The Fundamental Bullish Case

Why is Bitcoin going up? There are many reasons to be optimistic about Bitcoin now. We could talk about its network effects or censorship resistance characteristics. We can also explore the narrative that millennials exceedingly prefer to own Bitcoin relative to other assets, including gold. As millennials and Gen Z inherit nearly $78 trillion of wealth, some of it will inevitably flow into Bitcoin. However, in 2020 and looking into 2021, the digital gold story, institutional adoption and supply-demand dynamics will be the main drivers of the Bitcoin price.

Bitcoin as Digital Gold

Gold has been used as a reliable store of value for centuries. Its main attraction is its scarcity as limited supply exists, and gold mining is an expensive and slow process. This puts gold in stark contrast to fiat currencies, that can be printed at will by central banks around the world.

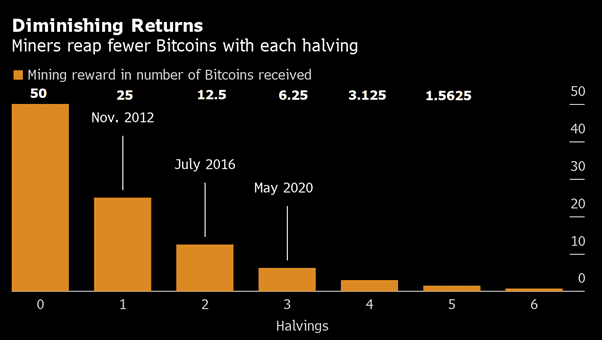

Like gold, Bitcoin is a scarce asset. Only 21 million coins will ever be created, and close to 90% have already been mined. The current inflation of the Bitcoin network is 1.8% and will decline over time as block rewards decline further. This process is known as halving and refers to the gradual reduction of block rewards by 50% approximately every four years. As a quick reminder, block rewards are the only way new Bitcoins can be created.

Source: Bloomberg

Note: Chart shows declining rewards for the first six halvings. There are 64 planned halvings in total.

Scarcity aside, Bitcoin is more portable and divisible than gold, making it a better store of wealth in the eyes of some investors. Recent comments by Deutsche Bank, Stan Druckenmiller and Rick Rieder suggest as much. And while gold has an estimated market cap of around $9 trillion, Bitcoin is currently valued at under $350 billion.

Institutional Adoption

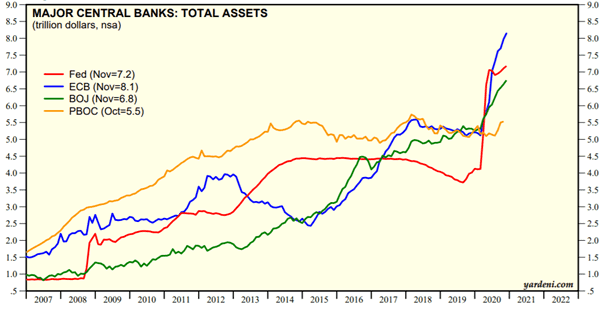

There is sufficient evidence of increasing institutional interest in Bitcoin. It is driven, in part, by fears that current expansionary monetary policy pursued by central banks around the world will eventually lead to inflation. Federal Reserve, for example, has printed around 20% of all US dollars in circulation just this year. Over the next several years, accelerating institutional inflows could have a meaningful impact on the Bitcoin price potential, considering the relatively small size of the market.

Source: Haver Analytics

In 2020, Bitcoin is increasingly being used to hedge against inflation and macroeconomic risks, including by prominent Wall Street investors. Paul Tudor Jones and Bill Miller, among others, have disclosed their positions in Bitcoin and reiterated a bullish view on the asset.

