and the underlying asset for direct share dealing from 80+ global stock exchanges. It results in a broad-based choice of trading instruments ideal for demanding asset managers and long-term dividend income-generating portfolios. BlackBull Markets has also added cryptocurrency CFDs, and the only asset class not offered is ETFs.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Blackbull Markets Leverage

BlackBull Markets offers leverage of up to 1:500 for all deposits without restrictions.

Blackbull Markets Trading Hours

All times shown are in UTC.

Forex trading is available from Monday 00:00 to Friday 24:00. Most commodities are available from Monday through Friday from 01:00 to 24:00. European index CFDs are tradeable Monday through Friday between 09:00 to 23:00, while US index CFDs are available between 01:00 to 23:15 and from 23:30 to 24:00.

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Cryptocurrencies | Monday 01:00 | Friday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:00 | Friday 24:00 |

Metals | Monday 01:00 | Friday 24:00 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 10:00 | Friday 23:00 |

Stocks (non-CFDs) | Monday 10:00 | Friday 23:00 |

Account Types

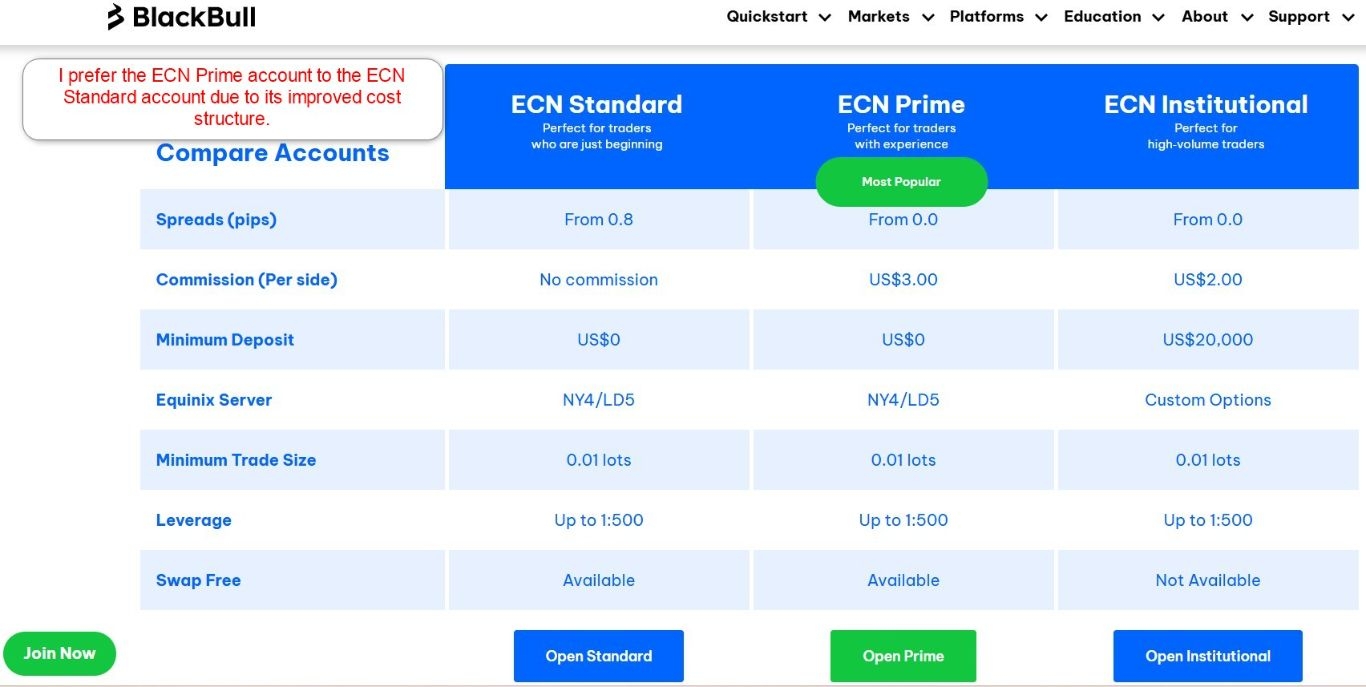

I like the ECN Prime account at BlackBull Markets as it offers the best cost structure. There is no minimum deposit requirement for either the ECN Standard account or the ECN Prime account, and the minimum trading costs are $8 and $3 respectively. I am a high-volume and high-frequency trader, so the $1 price difference results in thousands of dollars more annually in profits from the same trading strategy. The maximum leverage is 1:500,and users can choose their preferred leverage up to this limit. BlackBull Markets also offers an Islamic account, an institutional account, and a special offer for active traders.

