FXGiants Editor’s Verdict

FXGiants offers traders the MT4 platform alongside a proprietary mobile app and copy trading service. One of its six account types includes a competitive cost structure, and this broker relies on bonuses as a marketing tool. I conducted an in-depth review of this broker to determine if traders should consider an FXGiants trading account. Should you trust FXGiants with your portfolio?

Overview

A proprietary mobile app and copy trading service alongside MT4.

United Kingdom FCA 2015 ECN/STP, Market Maker Undisclosed MetaTrader 4 69.00% 0.0 pips 1.0 pips $7.50 7

I like that FXGiants offers a proprietary copy trading service, picking a niche to grow their business. However, the unqualified customer support is unfortunate. Traders get six account types, but only one has competitive fees, and FXGiants needs to list minimum deposits. Customer support responded to my request by asking me to open a live account, after which a personal account manager would assist with questions. From the beginning, my experience with FXGiants was unacceptable.

FXGiants Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. FXGiants presents clients with one regulated entity, but only for UK-based traders.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

UK | Financial Conduct Authority | 585561 |

Is FXGiants Legit and Safe?

FXGiants was founded in 2015 with subsidiaries in the UK and Australia, but the Australian unit no longer operates. While UK-based traders get an FCA-licensed broker, international traders will deal with an unregulated but duly registered subsidiary in Bermuda. FXGiants offers negative balance protection, but while the UK subsidiary operates by the book to maintain its license, the Bermuda unit engages in questionable behaviour.

Fees

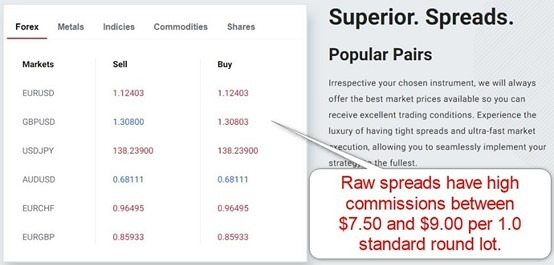

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. FXGiants lists six account types, but only the STP/ECN Absolute Zero provides traders with competitive trading fees, consisting of commission-free minimum spreads of 0.2 pips or $2.00 per 1.0 standard round lot.

The remaining accounts feature average trading fees between $7.90 and $17.40 per lot. FXGiants has two commission-based options, but commissions are either $7.50 or $9.00 per lot, plus spreads, resulting in unacceptably high costs. Swap rates impact trading strategies significantly, making FXGiants suitable for short-term traders and those with trading strategies that benefit from positive swap rates.

Minimum Raw Spreads | 0.0 pips |

|---|---|

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.50 |

Deposit Fee | |

Withdrawal Fee |

Here is a snapshot of FXGiants trading fees:

The average trading costs for the EUR/USD at FXGiants are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.74 pips (Live Floating Spread) | $0.00 | $17.40 |

1.90 pips (Live Fixed Spread) | $0.00 | $19.00 |

0.00pips (Live Zero Fixed Spread) | $9.00 | $9.00 |

1.74 pips (STP/ECN No Commission | $0.00 | $17.40 |

0.04 pips (STP/ECN Zero Spread) | $7.50 | $7.90 |

0.24 pips (STP/ECN Absolute Zero) | $0.00 | $2.40 |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free STP/ECN Absolute Zero account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.24 pips | $0.00 | -$11.75 | X | $14.15 |

0.24 pips | $0.00 | X | $2.01 | $0.39 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.24 pips | $0.00 | -$82.25 | X | $84.65 |

0.24 pips | $0.00 | X | $14.07 | -$11.67 |

Noteworthy:

- FXGiants offers positive swap rates in qualifying assets, meaning traders can get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

Range of Assets

Forex traders at FXGiants get 78 currency pairs plus 40+ futures contracts, a competitive selection, including minors and exotics. Commodity traders get 100+ assets, consisting of CFDs and futures contracts. This makes it an excellent broker for traders diversifying their Forex portfolios with commodities. The same extends to index traders, as FXGiants lists 100+ trading instruments in this sector.

Equity traders get dozens of blue-chip stocks listed in the US, the UK, Spain, Hong Kong, Germany, France, and the Czech Republic. The bulk are US and UK names, but they suffice for beginners to gain exposure and for traders requiring few but highly liquid assets. The absence of cryptocurrency CFDs is notable, especially since FXGiants allows cryptocurrency deposits.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Bonds | |

ETFs |

FXGiants Leverage

The maximum Forex leverage at FXGiants is 1:1000 in the Live Floating and Live Fixed Spread accounts, 1:500 in the Live Zero Fixed Spread option, and 1:200 in the ECN/STP alternatives. FXGiants does not disclose leverage details by sector and only lists its maximum, which applies to Forex.

Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

FXGiants Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 00:00 | Friday 24:00 |

European Equities | Monday 09:00 | Friday 17:30 |

US Equities | Monday 15:30 | Friday 22:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5.

