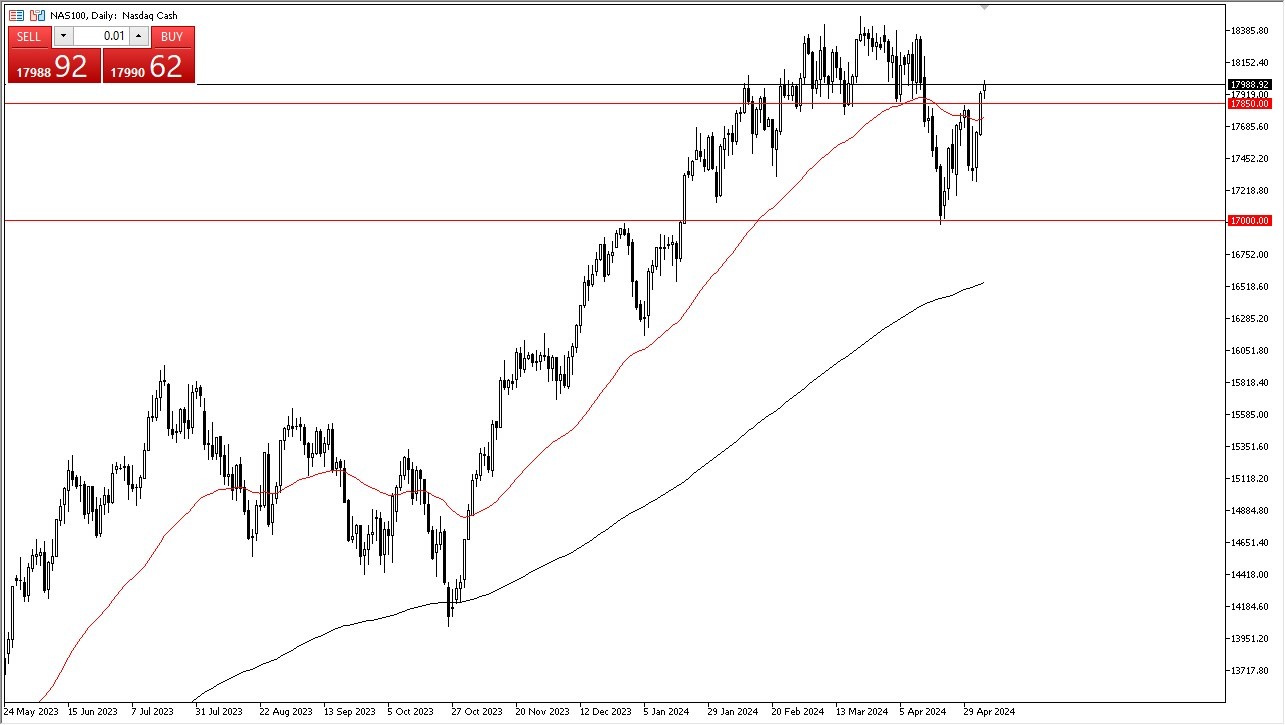

- The Nasdaq 100 rallied a bit during the trading session on Monday, after initially pulling back the 17,850 level continues to be important as it showed itself to be support on that short term pullback.

- Nonetheless, this is a market that I think does continue to go higher and eventually goes looking to reach the 18,385 level.

- The market has been bullish for some time, and the fact that we have recovered so aggressively over the last couple of trading days certainly bodes well for the index.

Keep in mind that the 50 day EMA sits just below the 17,850 level as well. So that's another reason to think that there are buyers just waiting to get involved in this environment. I just don't have any interest whatsoever in trying to short this market because quite frankly, there's just too much momentum. We will have to pay close attention to interest rates in the United States because quite frankly, if they start to rally, that might cause major issues for the Nasdaq 100 and some of the major technology companies.

We are in the midst of earnings season, so that could bring in a little bit of volatility. But I think at this point in time, it's obvious that the Nasdaq 100 index wants to do everything it can to go higher. The short term pullbacks, I think, continue to be buying opportunities. The 17,000 level underneath is probably a major floor in the market, as it was the most recent swing low. This is more than likely not to be a concern, but it is a possibility if we get a sudden surge of fear in the markets overall.

The Other Scenario

If we break down below there then the 200 day EMA comes into the picture. But really at this point in time, I just don't see an argument for shorting the market. And every time we pull back, I would have to assume that there will be buyers getting involved trying to take advantage of the Nasdaq 100 itself.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.