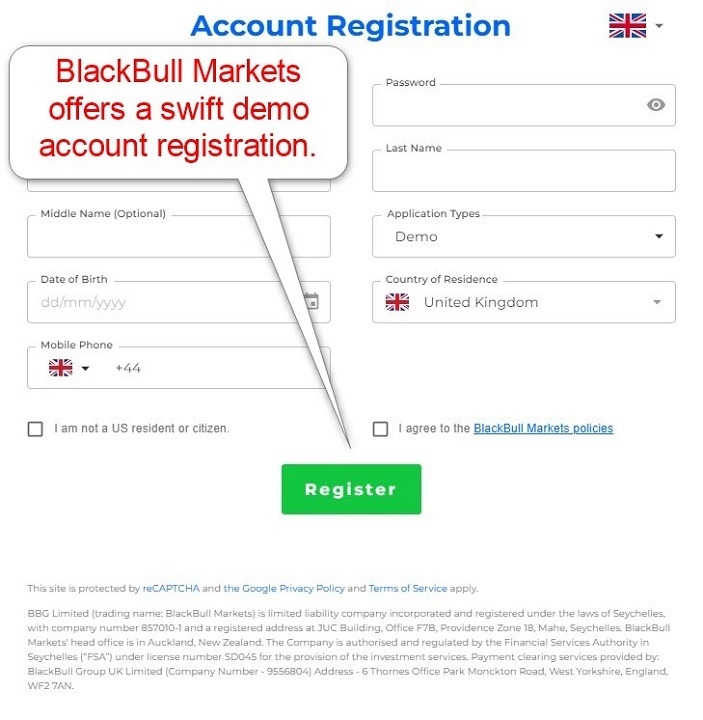

Demo Account

BlackBull Markets provides traders with flexible demo account options designed to support both beginners and experienced traders. Clients can open a demo account on multiple platforms, including MT4, MT5, TradingView, and cTrader, and fund it with any virtual balance of their choice. Traders can also select their preferred leverage level, making it easy to simulate real trading conditions. Demo accounts remain open as long as they are used, with closure only after 90 days of inactivity, giving traders ample time to practice, test strategies, and get comfortable with the platforms.

BlackBull Markets Trading Platforms

Every trader has their own style of trading and so access to a variety of trading platforms is useful because it allows you to choose the one that best fits your preferred strategies, tools, and experience level. Popular platforms like MT4, MT5, TradingView, and cTrader each offer unique features, such as advanced charting, automated trading, or social trading integrations.

In reality, each of these platforms provides all the main tools and features that most retail traders use. However, by offering a range of choices, including proprietary platforms designed in-house, a broker ensures that all different kinds of traders can benefit from a flexible and convenient trading experience. This variety and versatility allows you to switch between platforms as your strategies, capabilities, and requirements evolve.

Available Trading Platforms:

Platform | BlackBull | Think Markets | IC Markets |

|---|---|---|---|

MT4 | √ | √ | √ |

MT5 | √ | √ | √ |

C Trader | √ | X | √ |

Trading View | √ | X | √ |

BlackBull Markets offers traders the core MT4/MT5 trading platforms, upgraded with the Autochartist plugin, which assists manual traders with automated chart pattern recognition and trading set-ups.

BlackBull also offers TradingView as a standalone platform in addition to the MetaTrader solutions. Unfortunately, BlackBull Markets doesn’t offer a proprietary solution, but MT4 and MT5 have a built-in copy-trading system and BlackBull Markets offers both platforms as a desktop client, webtrader, and mobile app.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

I like that BlackBull Markets offers the FIX API, allowing algorithmic traders to connect advanced trading solutions. I also appreciate that the broker offers free VPS hosting for ECN Prime accounts with trading volumes above 20 lots. BlackBull Markets also supports social trading via market leaders ZuluTrade and Myfxbook Autotrade, plus newcomer HokoCloud. In addition, the broker allows its clients to connect their accounts to TradingView, an active community with 30M+ traders.

