MultiBank Group Editor’s Verdict

MultiBank Group offers traders an excellent choice of assets from the MT4/MT5 trading platforms. With a minimum deposit of $50, maximum leverage of 1:500, and as one of the most regulated brokers, I reviewed MultiBank Group to determine if you should trade at this broker. Is their claim of being the number one financial derivative broker accurate?

Overview

A Broad Asset Selection from a Pure ECN Environment

Headquarters | United Arab Emirates |

|---|---|

Regulators | ASIC, AUSTRAC, BaFin, BVIFSC, CIMA, CySEC, ESCA, FMA, MAS, TFG, VFSC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2005 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader |

Average Trading Cost EUR/USD | 0.1 pips |

Average Trading Cost GBP/USD | 0.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.02 |

Average Trading Cost Bitcoin | $33 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $3.00 per 1.0 lot |

Funding Methods | 12 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the choice of trading instruments at MultiBank Group, ideal for all types of traders. It offers MAM/PAMM managers the necessary tools to provide effective asset management. Social traders also have access to the broadest market exposure, granting signal providers the diversity they need to stand out from the crowd, an invaluable asset.

Regulation and Security

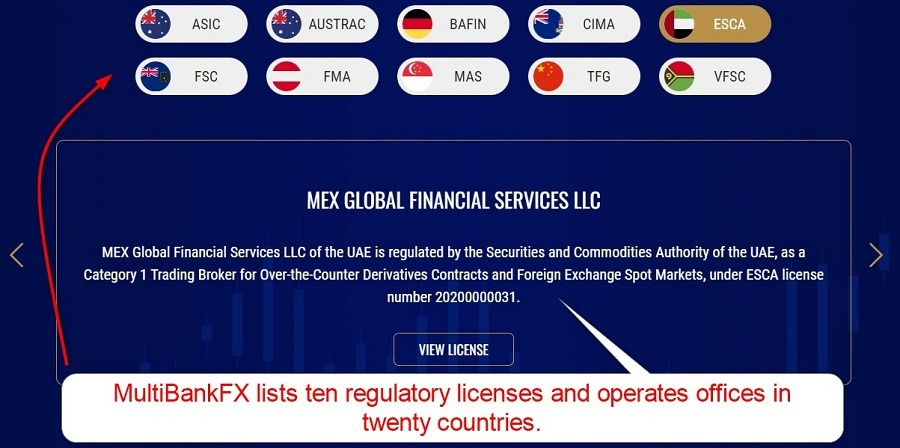

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. MultiBank Group presents clients with 7 well-regulated entities.

MultiBank Group is comprised of several entities which are regulated by over 10 financial regulators. The Group’s subsidiaries include:

Country of the Regulator | Austria, Australia, China, Cyprus, Germany, Cayman Islands, Singapore, British Virgin Islands, Vanuatu |

|---|---|

Name of the Regulator | ASIC, AUSTRAC, BaFin, BVIFSC, CIMA, CySEC, ESCA, FMA, MAS, TFG, VFSC |

Regulatory License Number | 416279, 73406, 1811316, 491129z, SIBA/L/14/1068, CMS101174, 120000400121019, 700443, 430/23 |

The overall regulatory environment is superb, and MultiBank Group maintains a secure and trustworthy trading environment.

I also like the transparency concerning the paid-up capital at MultiBank Group, which stands at $322 million. Traders get negative balance protection, which I find paramount for leveraged trading, and all client deposits remain segregated from corporate funds.

Fees

Average Trading Cost EUR/USD | 0.1 pips |

|---|---|

Average Trading Cost GBP/USD | 0.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.02 |

Average Trading Cost Bitcoin | $33 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $3.00 per 1.0 lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $60 monthly after three months |

