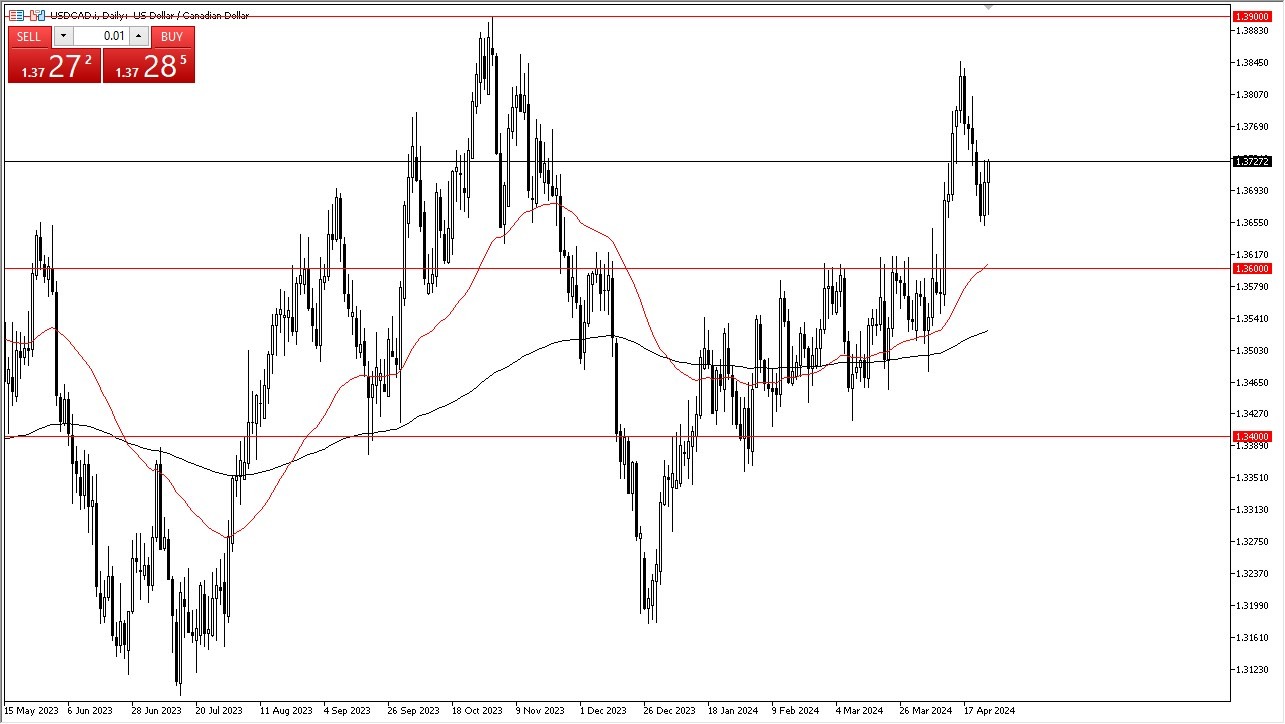

- The US dollar initially fell against the Canadian dollar during the early hours on Thursday, but then turned around to show signs of strength again.

- By doing so, the market looks very likely to continue going higher, as the momentum continues to be a major issue.

- At this point, if we can break above the 1.3750 level, then it’s likely that we will go to the 1.3850 level next. That was where we pulled back from last week.

Any move above there then opens up the possibility of a move to the 1.39 level above, which of course is an area that previously had been major resistance. I do think that it is probably only a matter of time before we break higher, but I also recognize that there is a lot of volatility out there. On the downside is the 1.36 level, which is also backed up by the 50-Day EMA. It’s worth noting that this is an area where we had seen a lot of resistance previously, so I think at this point in time, there is likely to be a situation where traders will look at that as the “floor in the market.”

Buying Dips

The only thing I am interested in doing in this pair is buying on the dip. If we can somehow break above the 1.39 level, obviously becomes much more of a “buy-and-hold” market, but in the meantime, I expect to see a lot of volatility and therefore you need to take advantage of “cheap greenbacks” whenever you get an opportunity to do so.

Keep in mind that crude oil no longer has the influence on this pair that it once did, as the United States is now a major producer of crude oil, and therefore even though crude oil markets can greatly help the Canadian dollar, it may be much more of a subtle difference in this USD/CAD pair. Furthermore, it’s probably worth noting that there are a lot of geopolitical concerns out there, which puts a natural bid into the idea of owning the greenback anyway.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers in Canada for beginners to trade Forex worth using.