Account Types

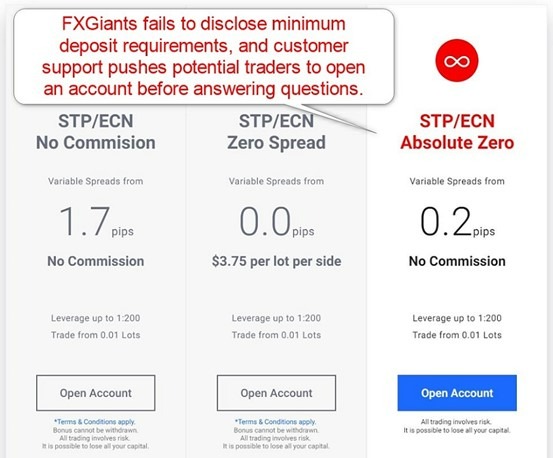

FXGiants lists 6 account types but does not provide minimum deposit details. After contacting customer support, the representative repeatedly asked me to open an account and discuss it with the personal account manager. The representative further advised that if I did not like the minimum deposit requirement, I could open other trading accounts from the back office. I find this approach unacceptable, and it confirms countless scam allegations where victims report the same push to open accounts and, in some cases, fund them before receiving assistance.

Since only the STP/ECN Absolute Zero account presents traders with competitive trading fees, I pressed the representative, who stated the absence of a minimum deposit requirement. I found it odd, as it renders the other five account types pointless, and it contradicts the previous suggestion to open different accounts if I disagreed with the minimum deposit requirement. Therefore, I cannot conclude if and what the minimum deposit requirement for the STP/ECN Absolute Zero account is, but I advise against the other account types due to high trading fees. I suspect that the personal account manager comes up with a minimum based on the geographic location of traders and perceived income and deposit capabilities, which is a significant red flag.

The maximum leverage is 1:200 in the ECN account, and FXGiants does not detail account base currencies or currency conversion costs. It accepts EUR, USD, GBP, CZK, PLN, JPY, CHF, CNY, and BTC deposits via bank wires. The account registration page lists them, except for CNY and BTC, plus the NGN, IRX, and XBT, as account base currencies.

FXGiants Demo Account

The FXGiants demo account features a complete account registration. FXGiants collects contact details for cold calls to press traders to open and fund live trading accounts. No details exist concerning the demo account balance or expiry, but FXGiants states that traders can open multiple demo accounts. Only the Live Floating Spread and the STP/ECN Absolute Zero are eligible, which is fine, as the latter is the only account type traders should consider. Demo account base currencies are USD, EUR, GBP, and JPY.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations.

Trading Platforms

FXGiants offers the MT4 trading platform. It is available as a customizable desktop client, a lightweight web-based alternative, and a user-friendly mobile app. MT4 fully embraces algorithmic trading and remains the industry leader with 25,000+ custom indicators, plugins, and EAs available for MT4. However, the quality upgrades are not free. It also has an embedded copy trading service.

FXGiants upgrades MT4 via MT4 Advanced, featuring advanced trading and analytical tools. It also developed a proprietary mobile app, a user-friendly option for traders using the in-house copy trading service.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

FXGiants maintains its in-house copy trading service AutoTrade, which requires traders with live accounts to contact FXGiants to inform them of their intent to use it. Algorithmic traders get free VPS hosting if they deposit and maintain a $5,000 account equity. Otherwise, they must pay for the service.

The Personal Multi-Account Manager (PMAM) caters to traditional account management services. FXGiants offers a currency conversion tool and three calculators which traders may find beneficial. I like the four tools but prefer them as MT4 plugins.

Research & Education

FXGiants neither publishes in-house research nor offers third-party content. Since it has its proprietary copy trading service and counts on the community for research, plus the availability of free and paid-for research, market commentary, and analytics, I do not consider its absence a factor against FXGiants. It does create a services gap compared to its established competitors.

FXGiants does not feature a dedicated educational section, but it publishes content on its blog with educational value for beginners. I prefer a more structured and thought-through approach. Still, I commend FXGiants for including topics covering trading psychology and leverage in a well-written format.

I advise beginner traders to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |         |

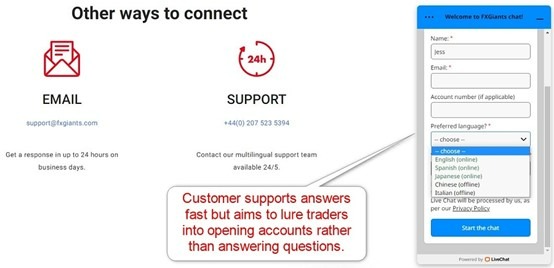

FXGiants offers 24/5 customer support, best reached via live chat in English, Spanish, Japanese, Chinese, and Italian. The FAQ section did not answer my questions, and live support was unwilling to assist. They excused themselves by stating the company grants them limited access to information and pushed me to open a live trading account to get answers from a personal account manager. This added to the red flags I encountered during my review, as it follows the pattern of fraudulent brokers, which made sense following the scam/fraud claims over the past three months. The live chat function is also very intrusive, with constant reminders of its availability.

