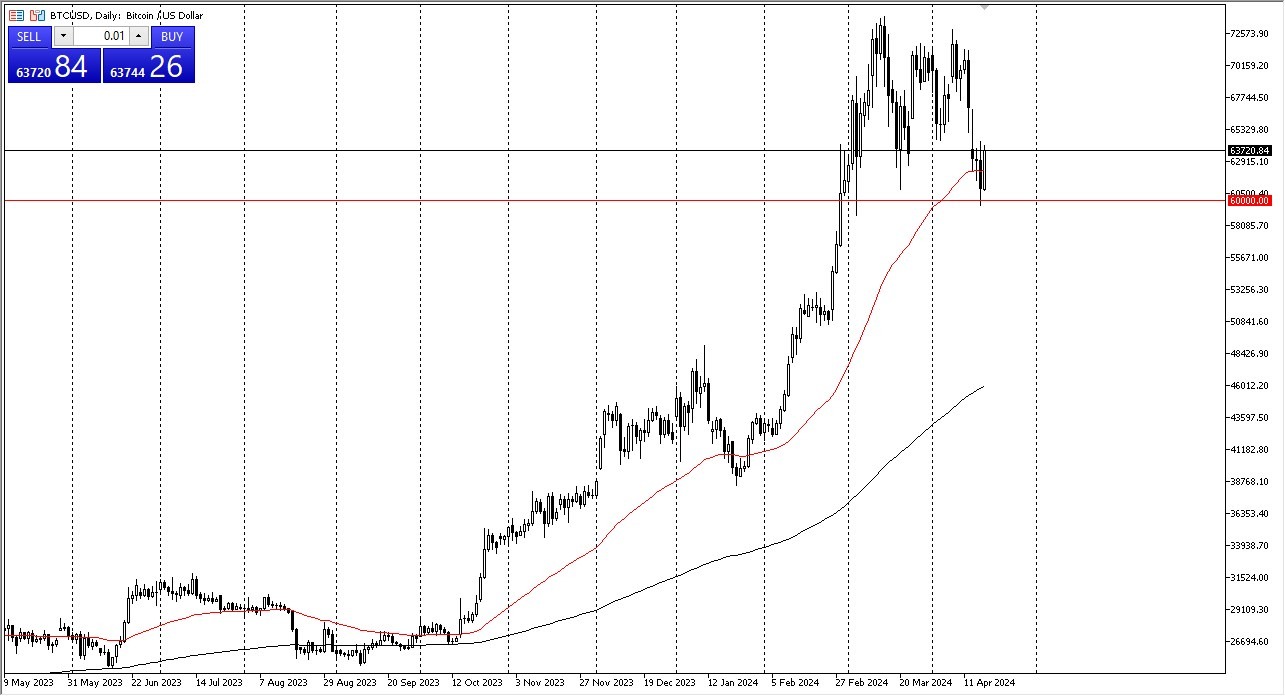

- Bitcoin has rallied significantly during the course of the trading session on Thursday, as we have seen the $60,000 level offer significant support.

- By doing what it has done during the day, it suggests that we are ready to go higher, and given enough time I think we in fact do just that.

- The 50-Day EMA is hanging around in the middle of the last couple of candlesticks, and therefore I think a lot of technical traders are starting to come back into this market.

Technical Analysis

The technical analysis for Bitcoin is rather straightforward, as we are in a significant uptrend, with the $60,000 level course offering a lot of psychological support, as well as previous structural support. All things being equal, this is a market that I think does continue to consolidate overall, meaning that we could go as high as the $74,000 level and not much will change. Yes, we have seen a significant pullback in the last week or so, but this is a market that ran 92% to the upside over the course of 6 weeks.

On the other hand, if we were to break down below the $60,000 level, then it’s likely that we could drop down to the $52,000 level. The $52,000 level is an area that previously has been resistance, and therefore it should have a certain amount of “market memory” attached to it, therefore I think that a lot of value hunters would be more than willing to step into the market and pick up “cheap coins.”

Ultimately, I think Bitcoin has to work off all of this excess fraud, but eventually we will continue to go much higher. If we can break above the $74,000 level, then I think at that point it opens up the possibility of Bitcoin going all the way to the $100,000 level over the longer term. Yes, I recognize that is a huge move, but we have seen an insatiable demand for the ETF, and that of course will continue to push this market to the upside. In general, this is a market that I think given enough time does go higher, but you are going to see a lot of noisy behavior, and of course volatility.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.