Editor’s Verdict

Questrade is the largest Canadian independent online broker; it also maintains a wealth management unit. Founded in 1999, this discount broker applied in December 2019 for a banking license, signaling a dual desire to expand financial services to its clients and, at the same time, keep all aspects under one corporate umbrella. Per its own account, over 100,000 new accounts join this broker annually, with its core business in self-directed investing. Assets under management exceed $15 billion, and Questrade is an eight-time winner of the Best Managed Companies in Canada.

Overview

It deploys proprietary trading platforms, and its Questrade Wealth Management Inc. (QWM) added Robo-Advisory capabilities, centered on ETFs.

Canada CIRO 1999 ECN/STP, Market Maker None (but $1,000 required to start trading) Proprietary platform, Web-based 1.9 pips ($19.00) 2.0 pips ($20.00) $0.05 $0.75

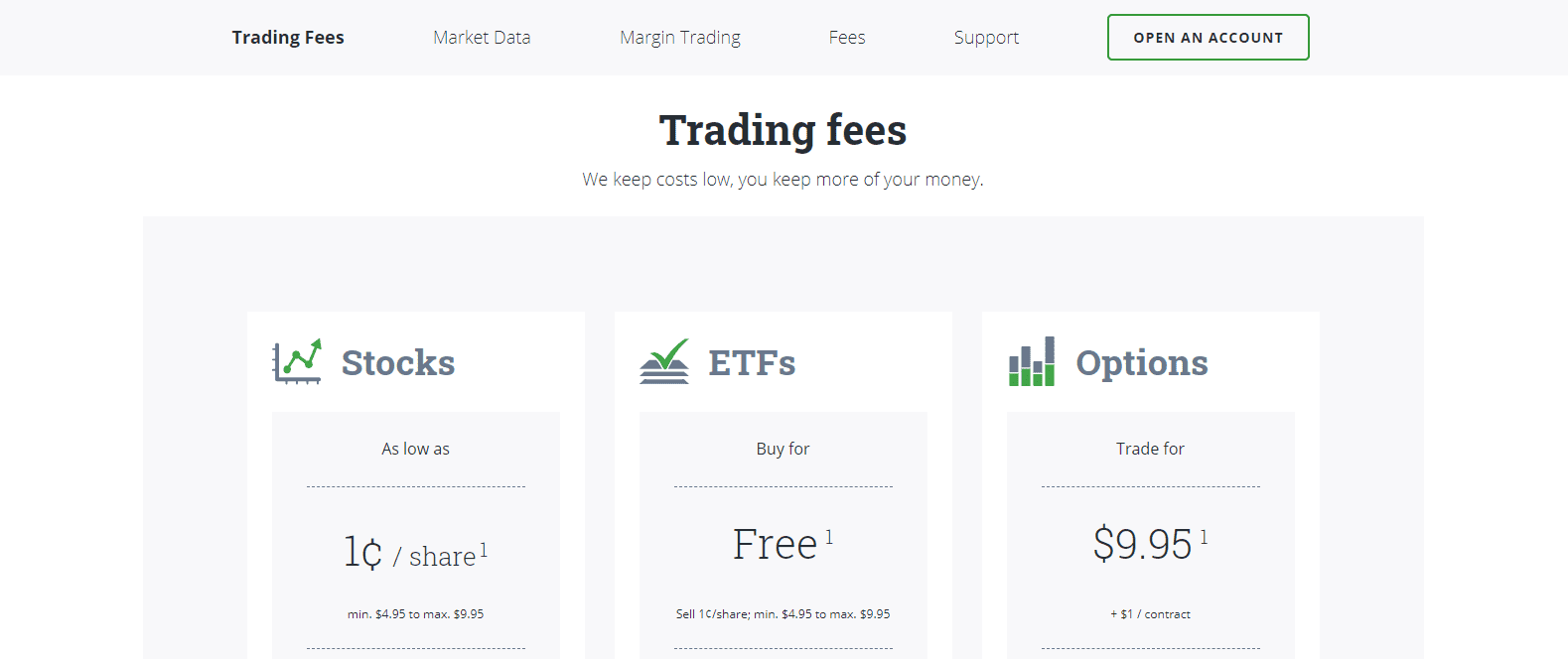

The self-directed investing accounts at Questrade Canada offer retail traders a competitive commission structure starting from just $0.01 per share with a minimum of $4.95 and a maximum of $9.95. The rise of demand among retail traders with the product and services portfolio at Questrade combine for a promising business outlook for this Canadian financial firm. Since 2020, Questrade Canada became the fastest-growing online brokerage. The wealth of services serves the Canadian market exceptionally well. Its proprietary trading platform features a user-friendly interface, while advanced users get a powerful alternative with Questrade IQ Edge. A mobile app is also available and integrated with the account. Canadian traders who wish exposure to international markets have a dedicated trading platform in Questrade Global. Two high-quality trading tools, Intraday Trader and IPO Center provide Questrade Canada clients with exceptional value-added services. The sole drawback on the trading platform portfolio remains the lack of support for automated trading solutions. While manual traders have access to an industry-leading choice, Questrade fails to bridge the gap towards the most advanced solutions.

Questrade Canada remains committed to providing excellent service. It won the JD Power #1-Ranked Self-Directed Online Brokerage in Investor Satisfaction award. Clients have access to a competitive asset selection from a transparent and secure trading environment. Besides trading services, Questrade offers retirement planning. New traders should start with the educational resources, as the product and services portfolio available may appear overwhelming. With management expansion plans to venture into banking, Questrade can become a one-stop solution for all Canadian financial needs. It has the infrastructure in place, with the most significant roadblock provided by the Investment Industry Regulatory Organization of Canada (IIROC), its regulator. It remains outdated and business-unfriendly, mirroring that of the US regulatory environment. Offering an international subsidiary remains one notable oversight at Questrade.

Regulation and Security

The Investment Industry Regulatory Organization of Canada (IIROC) regulates Questrade, which is also a member of the Canadian Investor Protection Fund (CIPF). It is critical to distinguish that its Robo-Advisory wealth management unit, Questrade Wealth Management Inc. (QWM), is not included in either the IIROC or CIPF. This broker additionally offers 100% reimbursement for unauthorized transactions in a statement of its confidence in deployed security technology and protocols. All self-directed portfolios also have an insurance policy of up to $10,000,000, ensuring most accounts enjoy full protection in the unlikely event that Questrade will go out of business. Overall, this broke maintains a very trustworthy and secure trading environment under the oversight of the IIROC.

The IIROC regulates Questrade, but not its Robo-Advisory wealth management unit.

In case of unauthorized transactions, Questrade will reimburse investors 100%.

$10,000,000 in private insurance covers investors against the unlikely event of default by Questrade.

Fees

Average Trading Cost EUR/USD | 1.9 pips ($19.00) |

|---|---|

Average Trading Cost GBP/USD | 2.0 pips ($20.00) |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.75 |