I appreciate the availability of phone support, which lists a UK number for the Bermuda subsidiary. I need a direct phone line to the finance department, where most issues can arise.

Bonuses and Promotions

Besides three deposit bonuses, FXGiants offers traders two no deposit bonuses, $10 for e-mail verification and $15 for phone verification. Terms and conditions apply, but I advise against the phone verification offer, which FXGiants uses for cold calls, reported by many former clients, with an uptick over the past three months.

The FXGiants Booster bonus claims to cover some losses, making it a unique but questionable offer. The maximum bonus is $4,000. It extends to the FXGiants Maximiser, a 100% deposit bonus without listed maximums, where FXGiants claims to cover 50% of trading losses.

While the offers sound excellent on paper, with 69% of traders losing money at FXGiants, as reported by its UK subsidiary, and the number likely higher for the Bermuda unit, covering trading losses for retail traders is an impossible business model that would bankrupt any broker. Therefore, it is another red flag, as it suggests trading in FX Giants accounts remains simulated, and no actual trading occurs.

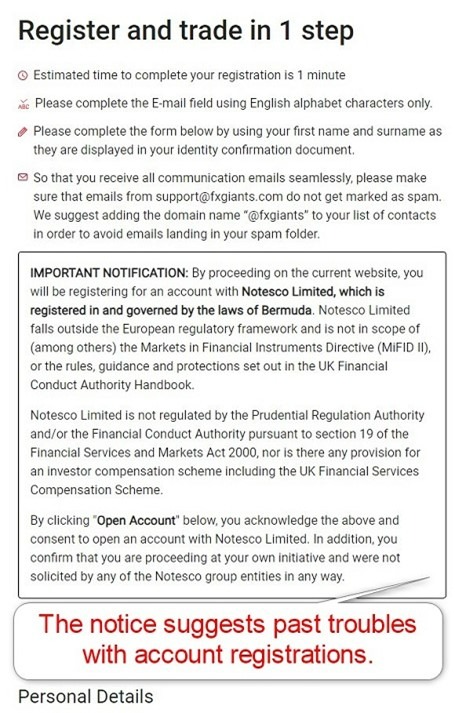

Opening an Account

FXGiants onboards new clients via an online application form, following well-established industry standards. It includes the account setup, which is convenient. The application starts with a disclaimer differentiating its Bermuda and UK subsidiaries. I conclude that FXGiants had issues in the past where traders thought they would deal with a regulated entity, ran into operational problems, and found out they opened an account with an unregulated broker.

I appreciate the openness, but it points to deeper issues, which reflect the scam allegations against it. FXGiants follows a well-known road map of fraudulent brokers.

FXGiants complies with AML/KYC requirements, meaning account verification is mandatory. Most traders will satisfy this by sending a copy of their government-issued ID and one proof of residency document.

Minimum Deposit

FXGiants does not disclose its minimum deposit requirement.

Payment Methods

FXGiants supports bank wires, credit/debit cards, Bitcoin, bitwallet, China UnionPay, Skrill, and Neteller. Geographic restrictions may apply.

Accepted Countries

FXGiants accepts traders resident in many countries but lists the US, Iran, Cuba, Sudan, Syria, and North Korea, as restricted countries.

Deposits and Withdrawals

The secure FXGiants Hub handles all financial transactions for verified clients.

FXGiants does not refer to minimum deposit or withdrawal amounts. Processing times are instant for all payment processors, except for bank wires, which can take two to five business days. FXGiants allows eight deposit currencies and a good choice of payment processors. Traders should consider potential currency conversion fees and third-party payment processor costs. Geographic restrictions may apply, but the FXGiants Hub will only list the ones available to traders.

Is FXGiants a good broker?

FXGiants looks good on paper, but I have encountered too many red flags. I like the trading fees in the STP/ECN Absolute Zero account. Still, the lack of transparency concerning the minimum deposit requirement was only one of many issues. FX Giants pushes traders to open accounts for answers to basic questions. It also follows a well-known road map of fraudulent brokers who operate one well-regulated company and one unregulated one where misconduct reigns.

The bonuses are unsustainable from a business perspective, as FXGiants claims to cover trading losses partially. It suggests a simulated trading environment and potential pyramid scheme, explaining the push for account openings and deposits. It also mirrors the growing scam allegations against FXGiants over the past few months. I recommend traders stay away, and those who proceed must do so cautiously. FXGiants is good on paper but has rising scam allegations and follows a well-known roadmap of fraudulent brokers. Therefore, traders should avoid this broker. FXGiants does not disclose its minimum deposit requirement. Traders can withdraw via bank wires, credit/debit cards, Bitcoin, bitwallet, China UnionPay, Skrill, and Neteller. Yes, FX Giants operates one FCA-regulated subsidiary for UK-based brokers. Still, most traders will deal with the unregulated but duly registered Bermuda unit.FAQs

Is FXGiants a good broker?

What is the minimum deposit for FXGiants?

How do I withdraw money from FXGiants?

Is FXGiants regulated?