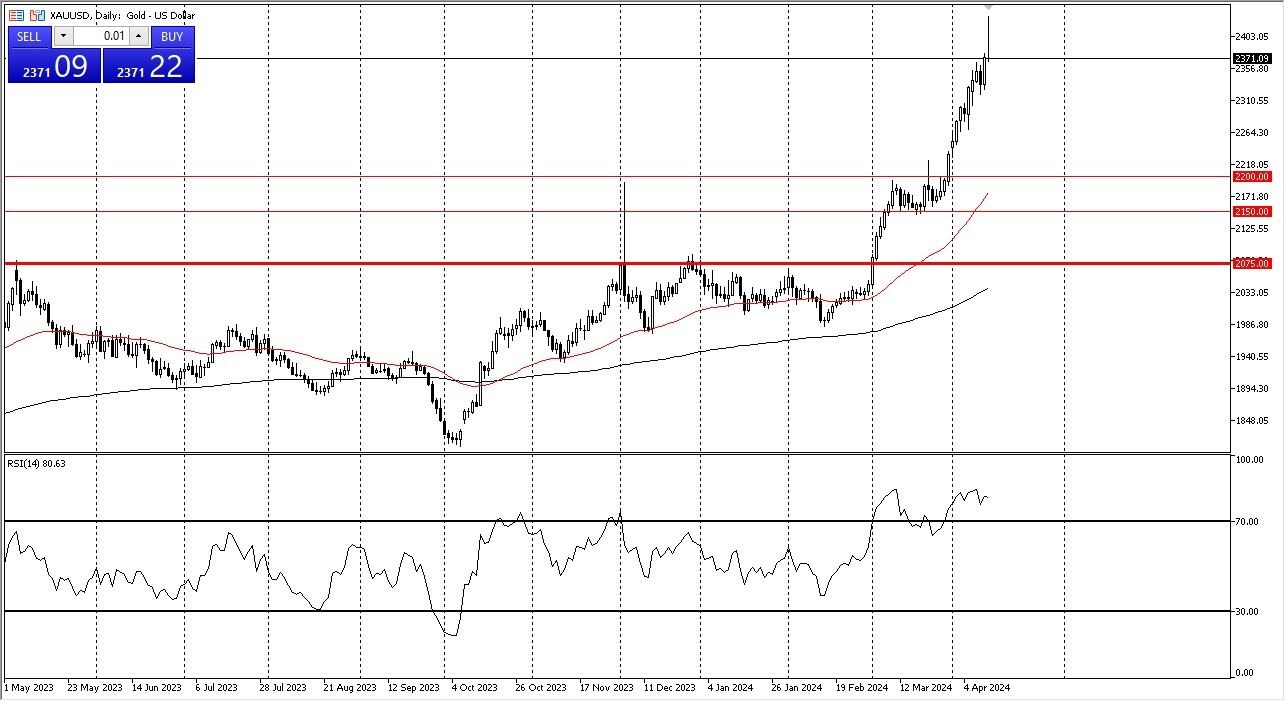

- Gold markets initially shot higher during the trading session on Friday but got absolutely crushed to turn things around and look quite ugly.

- By doing so, I think we are going to see some type of pullback, and quite frankly this is a situation that desperately needs to happen.

- Ultimately, the gold market has gotten far too ahead of itself, and therefore needs to pullback in order to find a bit of value.

There are plenty of places underneath that I think buyers would return to the market, so I’m not necessarily concerned. Given enough time, I think this is a situation where we will eventually have to get back some of the gains, therefore I think a little bit of value could end up showing itself in this market. By forming a massive shooting star, this will attract the attention of a lot of people.

Technical Analysis

It’s worth noting that the shooting star is one of the most widely recognized selling signals, and of course we also have some other things to consider. The Relative Strength Index reading is well above the 70 level as well, so certain traders will be paying attention to that also. While I don’t necessarily think the market is ripe for selling, I do think that it could pullback enough to offer a certain amount of value if you are patient enough. Remember, markets cannot go straight up in the air forever, so it’s not a huge surprise to see that we have turned back around the way we have, because quite frankly I’m surprised it hasn’t happened already.

Various Support Levels

There are various support levels underneath, the first one of course being the $2300 level. If we break down below there then we have the $2200 level, an area that has proven itself to be important in the past as “market memory” should come into the picture as it was significant resistance. The 50-Day EMA’s is just below there as well, so it offers a significant amount of support also.

With all that being said, I think this is a market that you will be a buyer of sooner or later, but hopefully it’s a much lower pricing. The fact that traders were not willing to hang onto it into the weekend also tells me that perhaps things are getting well overdone.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.