Short Trade Idea

Enter your short position between $410.00 (an intermediate horizontal support level) and $427.97 (Monday's intra-day high).

Market Index Analysis

- Celestica (TSE:CLS) trades on the TSE (the Toronto Stock Exchange in Canada).

- The S&P/TSX pushed higher to start 2026 with a 0.5% gain despite downbeat domestic manufacturing data showing an 11th consecutive month of contraction, with trading volumes declining overall as cautious sentiment persists amid trade uncertainty.

- The Bull Bear Power Indicator of the S&P/TSX is bullish but shows a negative divergence, which does not support the uptrend and suggests that buyers are losing conviction as the index tests record highs, a classic setup for near-term profit-taking.

Market Sentiment Analysis

Celestica has been riding the coattails of broad technology sector strength and artificial intelligence euphoria, with recent analyst upgrades from JPMorgan and RBC pushing price targets to $360 and $400 respectively based on Q4 2025 earnings beats and strong revenue guidance. However, this bullish consensus masks deteriorating sentiment: Zacks Research downgraded the stock to Hold in late December 2025, reflecting concerns about valuation extremes and sustainability of margin expansion in the face of rising competition from other EMS players and potential slowdowns in AI-driven capital expenditure cycles. The disconnect between rising analyst targets and the stock's extreme valuation leaves little room for guidance disappointments, particularly given that the broader TSX is contending with ongoing domestic manufacturing weakness and trade-related uncertainties that could weigh on industrial and technology spending.

Celestica Fundamental Analysis

Celestica is a multinational design, manufacturing, hardware platform, and supply chain electronics manufacturing services (EMS) company doing business from its four entities: Atrenne, NCS Global, PCI, and Sturgeon.

So, why am I bearish on CLS despite its platform expansion

Celestica's valuation at a P/E ratio of 49.51—a staggering 2.4x premium to the S&P/TSX composite average—reflects excessive optimism about agentic commerce innovation and AI-driven growth that may not materialize at consensus rates. The stock has already priced in years of uninterrupted margin expansion, yet the EMS industry is inherently margin compressive as customer concentration grows and bargaining power shifts to hyper-scalers and OEMs seeking price concessions to offset their own margin pressures.

Profit margins, while currently respectable at 6.35% net margin (latest quarter), show signs of peaking as competitive intensity rises and AI capex growth moderates from frenzied mid-2025 levels. The debt-to-asset ratio has been worsening year-over-year as Celestica has been increasingly leveraging its balance sheet to fund acquisition strategy and share buybacks, a dangerous combination when cyclical downturns hit the electronics manufacturing space. At current valuations, the stock offers absolutely no upside potential, with downside risks accelerating if management guidance disappoints or if AI spending cycles moderate sooner than the Street expects.

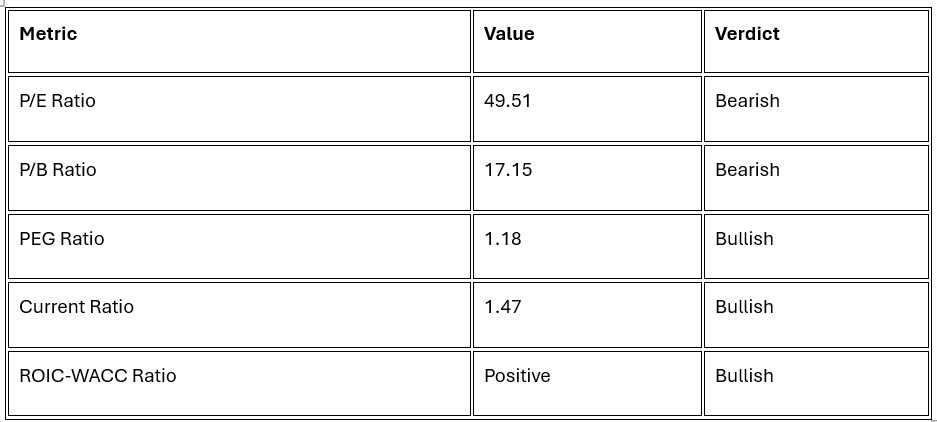

Celestica Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 49.51 makes CLS.TO an expensive stock. By comparison, the P/E ratio for the S&P/TSX is 20.48.

The average analyst price target for CLS is $372.36. This suggests no upside potential, just accelerating downside risks, given the stock's stretched technical setup and deteriorating relative strength versus the broader index.

Celestica Technical Analysis

Today's TSE:CLS Signal

The Celestica D1 price chart below shows price action failing to hold above the $425.00–$428.00 resistance zone despite multiple retest attempts, with sellers stepping in aggressively to cap rallies. This suggests that the bulk of the AI enthusiasm has been priced in and conviction is fading.

Celestica trades well above its 50-day and 20-day moving averages, but the Stochastic Oscillator on the daily chart has recently rolled into overbought territory (>80), a classic warning signal that often precedes sharp reversals in highly leveraged, momentum-driven trades like this one.

The Bull Bear Power Indicator on the Celestica daily price chart has turned neutral from bullish, with the indicator failing to confirm price strength above $425.00, a bearish divergence that suggests institutional buying momentum is waning and distribution may be beginning.

Average trading volumes on recent pushes toward the $427.97 intra-day high are below the 20-day moving average, a red flag that suggests the stock is running out of fuel and near-term pullbacks are likely to accelerate as early buyers take profits.

Celestica has begun to underperform the broader S&P/TSX and the technology sub-sector on a relative strength basis, a technical signal that undermines the bullish narrative embedded in analyst price-target increases. This suggests the stock is vulnerable to sharper pullbacks.

Celestica Price Chart

My CLS Short Stock Levels and R/R H2

CLS.TO Entry Level: Between $410.00 and $427.97

CLS.TO Take Profit: Between $295.00 and $315.41

CLS.TO Stop Loss: Between $451.00 and $464.94

Risk/Reward Ratio: 2.81

Ready to trade our analysis of Celestica? Here is our list of the best stock brokers worth checking out.