The British pound has gone back and forth during the trading session on Tuesday, as we continue to see a lot of questions when it comes to where we are going next. This is a market that I think will eventually try to figure out a bigger move, but obviously Brexit is going to continue to hold the market hostage. I do not believe that this is a market that can simply take off to the upside without some type of Brexit agreement, unless of course it is a reaction to stimulus in the United States. Having said that, any rally based upon that is probably short-lived.

If we were to get some type of massive stimulus package out of the United States, you are better off shorting the US dollar against other currencies it may not have the same issues that the British pound inherently will. That will be the case at least until we get through the Brexit scenario, so keep that in mind. However, if we do get some type of resolution to Brexit, the British pound will almost certainly take off to the upside as it will bring a certain amount of certainty back into the markets again.

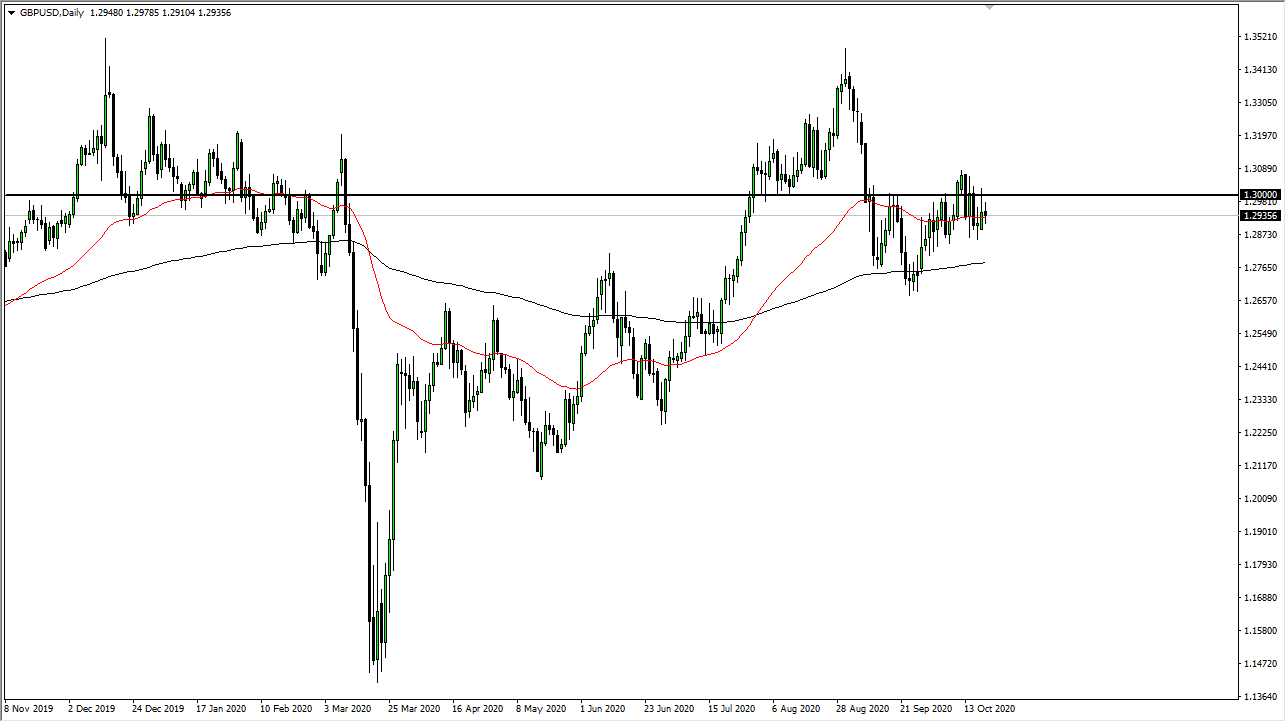

I believe that in the meantime we are simply looking at a market that wants to go between the 1.13 level on the top and the 1.2750 level on the bottom. The 50 day EMA is going sideways, and that suggests that there is not much in the way of conviction right now, so therefore you have to look at this as a potential range bound trading market and if you have been doing that, you probably have made pretty decent money.

If we were to break down below the 200 day EMA, which is below the 1.2750 level, the market is likely to unwind even further, perhaps reaching down to the 1.25 level. On the other hand, if we were to break above the 1.31 level it opens up the possibility of a move to the 1.34 handle given enough time. Unfortunately, we do not necessarily know which direction will go next because there are so many moving pieces including stimulus, Brexit, and of course the election. Looking at this chart, confusion seems to be the biggest thing that people will be assuming in this market.