By: Dale Woods

Are you losing grip with your trading? Feeling lost in your own analysis and getting angry at the markets because your trading is going nowhere?

You’re not alone.

Many other Forex traders suffer from ‘analysis paralysis’ due to excessively complicated trading strategies. The problem is, everything we learn in life teaches us how to survive in the workforce – and how to make it in the ‘real world’. Forex trading is a different world that you are not prepared for, and naturally we apply what we know from the workforce to the Forex markets.

Forex trading requires a completely different approach - one of mental strength, one that requires you to discipline yourself to sickening levels.

As you probably have already discovered - the two don’t mesh well together.

Forex trading requires a completely different approach - one of mental strength, one that requires you to discipline yourself to sickening levels. Sometimes ‘doing nothing’ is the most profitable approach - sounds counter intuitive right? Most things about the Forex market are. From my experience, most traders don’t find success until they ‘simplify’ their trading.

Today, I am going to show you a few easy steps you can take to really turn your trading around by ‘keeping Forex simple’.

Ditch all the Unnecessary ‘Extras’ from your Charts

It’s natural that you want to gain every single edge possible to turn the probabilities of success in your favour.

For a newbie trader, that generally means going out and hunting down all the ‘shiny new objects’ like flashing indicators, other charting tools, and anything that looks exotic enough to give you a ‘secret insight’ to the market that not many other people are privy to. Those who chase forex trading strategies which use indicators are generally unsatisfied with the performance the system provides in the longer term.

The natural inner workings of most Forex indicators cause them to respond very slowly to the organic market movements. The indicator may give up a buy or sell signal, only when the majority of the move is already over – getting you in at a very bad price. Indicators also suffer very badly in consolidating markets, generating a string of bad trade signals that can cause depressing drawdown.

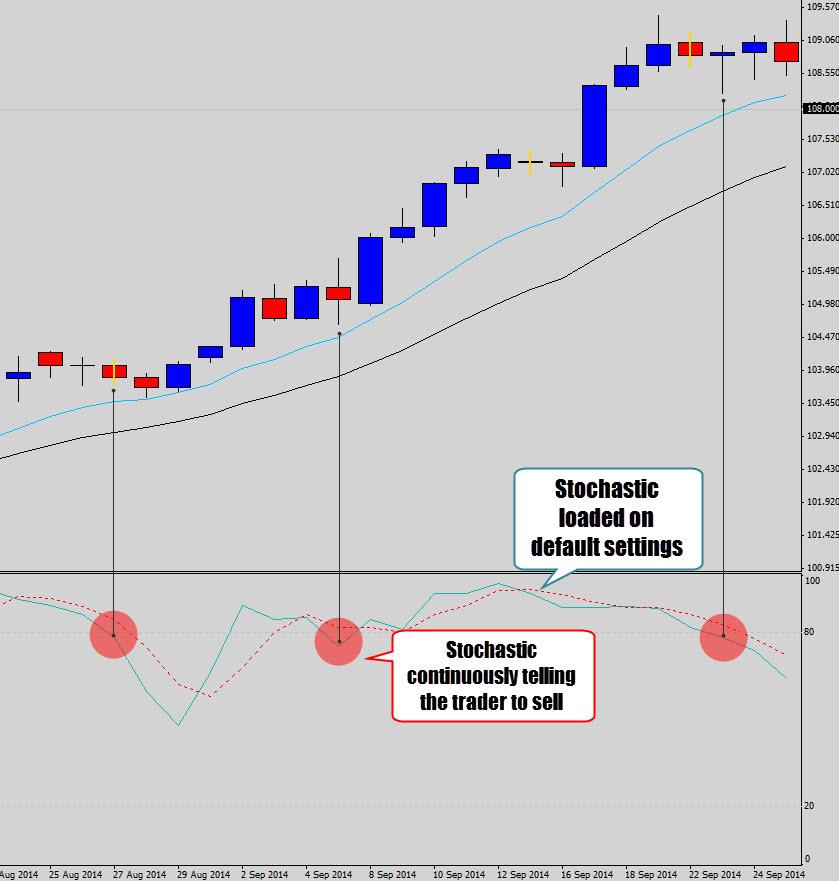

Have a look at the stochastic – a popular forex indicator that comes packaged with most popular charting software.

