Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2013 |

Execution Type(s) | Market Maker |

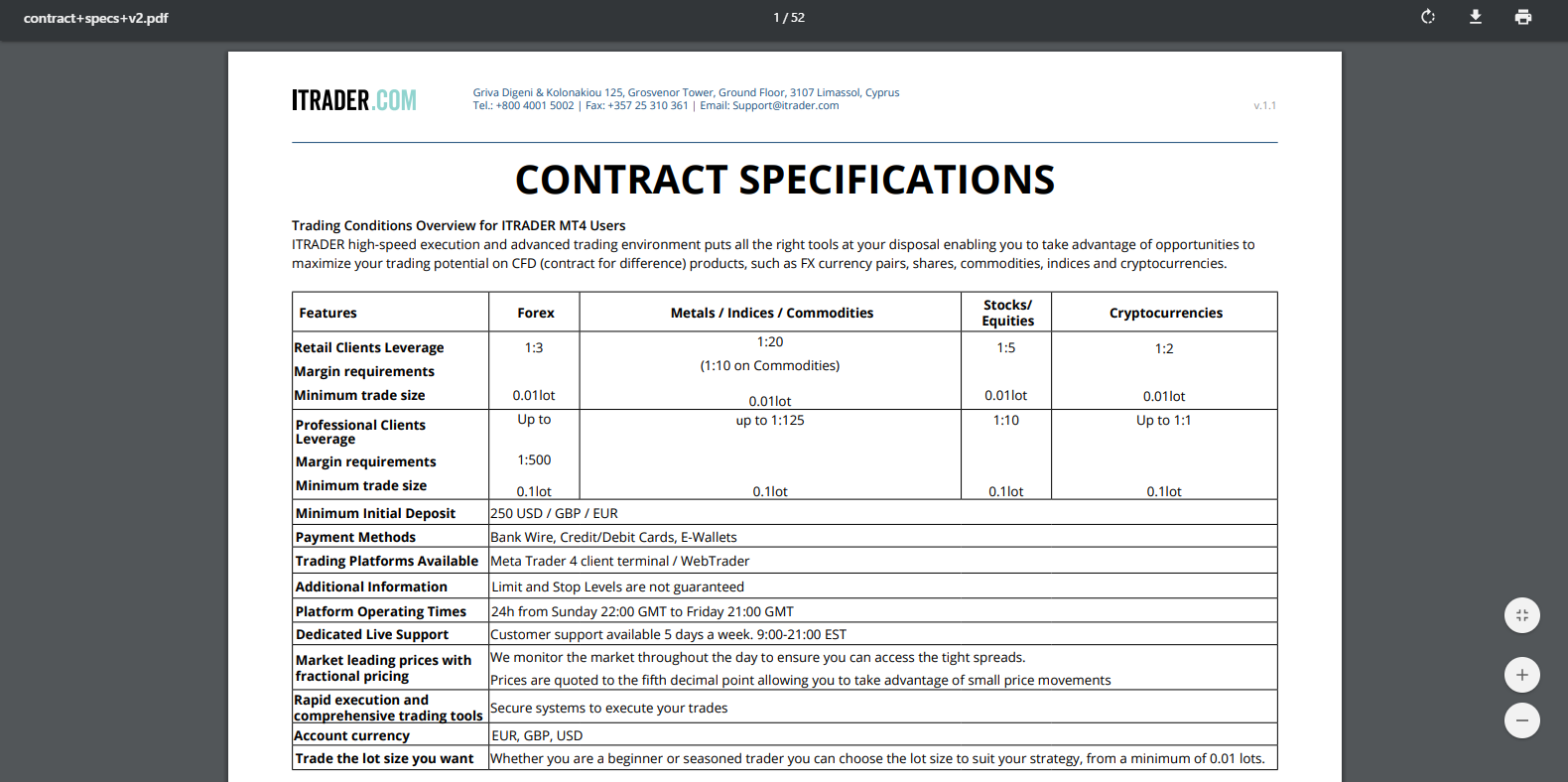

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

ITRADER represents the brand name of Hoch Capital LTD, a Cyprus-based investment firm, which received its CySEC authorization in 2013. This broker has a clear focus on retail traders, but it appears that the experience of the team running ITRADER is more in web-commerce than financial services. Possessing an efficient sales team is not undesirable, but highlighting it as a critical asset appears a bit off. Hoch Capital LTD maintains its website, light on information, and nothing on the company’s website made us feel confident in the broker’s abilities.

ITRADER is an adolescent broker which provided us with an unfavorable first impression during this ITRADER review as its website appeared to be little more than window dressing for traders who don’t know what they’re looking for.

Inexperienced retail traders will likely be misled by a fairly well-designed website that seems to present an extremely sophisticated brokerage operation, but an experienced trader will immediately see that this brokerage offers little more than smoke and mirrors. To be fair, ITARDER did mention it had plenty of sales experience, and it shows to a fractional degree in their presentation.

