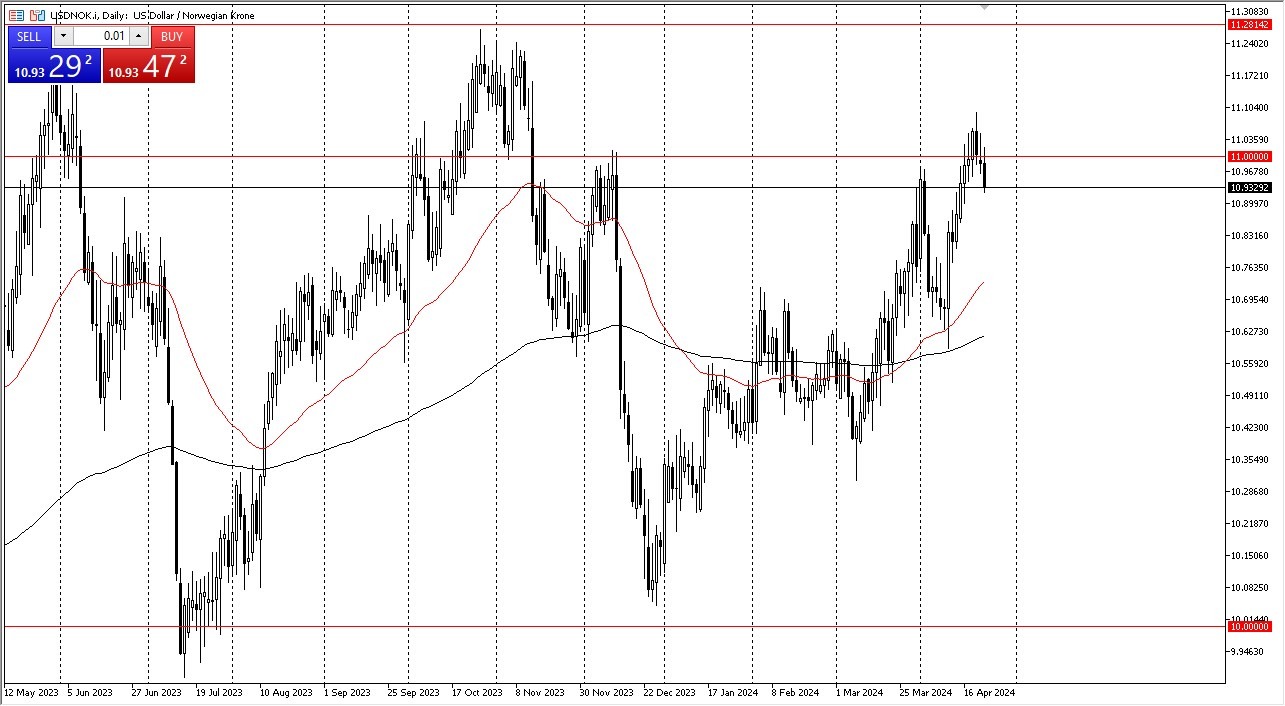

- The US dollar has pulled back a bit against the Norwegian krone during the early hours on Tuesday, as we continue to see the 11 NOK level offer a bit of a barrier.

- All things being equal, this is a market that given enough time will more likely than not try to take that level out, but the pullback was needed, as the market is likely to see a lot of volatility near this historically important level.

With this being the case, the market pulling back could open up the possibility of a move down to the 10.75 NOK level, where the 50-Day EMA comes into the picture and offers a bit of technical support. Any type of bounce in that general vicinity could turn around and send the market much higher. In general, that could send the market toward the 11 NOK level. If we can break above the 11 NOK level, then the market is likely to test the 11.10 NOK level, before allowing a move to the 11.28 NOK level.

Norwegian krone

Keep in mind that there is a reasonable amount of interest being paid out of Norway, with the Norges Bank offering 4.5%, unlike many of the other contemporaries around the world so unlike a lot of the US dollar pairs, it’s not necessarily going to be a major interest rate differential. Quite frankly, it’s probably going to have more to do with geopolitical tensions, as the US dollar course is considered to be a major safety currency, so as long as we have a lot of chaos in the world, there is going to be a certain amount of demand for the greenback.

Keep in mind that the interest rate differential is slightly positive for America, but at the end of the day, I think what we have to pay more attention to than anything else is going to be geopolitical tensions in the Middle East. As far as Norway is concerned, it’s almost a bit of an afterthought, unless of course you start talking about oil markets, as Norway is a major exporter of crude oil. At this point, it looks like this will remain a “buy on the dips” type of market.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.