Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | FCA |

Year Established | 2011 |

Execution Type(s) | Market Maker |

Minimum Deposit | $500 |

Trading Platform(s) | Other, MetaTrader 4, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Abshire-Smith, founded in 2011 and located in London and Wales, is a Forex and CFD broker, authorized and regulated by the Financial Conduct Authority. Abshire-Smith also trades commodities, shares, options, spread bet, futures, government and public securities. Client funds are held in segregated accounts.

Accounts

Abshire-Smith provides tailored trading accounts with different specifications to meet the requirements of all clients. There are several different types of accounts. A live trading account can be opened using any of the broker’s trading platforms—Vertex FX 10, MetaTrader4 and Stratacator.

The Standard and VIP accounts are aimed at the individual trader. They provide fixed spreads and a maximum leverage of 1:200. A minimum deposit of only $500 is needed to open the standard account; $15,000 is required for the VIP account. The standard trading account by default is offered on the VertexFX Trader platform.

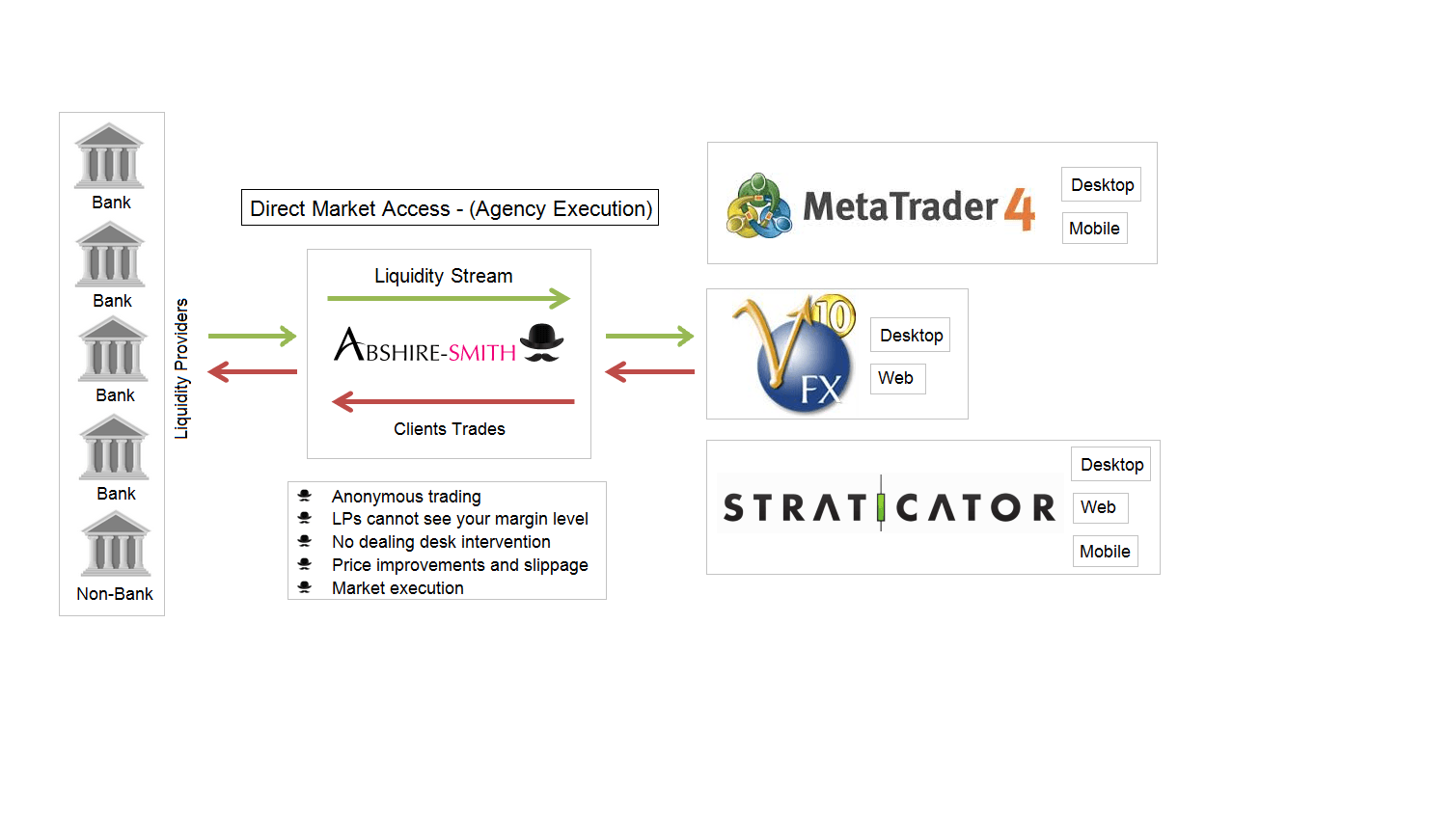

The Direct Market Access (DMA) account is provided at an institutional level for trading desks that require exceptional execution and a depth of liquidity. This account, which requires $500 to open are suitable for professional traders, CTAs, hedge funds and money managers, offering minimal market impact and institutional pricing.

Abshire-Smith DMA Liquidity

Abshire-Smith is a leading provider of financial derivatives in the Middle East for both retail and institutional traders and so it is no surprise that they offer an Islamic account that adheres to Sharia laws where there are no incurring rollovers (positive or negative interest) and where no abuse of the free facility is tolerated.

Abshire-Smith offers competitive Prime Brokerage solutions to institutional clients where investors have investors access to vast amounts of liquidity across a number of asset classes. A deposit of $50,000 is needed to open the Corporate or Institutional account.

