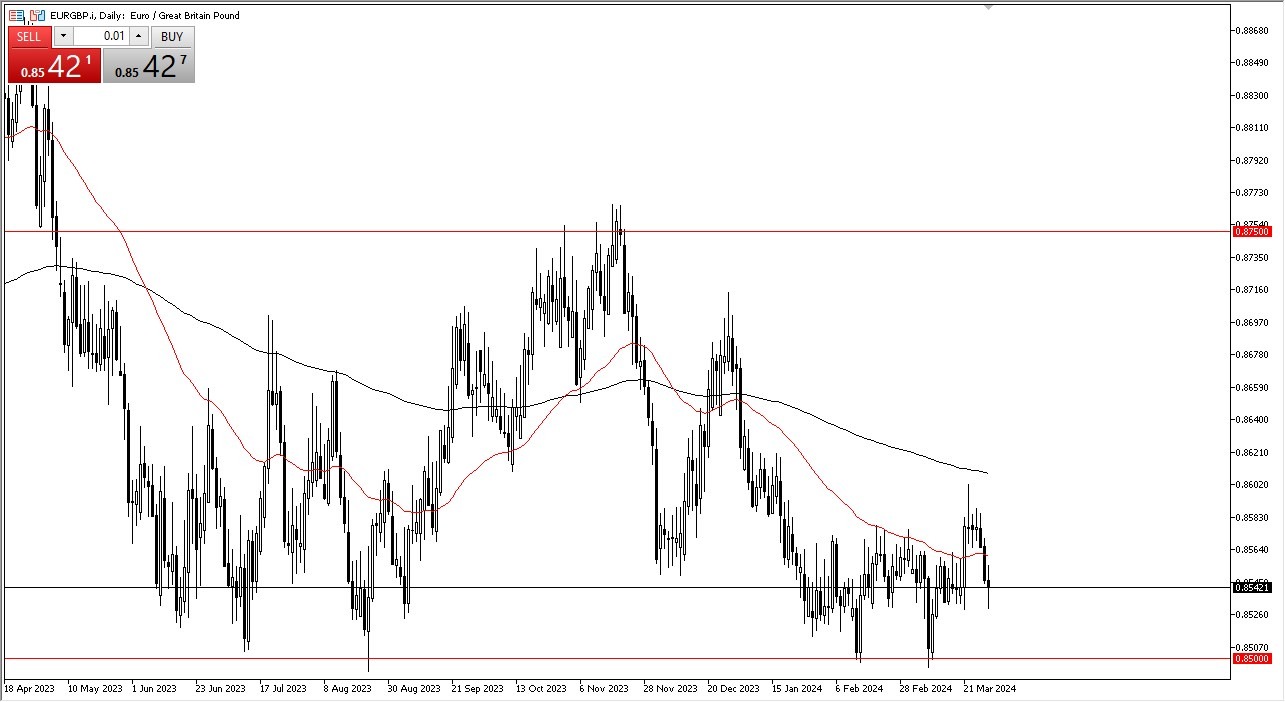

- The euro has gone back and forth during the trading session on Friday, as we continue to dance around the 0.8550 level.

- This is the middle of the overall consolidation area, and therefore I think we get a situation where we could turn around and break above the top of the candlestick, further putting momentum into the bottoming pattern that has recently been formed.

- The 0.85 level underneath is a large, round, psychologically significant figure that a lot of people pay close attention to, as it is an area that not only has all of that going forward, but it also is an area where we have seen a lot of support previously.

If we break above the 50-Day EMA, then we could go looking to the 200-Day EMA above. That is just above the 0.86 level, and if we were to clear that I think that could send this market much higher. At this point on, then the market could go looking to the 0.87 level, and then eventually the 0.8750 level. That would obviously be a very bullish sign, but at this point in time it’s worth noting that this is a market that is notoriously choppy under the best of circumstances.

On the other hand, if we were to break down below the 0.85 level, then it opens up the possibility of a move down to the 0.84 level. All things being equal, this is a market that is testing a major area that will have to be very close to the minds of traders, and I think given of time it is probably going to be a situation where we have to make a bigger move, and once we do it’s probably going to be a nice swing trade just waiting to set up.

Position sizing is crucial

The position sizing is going to end up being the biggest thing that you want to do here, due to the fact that the PIP size is much bigger in this pair than it is many other currency pairs. Because of this, it may not need a massive move to make big profits, because this is a bit of a grinder, but it is a bigger contract. All things being equal, make sure you factor all of that into the picture.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.