The stochastic is only tailored to work during specific market conditions. Unfortunately, it doesn’t work well in trending markets – which are the prime conditions for making money. What the trader usually does next is seek out another indicator to ‘fix’ the problem, one that will ‘filter’ out the bad signals, and make the original indicator perform better. Despite the best of intentions - this only introduces more problems to the chart. Instead of making analysis easier, it makes it more frustrating – the two indicators will most likely give conflicting signals, and never line up in harmony to give a clear trade opportunity. The trader will then seek out more ‘chart aids’ to remedy this, but the situation gets out of control, and the chart template ends up looking like something out of a nuclear power plant control panel.

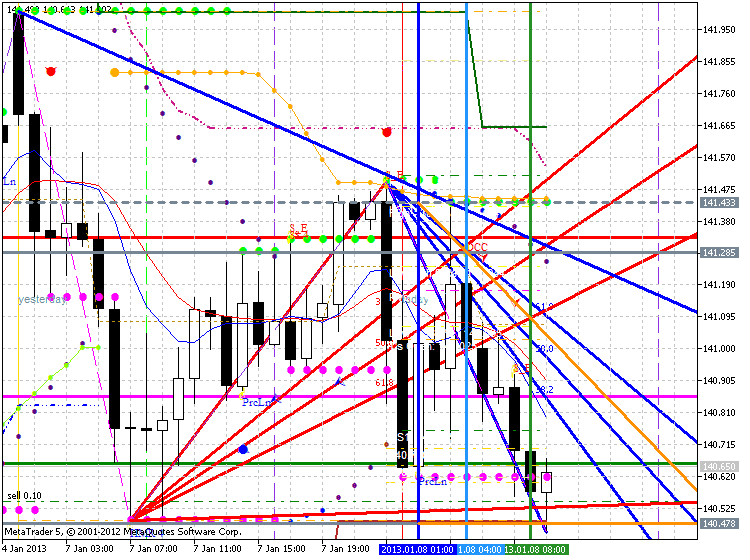

Has your chart ever gotten out of control, and looked something like this?

It’s a very frustrating working environment to trade with – you can’t even see where the actual price is anymore, and price is the most important data on your chart. Once a trader gets to this point, they usually end up wiping their template clean and ‘starting again’. Most traders will find themselves back to the plain price chart, and there is nothing wrong with that. It is at this point where you should have your “ah-ha” moment. Trading with a plain price chart is the simplest, most effective, and most commonly used approach in the trading industry today.

If you find your charts are getting out of control, then do yourself a favour, strip all unnecessary data off your chart template and start learning how to trade with the price action directly.

Continue reading and I will show you how easy it is to trade directly from a plain candlestick chart.

Don’t Overcomplicate Support & Resistance

Even with a plain price chart, a trader can still get carried away and make a frustrating mess – and that’s exactly what happens most of the time. Marking support and resistance levels on your chart is one of the most basic, but vital skills you need to have to succeed with any Forex trading strategy.

Even fundamental traders who follow and trade the news, need to have a good understanding of how to draw Forex support and resistance levels to ‘complete’ their trading analysis. Surprisingly, many traders – new and seasoned alike, continuously screw up their support and resistance line plotting and ‘poop in their own nest’ by going crazy with the way they go about marking levels on their chart.

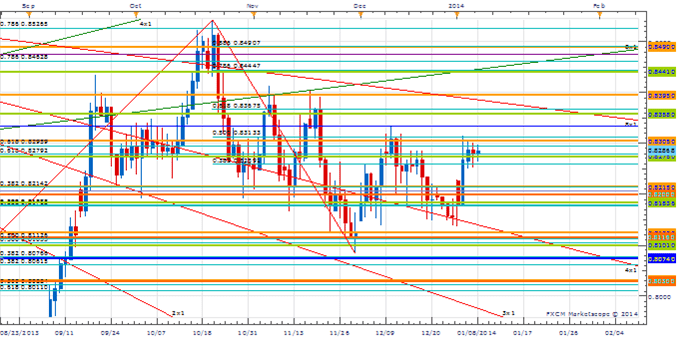

The chart above is an extreme example, but hey - I found this on a public Forex forum. This is someone’s legitimate technical analysis.

It’s time to focus back on the lesson here and learn to keep trading simple – that applies to your support and resistance levels too. Do this and your forex trading strategy will benefit greatly from it.

