Who’s Brave Enough to Go Against an Upwards Trend?

You do not have to be a brain surgeon to understand the major global stock indices are essentially mirroring the results coming from the United States, particularly the S&P.

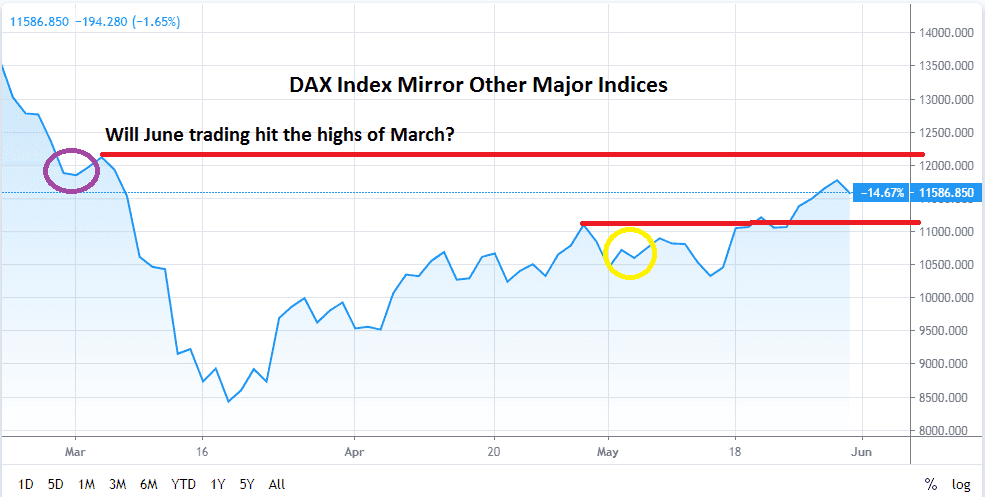

The DAX Index has come off short term highs made early last week but is still enjoying the fruits of a solid trend upwards since hitting lows near 8,500.000 mid-March. As fears of the Coronavirus caused mayhem in global indices in February the DAX Index joined the plummet from historic highs. Civil disturbances in the U.S this coming week may prove troublesome in the global markets, but will likely be brushed aside as a small nuisance if calm returns to urban streets.

Does this mean it is a good time to invest in the stock market and not worry about anything? No, it doesn’t mean you should put your life savings into the major indices such as the DAX Index without paying attention. However, historically indices do have a habit of recovering from storms and proving they are capable of trending upwards. If you have a long term outlook and do not over leverage yourself with mindless speculation there is a chance buying the DAX Index with a proper amount of patience will turn a profit.

The 12,000 level has significance and market players have this number in their sights.

Indices are currently being bought because money is cheap and investment houses looking to turn a profit for their clients have few other places to ‘park’ their money. All fancy talk about how and why the DAX Index and all of its brethren are resuming technically strong trading due to growing confidence in the global economy should be viewed very skeptically. However, that doesn’t mean the DAX Index will not continue to enjoy the fruits of stupid money. And yes, I mean stupid money. This because financial houses need to do something with the pension money they are in charge of investing. It is a herd mentality, when investment houses make profits for their clients they exalt themselves as magnificent, when they lose money they tend to say ‘these are challenging times.’

This time period is challenging for those who analyze numbers. Global indices are not going up because investment analysts suddenly realize that the world’s greatest corporations are going to start enjoying better revenues and definite profits in the coming quarter. No, the DAX Index is going up because everyone loves a parade, everyone loves a trend. The economic numbers and forecasts for many corporations remain challenging and in some cases grim, but to borrow a lyric from an old American song, ‘the sun will come out tomorrow.’ Investors do not like to keep their money under mattresses, nor do financial institutions carrying the burden of investing the wealth of corporate clients trying to insure the economic prosperity of their employees in pension funds.

Does this mean the DAX Index will simply continue to rise? No, it doesn’t mean there is a guaranteed outcome for profits if you simply buy the DAX Index, but it does mean you are speculating with the trend which indicates stock markets globally are trying their best to retest the highs of March.

The values of March are still far below the top of the markets that most global indices experienced in February. Re-attaining the values of February remains rather questionable at least at this juncture, but if you had to pick a side in this race it appears optimism will outweigh pessimism as June progresses. Yes, there are shadows. New outbreaks of Coronavirus would be bad news, and growing civil unrest in the U.S will not please global investors and may actually present short term speculative selling opportunities. However, upwards momentum remains alluring and traders may want to simply follow the trend higher with the DAX Index in June.

DAX Index Outlook for June

Speculative price range for DAX Index 10,800.000 to is 12,200.00 during June

Support levels at 11,300.000 and 11,400.000 USD should be targeted by speculative ‘long’ buyers

Resistance at 11,700.000 and 11,800.000 could intrigue speculative ‘short’ sellers