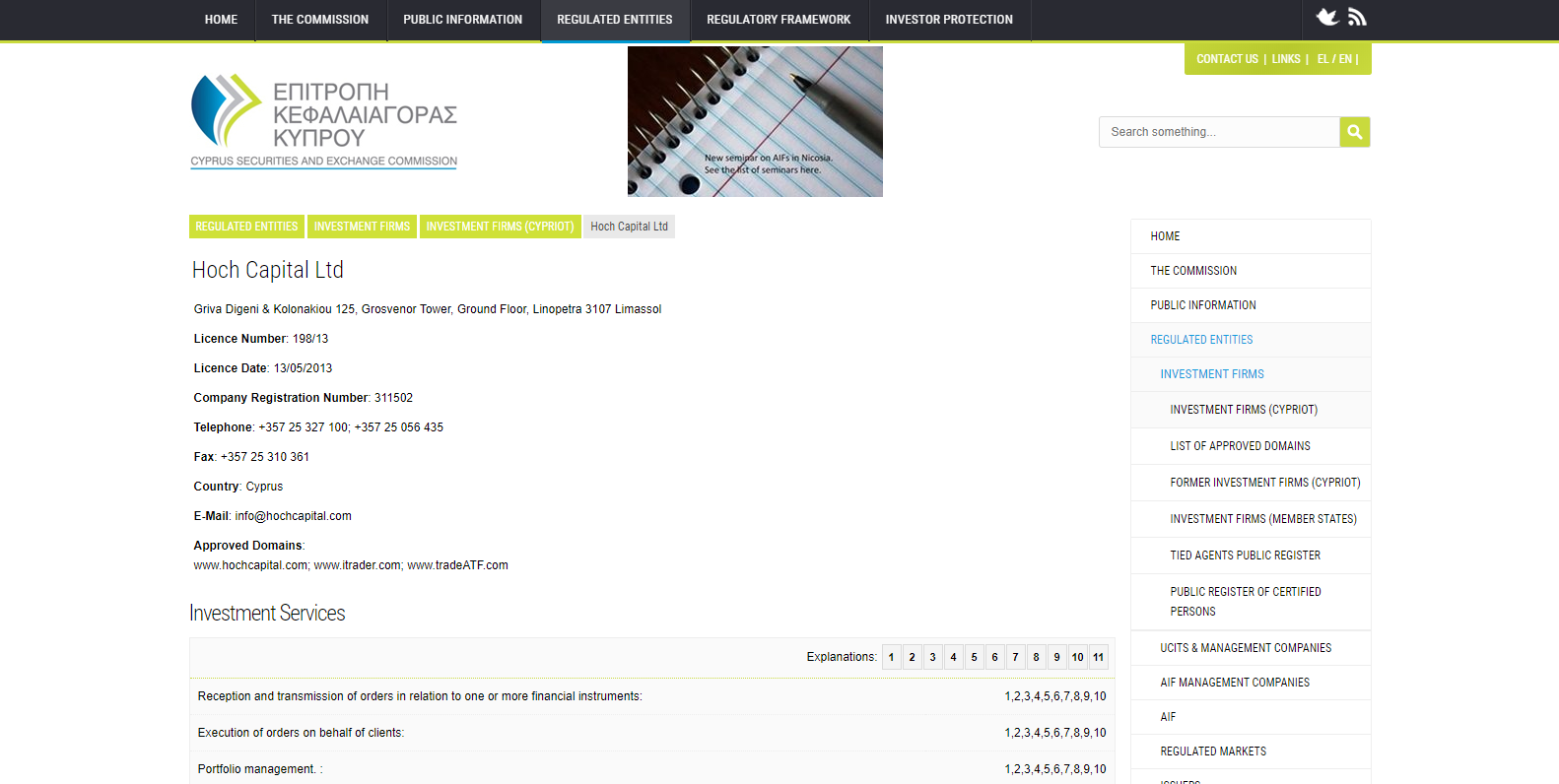

Regulation and Security

Hoch Capital LTD, the owner of ITRADER, is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 198/13. The license was granted on May 13th 2013. As an EU member state, Cyprus regulated firms are subject to cross-border regulation by all regulators inside the EU. ITRADER is fully compliant with the Markets in Financial Instruments Directive 2014/65/EU or MiFID II as well as the EU’s 4th Anti-Money Laundering Directive and publishes its Pillar III disclosure documents which describe the financial health of this brokerage.

Transparency is refreshingly high at ITRADER and clients are further protected by the Investor Compensation Fund (CIF), as mandated by the EU Directive 2014/49/EU; the maximum amount considered in the event of insolvency by this broker is €20,000, which remains the norm across the EU and covers most retail accounts. Client accounts are held in segregated bank accounts and from a regulatory perspective, everything does appear in order.

Fees

ITRADER is a market maker and generates most of its income from losses of its clients where this broker acts as their counterparty. Spreads, the difference between the bid and ask prices, also provide this broker with income.

Since ITRADER does offer CFDs in equities and indices, corporate actions such as dividends apply. No mention is made, on their website, about how they are transferred to clients; this represents a significant oversight. Swap rates are noted, and it is therefore expected that positive as well as negative swap rates are passed onto traders.