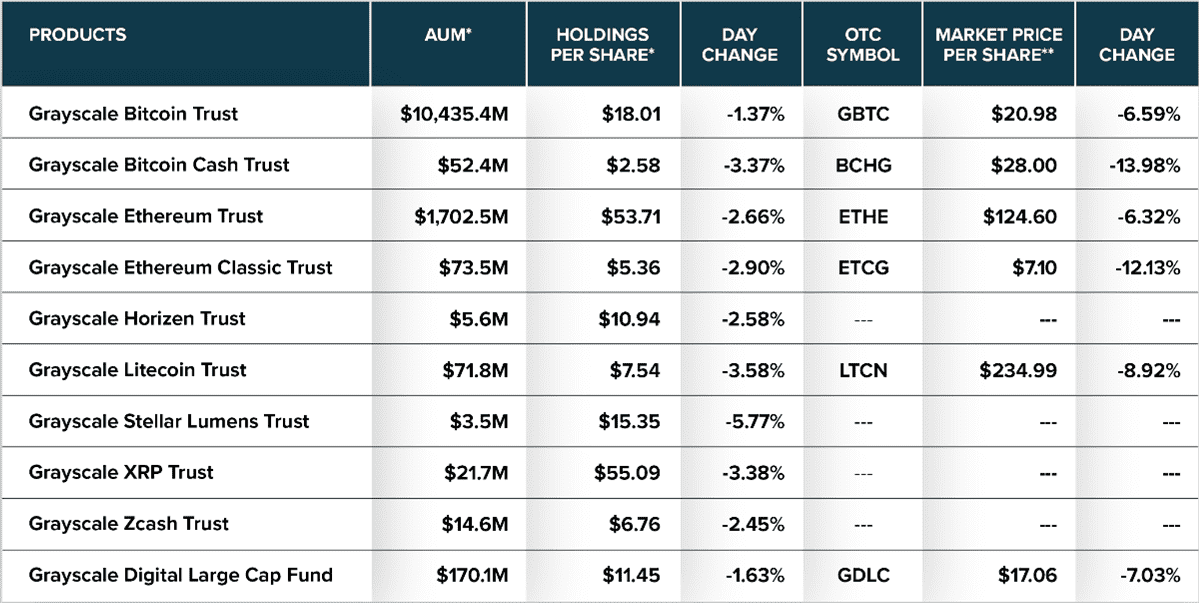

The rapid growth of the Grayscale Bitcoin Trust, the first publicly quoted trust for bitcoin, is another indicator of growing institutional participation. Around 80% of Grayscale investors are institutions making it a reliable barometer of institutional sentiment. The latest update from Grayscale on December 8th, shows total asset under management (AUM) of $12.6 billion, up from around $1.2 billion at the end of 2019. AUM for the Grayscale Bitcoin Trust was at $10.4 billion up from circa $0.8 billion at the end of 2019.

Source: Grayscale

Another interesting development seen in 2020 was the push by some corporate treasuries to allocate a portion of their cash balances to Bitcoin. MicroStrategy's $425 million investment and Square's $50 million position are two notable examples. Earlier this month, MicroStrategy announced plans to offer $400 million of convertible bonds with net proceeds used to double down on its Bitcoin investment. Due to the overwhelming demand, the bond offering was upsized to $550 million. According to the latest data, company treasuries now own around 4.2% of the total outstanding supply of Bitcoin.

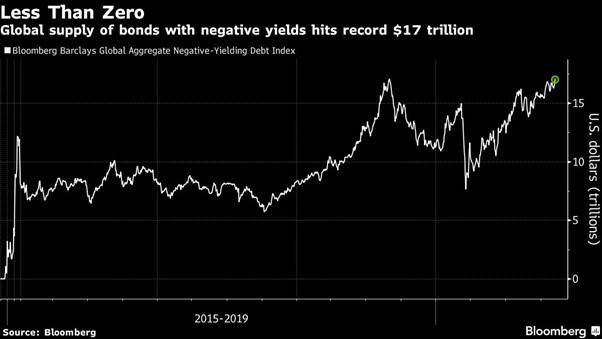

Why are they investing in Bitcoin? From the corporate treasury perspective, there are few other options. Global supply of bonds with negative yields is at an all-time high, and traditional fiat currencies tend to lose their purchasing power over time due to inflation. Under these conditions, holding an excessive amount of cash on the balance sheet might be detrimental to shareholder value.

Source: Bloomberg

From a portfolio management perspective, adding Bitcoin exposure to a diversified portfolio is as much about risk management as it is about returns. Bitcoin is one of the least correlated assets in the investment universe, offering meaningful diversification benefits. According to the analysis conducted by Messari, a blockchain analytics firm, Bitcoin also offers the highest risk-adjusted returns. Furthermore, its volatility, often cited as an impediment to institutional adoption, has been coming down, recently hitting an all-time low relative to gold.