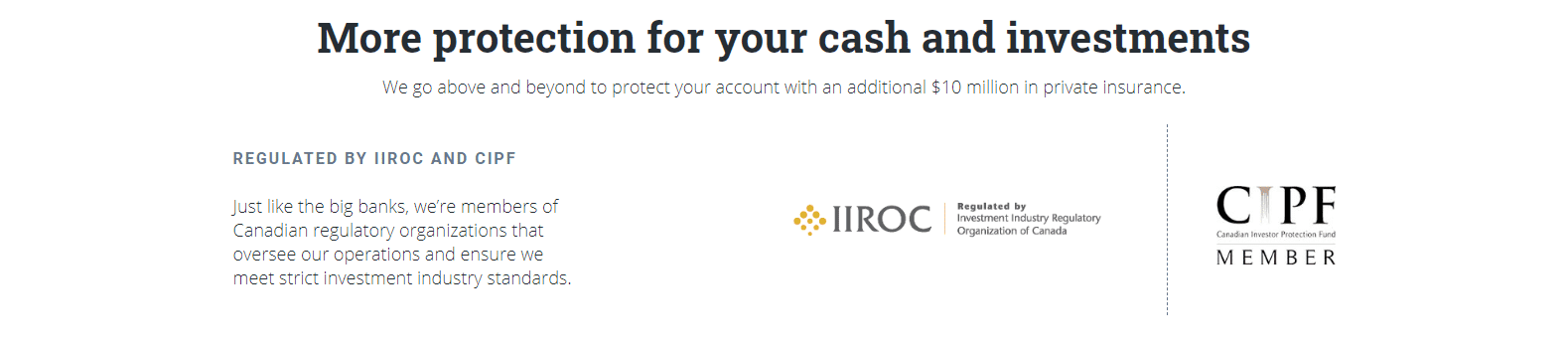

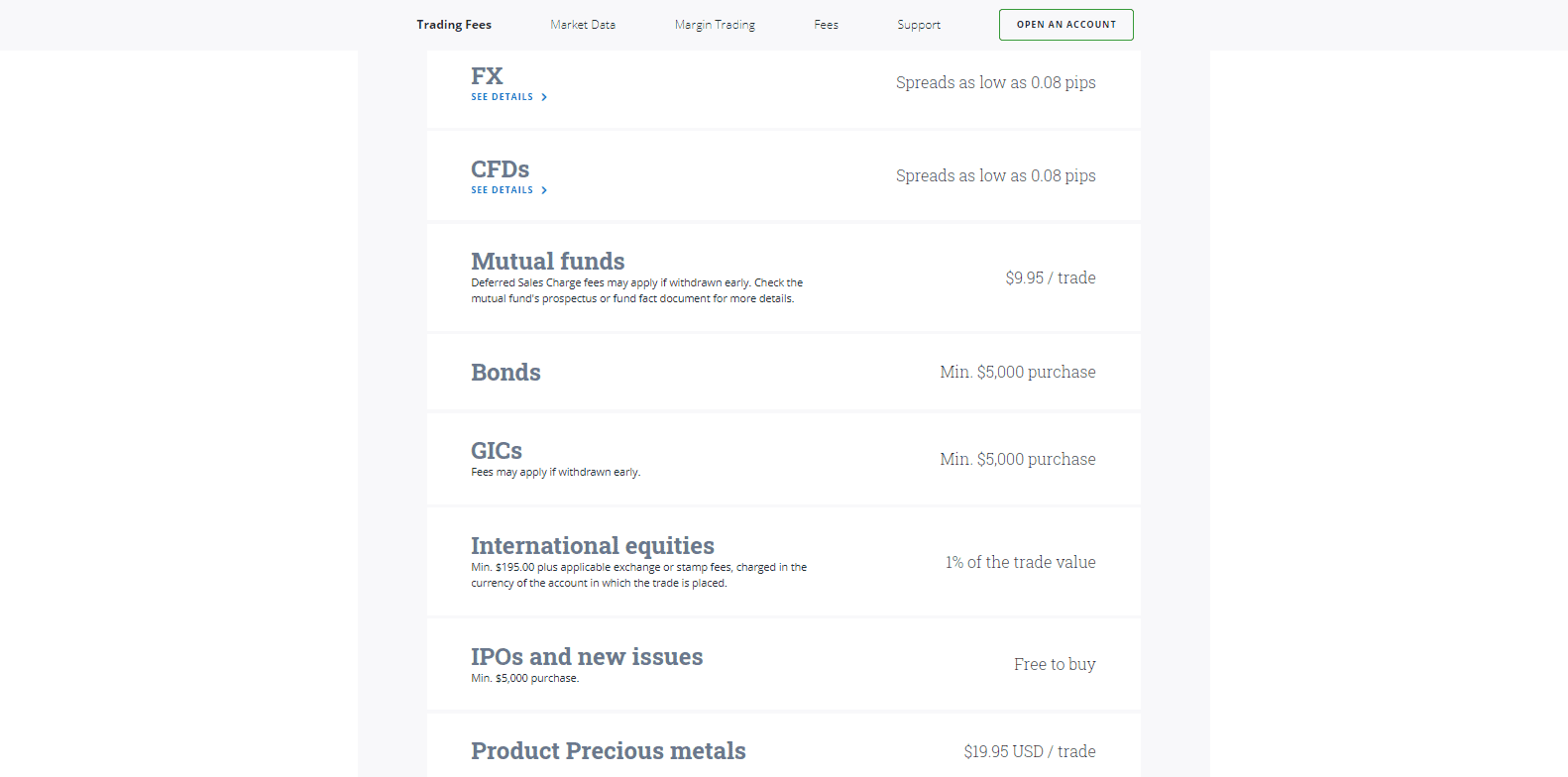

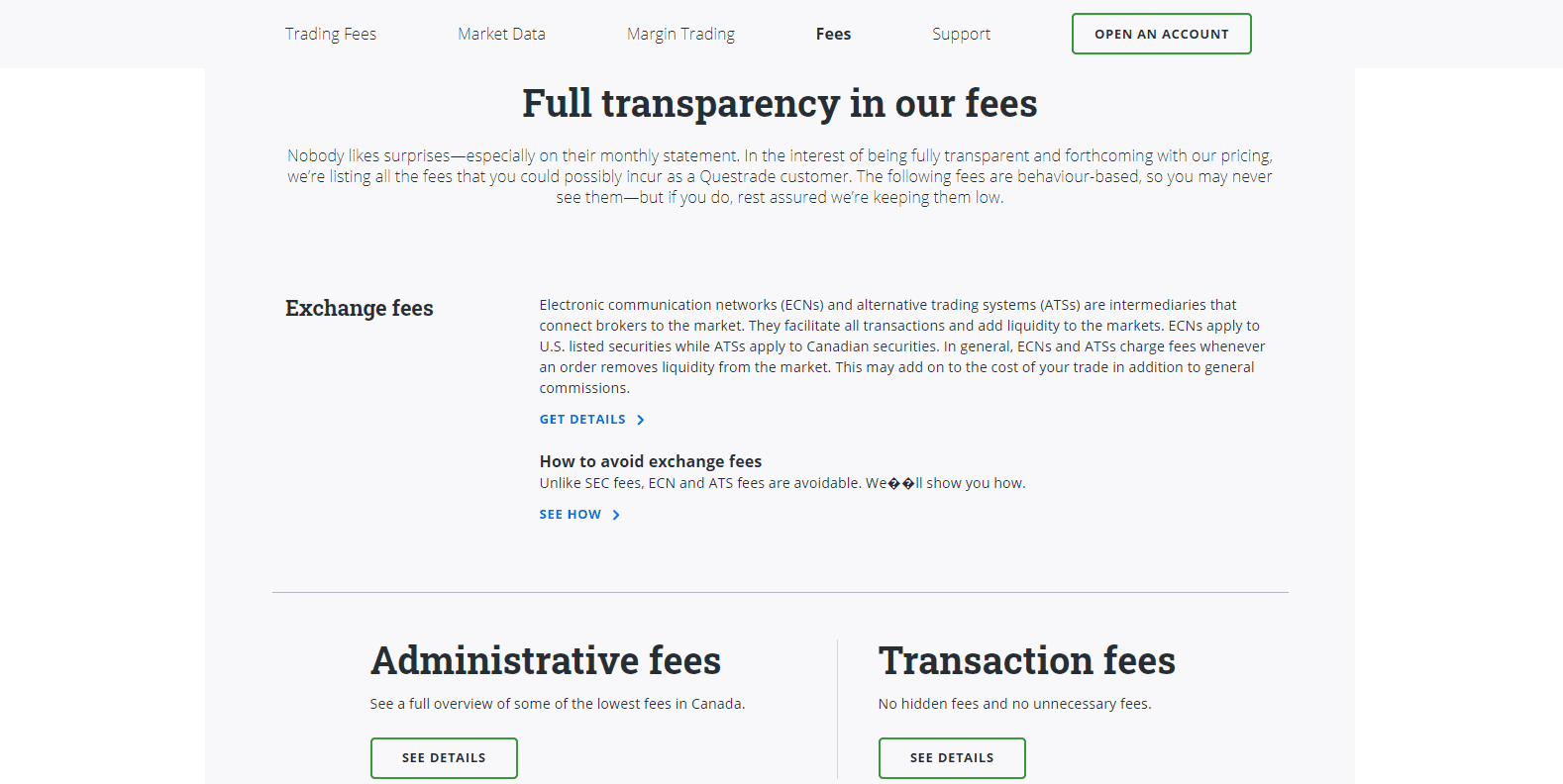

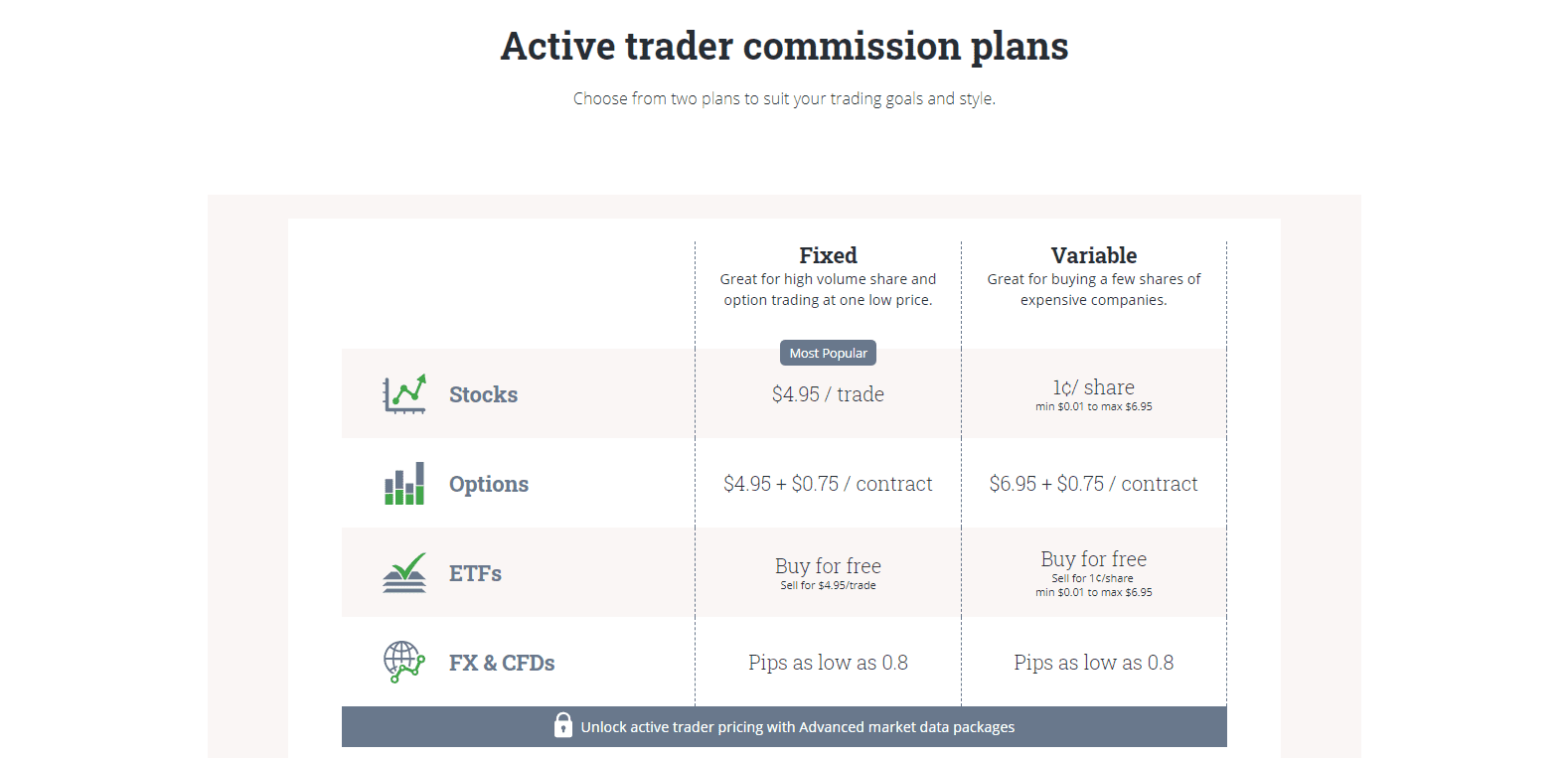

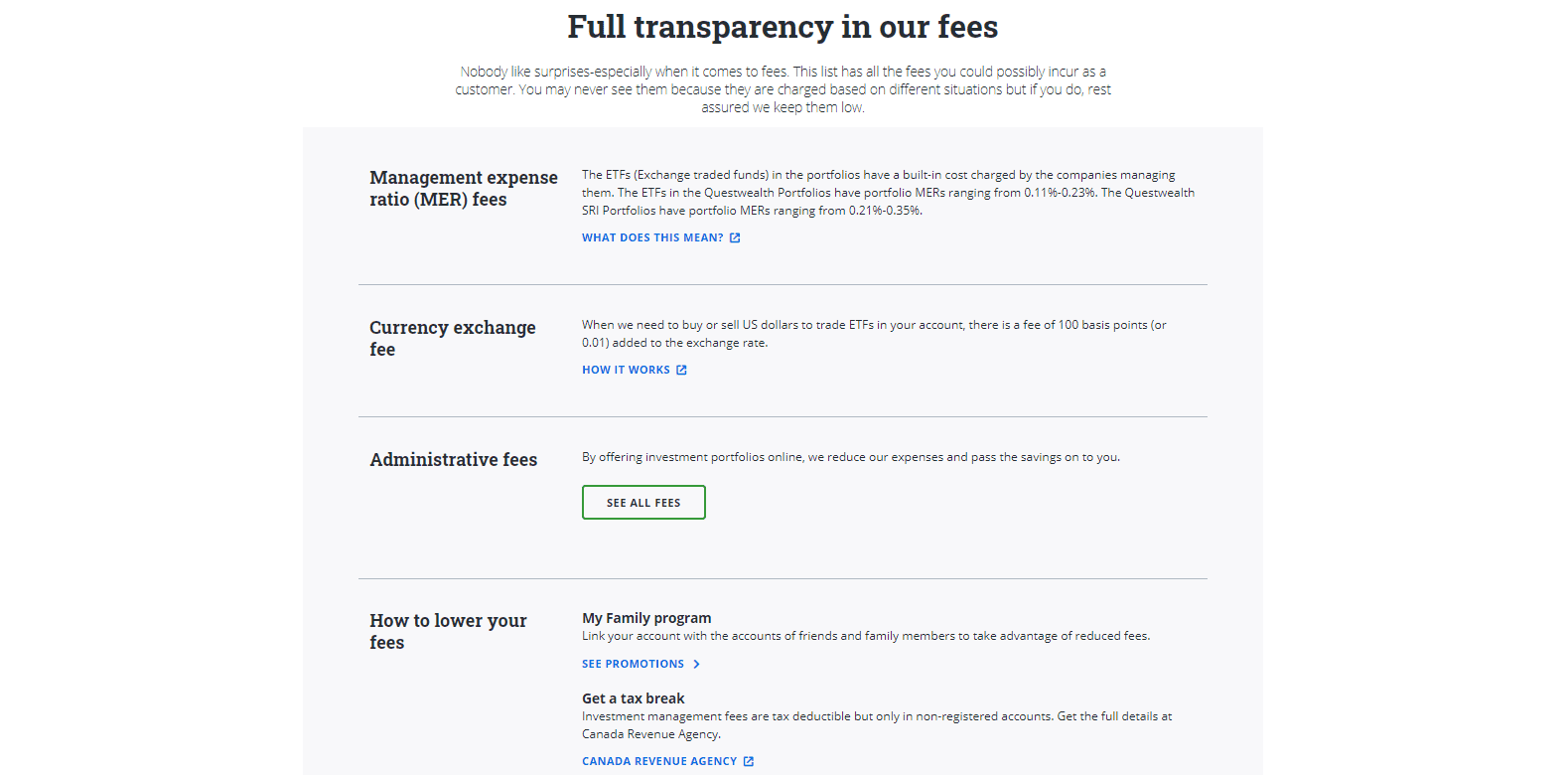

While Questrade remains transparent about fees, a complex structure appears overwhelming at first glance. The primary distinction is between self-directed investors, active traders, and Questwealth portfolios. Equity trading commences from $0.01 per share with a minimum commission of $4.95 up to a maximum of $9.95. Management fees for Questwealth portfolios are 0.25% of the portfolio size, reduced to 0.20% above $100,000. Active traders enjoy a fixed commission of $4.95 and have access to CFD trading with spreads as low as 0.8 pips.

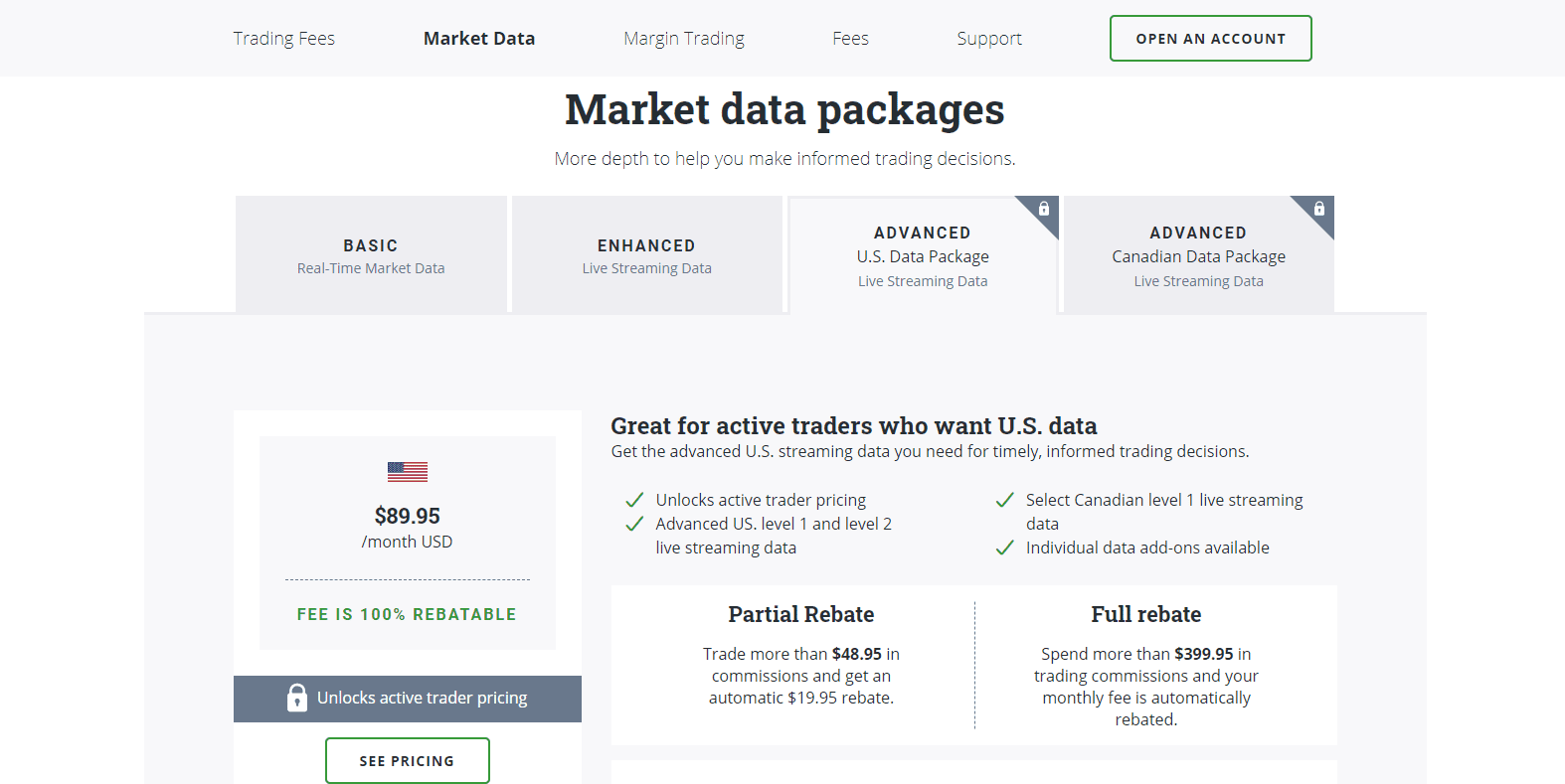

