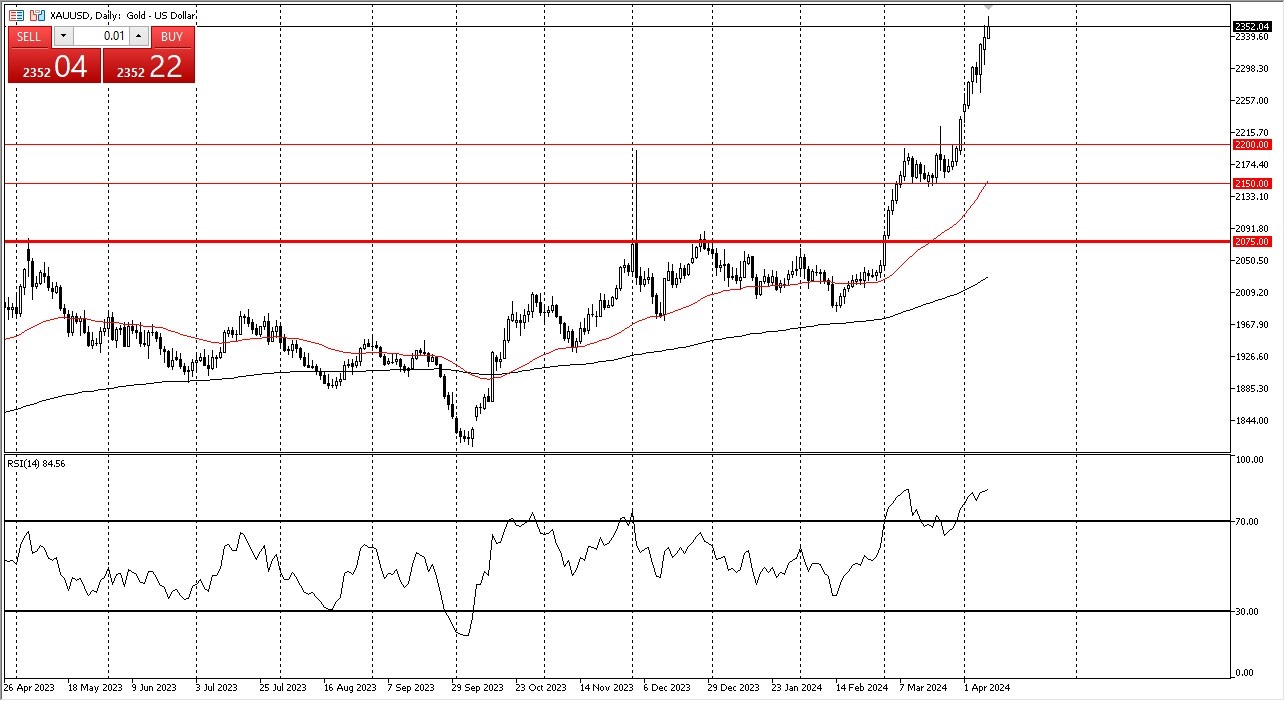

- Gold rallied a bit during the trading session on Tuesday as it looks like we are going to continue to try to take off to the upside.

- Regardless, I think this is a market that is getting a bit stretched and it's probably worth noting that the relative strength index is well above the 70 level again.

The question now is whether or not we are going to pull back significantly or if we are just going to go sideways for a while to work off some of this froth. I certainly would not be shorting this market anytime soon. It is far too strong. And of course, there are plenty of reasons for gold to continue going higher. In fact, you can't necessarily think that just because the RSI is above 70 means that we have to pull back. It's just that it typically does run out of momentum eventually.

My overall attitude…

In general, I do think that the $2,200 level underneath would be an excellent support barrier right along with the 50-day EMA which is at the $2,150 level. To the upside, I think we are going to go looking to the $2,500 level but sooner or later you have to pull back as people will collect profit and of course you need to bring more buyers into the market. Speaking of buyers, it is probably worth noting that the central banks around the world are net buyers of gold in general and that is a bit of a flaw in the market, but we also have to keep in mind that interest rate scenarios favor gold right now and most certainly geopolitical concerns do. So, with all of that being said, I'm just looking for an opportunity to buy cheaper gold on a dip. I have no interest in selling in this market.

Anytime gold drops $50, you have to start paying attention to whether or not there’s going to be a bounce, because there are so many different reasons for this market to go higher and of course we have plenty of momentum that being said, it is a bit of a crowded trade so to be interesting to see how the market behaves on the first signs of trouble.

Ready to trade today's Gold forecast? Here are the best Gold brokers to choose from.