When you’re mapping out ranging markets, just stick with marking the upper and lower containment lines. They don’t have to be an ‘exact match’, where all the wicks or bodies like up perfectly – that’s very rarely going to happen. Just mark out the general area where price is turning.

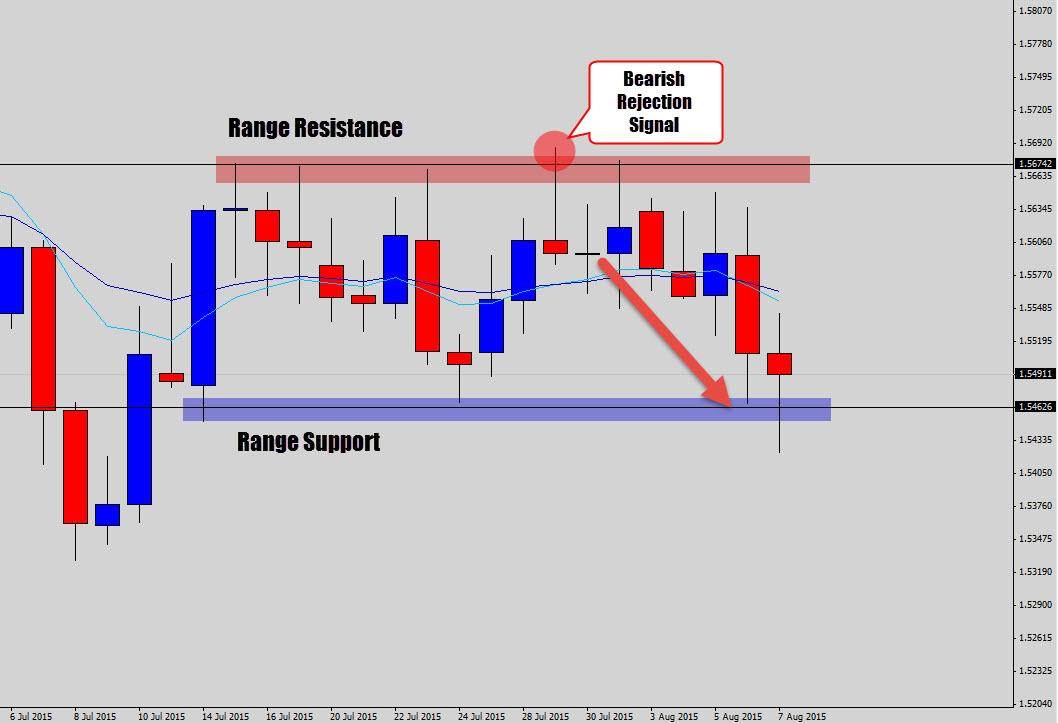

In the example above, I am using the current GBPUSD daily chart which is currently stuck in range-bound conditions. All you should really be focused on is the main turning points here, where price is going to reverse and create a decent price move that you can capitalize on. Trading in the middle of the range is risky, price can get very erratic, unpredictable and volatile – it’s like a high-churn zone that can burn plenty money. But traders still try and do it, don’t be one of them. The most optimal point to catch a range trade is at the boundaries - so you mark them and only them. It’s as simple as that, if you don’t see a buy or sell signal at these main turning points, then wait until you do see one.

Sometimes doing nothing is the most profitable play you can make – and one of the hardest decisions to make, and see through.

Ranging markets are simple to work with, two levels that’s all you need. Moving markets, however, are a little different. I work with swing levels in a trending environment.

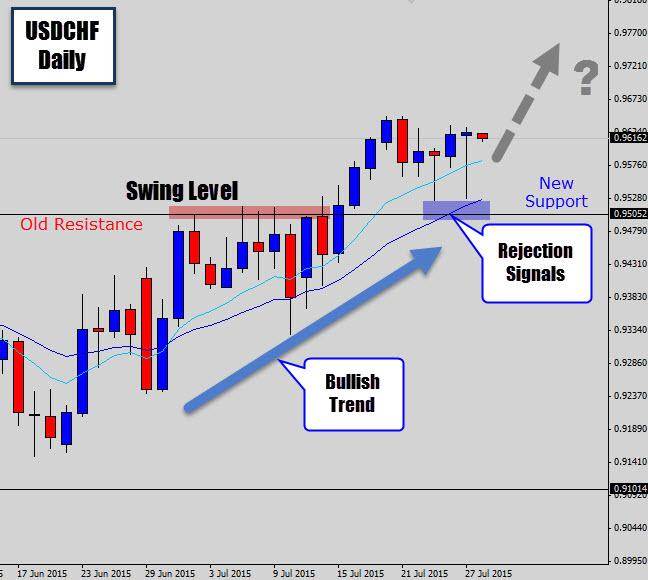

You see, even when you get these beautiful trends on the daily chart that seem to go forever and are an obvious buy or sell, many traders are still losing money despite how obvious things are. I truly believe the main problem comes down to timing. Losing traders are not entering the trends at the correct time, and getting screwed over by the corrections in the trend. Marking simple support and resistance levels can save your trading account from these mistakes. During trends, I mark out and concentrate on the ‘swing points’ - where old resistance becomes new support, or old support becomes new resistance. Time and time again, trend swing points will terminate the countertrend moves - it’s here you will more often than not see the trend pick up, and move into new highs or lows again.

Start looking out for and mark these swing levels – monitor them for buy or sell signals that align with the trend.

Check out the chart below…

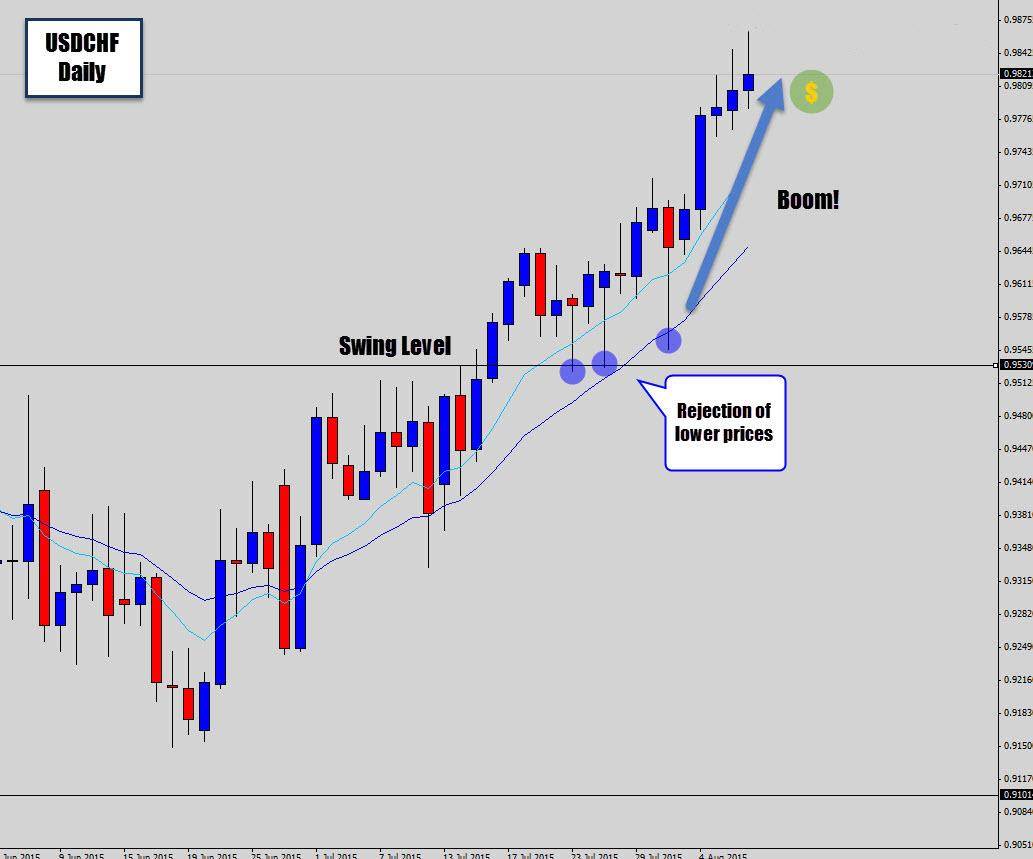

This is text-book swing trading, which is taking advantage of countertrend retracements during a trending market. Notice how old resistance started to be respected as new support – this creates a swing level in the trend. It is generally the most optimal point to enter into a trending environment to get you maximum return on investment. It’s these swing levels that you should watch for buy or sell signals. In this case we have some bullish rejection candles that communicated to the trader that lower prices were denied by the market at the swing level. This is a perfect ‘trend trade’ setup, it is a high probability situation that tells the Forex trader higher prices are very likely to develop…

Just remember, with a trending market you only really need to be concerned with swing levels.

