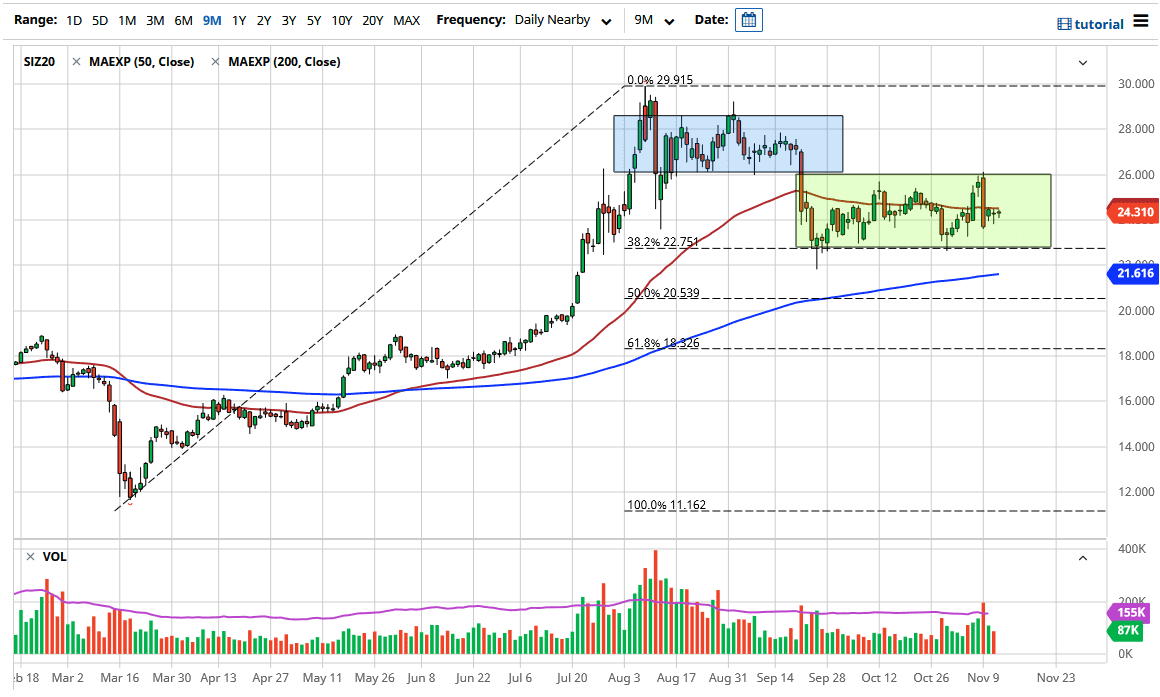

Silver markets remain very quiet after the session on Thursday, as we are sitting just below the 50 day EMA. Because of this, the market looks very likely to continue to go sideways in the short term. The 50 day EMA is flat and sitting just above the market so to me it suggests that we are going to continue to see a lot of sluggish behavior. After all, silver is a market that is almost purely momentum market, and it does take some time to build things up. Looking at this chart, we are roughly in the middle of a consolidation area between the $22.75 level on the bottom, and the $26 level on the top. All things being equal, this is a market that continues to be choppy to say the least.

Looking at the US Dollar Index is probably one of the best things you can do, as the negative correlation between silver and the US dollar has been extraordinarily negatively correlated to the silver market, and as a result of this you need to keep an eye on both. In fact, the US Dollar Index can be thought of as a bit of a tertiary indicator. If we can break above the 50 day EMA and the US Dollar Index dropped a bit, that could be a nice short-term buying opportunity for a target of $26 or so.

Ultimately, if the US dollar starts to strengthen a bit, it could drive down the value of silver, but longer-term I think that silver is going higher regardless, due to the fact that central banks around the world continue to flood the markets with cheap currency and therefore people will be looking towards hard assets such as silver in order to protect wealth.

Looking at this chart, we are essentially in “no man’s land”, so we need a bit of confirmation when it comes to the US dollar instead of simply jumping into the market based upon its sole price action. This is typical of silver, because silver has other components in it, not just the central bank argument. Silver also has a huge industrial demand component built into it, and therefore it can be a reflection on the economy. With that in mind, there is a whole litany of things that could cause volatility but right now I think the best thing you can do is look for dips to start buying.