What Can I Trade

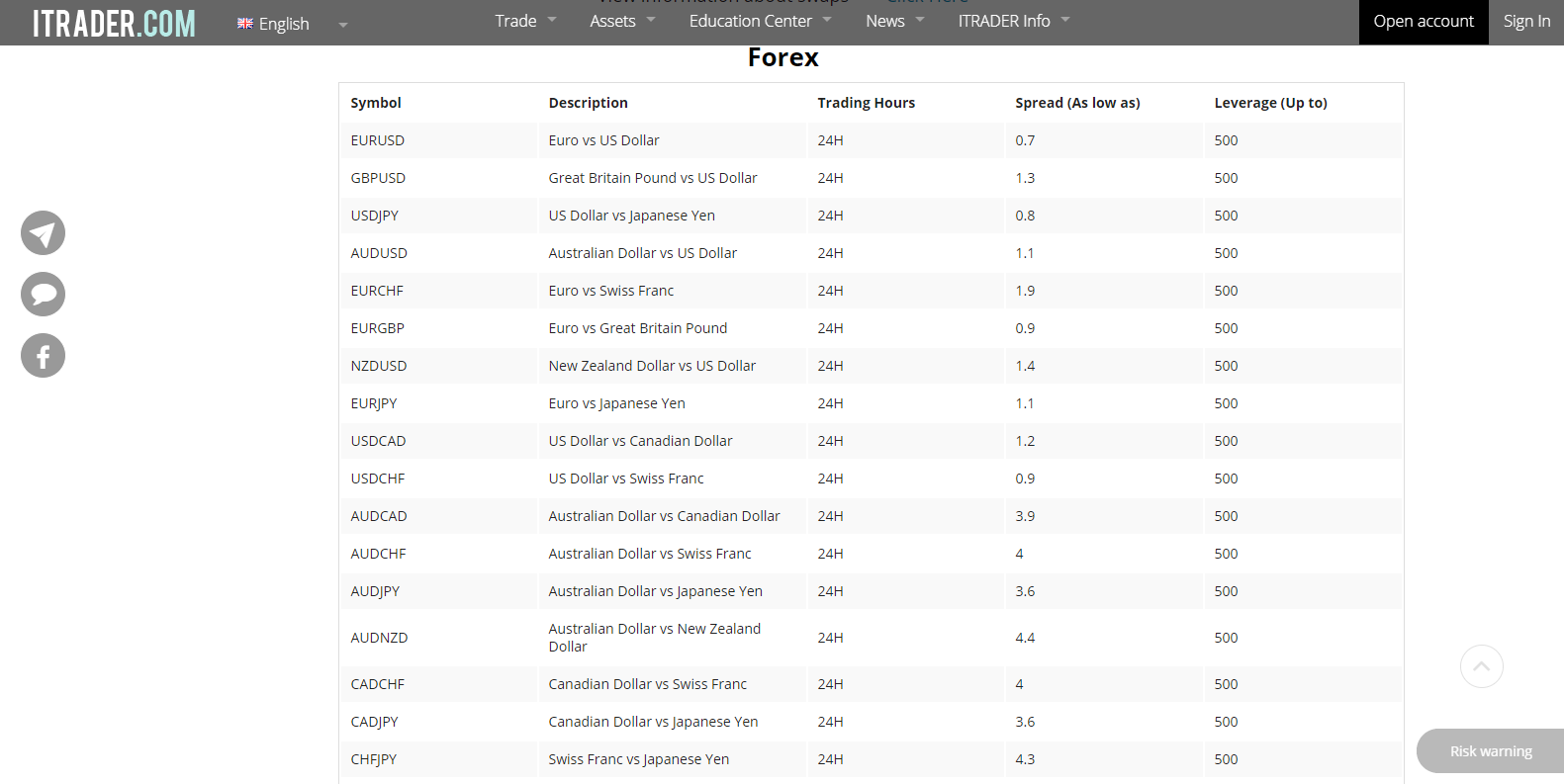

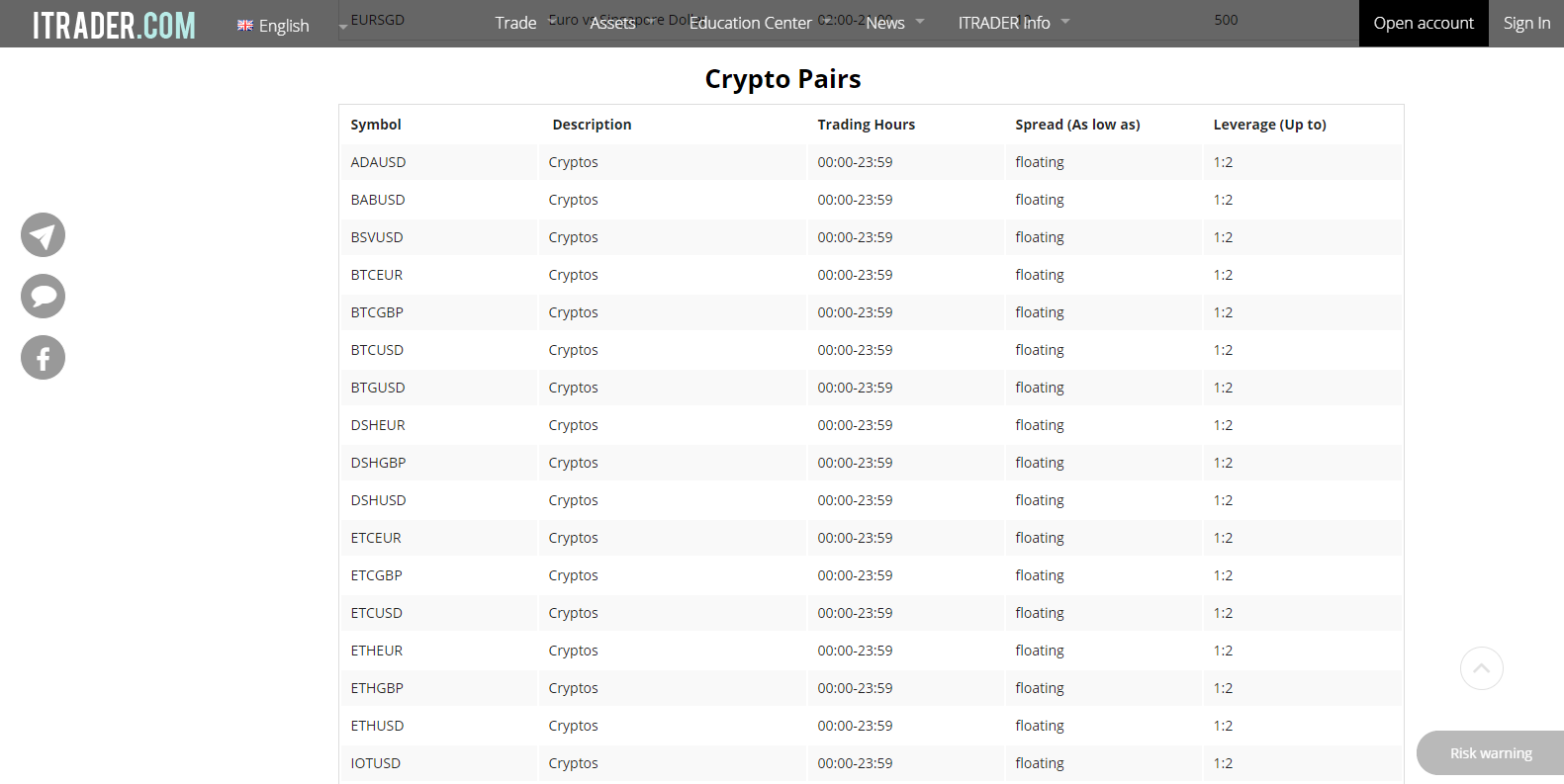

Asset selection is great across the Forex market with a surprise when it comes to cryptocurrencies where ITRADER offers a more extensive selection than most of its competitors. Commodity CFDs are also properly presented, but equity CFDs are limited to commercial names in the US and Europe with a handful of names in Australia while index CFDs cover a nice introductory selection. Overall, there are enough assets offered across five categories which will allow most retail traders to achieve proper cross-asset diversification. An Asset Index is published which lists all assets with the minimum spread offered, but it is worth noting that actual spreads are likely to be higher than listed.

