Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | FCA, FSC Mauritius |

Year Established | 2010 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Key to Markets, a Mauritius-based broker founded in 2010, claims to offer access to the electronic communication network (ECN) via the MT4 trading platform. Two subsidiaries, one in the UK and one in New Zealand, complete the group structure. The UK-based entity operates as a broker which caters to traders from the European Economic Area (EEA). The New Zealand entity is not a broker; it merely owns the MT4 trading platform, which it distributes to the two brokerage units. Key to Markets claims to offer a wide range of products but lists only 167 assets. Other claims include direct market access (DMA) and no dealing desk (NDD) execution. Social trading and retail account management are also available at this broker. Statistics show that 71.0% of retail traders lose money at Key to Markets.

Regulation and Security

KEY TO MARKETS INTERNATIONAL Limited, the Mauritius-based broker, operates under the oversight of the Financial Services Commission (FSC) of Mauritius as an Investment Dealer. All non-EEA traders will manage their portfolios there, the most competitive trading environment available at Key to Markets. It is also the payment processor for non-EU clients, using Skrill and Neteller wallets. The UK Financial Conduct Authority (FCA) authorizes KEY TO MARKETS (UK) Limited, and this unit serves all EEA-based traders. KEY TO MARKETS NZ Limited is not a broker but rather a duly registered company in New Zealand and operates as a wholly-owned subsidiary of KEY TO MARKETS (UK) Limited.

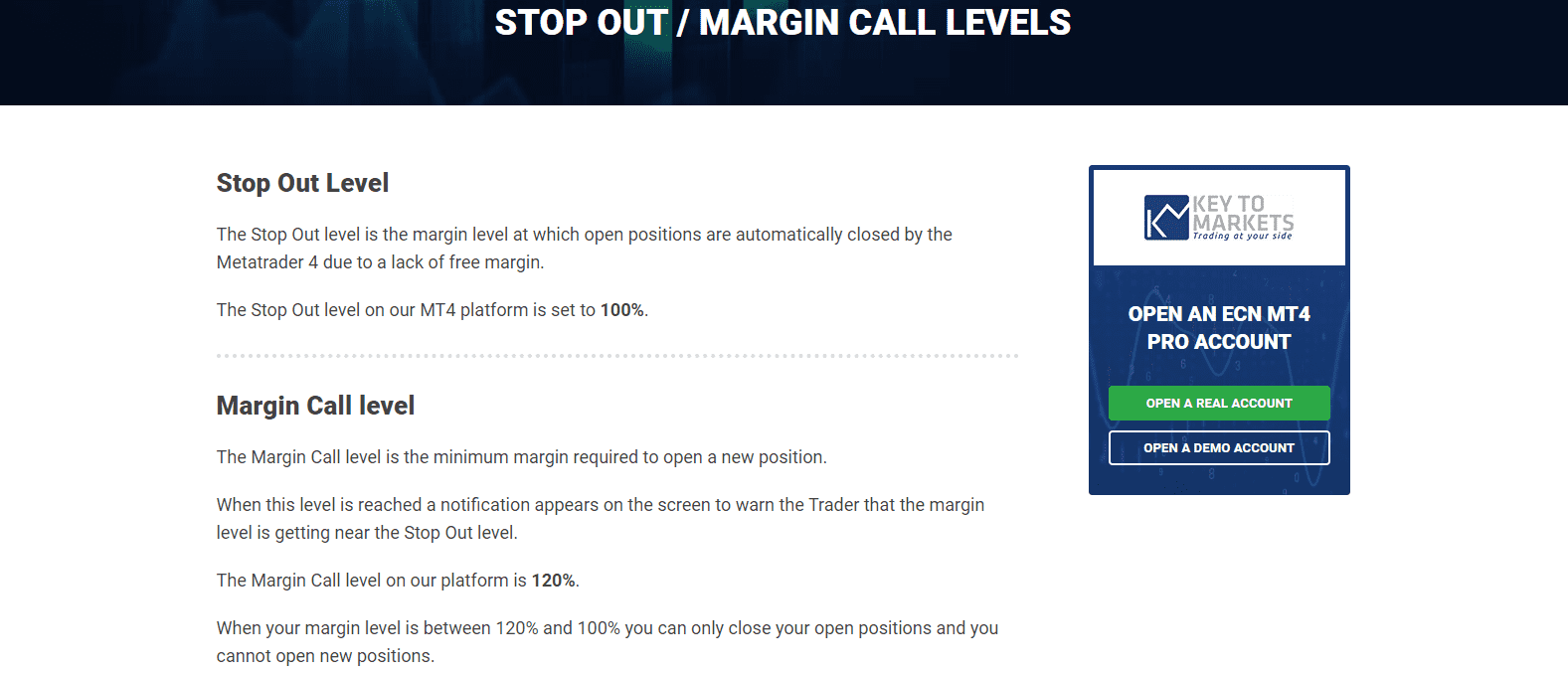

Client deposits remain segregated from corporate funds, but traders should be aware that negative balance protection for the Mauritius-based brokerage does not exist. Traders should consider this carefully, especially given the leverage of 1:500. Allowing it, without protection other than a stop-out at a 100% equity ratio, may not always prevent an account from going negative. Key to Markets maintains a clean record with both regulators, offering traders a secure trading environment.