A demo account is prominently promoted and offers several benefits to traders just starting out in Forex traders. They have a choice of trading platforms and live market prices and are able to practice new strategies, understand trading platforms and trade with no risk of financial loss.

Features

The Abshire-Smith.com website is probably the liveliest website I have ever reviewed. Its pinkish-purple hues and use of cartoon characters on the landing page create an atmosphere of youthfulness and gaiety and I am certain this had succeeded in attracting many clients.

Traders can choose to use any of the three platforms offered by Abshire-Smith. What I liked when doing this review was that besides listing the availability of the platforms, each platform was described in detail and included its history, accessibility and specific features.

I was introduced for the first time to the Staticator platform which I had never known before and had not seen offered by any other broker.

Education

All account holders are entitled to sign up for Market Squawk, a real time 24-hour market analysis with many benefits, including intermediate coverage of live news events such as Central Bank news conferences, live coverage of market moving data releases such as Non-farm Payrolls. It also delivers invaluable insights into market movement from a team of analysts and worldwide contacts ranging from brokers and traders through to hedge fund managers and investment banks.

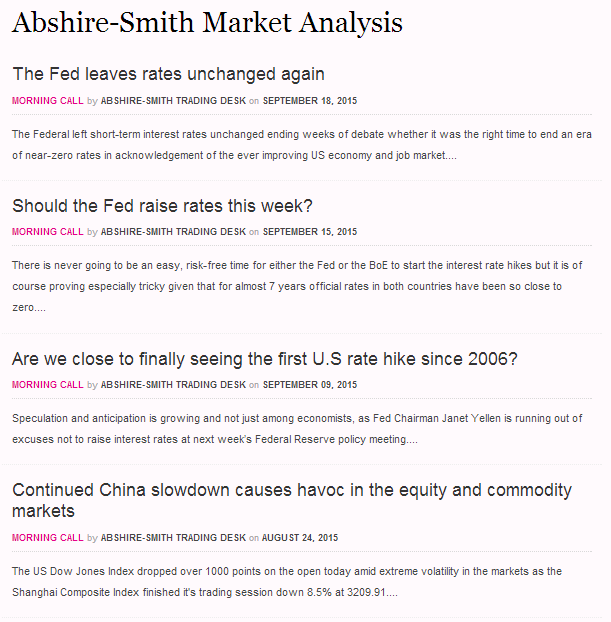

Abshire-Smith Market Analysis

The Squawk uses an audio news feed which provides traders with a competitive edge on breaking news events over other market participants and enables them to react faster to market moving news.

There is up-to-date news reporting and an economic calendar with current listings of financial events scheduled to take place over a period of a few days.

I was surprised that there were no tutorials, seminars or webinars offered by the broker.