Self-directing investing accounts have multiple asset classes, priced differently, but transparency makes understanding the costs simple. Besides trading fees, clients must consider advanced market data package costs, exchange fees, and administration and transaction charges. Margin requirements depend on the price of the asset and increase as the price decreases. Active traders may choose between two cost structures, one fixed and one variable. Questwealth portfolios offer a series of smaller fees but are, overall, more competitive than most mutual funds.

Three distinct pricing structures exist at Questrade.

Questrade remains transparent about costs.

The trading costs are asset-dependent.

Advanced market data packages incur additional costs.

Exchange fees and administration/transaction charges also apply.

Two cost structures exist for active traders.

A separate pricing environment applies to Questwealth portfolios.

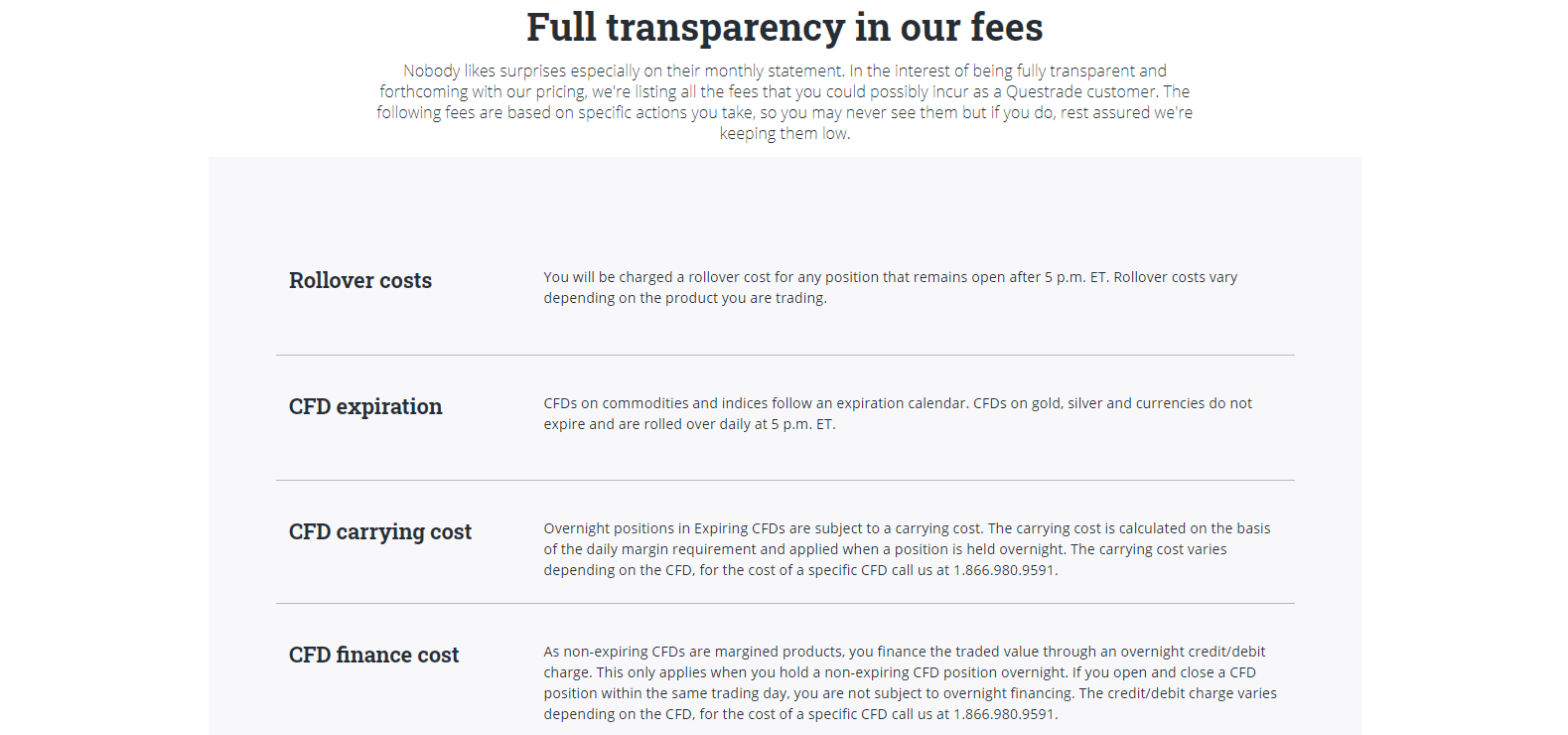

Swap rates and carrying costs also apply.