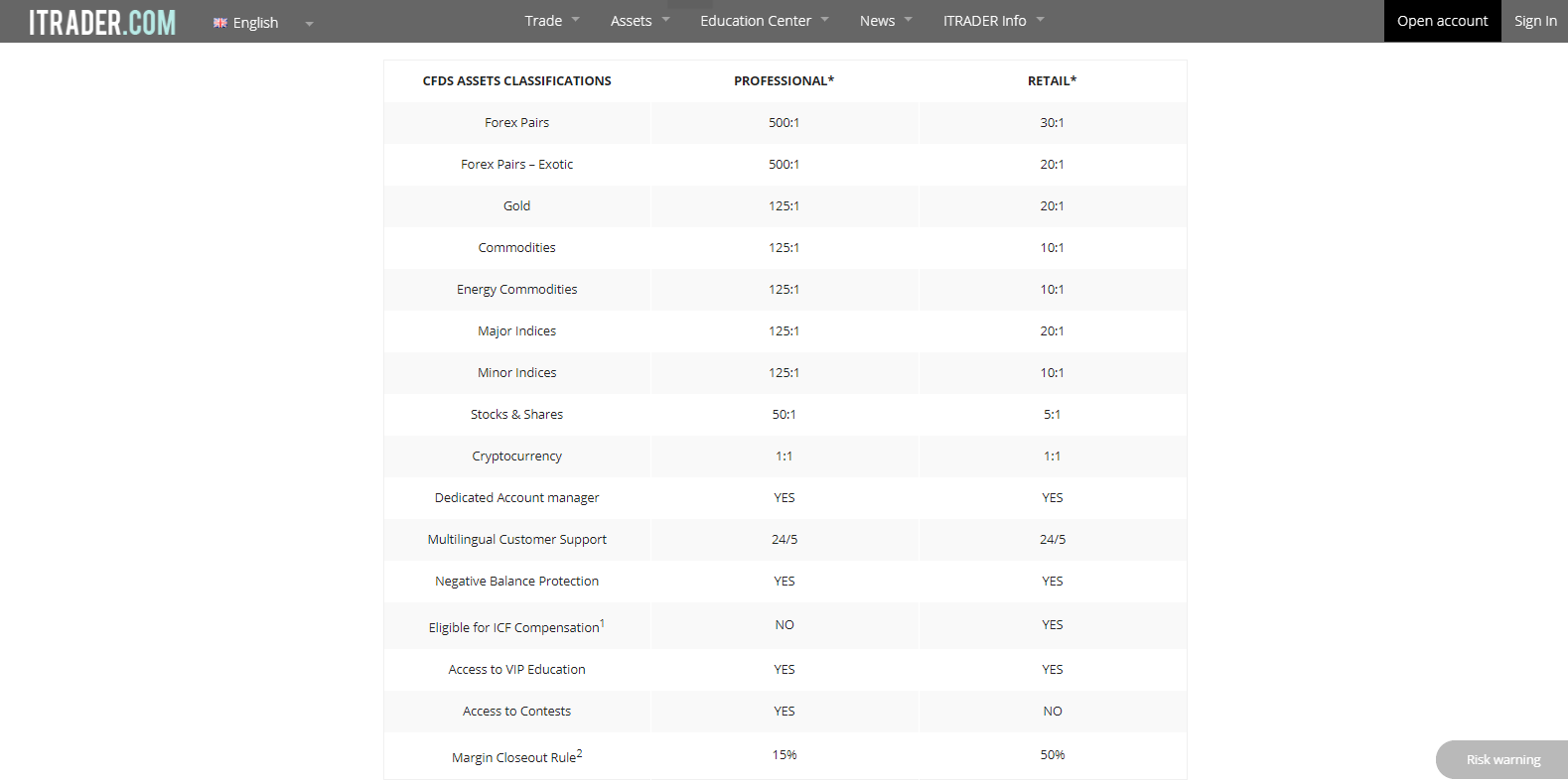

The maximum leverage stated for Forex trading is 1:500, but this only refers to professional clients, retail traders are limited to 1:30. This is another marketing tactic intended to persuade potential clients to open accounts, hoping for deposits. Under Account Types, this is rectified but it lists maximum leverage for professional traders as 1:400. The lack of clarity in key aspects of the trading environment is unfortunate.

ITRADER offers a sound selection of currency pairs and while spreads for the EUR/USD are listed at 0.7 pips, the actual spread is expected to be exceedingly higher. Spreads are overall acceptable, but the listed leverage doesn’t apply to retail traders who remain limited to 1:30.

ITRADER shines when it comes to the cryptocurrency market and offers an unusually attractive selection of assets. The maximum leverage offered to all traders appears to be 1:2, but this broker has made an effort to implement this emerging asset class which resulted in the most considerable positive surprise this review has uncovered.

Indices offer broad diversification and hedging tools and traders have access to a decent number of major global indices, suitable for retail traders.

When it comes to equity CFDs, the choice is limited to the major US and European names with a few Australian companies listed. While this is an adequate choice for new traders, who lack the research capabilities for a broader approach, advanced and professional traders will consider this an extremely limited selection.

On the plus side, a good commodities selection offers a combination of hard and soft commodities with all major metals available.