The FSC of Mauritius and the FCA of the UK provide the regulatory framework for Key to Markets.

Negative balance protection does not apply to the Mauritius-based entity.

Traders must rely on the 100% stop out level as the sole measure of security against a potential negative balance.

Fees

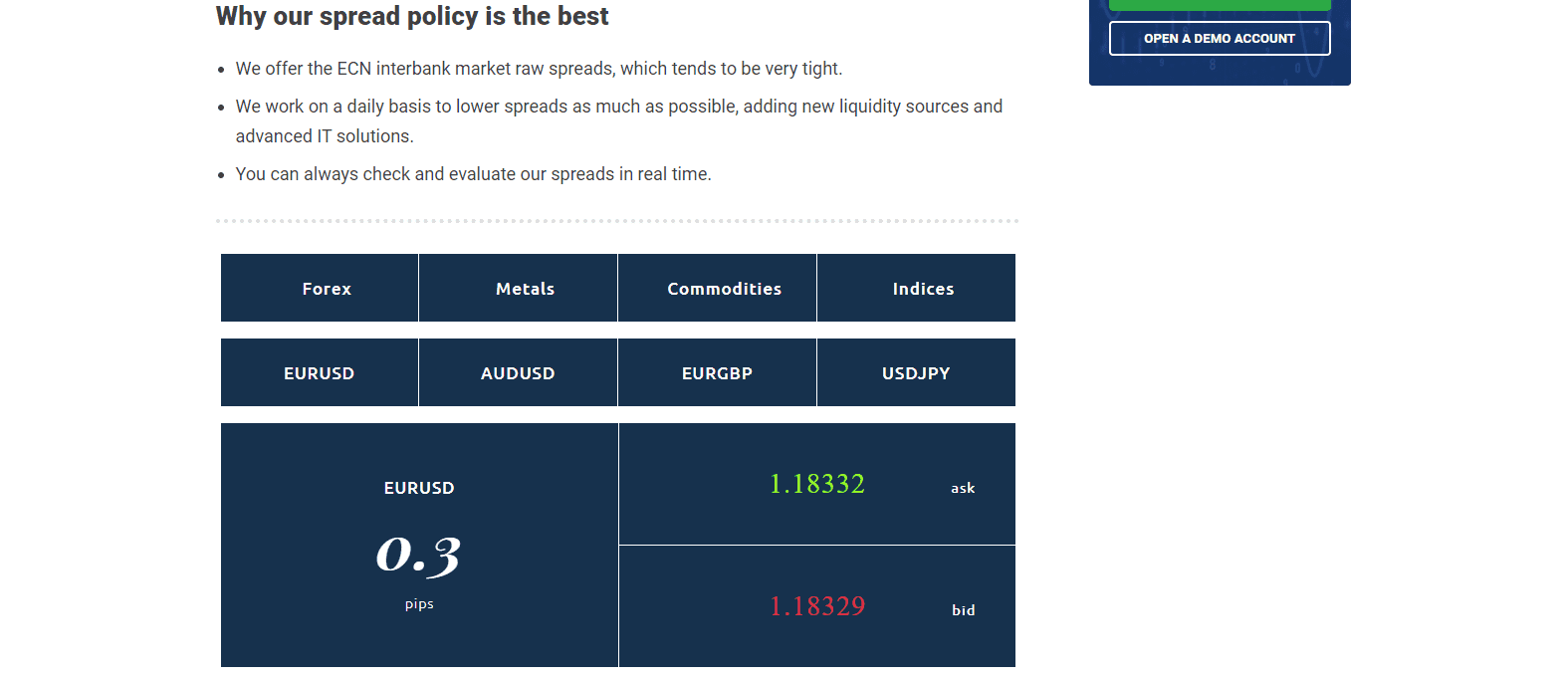

Key to Markets offers one commission-free MT4 account where the mark-up on all assets is 1.0 pip plus the spread. The commission-based alternative features raw ECN spreads for a commission of $8 per round turn. While this broker claims to have the best pricing, the EUR/USD shows an average spread of 0.02 pips to 0.03 pips, while more competitive brokers have it as low as 0.0 pips. The commission of $8 is acceptable, but higher than well-established competitors. Swap rates on leveraged overnight positions apply. This broker is transparent about the costs and also provides traders with a clear explanation as to how to check them in the MT4 trading platform; many brokers fail to disclose this.