Commission-Free Trading Canada

The debate on commission-free trading and its negative impact, particularly on retail traders, is ongoing. While many retail clients flock to commission-free offers, they fail to understand that products and services come at a cost. Brokers use marketing campaigns to lure in new clients. The term commission-free attracts scores of new traders who feel the global financial system discriminates against them in favor of professional clients. They fail to read the terms and conditions or comprehend how brokers compensate for the lack of commissions. Brokers with commission-free trading offers will make up the difference elsewhere, and often the final trading costs are higher than commission-based alternatives. The simplest way for brokers to cover the absence of commissions is by raising their mark-ups on raw spreads. Active traders will generally accomplish a more cost-efficient pricing environment with commission-based brokers, especially once they account for volume-based rebates provided by the best brokers.

While commission-free trading is not available at Questrade, ETF traders have an offer that gets them half-way there. Buying ETFs at Questrade is commission-free while selling them incurs a fee of just $4.95 in the fixed cost structure. Questrade also has a variable alternative with selling costs of $0.01 per ETF up to a maximum of $6.95. It represents one of the best offers Canadian traders will find. While it is not a commission-free trading environment, it is a high-value and high-quality offer. Traders should ignore commission-free trading Canada campaigns, as in most cases, the final trading costs are higher than the alternative. Rather than seeking commission-free brokers, traders should evaluate the products and services of brokers. In that regard, Questrade remains the top choice in the Canadian market. It delivers on its slogan “Keep More of Your Money” and maintains a trader-friendly cost structure.

Questrade Inactivity Fee

Brokers charge an inactivity fee if clients have not used their accounts to place trades. The absence of trading activity turns client accounts into no revenue accounts. Some apply a flat cost after a dormancy, for example, $10 monthly after three months. Several brokers levy a more significant fee, followed by a smaller one. It could be $100 after six months and $20 monthly afterward. A few brokers implement a progressive inactivity fee, starting at $80 after two months until it reaches up to $1,000. Traders may also face an administrative cost for becoming active again. The charges are often detailed in the terms and conditions and not openly stated on the broker websites. Most traders do not bother to sort through lengthy legal documents, and an inactivity fee is the most pointless cost. While some brokers justify it by claiming regulatory requirements to ensure compliance, it is a non-sense excuse.

Brokers move an inactive account to a different sub-database, and reactivation may consist of a trader resubmitting a copy of their ID or proof of residency. It does not cost brokers anything, making an inactivity fee a legal tool to drain the existing client account from the remaining capital. Fortunately, Questrade decided to abandon the Questrade inactivity fee as of October 2020. Before that, it was $24.95 per quarter, but if you had more than $1,000 in your account, made a deposit of $150 during three months, or were under the age of 25, you were exempt. Inactive traders who placed a transaction in the next quarter were eligible to get their commissions reimbursed up to $24.95. Therefore, even when there was a Questrade inactivity fee, traders had a chance to earn it back. It was by far the best offer besides the absence of one.

Questrade Account Fees

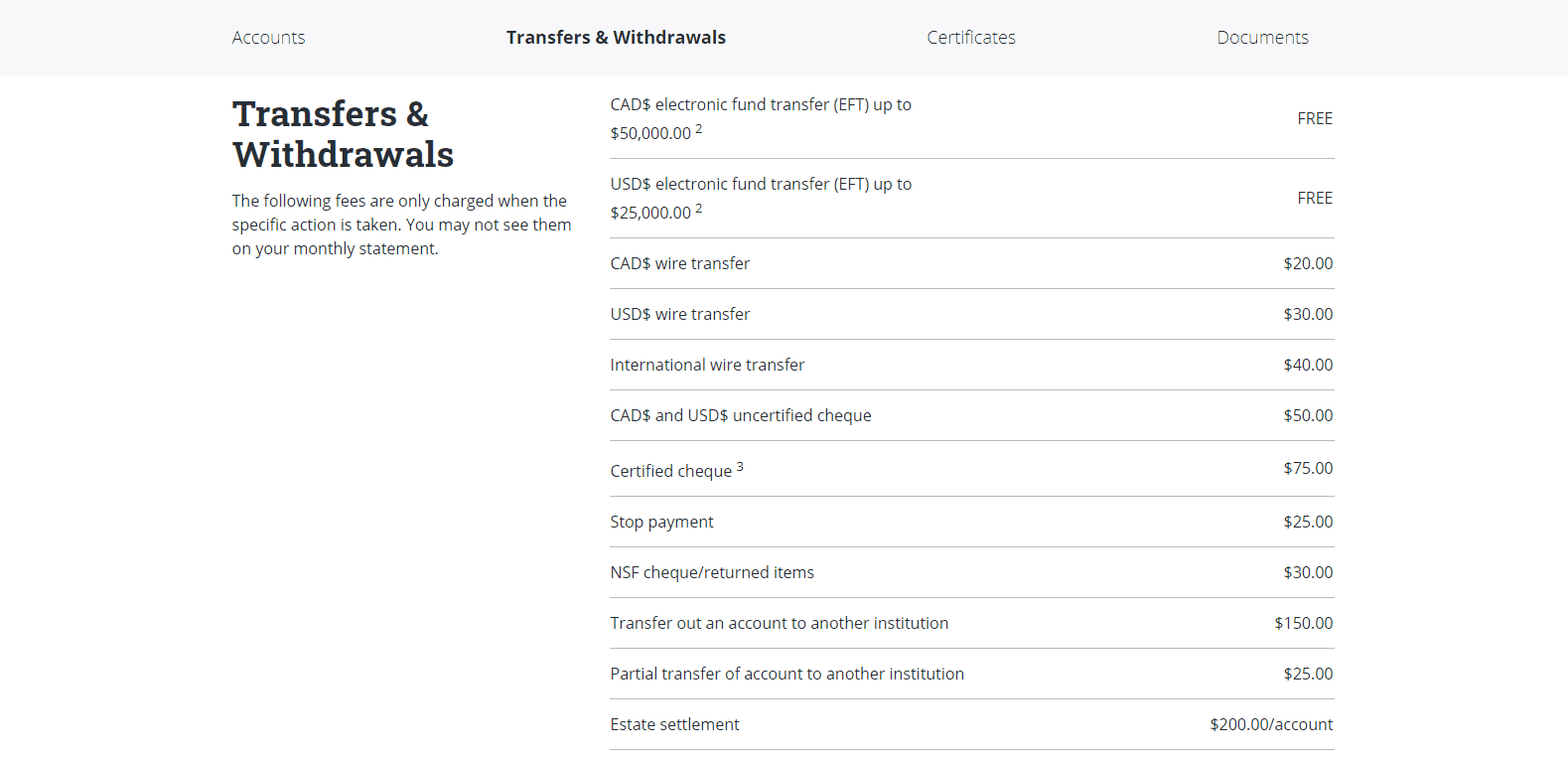

Questrade provides clients with a competitive trading cost structure, but there is a long list of account fees. Traders must understand that not all charges will apply to them, as costs remain tied to trading style and activity. Questrade is transparent about all of the fees associated with having an account. The opening and closing of accounts remain free of charge. A partial and full plan deregistration costs $50 and $100, respectively. The same applies to the Lifelong Learning Plan (LLP) and Home buyer’s Plan (HBP), but the levy is $25 and $50. Clients who wish to trade US equities in their Registered Education Savings Plan (RESP) will pay a commission of $5, on top of the regular costs, but only for the first trade of the day. Subsequent transactions face standard commissions. Estate settlement of a Questrade account costs $200 per client account. A partial account transfer to another institution incurs a cost of $25, while the complete transfer costs $150.

Electronic fund transfers up to C$50,000 or $25,000 are free of charge. Bank wires in Canadian Dollars face a $20 surcharge, increased to $30 for bank wires in US Dollars and $40 for international ones. Questrade also accepts uncertified cheques for an additional cost of $50 and only in Canadian Dollars or US Dollars. It lists a $75 fee for certified cheques, $25 for a stop payment, and $30 if the cheque returns due to insufficient funds. Certificate re-registrations cost $300 and $450 for rushed ones, while certificate deposits face a similar levy of $300 and $400, respectively. A direct registration statement or a custodian deposit or withdrawal face a $300 fee each. Any document retrieval at Questrade costs $20 per document plus courier charges between $10 and $75, depending on the service.