Account Types

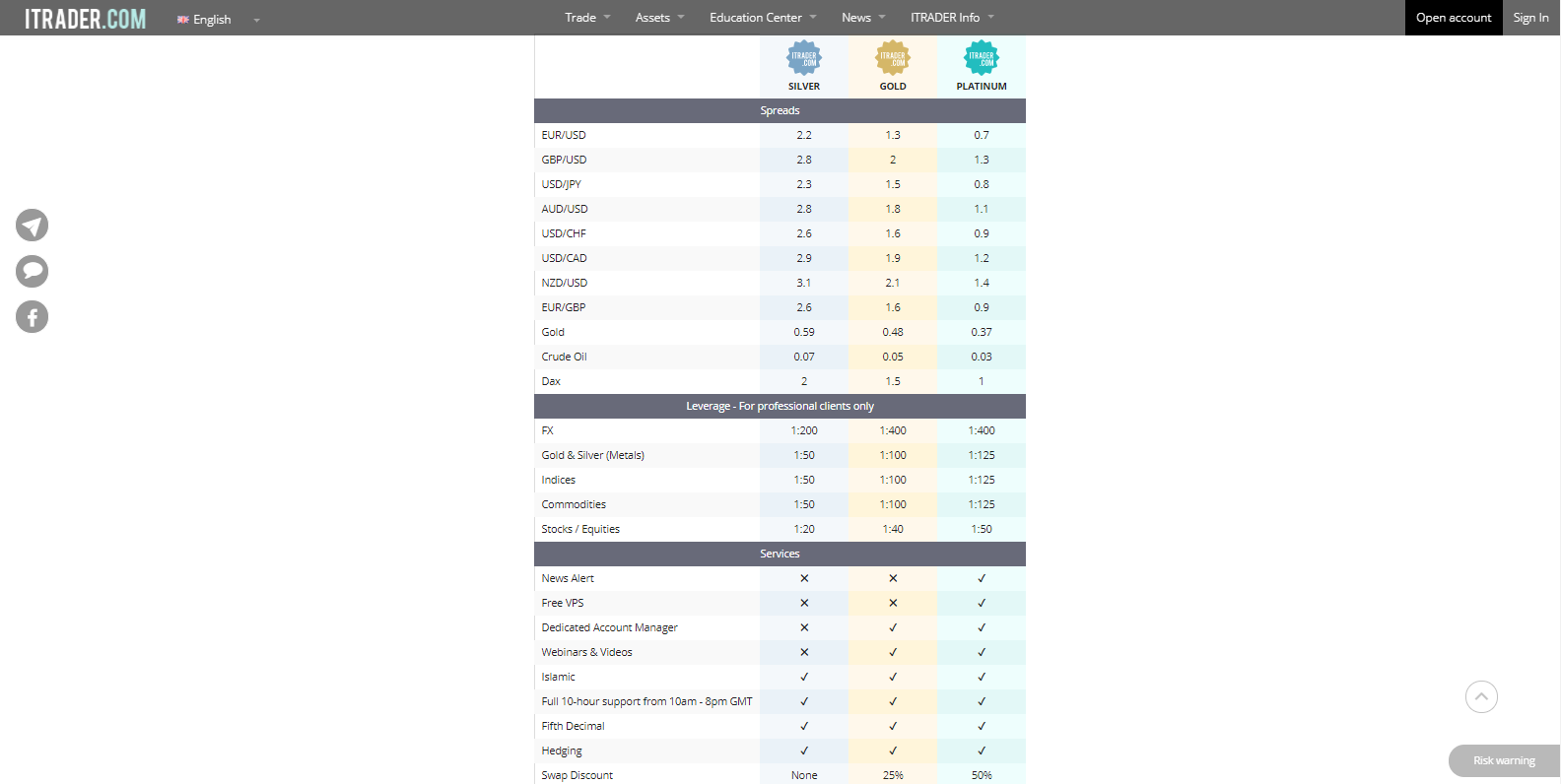

Three account types are available at ITRADER, but here’s where the lack of experience of this broker is plainly evident. The Silver, Gold, and Platinum account types differ with the spreads offered. The minimum deposit is listed as $250, but not provided in their “Account Types” overview, traders have to locate the “Contract Specifications” PDF. Since it appears that the deposit size doesn’t matter, which represents the proper approach and many established brokers have abandoned the pressure campaign for more significant deposits in return for better trading conditions, the bold choice would be the Platinum account.

Simply put, the other two account types are redundant. There may be unlisted requirements for the account upgrade from Silver to Gold, and from Gold to Platinum, but they should be communicated. Obtaining a more thorough look at services offered for each account, the Silver account has no access to webinars and videos; this is non-sense as those account holders would have the biggest need for educational material, assuming that Silver accounts are were retail traders do start at.

Swap discount rates are offered, 25% in Gold accounts and 50% in Platinum accounts; it appears that there is something amiss here and ITRADER has conducted a miserable approach in its transparency when it comes to account types. How those discounts are financed is unmentioned, and if trades are indeed placed, those charges do apply; without further information, this may suggest that all trades are kept in-house and never appear on the open market. Another misstep remains the listing of maximum leverage for professional clients, when the majority of traders if not all, will fall under the retail category.

The account information provided shows the lack of ITRADER’s experience.

More conflicting information is provided on the “Become a Professional” section where maximum leverage is listed as 1:500 and VIP education is made available for retail as well as professional clients. Access to contests is exclusively available to professional clients while retail traders are excluded; another backward approach as retail traders are likely to participate in the contest while no professional trader has use or interest in it.

Islamic accounts are available on request and are free of swap charges.

Trading Platforms

ITRADER offers the MT4 trading platform, an out-of-the-box solution that lacks the required upgrades to improve the trading environment for its clients. This starkly contradicts with the previous claim by this broker that its customers are their most valuable asset. The MT4 trading platform is available as a downloadable version, a web version, and a mobile version; this is the standard package of a license to offer the platform.

While the majority of retail traders use the MT4 as is, limitations of it are evident to advanced users. This has been corrected through the creation of third-party add-ons, which are available at a price; it would have been extremely appreciated if ITRADER would have gone the extra mile and offered some upgrades free to its traders. This is another example of a broker making big claims and failing to deliver.

The most beneficial feature of MT4 remains the intensive support of automated trading solutions, but the superior ones come at a price. The library is expanded with free EA’s and other tools, but traders should be extremely cautious. Back-testing is equally available which can help traders forge their strategy, but this all falls on the trader. ITARDER provides the bare minimum when it comes to the trading platform.

To be quite frank, we were disappointed to see during our ITRADER review that even the presentation of the MT4 trading platform is below average.

Unique Features

Regrettably, there are no outstanding features offered by this broker. On the contrary, as this review dug deeper into ITRADER, the number of red flags, discrepancies, and shortfalls become evident. The way services are tailored is backward; what should be geared towards retail traders is unavailable to them, while services offered to professionals should be provided to retail traders. On the “Account Types” page, a VPS service is listed, but ITRADER doesn’t provide details about it or even mentions it anywhere on their website.

Contradicting information regarding what type of trader is eligible for what type of service, a terrible presentation of the MT4 trading platform, lack of clarity on dividends and corporate events and how those effects are passed onto traders and how swap-rate discounts are offset just makes the broker seem apathetic, or perhaps lazy. The icing on the proverbial cake consists of a grammatical error on their Academy Center, where the button reads “Start Learn.”

Research and Education

ITRADER does offer its own research, or at the very least it attempts to do so; the same applies to its academy center where new traders are invited to “Start Learn” if they have access to it. Given the conflicting statements of what account or what type of traders have access to it, it remains unclear. At the bare minimum, the educational content should be provided to everyone interested in it.

Research

Research is provided in-house, but from the very start, the lack of professionalism and attention to detail is evident. Attempts have been committed to structuring the research division which represents a worthy idea, but unfortunately, the execution is awful.

The research section is broken down into four categories, somewhat scattered across the website. It consists of an economic calendar, financial calculators, a market summary and a daily review. The first three returned blank pages at the time of this ITRADER review, the latter appears to be a brand-new addition started on November 11th 2019 and is updated daily, but none of the videos are playing. Unfortunately, there is no dedicated research section which suggests this is not something taken seriously by ITRADER.