Research and Education

The BlackBull Markets research section provides daily news and views, stock research reports covering assets listed in Australia, New Zealand, and the US, and model equity portfolios for Australia and New Zealand. The research also consists of technical analysis, but the entire package costs $45 monthly.

Beginner traders get fifteen videos, and numerous short trading guides, offering an in-depth introduction to trading. While I would prefer to see more available content, BlackBull Markets presents enough information for beginners. A trading glossary is also available.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

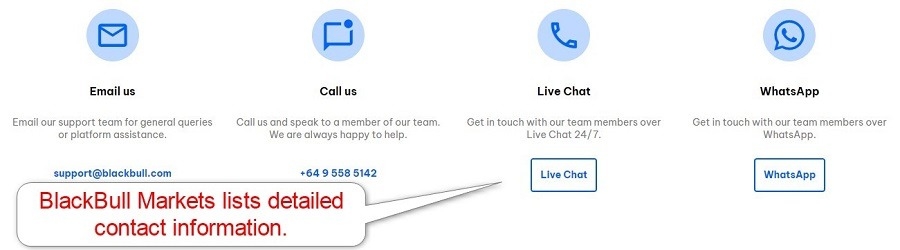

Website Languages |         |

Traders have access to 24/7 customer support via live chat, which I found to be the most convenient way to connect. A phone number, including a toll-free number for New Zealand, and nine email addresses are also listed, one of which is for receiving support in Chinese. I appreciate the transparency at BlackBull Markets, as fully detailed contact information is provided.

BlackBull Markets also answers many common questions in its FAQ section, where it describes its products and services well. So, most traders are unlikely to require assistance unless there’s an emergency. In such cases, the broker ensures a customer service representative is available.

BlackBull Markets Bonuses

While BlackBull Markets does not offer bonuses, it maintains an Active Trader Account where it presents qualifying traders with monetary incentives like lower commissions or free services like VPS hosting. Given the excellent trading infrastructure and competitive trading costs, I don’t consider the absence of incentives for new retail traders to be a negative.

Opening an Account

BlackBull Markets follows well-established industry practices for onboarding new traders. Opening an account is sufficiently quick and simple, in line with industry norms. However, I found some of the additional questions unnecessary. Traders can fill these out as they wish, and there is no verification of the answers.

BlackBull Markets includes the account verification with the account opening form, which I like, as it is a requirement and saves traders the extra step from the back office. New traders must submit a copy of their ID and a proof of residency document dated within the past three months.

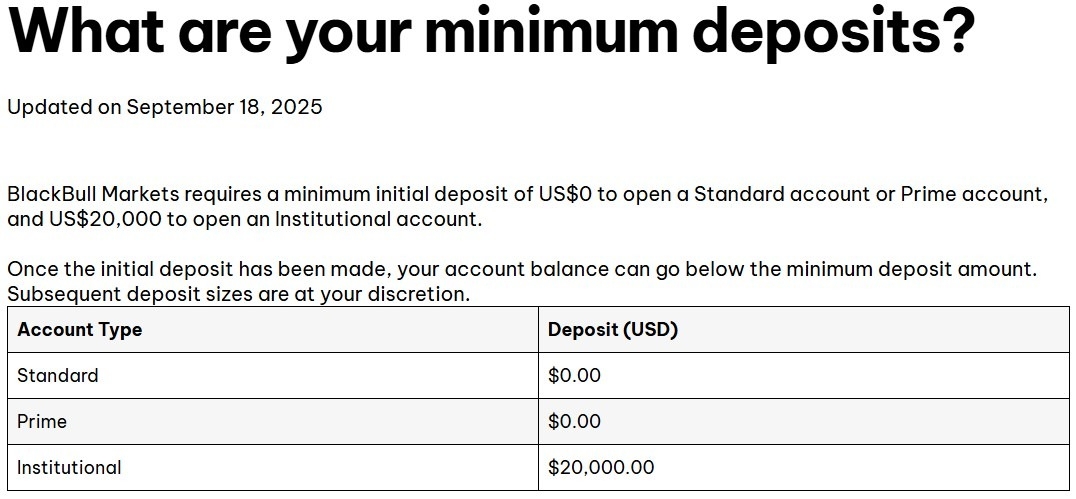

Minimum Deposit

There is no minimum deposit requirement for either the ECN Standard account or for the ECN Prime account, and for the Institutional account, $20,000. While the minimum deposit for ECN Prime accounts is higher than at most competing brokers, I found it fully justifiable and excellent value based on the services provided.