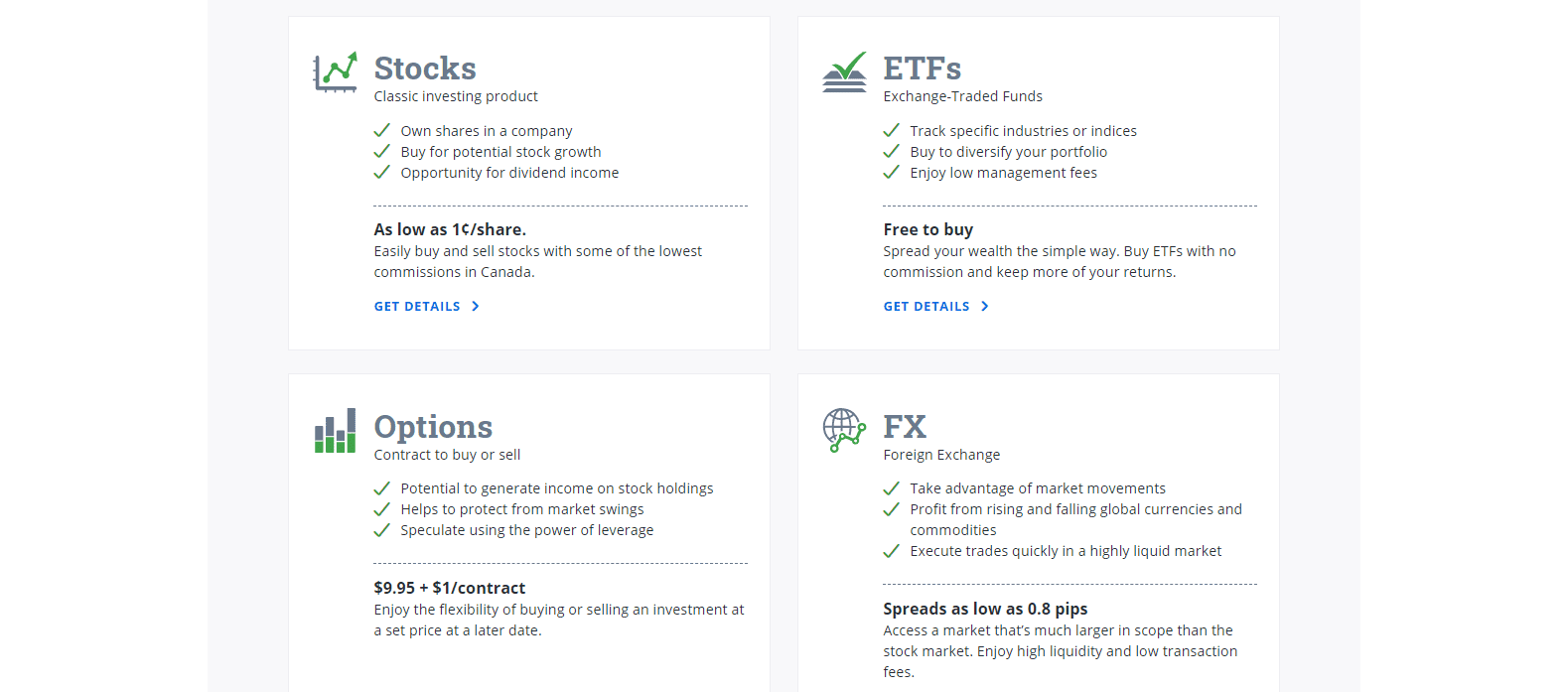

Questrade ETF Fees

Exchange-traded funds or ETFs represent the best trading instruments for most retail traders, especially with a deposit of less than $10,000. They trade like shares during regular exchange trading hours, hence the name. ETFs offer diversification and exposure in a manner mutual funds do. They also grant clients profitable opportunities during bear markets, which mutual funds fail to do. Demand for ETF products continues to soar. The Questrade ETF fees offer clients one of the most beneficial pricing environments in Canada. Buying ETFs at Questrade remains free of charge. Selling ETFs starts from just $0.01 per ETF with a minimum of $4.95 and a maximum cost of $9.95 for regular retail clients. Having a ceiling offers traders cost control, a beneficial tool non-existent at most brokers who do not maintain a maximum commission cost. Active traders receive an improved Questrade ETF fees structure that consists of a fixed and variable option. Buying ETFs remains free of charge, but the former comes with a fixed cost of $4.95 for selling ETFs, while the latter lists a cost of $0.01 per ETF with a maximum of $6.95.

ETF traders at Questrade should consider one additional fee for market data packages. New traders may not require it and determine the free Basic package sufficient. The Enhanced upgrade costs $19.95 per month, but if traders accumulate $48.95 in commissions, they qualify for a 100% rebate. Questrade also features an Advanced option for $89.95 per month, suitable for active professional traders. A full refund is available if clients incur a monthly commission of $399.95, while a $19.95 partial reimbursement applies with monthly commissions of $48.95, mirroring the offer from the Enhanced package. The overall Questrade ETF fees structure remains the most competitive on the Canadian market for retail traders and professionals alike.

Questrade Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 17:00 | Friday 17:00 |

Commodities | Sunday 17:00 | Friday 17:00 |

Crude Oil | Sunday 17:00 | Friday 17:00 |

Gold | Sunday 17:00 | Friday 17:00 |

Metals | Sunday 17:00 | Friday 17:00 |

Equity Indices | Monday 07:30 | Friday 20:00 |

Stocks | Monday 07:30 | Friday 20:00 |

Stocks (non-CFDs) | Monday 07:30 | Friday 20:00 |

Bonds | Monday 07:30 | Friday 20:00 |

ETFs | Monday 07:30 | Friday 20:00 |

Options | Monday 07:30 | Friday 20:00 |

What Can I Trade

The primary asset selection at Questrade consists of equities, ETFs, options, and Forex. Expanding the choice are mutual funds, commodities, bonds, guaranteed investments with interest rates, and access to the IPO market. While no complete details exist regarding the number of names in each category, over 110 currency pairs, and equities listed on nineteen exchanges, suggest that the overall choice allows for cross-asset diversification. The Questwealth portfolios add another layer of diversification. Overall, Questrade offers its investors and traders an excellent asset choice.

Traders have access to a broad asset selection at Questrade.

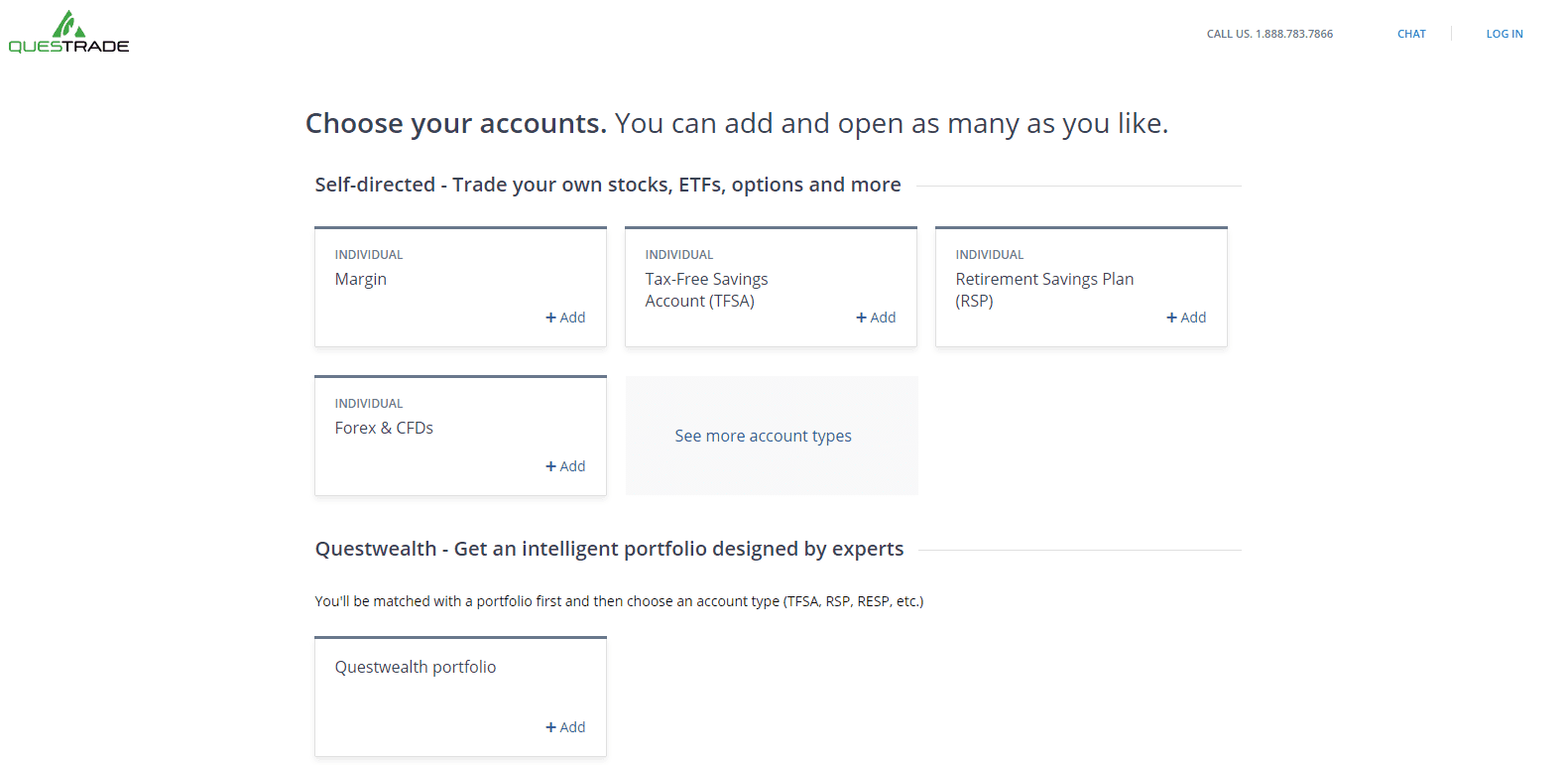

Account Types

Questrade offers twenty account types, divided into six Retirement accounts, two educational ones, seven for entities, two for margin trading, two for Forex and CFD trading, and one tax-free savings account. Each one comes with different benefits, but most traders will manage their non-retirement portfolios in the Forex and CFD accounts, with the addition of margin trading. Clients may open as many sub-accounts as they wish, and there is no minimum deposit, but an account balance of $1,000 is necessary before trading can commence. Specific assets carry a higher minimum investment, explained by Questrade, where applicable.

While twenty account choices exist, most traders will opt for the Forex and CFD account, with an added margin account.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