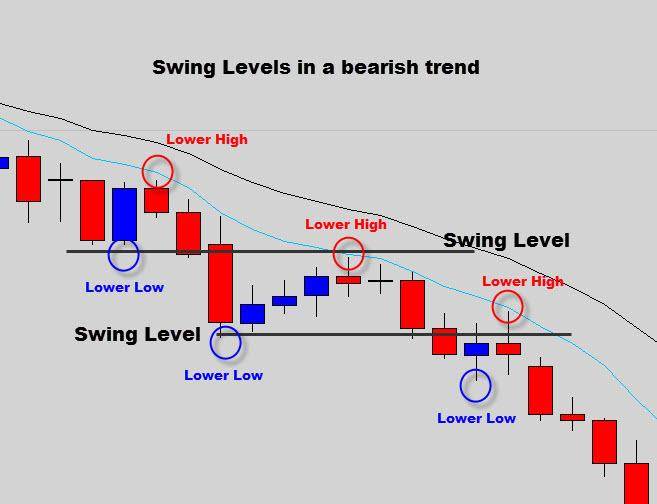

Above is an example of how swing levels will work in a bearish environment.

Remember what I said before – levels won’t always line up ‘picture perfect’ - you just need to mark the general area where you anticipate will act as a main turning point on your chart. Don’t forget to mark major weekly turning points also, as they can stop strong trends in their tracks and kick off major reversals. Same deal, go the weekly chart and mark out any obvious strong reversal points.

Hopefully, I am starting to demonstrate to you the power of ‘simple trading’. There was no need for any complicated indicators here, or other over the top charting tools. It’s just working with a plain price chart, and being very minimalistic with marking support and resistance levels. Once you simplify the way you mark your levels, your technical analysis will become much clearer, less frustrating, and you will start to learn how to anticipate future price movements from a plain price chart.

Learn a Forex Trading Strategy That Will Keep Your Trading Simple

If you’re following a trading strategy that requires use of indicators, heavy math, or even one that requires you to spend hours and hours in front of the trading screen – then I recommend you have the mental hospital on speed dial. There are so many trading strategies out there which do my head in just by being an outside observer. Most of us have busy lives and really can’t afford to spend hours in front of the charts scalping or day trading. Swing trading offers a really good solution to those who want to be able to trade with simplicity, and fit trading into their busy lifestyle. For example, you may want to trade at a ‘full time level’, while keeping your day job or being able to study full time.

The best way to do this is to use ‘end of day trading strategies’, where you only have to check the market once per day and spend about 15-30 minutes analysing the markets to make your trading decisions. I use price action trading strategies combined with swing trading as part of my overall end of day trading strategy. Using some of the examples I’ve shown in today’s tutorial, you can check the daily chart at the New York close to identify low risk and high reward trading opportunities on the daily time frame. This system only takes about 15 minutes to ‘set & forget’.