How Key to Markets handles corporate actions such as dividends, splits, and mergers which impact equity and index CFDs, is not noted. Third-party fees exist for deposits and withdrawals alike, but no inactivity fee applies, per the terms and conditions. While Key to Market does not waive deposit fees, as most brokers do, the overall pricing environment remains average and acceptable.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

The raw ECN spreads are acceptable but slightly higher as compared to other brokers.

Key to Markets does describe how traders can obtain the latest swap rates.

What Can I Trade

Traders may trade 65 currency pairs, 12 commodities, one bond, 64 equity CFDs, 14 index CFDs, and 11 mini index CFDs, for a total of 167 assets across five categories. While the selection is suitable for new retail traders, it is hardly sufficient for more demanding investors and traders, countering claims by Key to Markets that it offers a wide range of markets.

While Key to Markets claims over 180 assets, the website only lists 167.

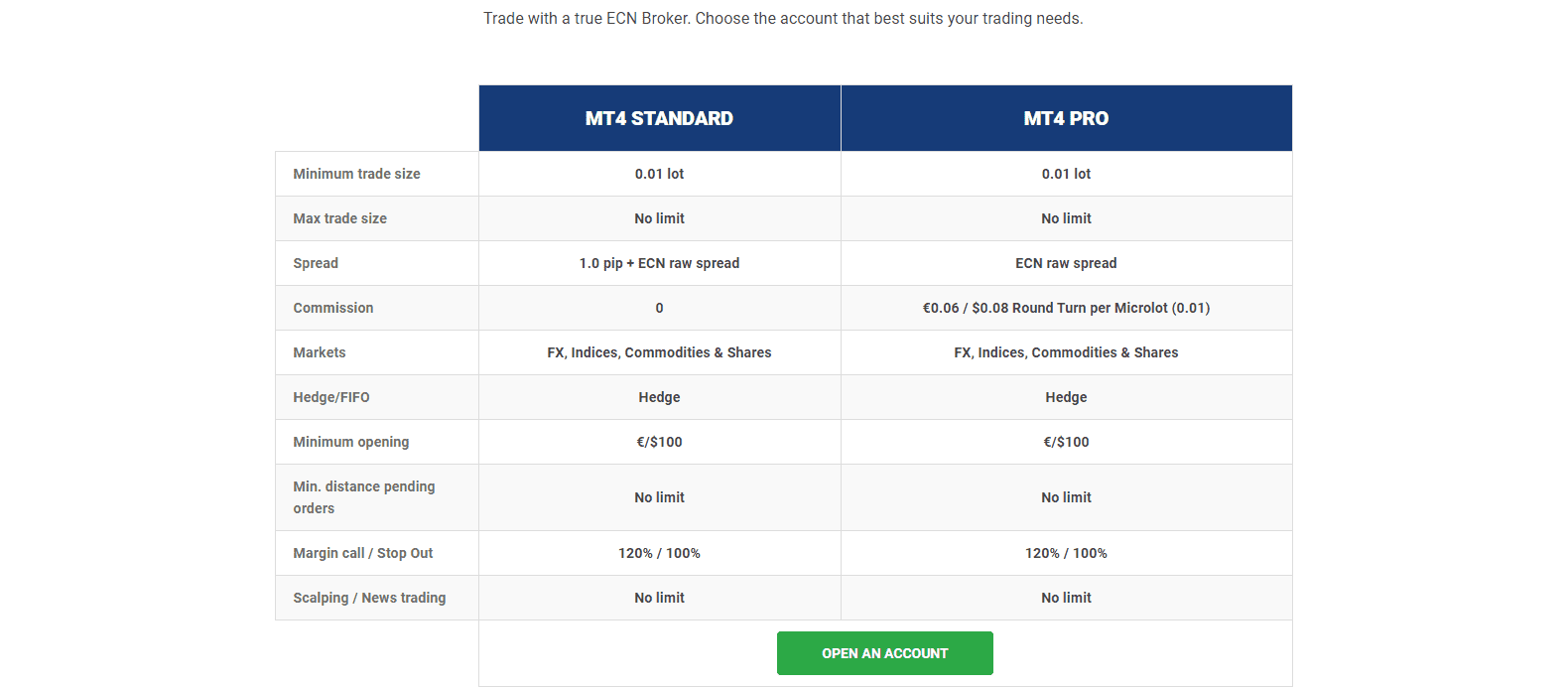

Account Types

The two main account types are the commission-free MT4 Standard and the commission-based MT4 Pro. The former adds a 1.0 pips mark-up to the raw ECN spread, while the latter offers traders no additional mark-ups on the difference between the bid and ask price for a commission of $8 per round lot. Both accounts demand the same acceptable minimum deposit of $100. A Euro account is equally available for €100, where the commission is €6 per round lot. Besides pricing, the MT4 Standard and the MT4 Pro offer the same trading environment.