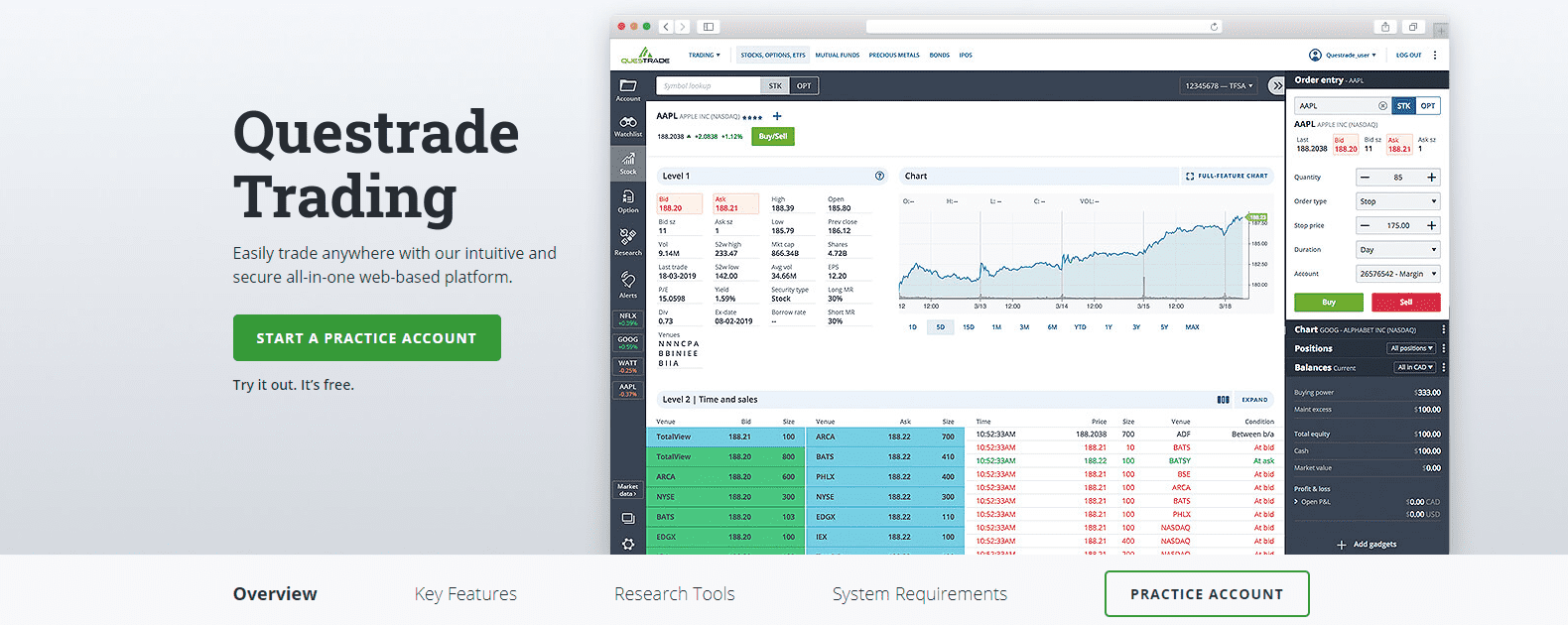

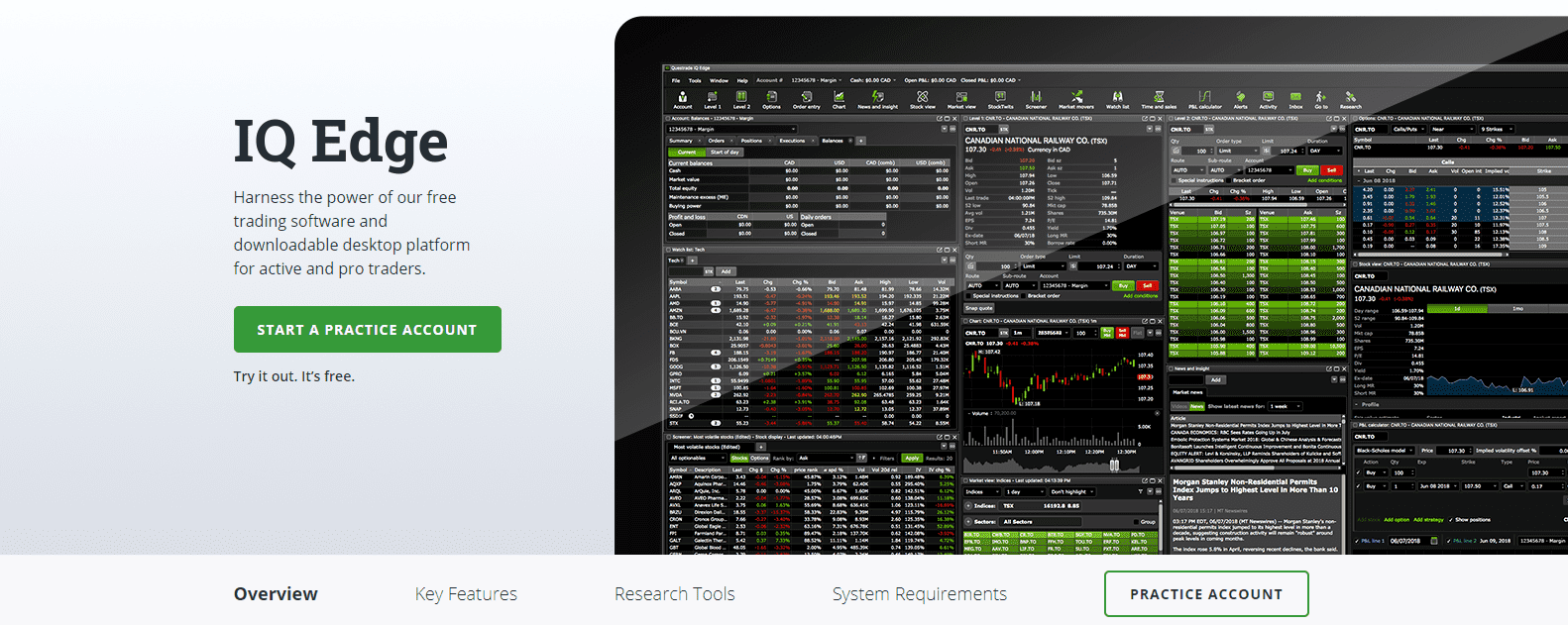

Three proprietary trading platforms are available at Questrade, offering traders different trading experiences. Most retail traders will opt for the Questrade Trading webtrader, a well-designed and user-friendly platform featuring alerts, charting capabilities, built-in research, market data, and customized watchlists. Traders may also use the mobile app. Questrade IG Edge is an upgrade for active and professional traders. Screener, research reports from Morningstar and Recognia, and conditional orders allow for more in-depth analytics and advanced trading strategies.

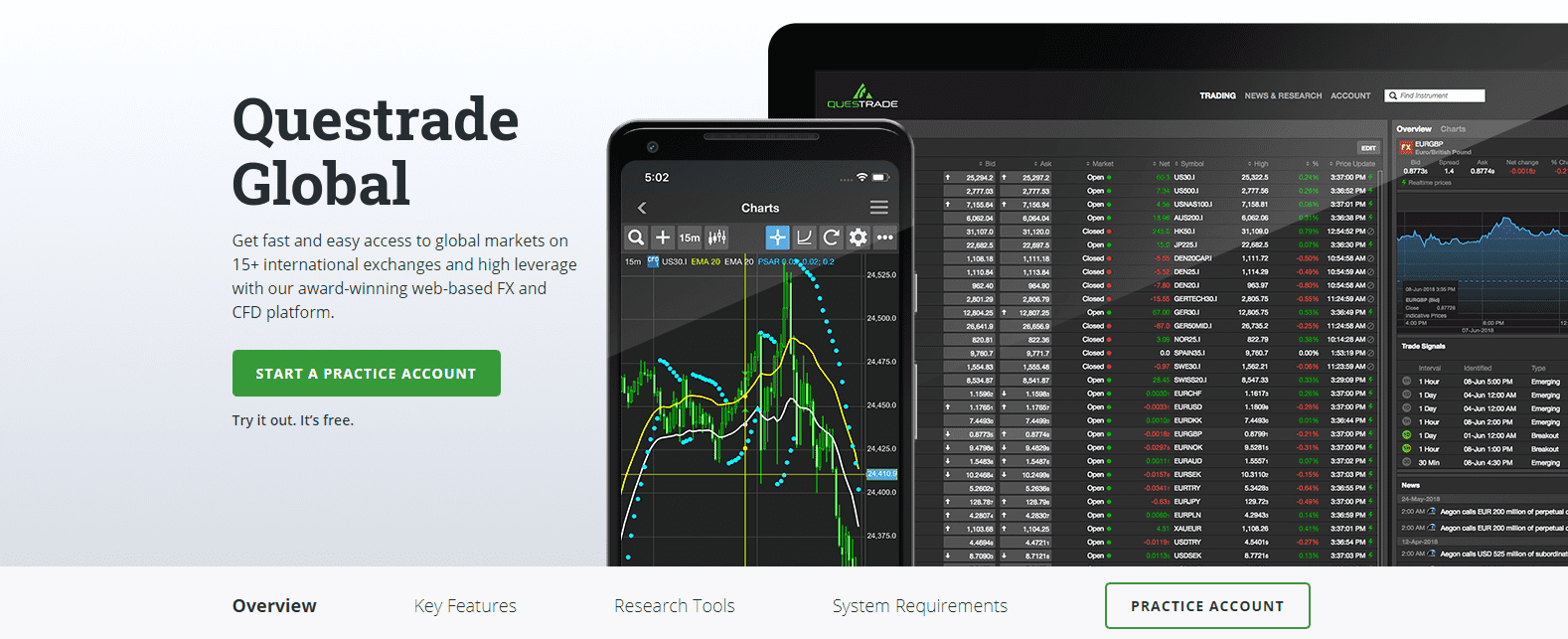

Questrade Global is the exclusive Forex and CFD trading platform, where traders have access to non-Canadian equities. It is available as a webtrader or mobile version and features live charts, economic releases, and research from NewsEdge and Autochartist. Market Intelligence and Intraday Trader are accessible by all clients, regardless of the trading platform. While Questrade does not offer the MT4 trading platform, and no alternative for automated trading solutions exists, the three proprietary versions offer manual traders an excellent trading environment.

Most retail traders will use the Questrade Trading webtrader.

Questrade IQ Edge grants active and professional traders an alternative.

Questrade Global is the Forex and CFD webtrader.

All traders have access to a range of additional tools and reports.

Unique Features

Questrade offers investors its Robo-Advisory service via Questrade Wealth Management Inc. (QWM). In-house portfolio managers maintain all Questwealth portfolios, supported by over 100 agents assisting interested clients. The service extends to ETF (exchange-traded funds) and SRI (socially responsible investing) portfolios. Questrade created a genuine marketplace for passive investors, and it maintains an excellent infrastructure supporting this sector.

Questwealth portfolios offer investors active management by Questrade.

Passive investors have access to a range of ETF portfolios.

Questrade also embraces SRI investing.

Research and Education

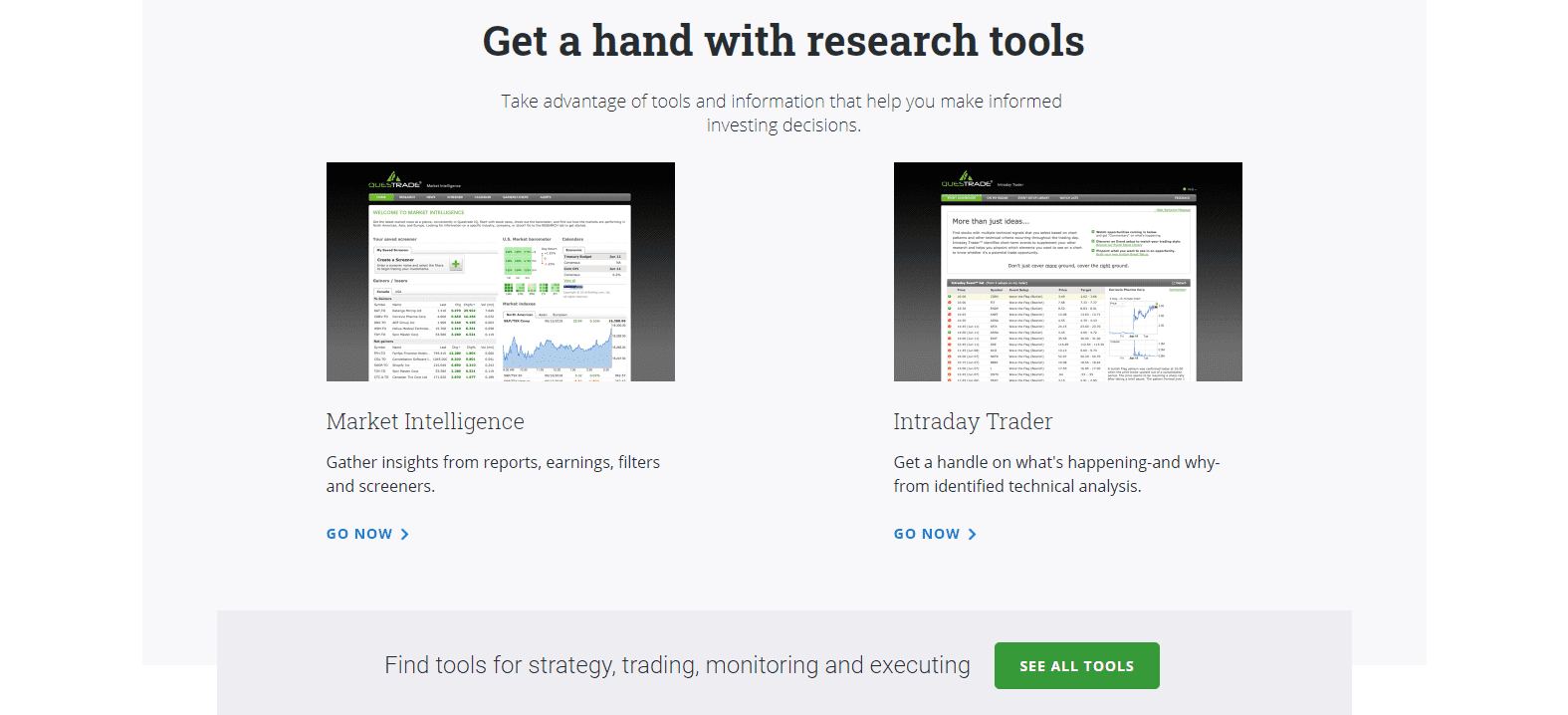

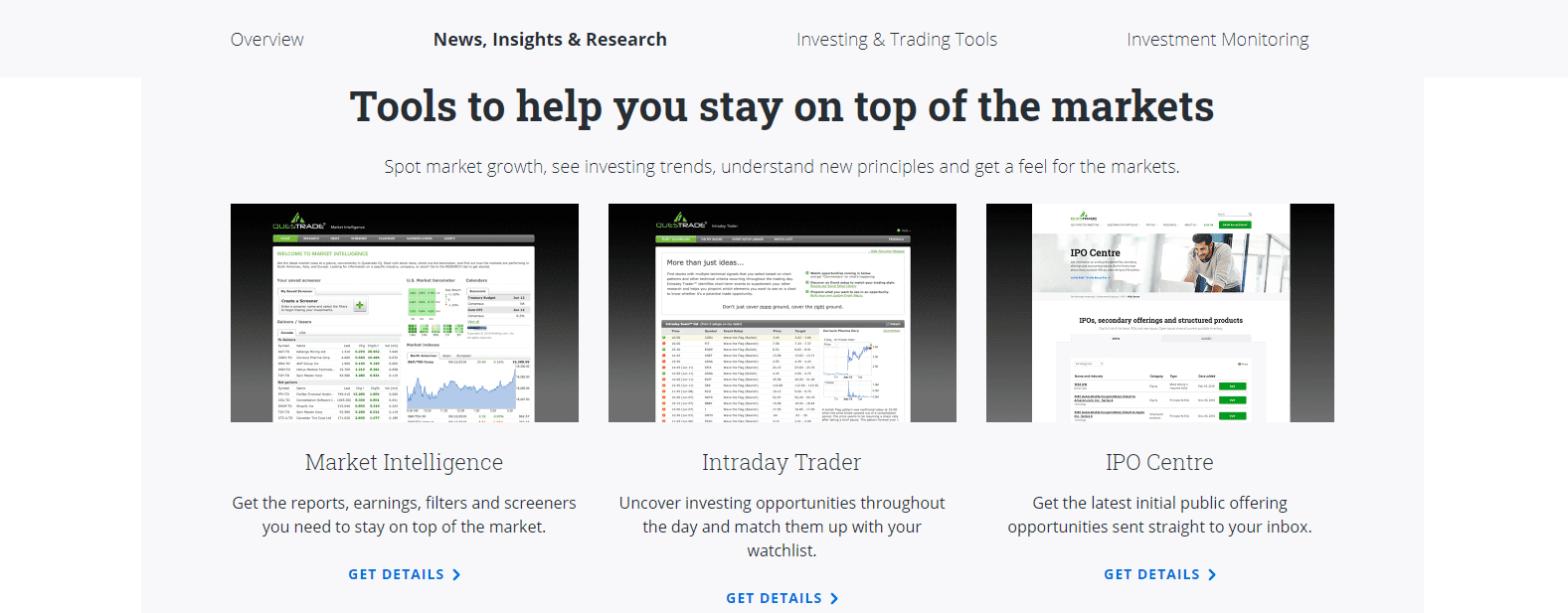

Investors and traders have access to three essential research tools provided by Questrade. Market Intelligence delivers asset-specific financials, valuations, regulatory filings, key metrics, and news. It also allows investors to overlay customized screeners identifying the growth, market, and valuations on the company, the sector, and ETF-related information. Intraday Trader, powered by Recognia, scans live data for technical chart patterns, sends alerts, and features an educational section. The IPO Center provides relevant data to new listings, allowing interested investors to analyze upcoming opportunities, while the blog offers additional market-related content. Questrade does an excellent job of delivering research, both in-house and via third-party partnerships.

Questrade offers clients an excellent research portal.

The blog offers additional market-related content.

Education is the distinct weak area at Questrade. Presently, there are nine webinars available, covering various topics, but no dedicated educational section exists. Some webinars feature content related to accounts at Questrade, diminishing the total value for new traders seeking an introduction to trading. The Intraday Trader reports by Recognia feature a category dedicated to education, but the overall approach by Questrade requires an overhaul and extensive upgrades.

Nine webinars are the only educational content offered by Questrade.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |  |

Support hours at Questrade are not listed, but the most convenient tool remains live chat. Clients may also call or send an e-mail. An FAQ section attempts to answer the most common questions, and this broker does an excellent job explaining its products and services. Most investors are unlikely to require customer support but can access it swiftly in case of emergencies.

Live chat is the most convenient tool to reach customer support.

An FAQ section answers the most common questions.

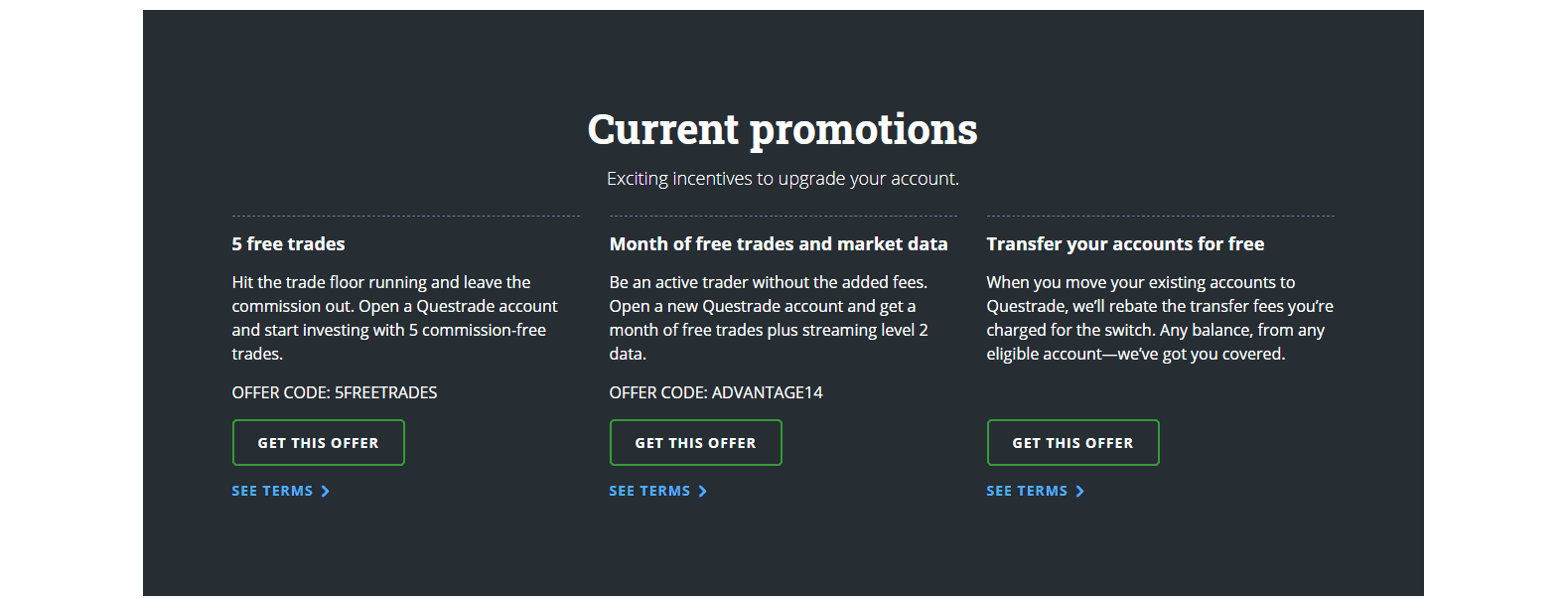

Bonuses and Promotions

Questrade maintains a refer-a-friend campaign together with the My Family incentive. The former grants a payment between $25 and $50, while the latter collectively lowers trading fees for all members of the family and close friends. Two promotions for new account openings presently exist, one granting five commission-free trades and one geared towards active traders with one month of commission-free trading and free streaming level 2 data.

Questrade offers two bonus campaigns, with the My Family plan granting outstanding value.

New account openings may take advantage of an additional bonus offer.

Opening an Account

An online application takes care of new accounts, following well-established global practices. The first step consists of the desired account options before proceeding with personal data. Questrade appears to cater exclusively to Canadian traders, and new clients need their SIN and driver's license to open an account. Additional information could be necessary, depending on the account type.

The account selection is the first step to open a new account.

A copy of the trader's SIN and driver's license is mandatory for verification purposes.

