The XAU/USD pair scored a gain of 1.35% on Monday as a weaker U.S. dollar lured bargain hunters back to the market. The XAU/USD pair traded as high as $1208.87 after prices encountered heavy buying pressure and changed direction just above the 1180/2 support zone. Gold prices have been falling steadily since mid-July when the American dollar got a boost from growing perception that the Federal Reserve will take a more hawkish tone on interest rates.

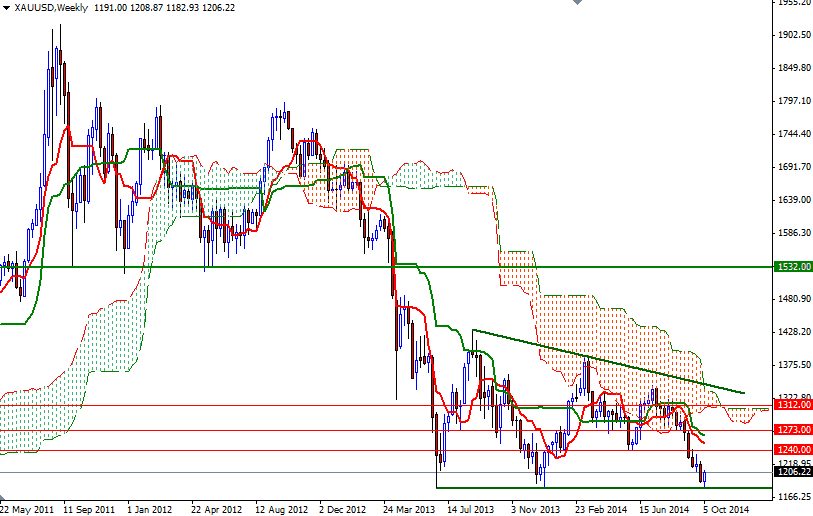

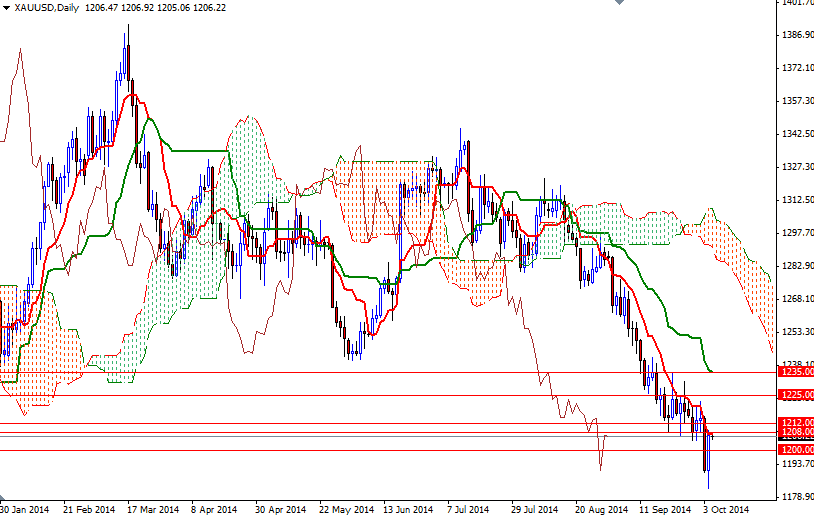

Recently falling prices put the shiny metal back in the spotlights. In my previous analysis, I said that it was very likely to see a rebound as long as this critical support -which caused prices to reverse twice in 2013- remained intact. Now the question is whether or not the market will continue its bullish reaction. Technically speaking, trading below the Ichimoku clouds on the weekly and daily time frames indicates that the outlook for gold is gloomy. This theory is also supported by the descending triangle (a bearish formation that usually forms during a downtrend as a continuation pattern).

Although the trend is rather bearish in the big picture, there is still some room for the pair to run higher, possibly up to 1235 level where the Kijun-sen line (twenty six-day moving average, green line) sits on the daily chart, if the market penetrates the 1208/12 resistance area. A sustained break above the 1240 level would prolong the bullish momentum and clear the path towards 1273. To the downside, support can be found at 1202.60 (Kijun-sen on the 4-hour time frame) and 1196 (Tenkan-sen). Closing below 1196 would make me think that the XAU/USD pair will revisit the 1288 level.