Source: Bloomberg

Supply & Demand Dynamics

In addition to the institutional side, the success of Square's CashApp and PayPal's recent foray into crypto services are making it increasingly easy for retail investors to get exposure to Bitcoin.

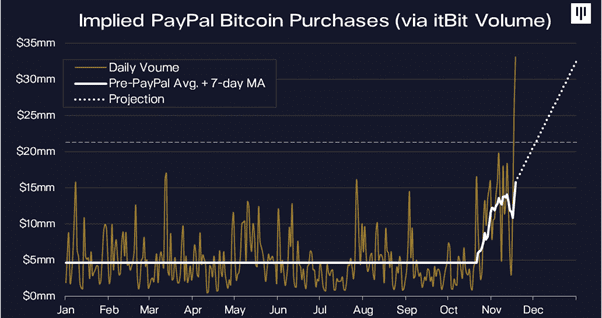

In a recent research piece, Pantera Capital looked at the impact of Square and PayPal on the market. Based on their analysis, Square's Cash App is buying around 40% of all new Bitcoin supply. PayPal, with its 300 million active users and 28 million merchants, is expected to have a much more significant impact. PayPal is working with Paxos as its infrastructure provider. Pantera looked at the trading volume on itBit, the Paxos-run exchange, to approximate the scale of PayPal's activity. They concluded that in the first four weeks since launching, PayPal was already acquiring nearly 70% of the new supply.

Source: Pantera Capital

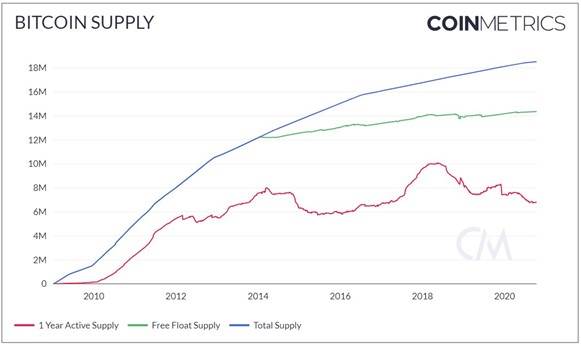

That is the demand side of the equation. On the supply side, an average of 900 new coins are created each day. When it comes to the maximum supply, however, it will likely be much less than 21 million. This is due to common mistakes associated with Bitcoin, from lost private keys to coins sent to a wrong address. Data from Coin Metrics shows that out of the current supply of 18.5 million coins, free float supply is closer to 14.4 million and only 6.8 million have been active in the last year. While the reduced number of Bitcoin in circulation has no meaningful impact on the Bitcoin network, it does add some value to each coin in circulation.

Source: Coin Metrics

Bitcoin 2020 vs 2017

To many observing from outside the cryptocurrency space, 2020 might look like 2017. After trading close to $20,000 in December 2017, Bitcoin subsequently lost almost 85% of its value from peak to trough. Price action is often unpredictable, but on many metrics, this bull run is happening on the back of exceedingly strong fundamentals.

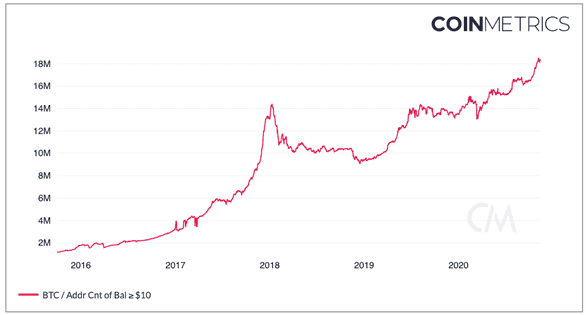

An article by Nick Carter, Partner at Castle Island Ventures, addressed the fundamental differences between 2017 and 2020. From the number of addresses with $10 worth or more BTC, to the open interest of Bitcoin options across all exchanges, he concludes that on many metrics of network strength and adoption, Bitcoin has already exceeded its 2017 all-high levels.

Source: Coin Metrics

Bitcoin Price Prediction 2021

Making cryptocurrency and Bitcoin predictions is extremely challenging even though Daily Forex’s Bitcoin prediction from 2020 was really very accurate.