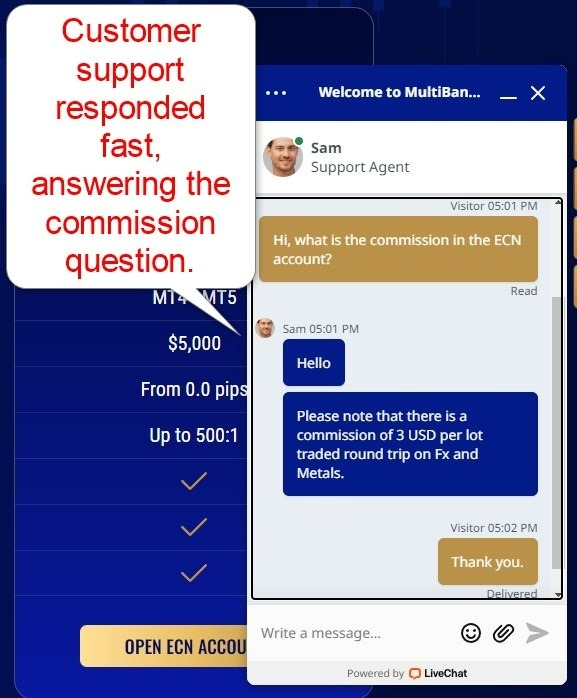

MultiBank Group offers commission-free Forex mark-ups as low as 0.8 pips or $8.00 per round lot in the Pro account, but the Standard one lists them at 1.5 pips or $15.00. The former is within the upper range of competitive trading costs, but the latter is expensive. The best offer is available in the commission-based ECN account, where traders enjoy raw spreads of 0 pips for a commission of $3.00 per round trip. The cost also applies to commodities, but index and equity CFD trading are commission-free.

Here is the minimum spread for the EUR/USD and the trading costs per 1.0 standard in all three pricing tiers.

Minimum Forex | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips (Standard) | $0.00 | $15.00 |

0.8 pips (Pro) | $0.00 | $8.00 |

0.0 pips (ECN) | $3.00 | $3.00 |

Unfortunately, MultiBank Group does not list commissions for the ECN account on its website, but I obtained them from their live chat customer support function.

One of the most widely ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the MultiBank Group Pro and ECN accounts.

Taking a 1 standard lot buy/sell position in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips (Pro) 0.0 pips (ECN) | $0.00 $3.00 | -$5.3895 -$5.3895 | X X | $13.3895 $8.3895 |

0.8 pips (Pro) 0.0 pips (ECN) | Text | X X | -$1.0996 -$1.0996 | $9.0996 $4.0996 |

Taking a 1 standard lot buy/sell position in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips (Pro) 0.0 pips (ECN) | $0.00 $3.00 | -$37.7265 -$37.7265 | X X | $45.7265 $40.7265 |

0.8 pips (Pro) 0.0 pips (ECN) | $0.00 $3.00 | X X | -$7.6972 -$7.6972 | -$15.6972 -$10.6972 |

I like the low swap rates at MultiBank Group, and together with other trading costs, this broker offers traders one of the lowest overall trading costs.

MultiBank Group levies a $60 monthly inactive fee after three months, which active traders will never face. I find it a bit too much and too early compared to the industry average, but it should not be a deal breaker as almost any trader is going to make at least one trade in three months.

What Can I Trade

MultiBank Group offer a choice of 55+ currency pairs, 5 cryptocurrency pairs, 6 commodities, 6 index CFDs, 15,000+ equity CFDs, and 13 index futures. Forex traders get an averagely ranged choice of trading instruments, while equity traders get one of the best in the industry.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

MultiBank Group Leverage

Traders at MultiBank Group get maximum leverage of 1:500 together with negative balance protection, a necessity for leveraged traders. Since MultiBank Group operates numerous subsidiaries in various regulatory environments, maximum leverage will differ. For active traders, I highly recommend flexible trading terms.

MultiBank Group Trading Hours (GMT+3)

Asset Class | From | To |

|---|---|---|

Commodities | Monday 00:00 | Friday 23:55 |

Crude Oil | Monday 00:00 | Friday 23:55 |

Gold | Monday 00:00 | Friday 23:55 |

Metals | Monday 00:00 | Friday 23:55 |

Equity Indices | Monday 10:00 | Friday 23:00 |

Stocks | Monday 10:00 | Friday 23:00 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies

MultiBank Group does not offer 24/7 cryptocurrency trading, per its MT4 specifications, making trading that asset unsuitable for traders.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

MultiBank Group offers its Standard account for a minimum deposit of only $50. Pro is available from $1,000, a high demand, but it cuts trading fees by almost 50%. The best trading conditions exist in the ECN option, but traders must commit $5,000, which may be high for some.