Partnerships

There are several ways to partner with Abshire-Smith. IB’s can take advantage of the broker’s streamlined bespoke solutions which allows them to take full advantage of their client base whilst being able to continuously develop their own brand.

A full service white label is offered for the VertexFX Trader, Straticator DMA and MetaTrader 4. White labels at Abshire-Smith benefit from a good trading environment, true company development and competitive financial incentives.

The Abshire-Smith team understands many of the hurdles facing a company just starting up and can can help with the regulatory process, white labelling or a full release of a trading platform.

Deposits/Withdrawals

Funding to accounts at Abshire-Smith can be done easily using credit and debit cards, bank wires and a choice of several online e-wallet programs such as Skrill, CashU, Neteller and others. Withdrawals are generally executed on the same day (during business hours: 9am - 5pm UK Time). However due to third party payment intermediaries (banks, credit cards, e-wallets), the time for receipt of funds can be up to 7 business days.

Withdrawals may incur a charge to ensure they at least cover the costs of making the payment.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

Clients can reach an Anshire-Smith representative by email or by phone to their London office. Call back and chat options appear on every page of the website which is available in English and Arabic only.

Conclusion

Abshire-Smith is not a very well-known Forex broker which is rather strange as it offers many features that should attract clients. Being a relative newcomer to the Forex scene perhaps it hasn’t gotten around to offering some attractions that are offered by many other brokers such as bonuses or promotions or additional educational programs. Still, the website is definitely unique and navigation is easy.

Features

Abshire-Smith offers several great features. Their choice of trading accounts is admirable and the three trading platforms are among the more popular ones used by other Forex brokers, including the well-known MetaTrader4 platform which seems to be the one most used in the industry today. The fact that each of the platforms can be used on mobile devices conforms to the needs of Forex traders today and adds to the attractiveness of these platforms.

Platforms

VertexFX 10

Clients can trade more than 35currency pairs and CFDs on the award-winning VertexFX10 trading platform. The VertexFX 10 can be used as a web based platform or downloaded to a desktop and provides fast and efficient trade execution. For institutional users Abshire-Smith also provides the VertexFX 10 Bridge where they source liquidity from multiple sources such as investment banks, hedge funds and proprietary trading desks.

