Long Trade Idea

Enter your long position between $151.86 (yesterday’s intra-day low) and $156.11 (yesterday’s intra-day high).

Market Index Analysis

- Molina Healthcare (MOH) is a member of the S&P 500.

- This index trades in a bearish chart pattern with rising bearish trading volumes.

- The Bull Bear Power Indicator of the S&P 500 is bullish with a negative divergence and does not support the recent uptrend.

Market Sentiment Analysis

Equity markets closed lower yesterday after a positive start. Equity futures remain mixed this morning as NVIDIA moved higher in after-hours trading after President Trump approved the company’s sale of its H200 AI chips to approved customers in China, in return for 25% of the sales value. Investors may exercise caution today ahead of tomorrow’s FOMC announcement, where a 25-basis-point interest rate cut remains priced in, but the outlook could still inject volatility. AI and retail earnings could move price action, with earnings from Oracle, Broadcom, Costco, and Lululemon on deck.

Molina Healthcare Fundamental Analysis

Molina Healthcare is a managed care company. It focuses on health insurance coverage for lower-income households through government programs, Medicaid, and Medicare.

So, why am I bullish on MOH following a huge earning miss?

Molina Healthcare provided a shocking miss on its latest earnings report, with EPS of $1.84 versus expectations of $3.90, driven by turmoil in Medicare and the Marketplace. Its share price cratered, creating an excellent buying opportunity. Famed investor Michael Burry calls MOH his bullish counterinvestment to his short position in Palantir. I remain bullish on its high retention rate in its top plans, low valuations, and double-digit revenue growth rate.

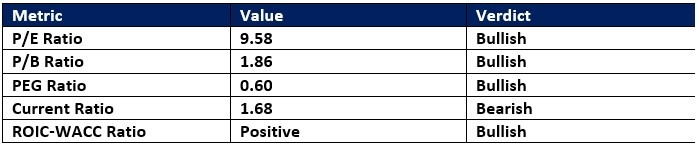

Molina Healthcare Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 9.58 makes MOH an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.21.

The average analyst price target for MOH is $178.81. This suggests good upside potential with manageable downside risk.

Molina Healthcare Technical Analysis

Today’s MOH Signal

Molina Healthcare Price Chart

- The MOH D1 chart shows price action inside a bullish price channel.

- It also shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes over the past nine trading sessions.

- MOH moved higher with the S&P 500, a bullish confirmation.

My Call on Molina Healthcare

Top Forex Brokers

I am taking a short position in MOH between $151.86 and $156.11. The massive revenue base of nearly $45 billion, high retention rate in its top plans, and defensive capabilities drive my bullish narrative.

- MOH Entry Level: Between $151.86 and $156.11

- MOH Take Profit: Between $192.85 and $206.89

- MOH Stop Loss: Between $133.40 and $142.28

- Risk/Reward Ratio: 2.22

Ready to trade our analysis of Molina Healthcare? Here is our list of the best stock brokers worth reviewing.