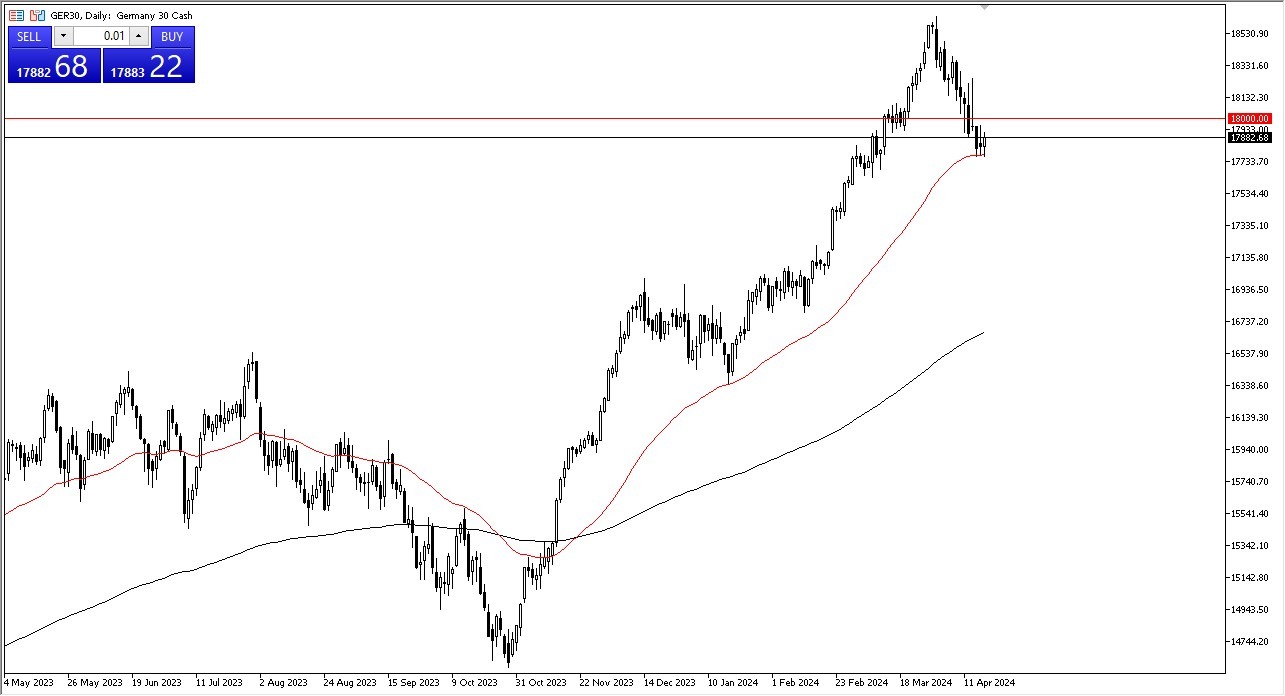

- The German DAX initially fell during the trading session on Thursday, reaching down to the 50-Day EMA.

- The 50-Day EMA is an indicator that a lot of people will be paying close attention to, and it is worth noting that we continue to find stabilization in this area.

- That being said, I also recognize that the €18,000 level above could offer a significant amount of resistance, so if we were to break above there then the DAX could really start to take off to the upside.

Short-term pullbacks continue to be buying opportunities

The DAX should continue to see plenty of buying opportunity is on each and every dip, due to the fact that the European Central Bank is likely to continue to see a lot of reasons to loosen monetary policy, and recently even stated that they were more likely than not going to do so sometime this summer. That directly affects stocks in the major indices such as the DAX, which of course represents the largest economy in the European Union, Germany.

Even if we were to break down below the 50-Day EMA, I think it’s probably only a matter of time before we find support, especially near the €17,500 level, perhaps even down to the €17,000 level underneath. That’s a large, round, psychologically significant figure that a lot of people would pay close attention to, therefore I think you have a situation where you are looking for value, and to simply take advantage of it. Furthermore, if the euro continues to slip a bit, that makes German exports cheaper, which is a huge sector of this index overall.

On a break above the €18,000 level, is likely that the DAX will go much higher, perhaps reaching recent highs, perhaps reaching the €20,000 level over the longer term. In general, we have been in an uptrend for some time, and therefore I think we have a situation where value hunters are starting to come back into the market to take advantage of the fact that the market has gotten cheap and corrected recently.

Ready to trade our DAX analysis? Here are the best CFD brokers to choose from.