Abshire-Smith VertexFX Platform

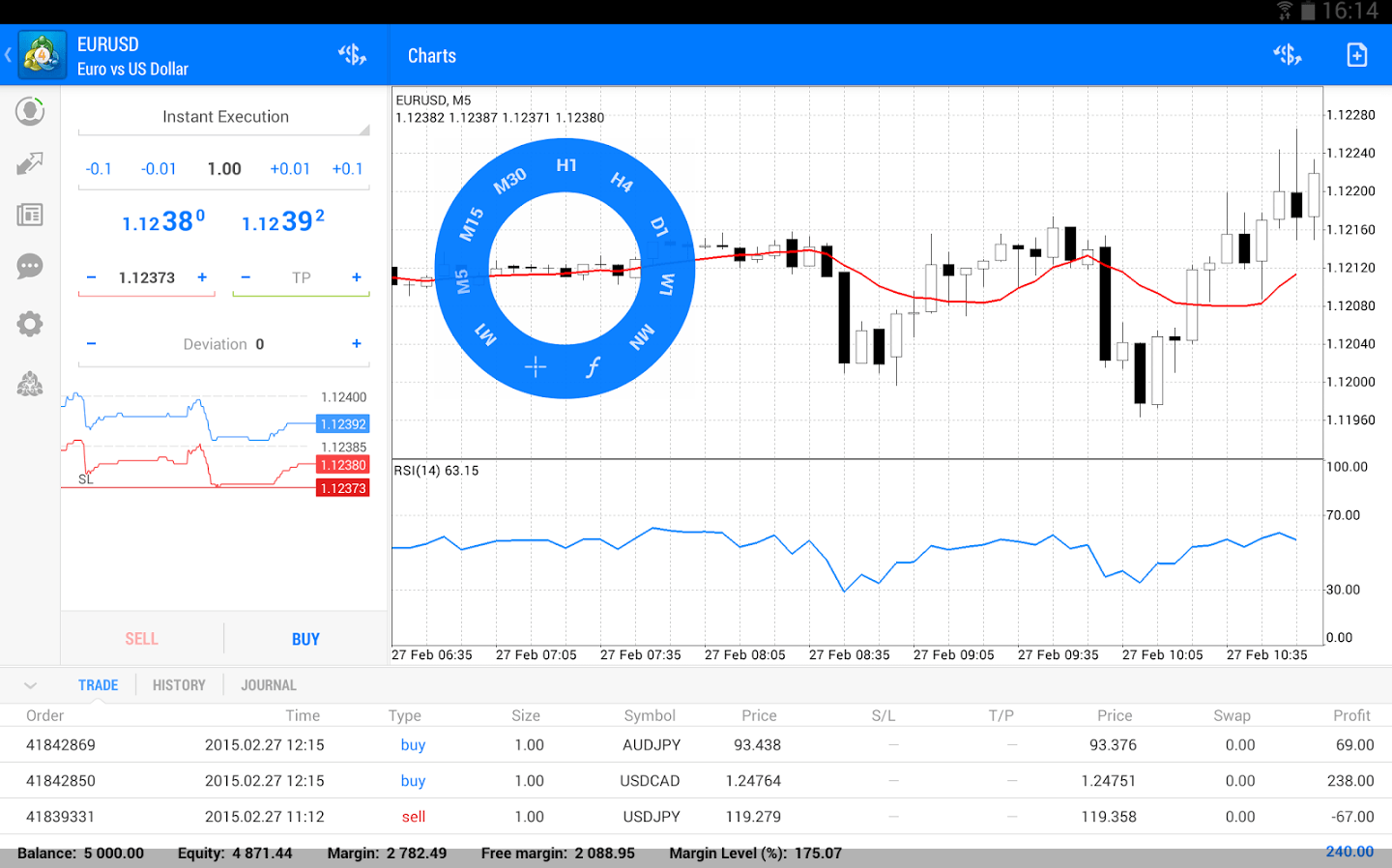

MetaTrader 4

MetaTrader 4 (MT4) is offered by Abshire-Smith with access to more than 40 currency pairs and CFDs in Indices, Commodities, Metals and Energies. MetaTrader 4 is one of the most popular and widely used retail trading platforms globally. It offers users-integrated pricing and charting for ease of trading with simple account management. The interface is simple to navigate and robust.

MT4 at Abshire-Smith is available as a desktop download and also a mobile application (iPhone, iPad and Android) to help clients trade on the go.

Abshire-Smith MT4 Platform for Tablets

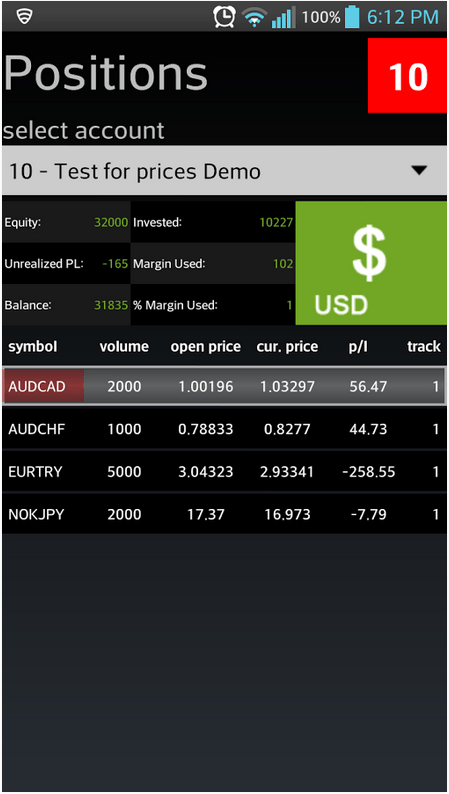

Straticator

The Straticator platform is a multi-asset platform and offers clients the ability to trade on exchange equities along with a DMA / ECN / STP /NDD FX model. The platform is available as a web based platform and also a mobile application.

Abshire-Smith Straticator Platform for Mobiles

The Straticator allows clients to easily build their own robot strategies for both a novice and expert programmer, compared to traditional retail trading platforms. It offers direct market access and deep liquidity.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |