NordFX Editor’s Verdict

NordFX operates out of Vanuatu as a market maker. It presents clients with commission-based raw spreads from 0.0 pips, maximum leverage up to 1:1000, and its proprietary copy trading platform. It also maintains PAMM accounts and a crypto-based account where it labels staking as savings, paying up to 30% annualized. I reviewed NordFX to determine if their low spreads and fast order execution deserve the awards they received. Should you consider managing a portfolio at NordFX?

Overview

An ECN Broker Focused on Asset Management and High Leverage

Headquarters | Vanuatu |

|---|---|

Regulators | VFSC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2008 |

Minimum Deposit | $10 |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.9 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.24 |

Average Trading Cost Bitcoin | $328 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I appreciate that NordFX created its proprietary copy trading platform, maintains traditional PAMM accounts, and manages five investment funds. It also provides in-depth analytics and has a trading signal service, a solid affiliate program, and 24/5 customer support. Scalpers will benefit from tight spreads and fast order execution, and beginner traders have access to an educational section.

NordFX Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | 0.0035% one side, 0.007% both sides |

Commission for CFDs/DMA | 0.10% - 0.20% |

Commission Rebates | No |

Minimum Deposit | $10 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | Yes |

Inactivity Fee | $20 annually after twelve months |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 9 |

Regulation and Security

NordFX has 15+ years of experience, and I consider it a trustworthy and secure broker. As a precautionary step, I would like a third-party insurance policy covering client deposits or membership with the Hong Kong-based Financial Commission.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Vanuatu | Financial Services Commission | Company Number 15008 |

I like the overall regulatory environment of the Vanuatu Financial Services Commission. IN addition, NordFX has 13+ years of experience, and I consider it a trustworthy and secure broker. As an extra precautionary step, I would like to see a third-party insurance policy covering client deposits or membership with the Hong Kong-based Financial Commission.

NordFX Regulator

Fees

Average Trading Cost EUR/USD | 1.2 pips |

|---|---|

Average Trading Cost GBP/USD | 1.9 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.24 |

Average Trading Cost Bitcoin | $328 |

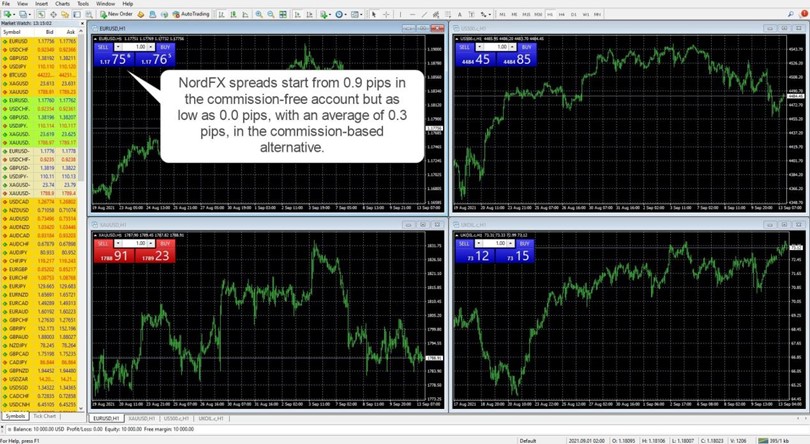

Traders may choose between a more expensive commission-free Forex account or a competitively priced commission-based alternative. The former starts with spreads from 0.9 pips or $9.00 per 1.0 standard lot. The latter shows a minimum of 0.0 pips for a commission of $7.00, but the average mark-up is 0.3 pips, increasing costs to $10.00 per lot. Index CFDs show a fee of 0.05% per round trip versus 0.20% for equity CFDs, matching industry standards.

Here is the minimum spread for the EUR/USD and the trading costs per 1.0 standard in both.

Minimum Forex | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.9 pips | $0.00 | $9.00 |

0.0 pips (minimum) | $7.00 | $7.00 |

0.3 pips (average) | $7.00 | $10.00 |

Here is a screenshot of the NordFX MT4 trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

NordFX MT4 Trading Platform

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. NordFX offers a positive swap on EUR/USD short positions, meaning traders get paid money.

All information about the trading conditions is found clearly on the company's website, and trading times are listed clearly within the MT4 platform.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based NordFX account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the tightest/AVG spread and holding it for one night will cost the following:

Minimum/AVG Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips 0.3 pips | $7.00 $7.00 | -$8.00 -$8.00 | X X | $15.00 $18.00 |

0.0 pips 0.3 pips | $7.00 $7.00 | X X | $3.80 $3.80 | $3.20 $6.20 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the tightest/AVG spread and holding it for seven nights will cost the following:

Minimum/AVG Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips 0.3 pips | $7.00 $7.00 | -$56.00 -$56.00 | X X | $63.00 $66.00 |

0.0 pips 0.3 pips | $7.00 $7.00 | X X | $26.60 $26.60 | -$19.60 -$16.60 |

I like that NordFX pays traders positive swap rates where applicable, as it confirms a manipulation-free trading environment.