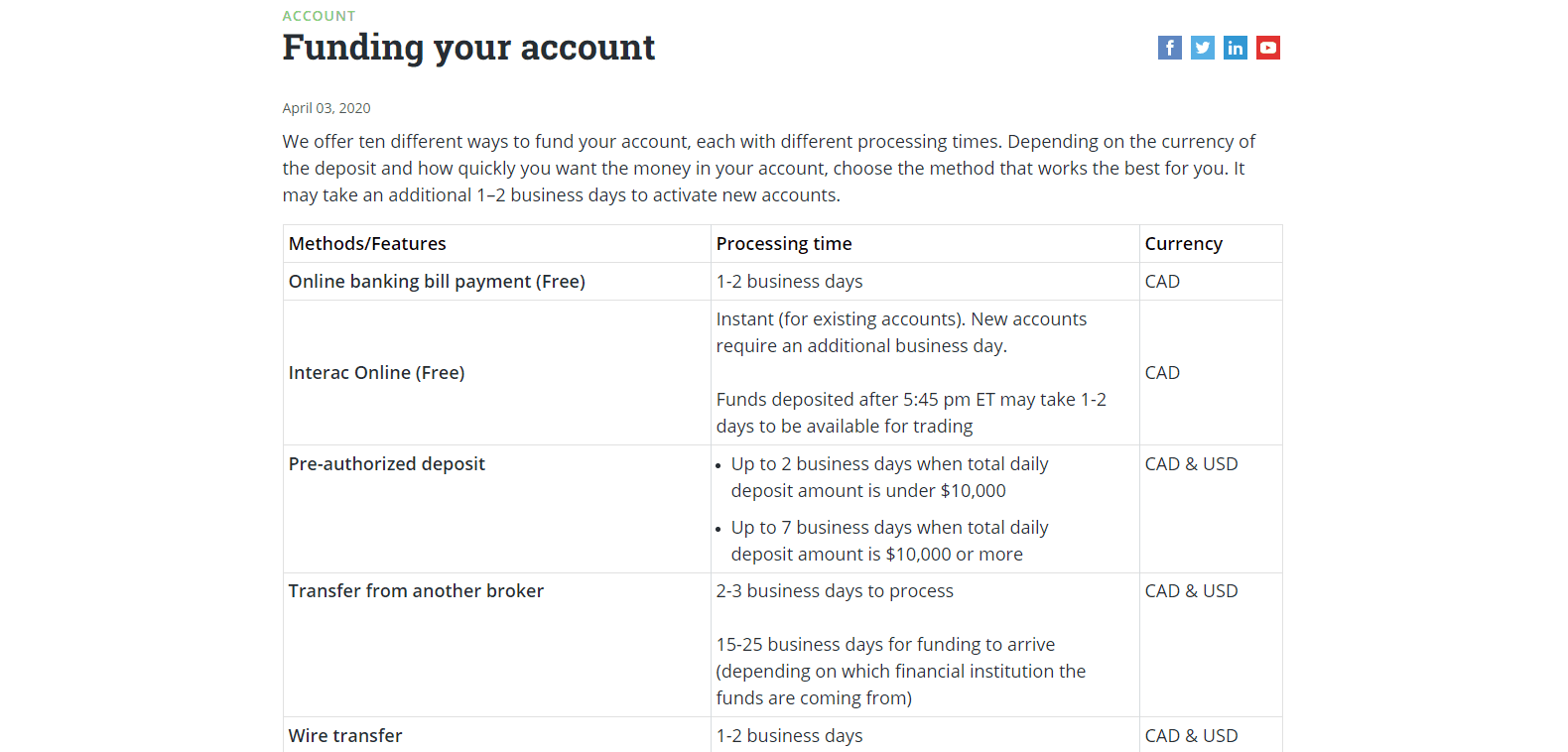

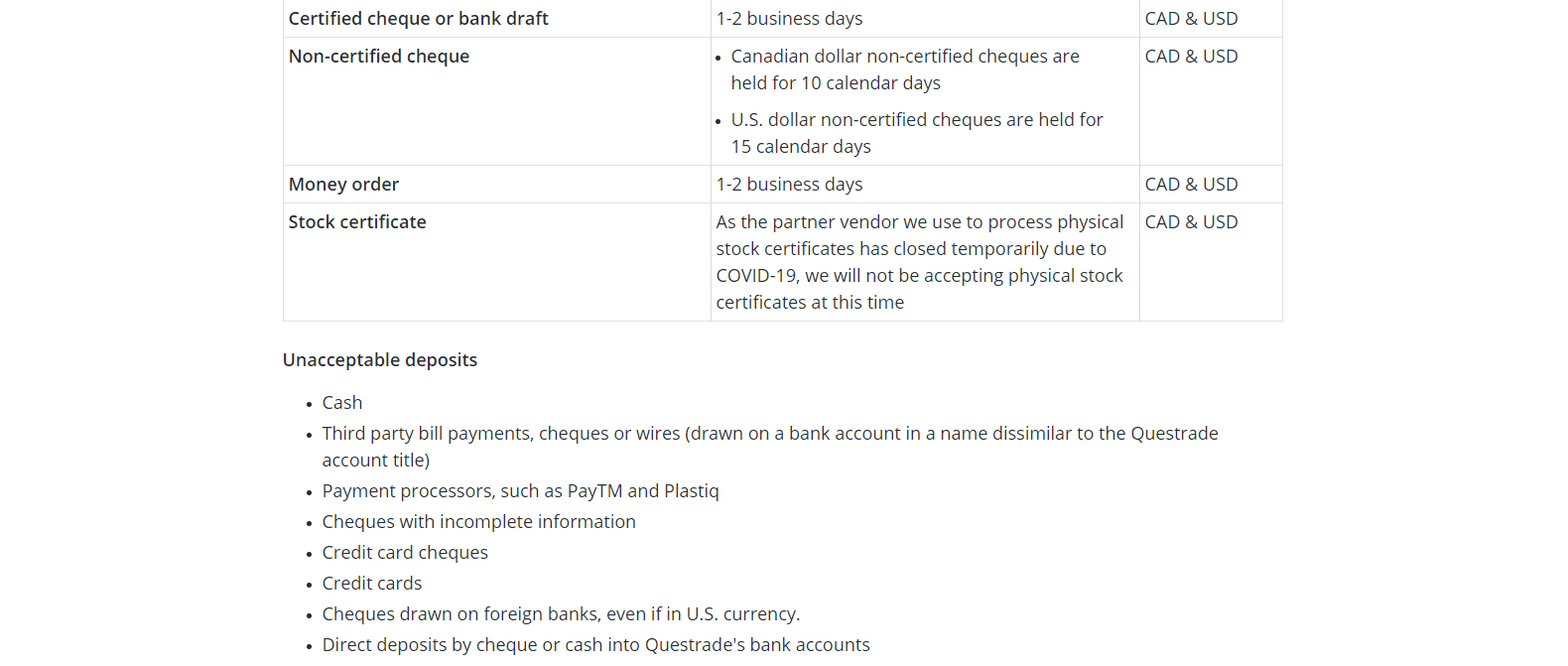

Deposits and Withdrawals

While Questrade offers ten deposit and withdrawal options, they are all centered around bank transactions. Depending on the payment or transfer options, transaction times range between one and twenty-five days with fees between $0 and $200. Regrettably, Questrade does not support third-party payment processors and e-wallets, leaving clients with disappointing but suitable options.

All deposit and withdrawal options are associated with bank transfers, while no support for e-wallets exists.

Fees can range between $0 and $200, depending on the payment or transfer option.

Instant Deposit

Questrade announced a new Instant Deposit feature via Visa Debit, which makes instant deposits from a client’s bank account into their Questrade trading account. The amount remains limited to $3,500, more than enough for retail traders to take advantage of opportunities in a fast-moving market. It is also ideal for leveraged traders to cover margin calls, adding a layer of security when times get turbulent.

New traders can open an account and use it instantly if depositing up to $3,500 via Instant Deposit by Questrade. At the time of writing this review, it only works with a Visa Debit card, but Questrade announced it works on introducing Instant Deposit via Mastercard Debit and Interac cards in late summer 2021. Traditional banking options attempt to remain competitive with third-party, modern payment processors. While non-bank solutions continue to offer international traders an edge, and I recommend using them instead of day-to-day banking solutions, Questrade is a Canadian broker, and North American ones generally lack optimized payment choices. Therefore, the Instant Deposit at Questrade presents clients with one of the best options available across the North American brokerage market. You can read the Questrade press release here.

Anyone with a Visa Debit card can use Questrade Instant Deposit.

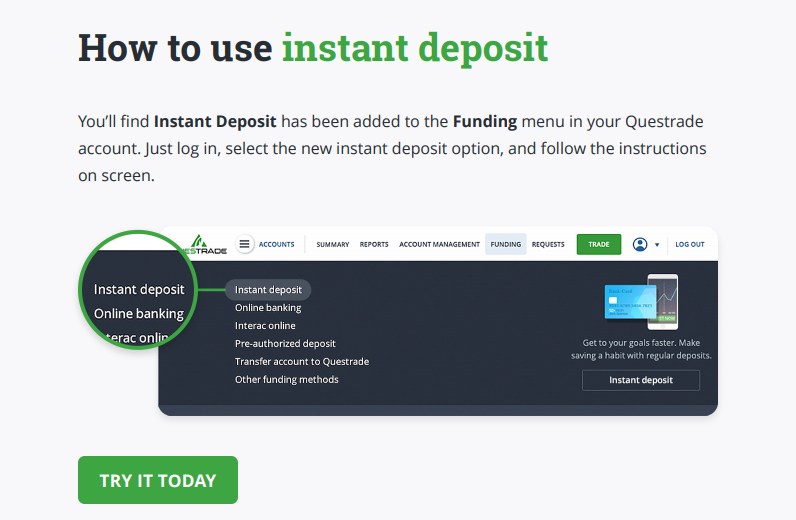

Questrade added the Instant Deposit option to its Funding menu.

Summary

Questrade is an excellent online broker for Canadians to consider. The asset selection is outstanding, and the core cost structure very competitive. New traders should browse the additional costs, but Questrade is very transparent about it. In operation for almost 21 years, and with over $15 billion under management, Questrade offers investors and traders three proprietary trading platforms and maintains a client-friendly trading environment. With twenty account options, all types of investors and traders will find a suitable choice.

While third-party automated trading solutions are not supported, Questrade Wealth Management Inc. (QWM) is the in-house Robo-Advisory, focused on passive investing, while active investment solutions equally exist. Manual traders have access to extensive research, but new traders will be disappointed by the educational capabilities of this broker. Overall, Questrade is an outstanding choice for Canadian investors and traders alike and rightfully the leading independent online broker in the country. Questrade applied for a banking license in December 2019, suggesting it seeks to expand across the financial spectrum. Yes, Questrade is a legitimate Canadian online broker, regulated by the IIROC, and in operation since 1999, with more than 100,000 new account openings annually. The cost structure and asset selection are exceptional, making Questrade an ideal choice for all types of traders. Those seeking in-depth educational material will be disappointed, but there are countless resources available online and free of charge. While it depends on personal preferences, Questrade maintains an overall superior product and services portfolio. Questrade offers the infrastructure to earn money from investing and trading activities. It features active and passive portfolios and its Robo-Advisory division. The rest is up to the individual investor or trader. It is not possible to avoid trading fees, but Questrade offers means to lower the overall cost structure by being an active trader and via the My Family incentive.FAQs

Is Questrade legitimate?

Is Questrade good for beginners?

Is Wealthsimple better than Questrade?

Can you make money on Questrade?

How do I avoid Questrade fees?