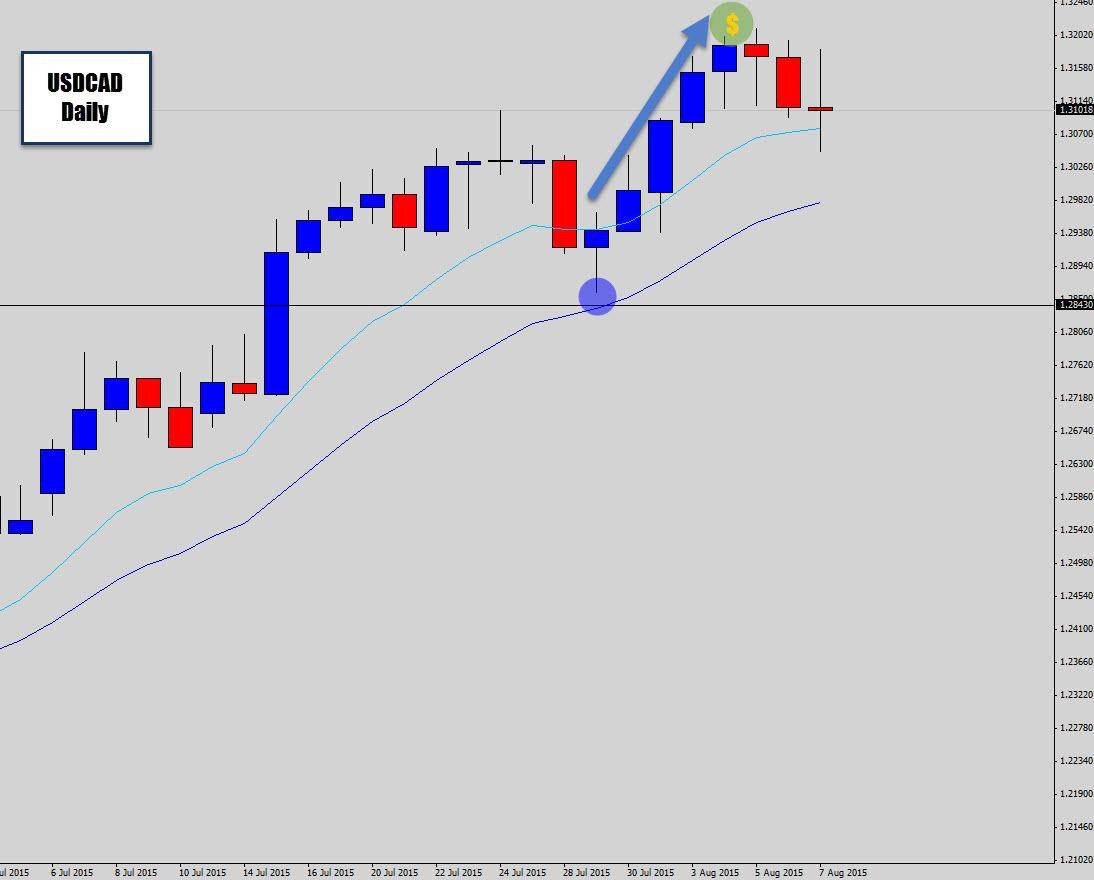

Below is an ‘end of day’ setup on the USDCAD daily chart…

We’ve got a nice uptrend in place, and we can see that a swing level has terminated a counter trend correctional move. This is a classic end of day price action ‘buy’ signal, right at the hot spot where we anticipate will act as a turning point for the broader trend. The bullish rejection candle communicates to the price action swing trader that higher prices are very likely to develop here. Really, it’s easy as 1 2 3. You can set up your buy order, complete with stop loss and target profit, and then let the market take over from here. The beauty of it is, you’re not stuck at the trading screen – you’re free to go live your life while the market takes care of the rest for you.

The market responded as expected and a bullish rally developed from our high probability ‘end of day’ price action signal.

I hope today’s tutorial has inspired you to cut away all the complication from your Forex chart and your forex trading system.

If your trading strategy is too ‘heavy’, or saps too much time out of your day – then you should consider moving to an end of day trading strategy that exploits the benefits of price action and swing trading. Even if you like to trade intraday - I strongly believe that you will benefit from removing indicators from your chart and learning how to ‘read’ a plain price chart, and anticipate price moves directly from the candlesticks themselves. Once you clear away all the mess and start working with clean price templates, your trading is going to become less stressful, offer more clarity and be a more profitable venture.

Do yourself a favour and at least give it a try.

If you liked some of the trade setups discussed in today’s lesson, and would like to learn more about keeping trading simple and minimalistic & profitable trading, then you can check out my Forex trading strategies. In my experience, Forex traders don’t find success until they learn how to read the markets using price action analysis. Keep things simple, logical, and trade a way that you understand. Don’t be greedy and chase money - redirect your energy to becoming the best trader possible and the money will naturally flow to you.

Best of luck on the charts this week.

Dale Woods is a retail Forex trader who specializes in swing trading & price action based strategies. He has been trading since early 2008 and is now runs his own Forex blog ‘The Forex Guy’, where he shares his strategies and trade ideas with other passionate traders. If you would like to learn more, you can visit his blog and check out some of his forex trading strategies.