It is fair to say that market sentiment is overwhelmingly bullish, with many Bitcoin 2021 predictions pointing to significant upside. The Winklevoss twins published their "Case for $500K Bitcoin" calling for Bitcoin to surpass gold as a store of value. Looking at Bitcoin price in the grams of gold, analysis by Charles Vollum suggests a 10x price increase would be in line with historical ranges.

Willy Woo, a popular cryptocurrency analyst, recently published a note suggesting that his previous price of $200,000 by the end of 2021 now looks conservative. His Bitcoin forecast is based on the technical Top Cap metric.

Wall Street firms are also exceedingly bullish. Citi recently published a note on BTC suggesting it could peak at $318,000 in December 2021. They acknowledge that this Bitcoin price forecast represents a substantial rally but say that "it would only be a low to high rally of 102 times (the weakest rally so far in percentage terms) at a point where the arguments in favour of Bitcoin could well be at their most persuasive ever."

Even Bloomberg has a bullish Bitcoin prediction 2021, citing favourable macroeconomic drivers and the digital gold narrative in their forecast. The firm expects Bitcoin to set the new resistance level at $20,000 and potentially reach $35,000, assuming it follows a much less explosive path compared to 2017.

Caution Factors for Bitcoin Bulls

Before investing in Bitcoin, it is worth considering that it is still a relatively early-stage technology, subject to many risks. While a credible bear case is currently hard to find, I would like to highlight some things that could still go wrong in 2021 or beyond.

The most significant threat to Bitcoin and its quest for mass adoption is regulation. Janet Yellen, the next Treasury Secretary under Biden Administration, has a history of somewhat negative comments about Bitcoin. The recently announced STABLE Act, while unlikely to become a law, shows a fundamental misunderstanding of cryptocurrencies. It would require all stablecoin issuers to acquire a banking charter and obtain FDIC insurance, among other prohibitive regulatory proposals. To be fair, regulators cannot shut down the Bitcoin network, but they can make it hard for people to use, slowing down adoption and weighing on the price.

Another, albeit less serious concern, is any vulnerability in the Bitcoin code. A coincidental inflation mechanism, for instance, would be damaging to the digital gold narrative.

Bottom Line

It appears that Bitcoin has entered a new bull market, supported by on-chain metrics, institutional investment flows and growing retail adoption. How high will Bitcoin go? My personal view is that Bitcoin will reach $50,000 in 2021. I expect Bitcoin to follow its historical price patterns but behave in a less explosive manner due to its maturity. Despite significant risks inherent in cryptocurrency investing, the reward to risk ratio for Bitcoin in 2021 is undoubtedly skewed to the upside.

Disclosure: I am long Bitcoin. This is not legal or financial advice.

FAQs

Will Bitcoins go up in 2021?

Predicting cryptocurrency prices is a thankless task. There is a strong bull case for Bitcoin in 2021, driven by the digital gold narrative and favourable macroeconomic dynamics. However, you should carefully consider the risks involved in cryptocurrency investing and conduct your own research.

What will Bitcoins be worth in 2025?

Various research reports expect Bitcoin to be trading materially higher in 2025. The threat of regulation, issues with its code or unpredictable changes to the macroeconomic environment, however, can all undermine the current bull case.

What will Ripple be worth in 2021?

Ripple is an open-source protocol created by Ripple Labs in 2012. XRP is the native token of the Ripple network. XRP prospects in 2021 are clouded by numerous class-action lawsuits against the company, claiming that Ripple Labs violated US securities laws. The investment appeal of the token, outside of pure speculation, is unclear.

What will Bitcoin be worth in 2023?

Bitcoin, like any other investment, will have its bull and bear market cycles. However, it should continue to benefit from inflationary monetary policies around the world and broader institutional acceptance.

Can Bitcoin make you rich?

Bitcoin is currently an attractive store of wealth investment option. A small allocation to Bitcoin, in the context of an investment portfolio, might indeed be warranted. However, Bitcoin still represents a speculative investment and investors should consider the risks involved before putting a sizable portion of their net wealth into Bitcoin.

Can Bitcoin ever crash?

During the previous market cycle, Bitcoin has declined by 85% from peak to trough. While it has matured since then and the underlying fundamentals are much stronger today, we may experience multiple sharp selloffs in the future.