Payment Methods

Traders may deposit into their BlackBull Markets trading accounts via bank wires, credit/debit cards, Skrill, Neteller, China Union Pay and FasaPay.

Withdrawal options |       |

|---|---|

Deposit options |       |

BlackBull also allows deposits to be made in the following cryptocurrencies:

- Bitcoin

- Bitcoin Cash

- Litecoin

- Ethereum

- Tether

- Stellar

- Ripple

- Chainlink

- USD Coin

BlackBull Markets Deposits & Withdrawals

I appreciate the flexibility at BlackBull Markets regarding account funding, as after the initial deposit, there is no minimum requirement for follow-on deposits. Another positive is that traders can deposit in nine different currencies. However, I found a significant downside to be the $5 withdrawal fee, which most brokers do not charge. BlackBull Markets processes all withdrawal requests within 24 hours, and all financial transactions can be handled from an easy-to-use interface.

Traders may deposit using six deposit methods and nine currencies.

Withdrawals above the deposit amount using payment processors are not possible. Traders must make such withdrawals directly to their bank accounts.

Bottom Line

I like the trading experience at BlackBull Markets due to its competitive cost structure and excellent trade execution. BlackBull Markets also supports API trading and offers VPS hosting, making it ideal for advanced algorithmic trading. The asset selection, especially for equity traders, ranks among the top five brokers within the retail Forex/CFD industry. Overall, the core trading environment is outstanding, and I rank BlackBull Markets as a leading choice for demanding equity traders, asset managers, and Forex traders.

- Raw spreads from 0.0 pips and a $6 round-trip commission

- Regulated by FMA (NZ) and FSA (Seychelles); segregated client funds

- Execution speeds under 75ms via Equinix NY4/LD5/TY3 servers

- ECN Prime account ideal for scalpers and high-frequency traders

- Full support for algorithmic trading via MT4/MT5, cTrader, and FIX API

- Educational content is limited compared to other top-tier brokers

- Social trading integrations with ZuluTrade, Myfxbook, and TradingView

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

Is BlackBull Markets regulated?

BlackBull Markets has a regulatory license from the FMA in New Zealand and the FSA in Seychelles.

Where is BlackBull Markets based?

The headquarters of BlackBull Markets is in Auckland, New Zealand.

How does BlackBull Markets make money?

BlackBull Markets makes money from spreads, commissions, and swap rates on leveraged overnight positions.

How do I open a live account with BlackBull Markets?

Clicking on Live Account on the homepage of BlackBull Markets opens the four-step online application process.

How do I deposit money with BlackBull Markets?

BlackBull Markets accepts deposits by bank wires, credit/debit cards, Skrill, Neteller, Union Pay, FasaPay, and selected cryptocurrencies.

How do I withdraw money from BlackBull Markets?

Traders can request withdrawals from the secure back office of BlackBull Markets in a straightforward process, usually completed within 24 hours except for bank wires.

Is BlackBull Markets legit?

BlackBull Market is a legit broker regulated in New Zealand, the UK, and Seychelles with an exceptional regulatory track record.

Can you trade crypto with BlackBull Markets?

BlackBull Markets offers cryptocurrency CFDs, but not physical cryptocurrency trading.

What is the minimum deposit for BlackBull?

BlackBull Markets has no minimum deposit requirement for its ECN Standard account, $2,000 for ECN Prime, and $20,000 for ECN Institutional.

How long does it take to withdraw money from BlackBull?

BlackBull Markets aims to complete each withdrawal request in less than 24 hours.

How much is BlackBull’s commission fee?

Forex commissions at BlackBull Markets are between $4.00 and $6.00 per 1.0 standard round lot, dependent on the account type.