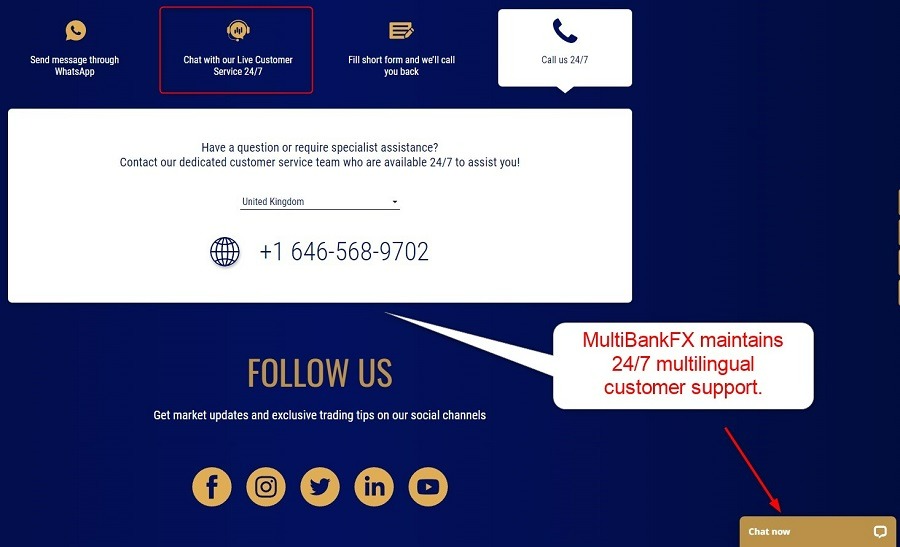

Other than trading costs, the rest of the trading conditions are identical. Maximum leverage is 1:500, multilingual customer support is available 24/7, and MultiBank Group offers MAM/PAMM accounts plus its proprietary copy trading platform.

MultiBank Group Demo Account

There is a free offering of MT4/MT5 demo accounts for all three account types, with no time limit listed. The demo account is ideal for testing trading strategies and algorithmic trading solutions/EAs. The flexibility of the MT4/MT5 demo account option can create trading conditions as close as possible to live accounts, but no demo can substitute the experience and emotions of live trading.

Trading Platforms

Traders may choose between the out-of-the-box MT4 or MT5. They are available as a desktop client, with full support for EAs, where MT4 remains a market leader. A lightweight web-based option and mobile app are equally available. I would really like it if MultiBank Group would offer in the future some of the third-party platform plugins to ensure that short time frame traders can get a more competitive analytical edge, matching its excellent trading costs.

I appreciate that MultiBank Group invested in the development of a proprietary copy trading platform. Together with its MAM/PAMM accounts, it presents an excellent choice for asset managers, especially those geared towards equity portfolios.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Two unique features I want to note are free VPS hosting and FIX API trading. The former supports algorithmic trading, which accounts for 80% of all trades at this broker. The latter allows for the connection of advanced trading solutions to the competitive MultiBank Group trading environment.

Research and Education

MultiBank Group neither offers research nor educational content. Both are readily available online from trusted sources, but MultiBank Group does cater to beginner traders, and it would be nice to see some educational offerings. However, this should not be a deal breaker for anyone as there is plenty of good free educational material available widely on the internet, MultiBank also offers newsletters weekly.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Business Hours |

Website Languages |          |

Multilingual customer support is available 24/7. MultiBank Group lists 23 phone numbers, provides live chat, video conferencing via Zoom and Microsoft Teams,WhatsApp and e-mail support. The overall customer support options at MultiBank Group are excellent.

Bonuses and Promotions

MultiBank offers a 20% deposit bonus capped at $40,000, subject to trading conditions.

A cashback program, which gives rebates on trading in volume in Forex currency pairs and metals, is also offered.

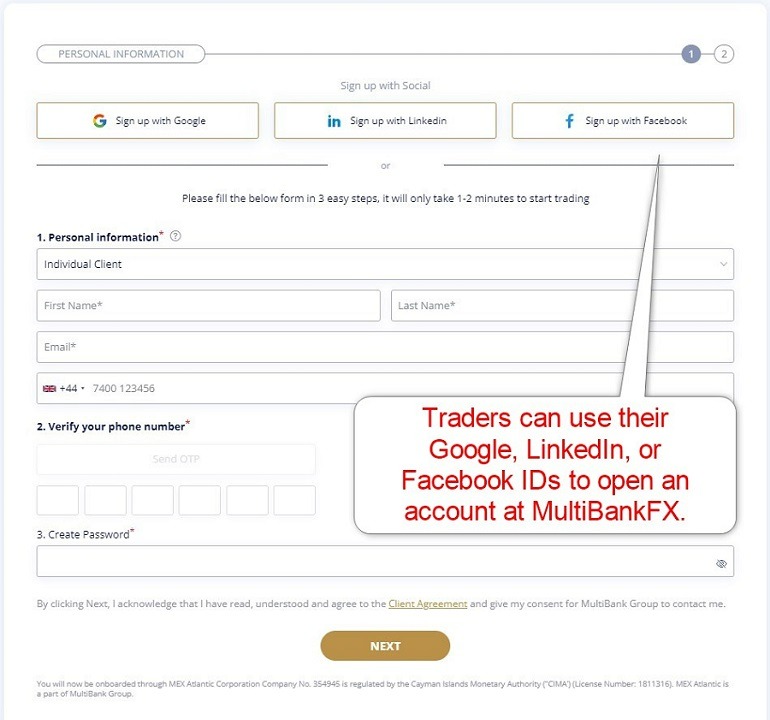

Opening an Account

Opening an account at MultiBank Group takes only a few seconds and requires a name, e-mail, and valid mobile phone number. MultiBank will send an OTP via SMS, which is necessary to complete the process. Traders must also select their desired trading platform and account tier. Traders must also select their desired trading platform and account tier. Within less than a minute, a MultiBank Group representative will call. This was an extra thing compared to many brokers, but on the other hand it is always reassuring to see your broker taking extra care over security and this is what MultiBank Group is doing here.

Account verification is a mandatory final step. Most traders will be able to satisfy this step by sending a copy of their ID and one proof of residency document. Then the new account is opened immediately.

Minimum Deposit

The minimum deposit for the MultiBank Group Standard account is $50 or a currency equivalent. Pro requires $1,000 and ECN $5,000. I strongly recommend the ECN account despite its high deposit requirement. Traders will get the most benefits from it due to excellent trading costs.

Payment Methods

MultiBank offers bank wires, credit/debit cards, SEPA, Skrill, Neteller, PayTrust, Payment Asia, Globe Pay, ThunderX, Help2Pay, POLi, and cryptocurrencies (Bitcoin and USDT). I like the choice and flexibility concerning financial transactions at MultiBank Group.

Deposits and Withdrawals

There are no internal deposit or withdrawal fees, but third-part charges apply, which is why I recommend traders check costs. The secure MyMultiBank account area handles all financial transactions, and MultiBank Group claims instant processing. It can take several business days for clients to receive funds, dependent on their payment processor.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

Bottom Line

I like the trading environment at MultiBank Group for equity traders and asset managers, as it presents a distinct competitive edge with MAM/PAMM accounts and the proprietary copy trading platform. I rank the trading costs among the best in the industry.

Despite the high minimum deposit for the ECN account, I can recommend it to active traders, as the cost savings for long-term portfolios remain priceless. Commission-rebates also exist, making MultiBank Group ideal for traders with $5,000+ accounts, maximum leverage of 1:500, and fast trade execution.

A generous bonus offering adds to the benefits available at MultiBank Group, which is one of the best overall brokers for committed traders. Mex Exchange, a division of MultiBank Group, remains regulated by the ASIC. MultiBank is primarily a multi-asset broker with a global client base. It also maintains a software and technology consulting division and a prime liquidity service for institutional clients. The MyMultiBank account area processes all withdrawal requests. Traders select the amount and desired payment processor, and MultiBank Group processes requests instantly.FAQs

Is Mex Exchange regulated?

What does MultiBank do?

How can I withdraw money from MultiBank?