A $20 annual inactivity fee applies after twelve months of dormancy. I find it acceptable, and active traders will never face this cost.

What Can I Trade

NordFX maintains 33 currency pairs, 13 cryptocurrency pairs, 5 commodities, 4 index CFDs, 23 equity CFDs, and 5 investment funds. NordFX is ideal for scalpers who require the most liquid assets with tight spreads. High-frequency traders can also benefit from the trading environment at NordFX as long as they deploy a focused trading strategy.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

NordFX Leverage

NordFX offers maximum leverage up to 1:1000, and negative balance protection is available, which I find paramount to leveraged trading. It grants traders flexibility and can increase profitability if used in conjunction with rigorous risk management.

NordFX Trading Hours (GMT+2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 00:00 | Friday 23:00 |

European CFDs | Monday 09:00 | Friday 17:30 |

US CFDs | Monday 15:30 | Friday 22:00 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

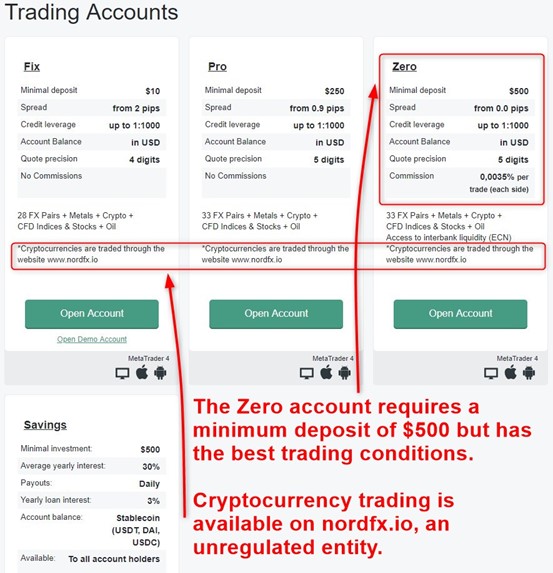

NordFX offers two commission-free trading accounts, Fix and Pro, one commission-based alternative, Zero, and a DeFi Savings account. With Fix, the spreads are higher, starting from 2.0 pips or $20 per lot. However, it only requires a $10 minimum deposit. For $250, traders get access to Pro, but I strongly recommend Zero, which requires $500.

The DeFi Savings provides traders with an average yearly interest of 30% and loans available for trading at 3%.

NordFX Account Types

NordFX Demo Account

An MT4 demo account is available at NordFX, which does not list a time limit. It is ideal for testing trading strategies and algorithmic trading solutions/EAs. The flexibility of the MT4 demo account option can create trading conditions as close as possible to live accounts, but no demo can substitute the experience and emotions of live trading.

Trading Platforms

NordFX provides traders with the out-of-the-box MT4 trading platform plus the MT4 Multi Terminal for PAMM accounts. MT4 is available as a desktop client, where it remains the leader for algorithmic trading. It also has an integrated copy trading platform. It would be nice if NordFX offered traders much-needed plugins to set it farther apart from competitors.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

What I like most about NordFX is the copy trading platform NordFX developed. It is simple, user-friendly, and NordFX provides all the necessary information to make informed investments.

Complementing copy trading is the PAMM service available at NordFX, catering to traditional retail account management under the NordFX umbrella. Completing the asset management focus at NordFX are five investment funds this broker manages. The minimum deposit requirements range between $500 and $2,000 with an investment timeframe from three months to one year.

NordFX also supports algorithmic traders with VPS hosting provided by Fozzy, but it costs $13.95 monthly. I would like to see a free offer for high-frequency traders.

NordFX Copy Trading

NordFX PAMM Accounts

Research and Education

Traders get quality weekly market reviews from NordFX, which I find informative and well-presented, but it would be better to get it daily. Other than that, NordFX does not provide research, as it focuses on asset management via PAMM, internally managed investment funds, copy trading, and the signal service embedded in MT4, which is perfectly fine.

The Learning Center at NordFX features dozens of ultra-short videos from third-party providers. I find them enough to touch the topics beginner traders should research. NordFX also features over a dozen articles, where new traders get quality written content.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |           |

NordFX provides multilingual 24/5 customer support, best reached via live chat. Clients may also fill out the web form, send an e-mail, or call one of the eight provided phone numbers. I doubt most will require assistance, as NordFX explains its products and services well but ensures customer support remains swiftly accessible.

NordFX Customer Support

Bonuses and Promotions

At the time of this review, NordFX hosted a $100,000 lottery for new and existing clients who have a Pro account. Traders may withdraw the winnings without restrictions, but I recommend reading the terms and conditions, which I find acceptable. Please note that this promotion only applies to Pro accounts, where trading costs are higher.