One of the most fundamental tools offered is an economic calendar, but at ITRADER it returns a blank page. Given the vast availability of economic calendars, there is no excuse not to ensure a functioning one is provided.

Numerous traders employ calculators, primarily to help with risk management. This is another section at ITRADER that returns a blank page.

Education

When it comes to education, ITRADER does a moderately better job than in other sections. The educational section consists of webinars, eBooks, a VOD section, courses, tutorials, and articles. A glossary is also available which lists the key trading terminology. All educational content enjoys its dedicated location on the website as ITRADER appears to have placed a more concentrated effort on education than research.

Providing education represents an easier task than providing research, but it is one of the most significant services a broker can and should provide to its clients; either by amassing their collection or by outsourcing it. ITRADER opted to handle education on its own, but given the services provided so far, it remains to be seen if this was the proper decision.

Webinars are offered several times per week which is a considerable frequency, it remains unclear if all traders have access to them as the information provided on different parts of the ITRADER website was conflicting. There is no library present to consider expired webinars so the quality of it is unknown.

Four eBooks are offered and the first two are surprisingly in-depth and consist of 78 and 94 pages respectively. Unfortunately, the last two which are only 10 and 8 pages long and can hardly be considered educational content.

Seven courses are available, and each course occupies several sections. At first glance, this appears to be great educational content with a well-thought-out concept. Unfortunately, we were hardly surprised to see that the pages didn’t return any real content.

There are sixteen pages completed with articles addressing topics in financial markets. The presentation is proper, which was a surprise given the failures by ITRADER so far. This section represents the best one this broker offers and it is functioning as intended.

Customer Support

Customer Support Methods |  |

|---|---|

Website Languages |        |

Since services offered by ITRADER are severely limited, it is no surprise that customer support is limited as well. Support hours are listed as Monday through Friday, 7 am to 7 pm GMT; most brokers offer 24/5 support, and this is not even close. Clients can contact support either by calling or sending an e-mail. An available FAQ section follows the same disappointing execution this review grew accustomed to, some questions are answered in one word or a short sentence. Given the short-comings, customer support may be used frequently by traders at ITRADER; at well-operated brokerages most traders never contact support.

Bonuses and Promotions

At the time of this review, ITRADER didn’t offer any bonuses or promotions to traders.

