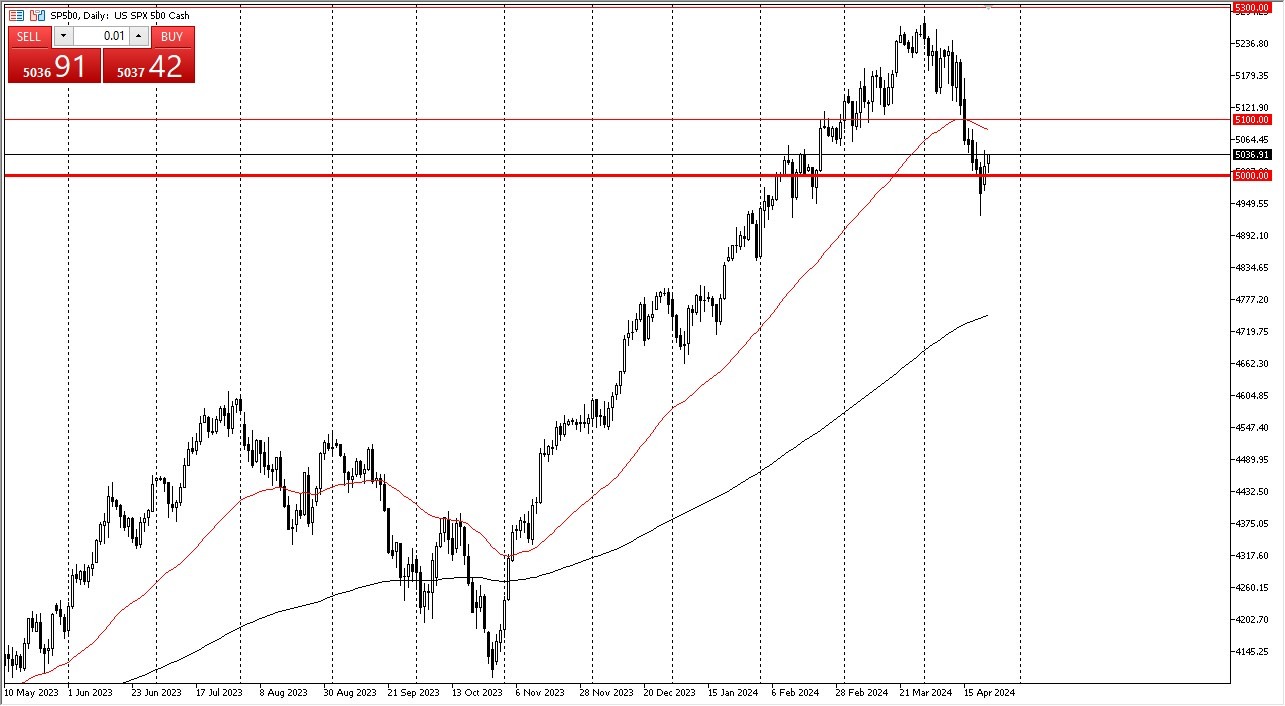

- The S&P 500 initially dipped a bit during the trading session on Tuesday, only to turn around and show signs of strength again.

- Ultimately, this is a market that I think you need to be very cognizant of the fact that the 5000 level is attracting a lot of attention.

- Of course, you have to pay attention to the fact that the 50-day EMA sits near the 5100 level.

- This is an area that I think a lot of traders will be paying close attention to over the next several days, if not weeks, in this market.

In general, I think this is a market that is going to bounce as we are heading into a significant part of the earnings season. Of course, we've had a nice pullback that longer-term traders will be looking at as a potential buying opportunity. If we can clear the 50-100 level, then it's likely that the market could go looking to the 5,250 level.

On the Other Hand…

Alternatively, if we were to break down below the bottom of the candlestick from Friday of last week, that could really send this market lower, perhaps dropping the S&P 500 down to the 200-day EMA. In general, I think this is a market that continues to attract inflows because there isn't anything else for Wall Street to do.

As long as earnings season doesn't have dire outlooks coming out of the CEO of major companies, it's very likely that this market continues to go higher, with perhaps the exception of some type of geopolitical tinderbox lighting off again. As things stand right now though, it looks like we are going to continue the uptrend and go higher. I think as long as we don’t get some kind of major military escalation, it is likely to return to the grinding higher type of environment that we had been in for so long.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.