In a surprise announcement today, which took political observers completely by surprise, the British Prime Minister Theresa May announced she would seek an early general election, to be held on 8th June. The next election had been scheduled for 2020, three years hence, but as the opposition Labour Party announced it would support the early election, the new date looks almost certain to be confirmed by the end of Wednesday 19th June. Opinion polls point to a landslide victory for Theresa May and her governing Conservative Party, suggesting a majority of 112, the size of which has not been achieved by any Conservative leader since Margaret Thatcher in the 1980’s. The opposition Labour Party is forecast to win 183 seats, which would be its worst result since 1935.

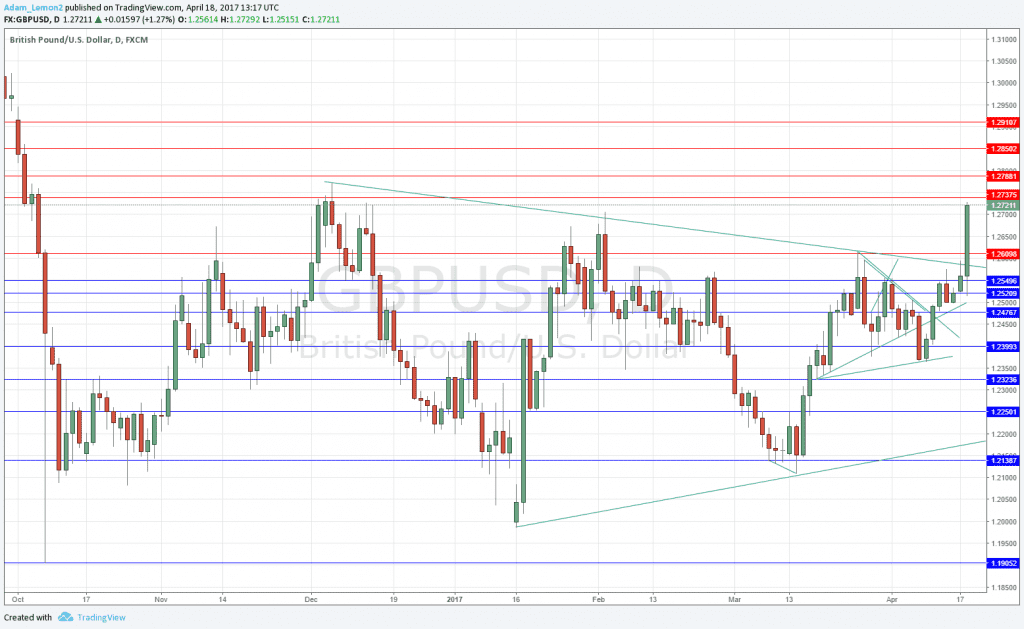

What does this mean for the British Pound? It began to rise against all currencies as soon as the announcement was made, and when the Labour Party quickly backed the early election, it broke out of its long-term range. It has already made a high of 1.2729 against the U.S. Dollar, its highest price in more than 4 months, and well above the area it was trading in following the “Hard Brexit” announcement on 7th October:

The long-term triangle formation shown in the chart above looks to have been decisively broken, although the price could fall back down below 1.2610 within the next few days.

Traders who have been respecting long-term trends will have noticed that the GBP/USD currency pair was already starting to look bullish in recent weeks. Nobody can forecast political surprises such as this, but it is interesting how “accidents tend to happen in the line of least resistance”. It should also be remembered that the price is not far from recent and historic lows, which are always an attractive area for long-term buyers once the price starts to bottom out.

starting to look bullish in recent weeks. Nobody can forecast political surprises such as this, but it is interesting how “accidents tend to happen in the line of least resistance”. It should also be remembered that the price is not far from recent and historic lows, which are always an attractive area for long-term buyers once the price starts to bottom out.

Why did the announcement make the market buy the British Pound? There are two theories, not necessarily contradictory. The first is that the election is very likely to produce a stronger and more stable government with a much larger majority in Parliament. The second, more doubtful conjecture is that Prime Minister May will use her mandate to negotiate a softer Brexit than had been backed by her current party representatives in Parliament.