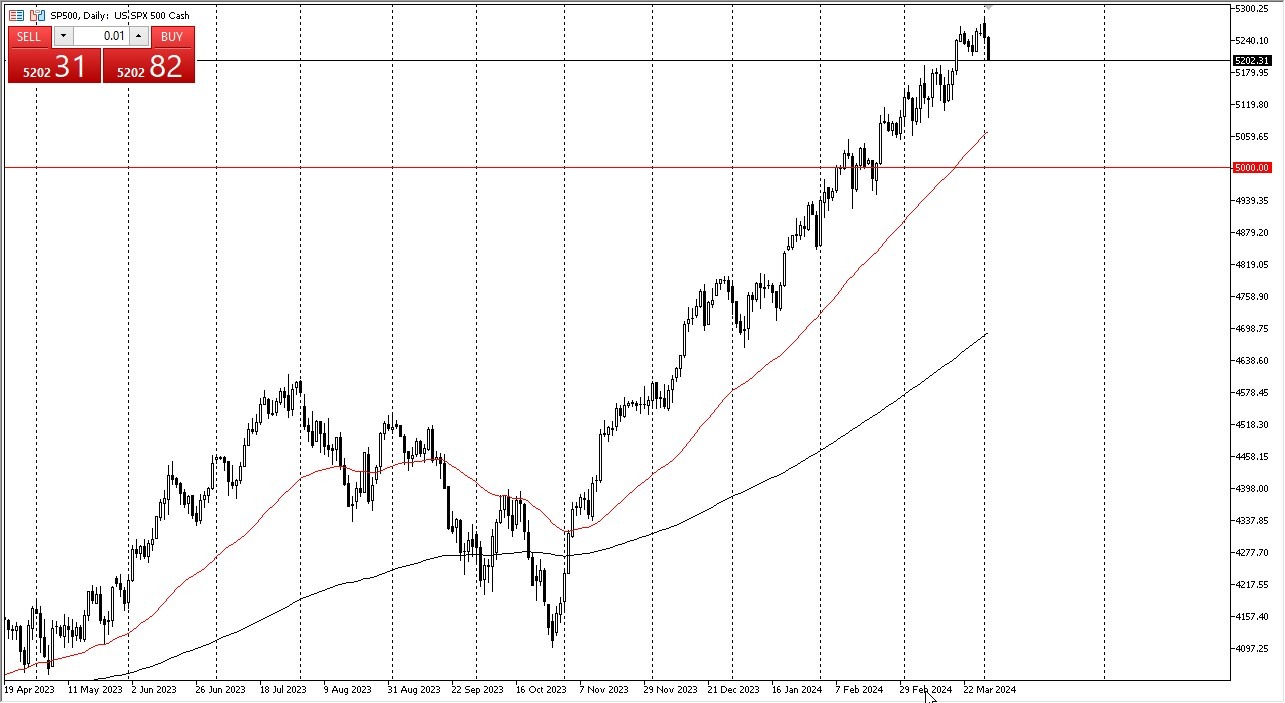

- The S&P 500 has kicked off the day on its back foot as we have fallen towards the 5200 level.

- The 5200 level, of course, is an area that previously had been resistant, so now one would think that there's probably a certain amount of support here.

That being said, I would be a bit cautious about jumping in right away, because some of this selling might just simply be people covering their positions ahead of the employment figures later this week. Furthermore, we also have a strong uptrend, so regardless of the negativity of the candlestick, I have no interest in shorting it, because there's far too many places where buyers may return. It's not only the 5200 level that they may return, but the 5100 level, the 50-day EMA and of course the 5000 level.

A Pullback Coming?

A 10% pullback would be exactly what this market needs, but at this point in time, I don't see it. We would need to see some type of shock on Friday to even get that moving, which of course is possible, but I don't think it's likely. Ultimately, I do think this market turns around and goes looking towards the 5300 level, but it may take some time to get there. If you are cautious, you could dip your toe here, but I wouldn't get overly aggressive, especially considering that Friday of course will be so massively important at this point in time. I remain bullish but I'm basically looking for value in this market as we see so much in the way of momentum in the longer term.

The market has seen a lot of inflows over the last several months, and therefore it makes sense to me that the markets will continue to see inflows. However, it has gotten ahead of itself, and therefore it makes a lot of sense that we will have a certain amount of profit taking in the short term.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.