Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSA, MiFID |

Year Established | 2014 |

Execution Type(s) | No Dealing Desk |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Capital Index is a financial spread betting, spread trading and CFD trading company headquartered in Limassol, Cyprus, with an FCA registered branch in the heart of the City of London. It was founded in 2014 and is a regulated EU broker licensed by Cyprus Securities and Exchange Commission (CySEC). It offers over 95 Forex currency pairs, indices, CFDs, commodities and precious metals.

Money received by clients are held in the client’s behalf in strict accordance with MiFID regulations and the funds are held in segregated trustee client accounts which are entirely separate from the bank accounts used for the running of Capital Index. The segregated accounts are held with a top tier UK bank, Barclays Bank Plc. in London.

Accounts

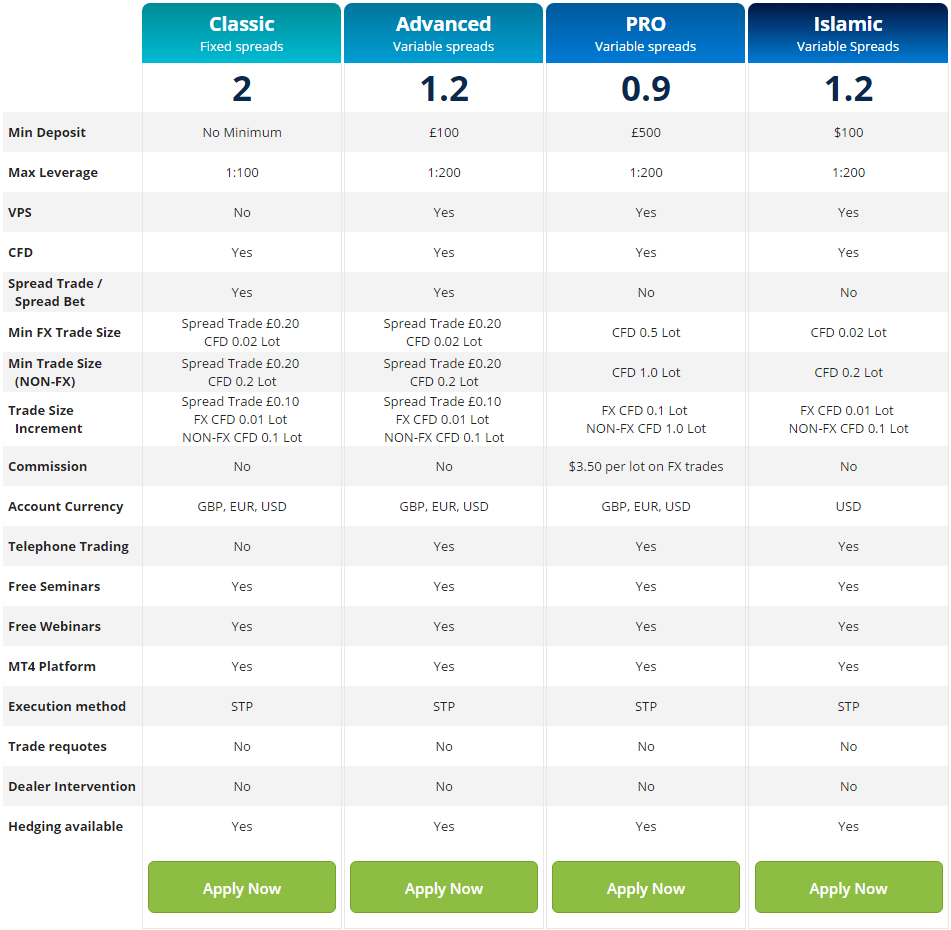

Capital Index offers three different trading accounts. The Classic account has no minimum deposit requirement and uses fixed spreads. There is no commission or telephone trading and there is no VPS service. Leverage is offered at 1:100 and spread betting is permitted.

Account Types

The Advanced account requires a minimum deposit of $100 to start and the maximum leverage is 1:200. Trading via the telephone is accepted and there is VPS service. The Advanced account uses variable spreads and spread betting is allowed. There is no commission.

The Pro account uses variable spreads as well. $500 is needed to open a Pro account which has a commission of $3.50 per lot on FX trades. Telephone trading cannot be done with this account and neither is spread betting accepted. Leverage of 1:200 is offered.

All three accounts provide traders with the opportunity to participate in all the educational tools offered by the broker including free seminars and free webinars. The MT4 platform is available for all account holders.

Applications for individual as well as joint accounts are available on the Capital Index website.

It was nice to see that a demo account is offered for traders with little background in currency trading who would benefit from some risk free practice trades.

An Islamic account is also provided for those keeping Sharia laws.

Features

Capital Index offers VPS service to holders of the Advanced and Pro accounts.

A VPS simply means a “Virtual Private Server” and it is one of many virtual computers running on a single server. A VPS runs 24 hours a day, 7 days a week, completely uninterrupted and on VPS the platform is running on a remote server that is accessible any time from any computer, tablet or smartphone connected to the internet.

A MAM (multi-account manager) solution is available which allows fund managers to trade from a single account for multiple clients simultaneously and make the distribution of profits and losses in a proportional manner between these clients. MAM involves master accounts, used by fund managers, and slave accounts/sub-accounts that repeat all trades from their corresponding master account proportionally to their balance.

Several different partnership arrangements are available that are ideal for individuals and institutions who wish to earn commission by directing new clients to Capital Index. These include programs for introducing agents, affiliates, regulated firms and white labels.

Deposits/Withdrawals

Deposits methods accepted by Capital Index are limited to Credit and Debit cards as well as bank wires.

