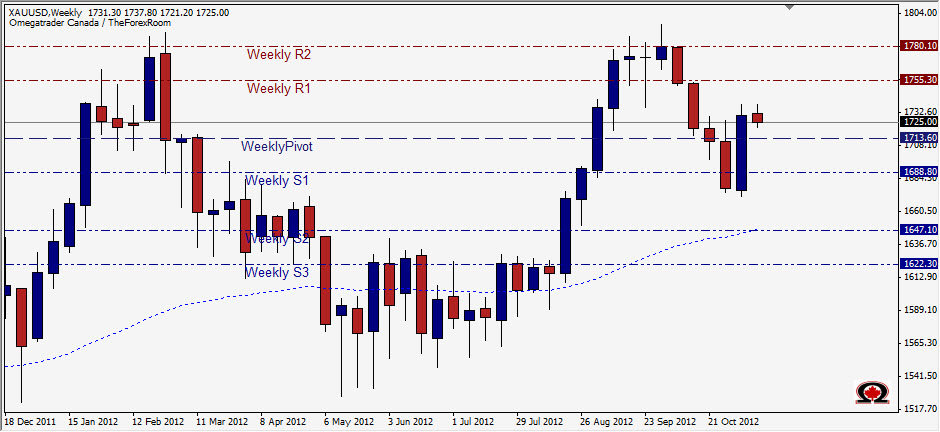

Last week Gold (XAU/USD) printed a perfect bullish engulfing candle that opened on the Weekly support level at roughly 1680 and climbed almost 700 pips before closing for the week. In the first day of trading this week, price has been for the most part bearish, but one must consider the lower trading volume due to New York observing Remembrance Day yesterday, and traders being slightly trigger shy while waiting for Greece and the EU meetings to unfold. That could all change today, but even more so tomorrow when the US releases its retail sales figures as well as the FOMC minutes which could hint at a direction for the Greenback. Gold is considered to be severely undervalued by many analysts and in uncertain times investors often like to put their capital in tangible assets like Gold. Fundamentals aside, the chart pattern certainly hints at gold gaining strength against the US Dollar, and a break of last week's high of 1738.40 could be the start of another 700-1500 pip climb. Several key resistance levels come into play between the current price of 1724.50 and the 'all time' high at 1920.70 such as the Monthly R1 at 1777.67 and Monthly R2 at 1835.26. 1875 will be the last form of resistance before that 'all-time' high is reached, if it is reached that is, and above 1921 there is simply a huge technical vacuum which could pull prices even higher. However, none of this will happen overnight so we also need to consider the other option, prices continuing down the path of the bears. Intraday traders should consider the pair truly bearish below 1720 with major support levels at 1680, and 1640 with the 62 day moving average acting as support as well at 1599.

XAU/USD Bullish Above 1739

Colin Jessup

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup- Labels

- Gold