Yesterday’s press conference by President-Elect Donald Trump – his first in almost 6 months – was seen by the market as an important event. The main reason for this is that it was hoped he would provide more details regarding some of his key policies, particularly those that are expected to have most impact upon the economy and by extension, the markets, such as economic stimulus, trade policy, and taxation.

The overwhelming consensus was that the press conference was a disappointment on these terms, as Trump focused mostly on allegations made against him and his nominees, and got involved in a minor yet rather un-presidential spat with a CNN reporter. To be fair to Trump, the reporter’s behavior was something that President Obama never had to face in any of his press conferences.

Just a few minutes after the President-Elect started talking, the market began to react in a clear and decisive way: the USD fell strongly against practically every currency, after rising in anticipation in the opening minutes of the presser. Stocks fell too. The downwards movement in the USD has continued ever since, and has been strongest against the Japanese Yen, Gold and the Swiss Franc: all traditional “safe-haven” assets. However, it is significant that stocks have recovered, and never dropped very strongly in the first place.

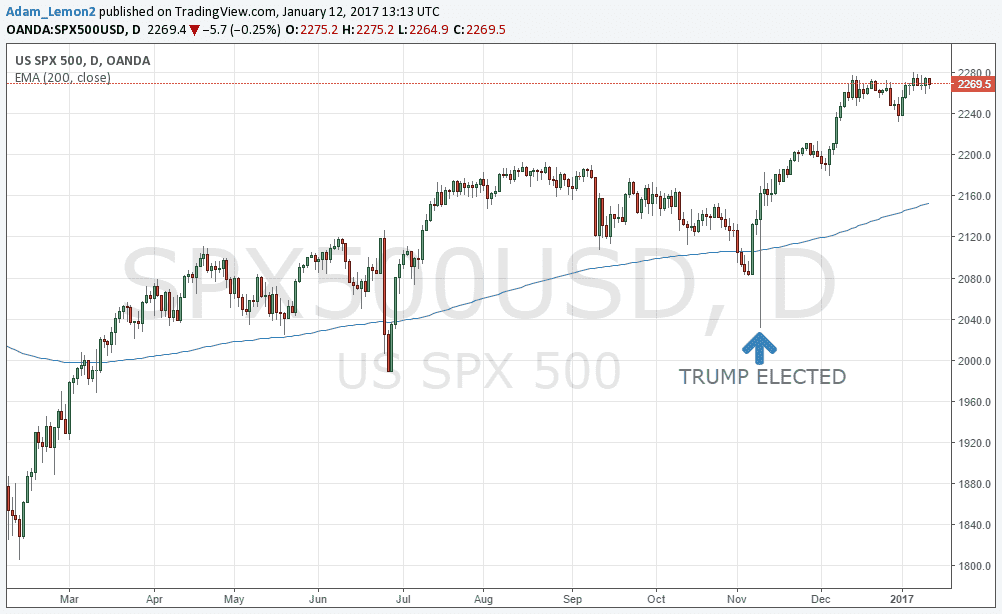

The reversal against a previously strongly bullish and trending USD has led a lot of pundits to speak of the end of the “Trump Rally”. This is premature, although some have instead called the end of the “Trump Trade” which would be more accurate. The U.S. stock market is still close to all-time highs and while it may not be going up, calling the rally over at this stage is a very, very brave call.

Below is a daily chart of the S&P 500 Index. Does this look like a rally that you can safely say is done? There is no technical justification whatsoever for calling an end to the stock rally.