NordFX Lottery Promotion

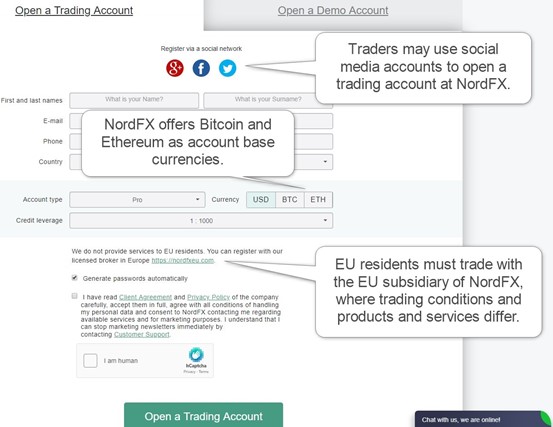

Opening an Account

Opening a trading account at NordFX only takes a few moments, as the process remains hassle-free and without unnecessary steps or questionnaires. New traders must provide their name, e-mail, phone number, and country. They must also select the desired account type and leverage, plus the account base currency. Traders may use their Google, Facebook, or Twitter accounts to complete this step.

Account verification remains a mandatory final step, and most traders will pass it after sending a copy of their ID and one proof of residency document. I like the overall simplicity NordFX deploys.

NordFX Account Registration

Minimum Deposit

The minimum deposit for the NordFX Fix Account is $10 or a currency equivalent. Pro requires $250 and Zero $500. The conditions to open the Zero account remain high, but I believe the trading conditions are worth the deposit. The DeFi Savings account is also available for $500.

Payment Methods

NordFX offers bank wires, credit/debit cards, WebMoney, Skrill, Neteller, Perfect Money, Ngan Luong, PayToday, and Dragonpay. All traders will find a suitable payment method, but I am missing cryptocurrencies, especially since NordFX grants USDT, DAI, BUSD, and other Stablecoins as account base currencies.

Accepted Countries

NordFX caters to most international traders, including resident of the UK, South Africa, Malaysia, and India. NordFX doesn’t offer services to residents of the following jurisdictions: the US, Canada, EU, Russia, Cuba, Sudan, and Syria.

Deposits and Withdrawals

NordFX does not charge deposit and withdrawal fees, but third-party payment processor costs apply. The Trader’s Office, the secure back office of NordFX, handles all requests. Traders must withdraw the initial deposit to the same method used to deposit but may use any payment method for processing profit withdrawals. I like the flexibility NordFX grants clients to manage their funds and appreciate the lack of forced bank wires for profit withdrawals.

NordFX Withdrawals

NordFX Withdrawals

Summary

I like the trading environment at NordFX for scalpers and high-frequency traders requiring few assets. The trading costs and execution speed remain competitive. I also appreciate NordFX for focusing on asset management, where it manages five internal funds, offers traditional PAMM accounts, and deploys its proprietary copy trading platform. The hassle-free withdrawals are another essential benefit, making NordFX a premium broker for committed traders.

NordFX is a steadfast broker, home to over 1,700,000 accounts from over 190 countries. This broker is regulated and grants four trading accounts. The Zero Account is the only one with a competitive structure, where traders will enjoy high leverage of 1:1000, plus tight spreads and competitive commissions.

The research provided by NordFX is light, but the educational section is solid. Asset selection is overall limited but should be sufficient for retail traders. Regrettably, only the core MT4 trading platform is available. NordFX manages five investment funds and supports PAMM accounts. VPS hosting is available via Fozzy at a reduced cost.

There is plenty of untapped potential at NordFX, but the existing foundation is solid. Adding third-party plugins for the MT4 trading platform will go a long way and boosting the overall appeal of this brokerage. A broader asset selection will be appreciated, complementing the great trading conditions in the Zero Account. This broker deserves consideration as a part of a well-diversified approach to trading. This broker continually adds services, and the innovative nature of NordFX is one of its prime attributes. NordFX has 13+ years of experience and a regulatory license from the VFSC with a clean track record. Therefore, NordFX is a reliable broker. NordFX operates an Indian subsidiary regulated by SEBI under registration number INZ010009835. The headquarters of NordFX is in Port Villa, Vanuatu. The secure back office of NordFX handles all withdrawal requests. Traders must first transfer funds from their MT4 terminal to the back office via “Deposit / withdraw funds from the MT4 balance,” and then to their preferred payment processor. The minimum deposit for Fix is $10, for Pro $250, and for Zero $500. The NordFX account types are Fix, Pro, Zero, and Savings. No, NordFX does not offer a no-deposit bonus. Forex traders get the highest leverage at NordFX at 1:1000. NordFX is a market maker / ECN hybrid. The NordFX headquarters is in Vanuatu.FAQs

Is NordFX reliable?

Is NordFX regulated by SEBI?

Where is NordFX located?

How do I withdraw money from NordFX?

What is the minimum deposit for NordFX?

What are the different NordFX accounts?

Does NordFX have a no-deposit bonus?

What is the maximum leverage at NordFX?

Is NordFX a market maker?

Where is NordFX headquartered?