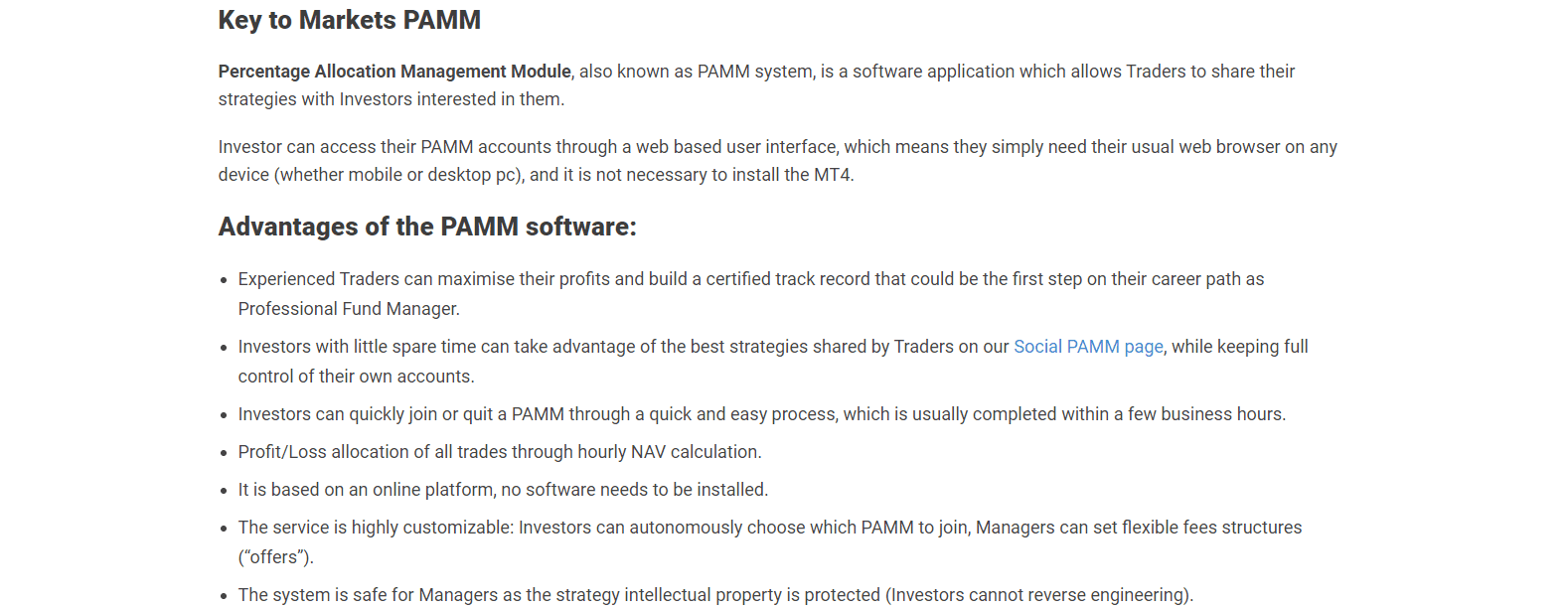

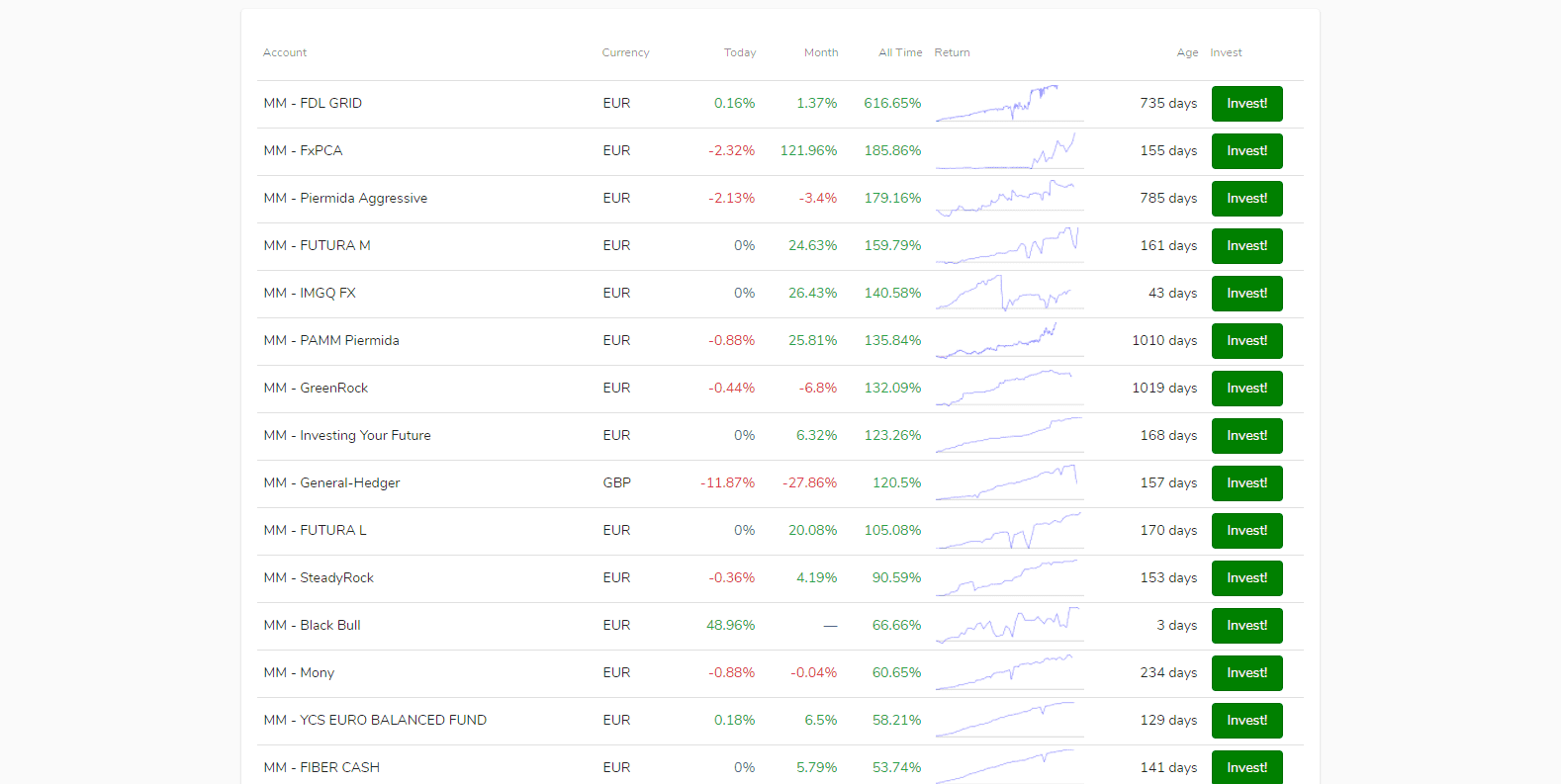

Retail account management is available via Percentage Allocation Management Module (PAMM) accounts, for which Key to Markets maintains a Social PAMM Page. It allows investors a brief overview of available PAMM accounts with information regarding the account base currency, daily, monthly, and all-time performance in percent, and the duration of it. Myfxbook AutoTrade supports social trading at Key to Markets.

The MT4 Standard Account and the MT4 Pro Account offer the same trading conditions, except for pricing. Most traders should opt for the latter.

PAMM Accounts cater to retail account management.

A Social PAMM Page offers interested investors a quick overview but no risk assessment.

Social trading is available via Myfxbook AutoTrade.

Trading Platforms

Only the out-of-the-box MT4 trading platform is available. While it remains the most popular retail trading platform, it is primarily due to the infrastructure on which over 20,000 expert advisors (EAs) and custom indicators exist, available from the Market. The MT4 is an excellent platform, but it requires upgrades to unlock its full functionality, which Key to Markets does not provide. The supported version offers a below-standard trading experience, and traders have to either accept it or invest in the necessary plugins.

Traders at Key to Markets have only the most basic MT4 version available, leaving them with a sub-standard trading platform unless they invest in upgrades.

Unique Features

A VPS service, in partnership with New York City Servers, is available for all traders who transact five standard lots with Key to Markets. Despite being marketed as free, a minimum volume requirement does apply. An upgrade is available if the volume exceeds ten standard lots, and traders who require more can purchase additional computing capacity at a 25% discount. It is an excellent service to support automated trading solutions. Another beneficial offer from Key to Markets is the Key to Savings Account. It pays an annual interest rate of 0.50%, paid out monthly, which may change depending on market conditions. Traders can swiftly deposit capital they do not require for trading and earn a minor passive revenue stream. Instant and free account transfers make it a valuable tool for traders to consider.

A VPS service with acceptable conditions supports automated trading solutions.

The Key to Savings Account pays 0.50% in annual interest payments each month.

It does not impact traders, but Key to Markets partnered with Forex Nations CIC, which donates 65% of broker profits in the form of interest-free micro-credits to entrepreneurs.

Research and Education

The Key to Markets blog is where traders will find research and educational content. A company, referenced as LCTO, provides the daily FX Outlook, while Key to Markets generates the KTM FX Daily reports. They are of good quality and consist of written content and related charts, offering clients fresh trading ideas. While Key to Markets does not feature a dedicated educational section with a well-structured program or lesson course, the blog contains posts with educational value. New traders will not get an education as with other brokers, but there are some hidden gems in the blog to broaden their investment horizon.

Daily trading ideas are available at the Key to Markets blog.

The blog also features posts with educational value; a traditional education program for new traders is not available.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | M - F, 9 am - 6 pm |

Website Languages |    |

Per the recommendation from Key to Market, e-mail is the best way to reach customer support. A webform and phone support are equally available; an FAQ section is not maintained. Operating hours for the UK-based support team are Monday through Friday between 9 am and 6 pm.

Customer Support is available via numerous channels, though e-mail is recommended.

Bonuses and Promotions

At the time of this review, Key to Markets neither provided bonuses nor promotions.

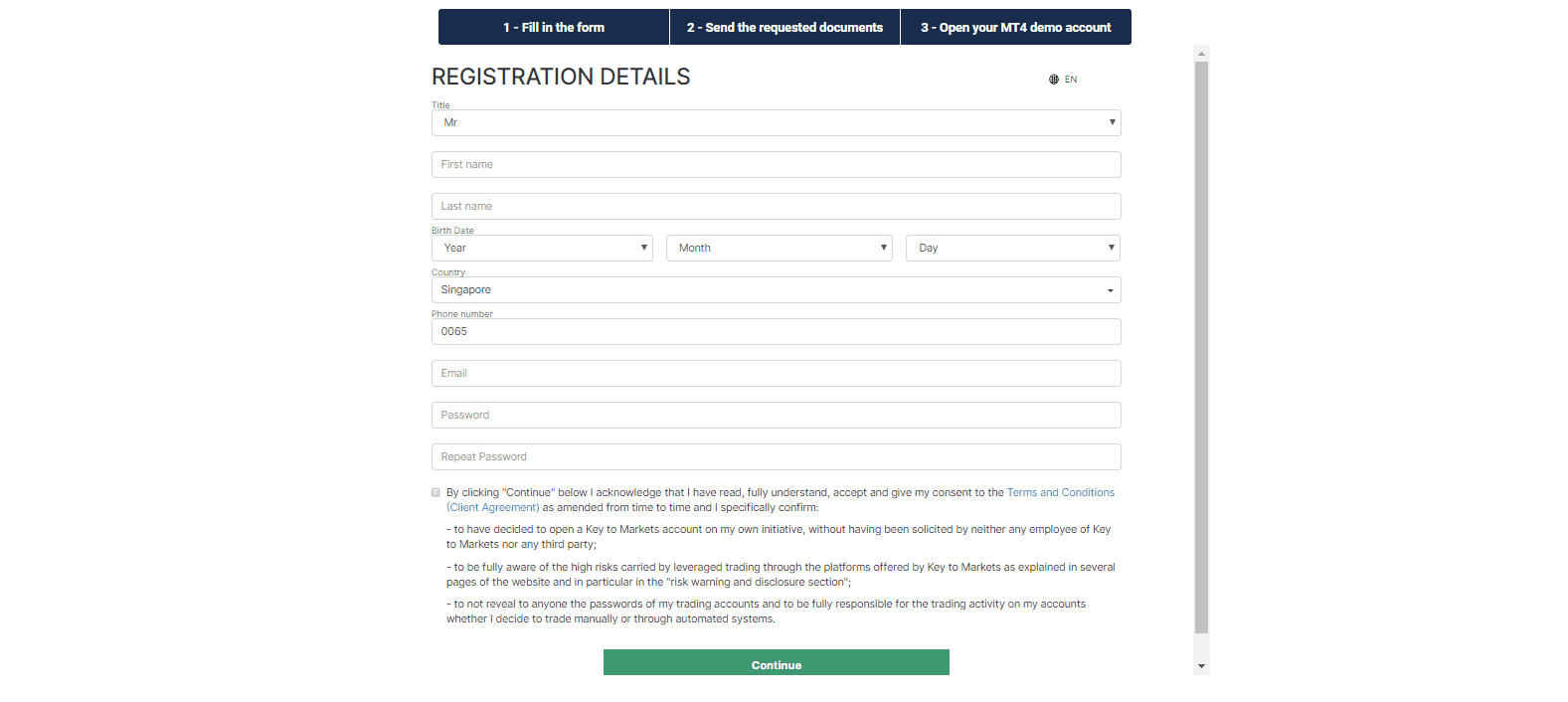

Opening an Account

An online application handles new account openings, per established industry standards. As a regulated broker, account verification at Key to Markets is mandatory. A copy of the trader’s ID and one proof of residency document usually satisfy AML/KYC requirements.

Key to Market's account opening procedure is in line with industry standards.

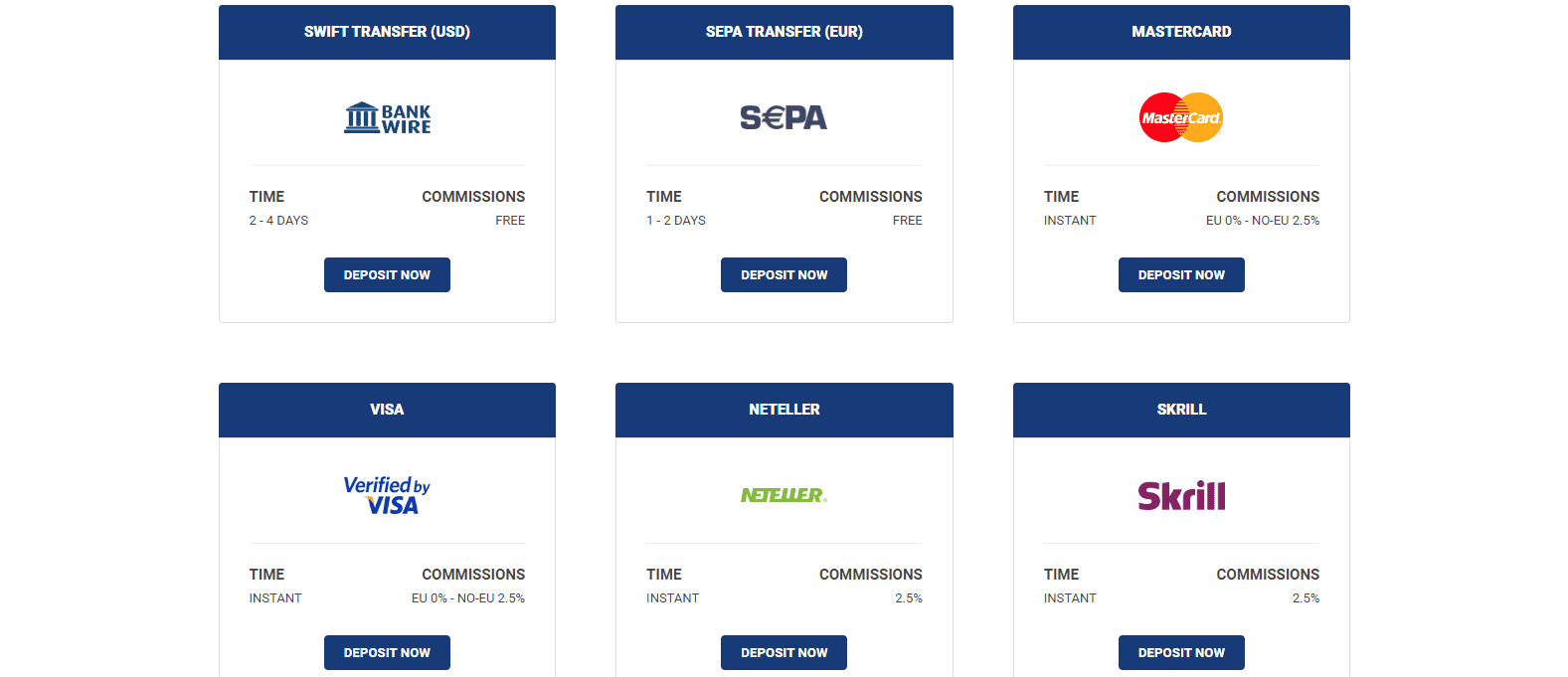

Deposits and Withdrawals

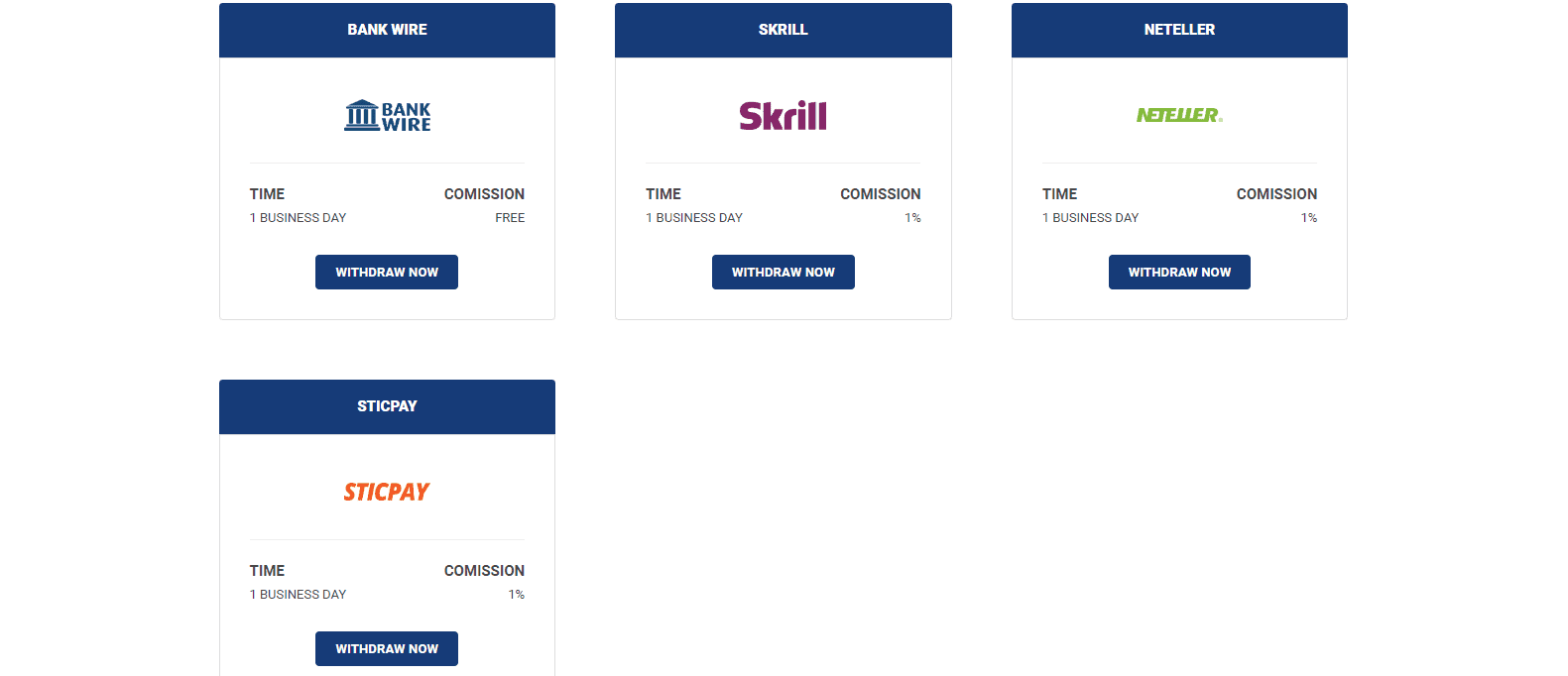

Supported deposit and withdrawal methods consist of bank wires, credit/debit cards, SEPA, Neteller, Skrill, STICPAY, UnionPay, and AliPay. Bank wires and SEPA remains commission-free. All other methods face a 2.5% levy, which is regrettable, as most brokers cover the deposit costs and waive fees for clients. Only bank wires, Skrill, Neteller, and STICPY, are available for withdrawals, where bank wires are, once again, free of charge, and the rest incurs a 1% cost. Unlike competitors, where deposits are free of charge and withdrawals may face costs, at Key to Markets, it will cost more to deposit than to withdraw. Processing times are between one to four business days.

A 2.5% deposit fee applies, which is unfortunate.

Only four withdrawal methods exist versus nine for deposits. The fee for withdrawals is 1.0%, making withdrawals cheaper than deposits.

Free bank wires are only available via SEPA. Third-party costs apply elsewhere.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

In operation since 2010, Key to Markets is well-regulated broker, compliant with the FSC in Mauritius and the FCA in the UK. A self-proclaimed true ECN broker, this broker offers traders raw spreads for a commission of $8 per round trip, placing it in the average cost category. It uses Microsoft Azure cloud servers for its ECN pricing aggregation, with an average execution time of five milliseconds.

With 167 assets across five categories, this MT4 ECN broker offers an acceptable choice for new retail traders, but not enough for more advanced ones. Only the standard MT4 trading platform is available, creating a sub-standard trading environment until upgraded, at the trader's expense. The blog features quality daily research and isolated educational content with the occasional hidden gem. Overall, Key to Markets offers a solid core foundation from where it can grow further. While not suitable as a primary choice, this broker makes an acceptable tertiary one. Two are available, the commission-free MT4 Standard and the commission-based MT4 Pro. The Key to Savings Account is an option in conjunction with the two main trading accounts. It is a multi-asset MT4 CFD broker operating out of Mauritius and the UK, with another, non-brokerage subsidiary in New Zealand. The maximum leverage is 1:500. Yes, Key to Markets regulation consists of the Financial Services Commission (FSC) of Mauritius and the UK Financial Conduct Authority (FCA). A demo account is available at Key to Markets.FAQs

What are the Key to Markets account types?

What is Key to Markets?

What is the Key to Markets leverage?

Is Key to Markets regulated?

Is there a demo account available at Key to Markets?