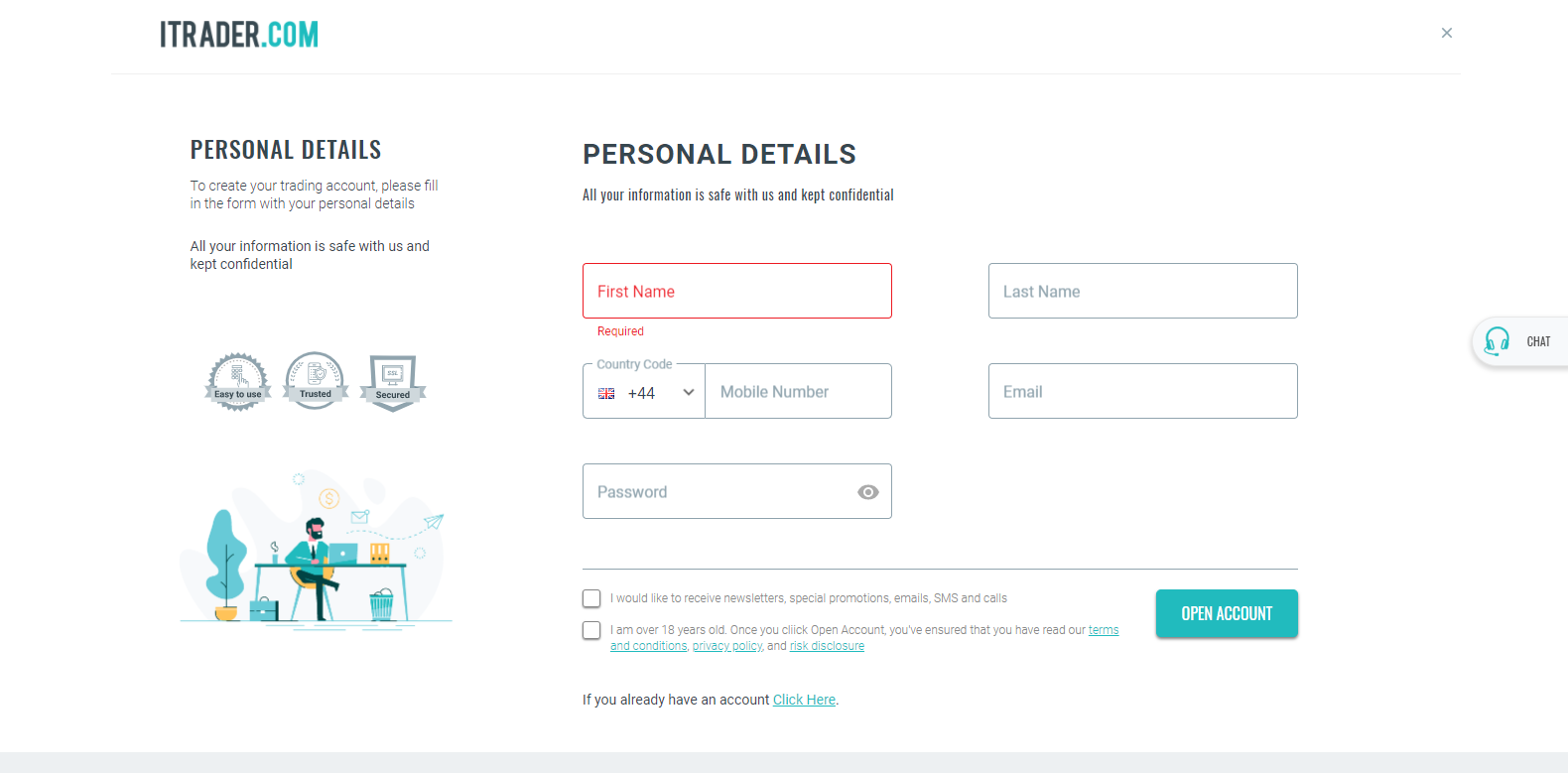

Opening an Account

Account openings are conducted through an online application form, which is standard for all online Forex brokers. Potential clients are required to fill out basic information, which at ITRADER consists of the name, e-mail, phone number, and password only. This should grant access to the back-office where a copy of the trader’s ID and one document to proof residency should be required as mandated by the regulator; this is a necessary step to satisfy KYC/AML requirements. There is a chat button, but once again it serves no function. ITRADER is regulated by CySEC, but potential traders should think twice before submitting personal details to a brokerage which has shown as many issues as this review has uncovered. When something isn’t appropriate at a broker, it is better to stay away and not expose yourself and your money to unnecessary risks.

Deposits and Withdrawals

Besides wire transfers and credit/debit card deposits, ITRADER lists the following payment providers as an option: Skrill, SafeCharge, E-Com Processing, Powercash 21, PayVision, Neteller, Truveo, PaySafe Card, Wirecard, and Decta. This marks a solid offering, but unfortunately, more precise information is unavailable. No dedicated page on the website describes this process in detail; the information is simply scattered across the website. The FAQ section answers the question in regards to charges with a simple and inconclusive “No”, which may apply to ITRADER but it may be that third-party charges do apply, we just can’t really know based on the information provided. Withdrawal processing time is listed in another section between one day for all payment options except bank wires, listed as five to seven working days which is fairly long by industry standards. A third section on the website asks for payment option verification which includes sending a copy of both sides of the used credit card; if a card was used, but it does state to display the last for digits only.

Each trader needs to assess if a broker can and should be trusted, being regulated is not always good enough. According to this ITRADER review, potential traders are urged to the utmost caution when considering ITRADER; too many things are off, and this should be taken into consideration.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

This review started with skepticism in regards to the owner of ITRADER, Hoch Capital LTD. Given the transparency when it comes to the documentation provided, there was hope that this broker may be on the right track to offer an alternative for traders to consider. A few bright spots followed, cryptocurrency selection was great, two eBooks were surprisingly in-depth and articles published marked a solid introduction to various aspects of the financial system.

Unfortunately, this is where the positives end and they are outnumbered by negatives and red flags which confirm the initial skepticism. If this brokerage is run by individuals skilled in web-commerce and finance, these skills are not wholly obvious. Most services offered return a blank page and there is no excuse for that. The presentation lacks professionalism and while this broker is authorized and regulated, at the end of this review it remains unclear if any trading takes place, trades may be fully kept in-house on a server as most traders face losses. This is further supported by the abnormally high loss rate listed at over 81.65%; other brokers range between 65% and 75%.

Transparency in regards to documentation is good but lacks when it comes to trading accounts. Three are listed, but no requirements provided on how to obtain better trading conditions; offering different trading conditions depending on deposits is a practice solid brokers abandoned, but it remains unclear what is offered and to whom under what conditions.

The presentation of the MT4 trading platform constitutes another critical failure that sums up what ITRADER has presented consistently. Given the number of red flags, conflicting statements about trading conditions, and many broken parts of the company’s website traders are better served elsewhere. There are too many things wrong at ITRADER which makes this broker a hard pass. ITRADER is headquartered in Limassol, Cyprus. ITRADER is a market maker and generates revenues from losses of its traders where it acts as a counterpart, it also earns money through spreads. Traders can deposit money via wire transfers, credit/debit cards, Skrill, SafeCharge, E-Com Processing, Powercash 21, PayVision, Neteller, Truveo, PaySafe Card, Wirecard, and Decta. The minimum trading size is listed as 0.01 lots. ITRADER initiates a margin call when the equity margin level reaches 50% in retail accounts which is lowered to 15% in professional accounts. Hoch Capital LTD, the owner of ITRADER, is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 198/13. The license was granted on May 13th 2013. The maximum leverage for retail traders is 1:30, but dependent on the traded asset. Professional traders can trade with 1:400 or 1:500, ITRADER issues conflicting statements in regards to this. ITRADER has an online application form which is the standard operating procedure. Yes, ITRADER offers the MT4 trading platform.FAQs

Where is ITRADER based?

How does ITRADER make money?

How can I deposit into an ITRADER account?

What is the minimum lot size at ITRADER?

When does a margin call take place at ITRADER?

Is ITRADER regulated?

What is the maximum leverage offered by ITRADER?

How do I open an account with ITRADER?

Does ITRADER offer the MetaTrader Trading Platform?