The broker has just introduced a new withdrawal option – the Intercash Prepaid MasterCard. Now funds can be accessed instantly without withdrawing them first to a bank account.

Education

In their education section, traders can find some interesting lessons for both novice and experienced traders. Textual explanations on the basics of Forex trading and how to go about trading currencies are accompanied by seminars and webinars that are offered to all traders.

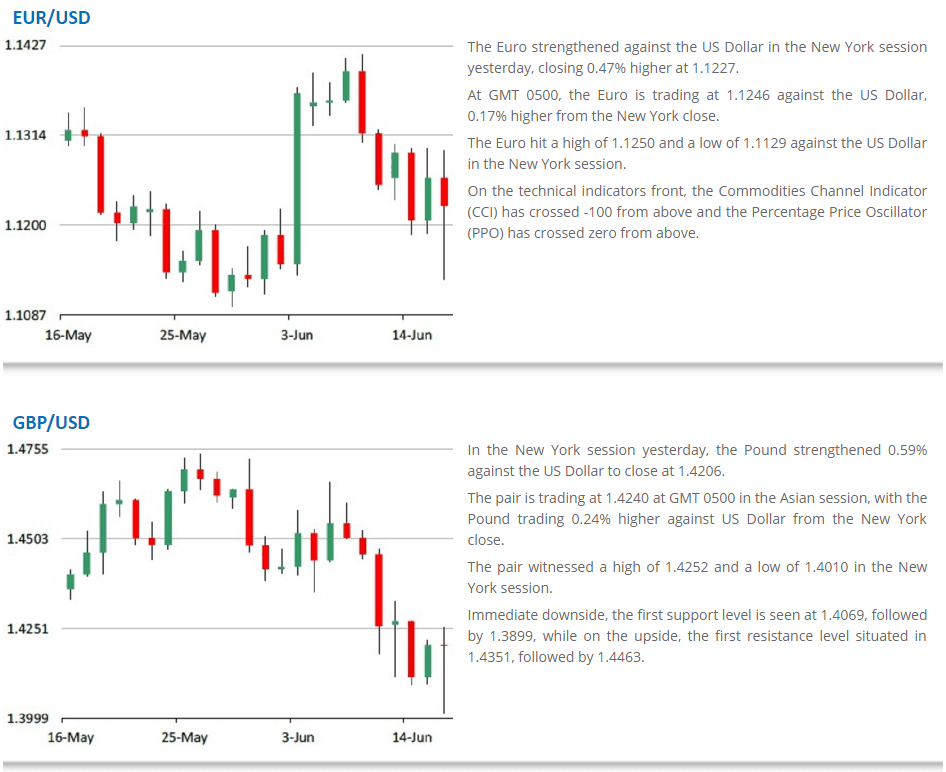

A nice feature is their market commentary which is an account of events that will take place during the coming week in the financial marketplace such as reports, policy meetings etc.

Market Analysis

In addition, the economic release calendar has an up-to-the-minute listing of upcoming economic events scheduled throughout the world.

There is a full financial glossary and the FAQ section is never ending and informative. Some of the topics covered in the glossary appear again in more detail in the FAQ listing.

Bonuses/Promotions

There was only one bonus offered at the time of this review. Anyone making a first deposit into a Capital Index account received a bonus of up to $10,000. Additional information about the terms and conditions of this bonus were not provided on the site. I assume that after one is registered and an account opened, more details would become available.

Customer support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Clients can contact a Capital Index representative via email or by phone to their Cyprus office 24/5. Live Chat is also available. The website is provided in English only.

The trading hours are 24 hours per day, starting at 00:00 Monday and closing at 24:00 Friday UK time + 2.

Conclusion

Capital Index has something for everyone. Although it is a recent entry into the Forex industry, there are many up-to-date features that make this broker worth a second look. I would have liked to see more information about their platform features.

In addition, the economic release calendar has an up-to-the-minute listing of upcoming economic events scheduled throughout the world.

There is a full financial glossary and the FAQ section is never ending and informative. Some of the topics covered in the glossary appear again in more detail in the FAQ listing.

Bonuses/Promotions

There was only one bonus offered at the time of this review. Anyone making a first deposit into an account received a bonus of up to $10,000. Additional information about the terms and conditions of this bonus were not provided on the site. I assume that after one is registered and an account opened, more details would become available.

Customer support

Clients can contact a Capital Index representative via email or by phone to their Cyprus office 24/5. Live Chat is also available. The website is provided in English only.

The trading hours are 24 hours per day, starting at 00:00 Monday and closing at 24:00 Friday UK time + 2.

Conclusion

Capital Index has something for everyone. Although it is a recent entry into the Forex industry, there are many up-to-date features that make this broker worth a second look. I would have liked to see more information about their platform features.

Features

Capital Index offers many interesting features. There is a choice of different trading accounts, a demo account as well as an Islamic account. There are also accounts for all partnership arrangements and a MAM account for those wishing to hold more than one trading account at the same time. I especially liked the FAQ section which was lengthy and informative. I was disappointed by the limited information on the MT4 platform they offered.

Platforms

MetaTrader 4

The MetaTrader 4 platform is the platform of choice at Capital Index and this platform is available for Mac IOS and Mac OS, Windows and Android devices.

For CFD accounts in MetaTrader 4, 1.0 equals 100,000 units, .10 equals 10,000 units, and .01 is equal to 1,000 units. A trader can enter a specific lot size when he/she places an order in the New Order window, the Mini Terminal, or the Trade Terminal.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |