I find myself writing this piece again and again every few weeks. I hope I’ll be writing it again a few weeks from now, because if I do, I’ll have made some money being long of major U.S. stock market indices such as the S&P 500. If you don’t understand what the hell I am talking about, then please bear with me for just a little while longer.

The quote “it’s a bull market, you know” comes from the character of Old Turkey mentioned in the Jesse Livermore classic ‘Reminiscences of a Stock Operator”. Old Turkey was an old trader who knew how to sit tight when he had a winning position. In fact, he understood that this was the true key to success in his profession as a stock trader. Livermore says that he himself finally learned from Old Turkey’s repetition of the headline that the way to make real money in a stock market is to refuse to be shaken out of a long position in a bull market (or short position in a bear market), ignoring the inevitable reactions against the trend, which Livermore explains are both natural and healthy.

Over the past few days, the airwaves and internet are again filled with laments that the U.S. bull market is over, Trump has no economic plan, etc. and so therefore the bull market is over and it is time to sell up. One ridiculous story this week even suggests that the European stock market is where the real action is at! All I can say is, just remember that financial journalists are mostly paid to make noise and incite the credulous, not to be right. Good traders that want to ride big waves learn to close their ears to this kind of noise and pay attention to what really matters.

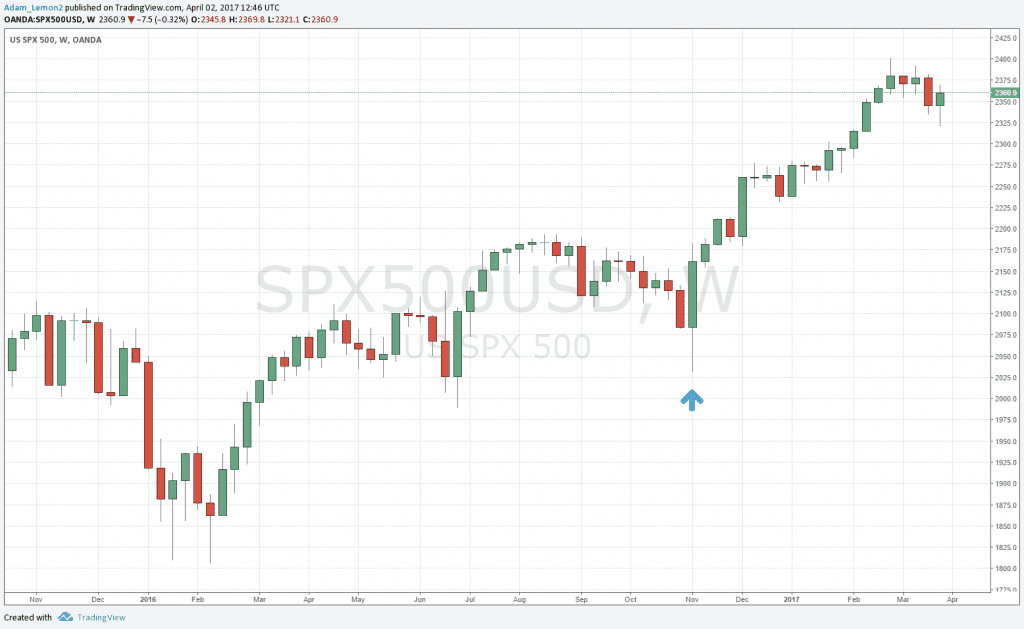

Talking of what really matters, the chart below is a weekly chart of the S&P 500 Index, with the up arrow placed at the time of Trump’s election victory. Does this look like a bull market that is clearly over? Or does it look like a strong bull market that has every chance of continuing upwards to new all-time highs, which begin at the high price of just a few weeks back?