Fundamental Analysis & Market Sentiment

I wrote on 25th February that the best trade opportunities for the week were likely to be:

- Long of the NASDAQ 100 Index following a daily close above 17962. This set up on Thursday and the price rose by 1.39% on Friday.

- Long of the S&P 500 Index. This gave a win of 0.87%.

- Long of Bitcoin following a daily close above $52,161. This set up on Monday, and the price has risen by 13.54% since then.

- Long of Cocoa Futures but only with a small (half size) position size. The price fell by 0.21% over the week, so the loss here was 0.11% at a half-size position.

The overall result was a net win of 15.91%, resulting in a gain of 3.98% per asset.

Last week saw somewhat higher directional volatility in the Forex market. Volatility has been relatively low ever since 2024 started. There was important action in the US stock markets. Last week again saw new all-time high prices reached by the benchmark S&P 500 Index and the Nasdaq 100 Index.

This rise in stock markets occurred despite the CME’s FedWatch tool showing strongly lowering expectations of a May rate cut by the Federal Reserve. Markets now see only a 4% chance of a rate cut in March. Only 10% expect some kind of a rate cut at the subsequent meeting in May, down from 25% last week.

Last week's agenda was quite light, dominated by the US Core PCE Price Index and Preliminary GDP data. Core PCE Price Index data is closely watched as a measure of likely inflation, and it came in exactly as expected, with a month-on-month increase of 0.4%. Preliminary GDP data disappointed by a fraction, with the US economy’s growth indicated at an annualized rate of 3.2%.

Another important item last week was the Reserve Bank of New Zealand’s policy meeting. As expected, the RBNZ kept rates unchanged, but its policy statement took a more dovish tilt on inflation, sending the Kiwi lower. The New Zealand Dollar was the most volatile of all major currencies last week and the only one to fluctuate in value significantly.

Australian CPI data released last week showed inflation slightly lower than expected at 3.4%, while German Preliminary CPI was also lower than expected at 0.4% month-on-month. This could be taken as slightly good news on global inflation.

US stock markets rose firmly last week, boosted by widespread surprises to the upside in corporate earnings.

There were a few other important economic data releases last week:

- Canadian GDP – no growth was shown, while a month-on-month increase of 0.2% was expected.

- US Unemployment Claims – roughly as expected.

- US ISM Manufacturing PMI – roughly as expected.

- China Manufacturing PMI – exactly as expected.

The Week Ahead: 4th – 8th March

The most important items over the coming week will be Fed Chair Powell testifying before Congress, US Non-Farm Payrolls and Average Hourly Earnings, and policy meetings at the ECB and the Bank of Canada. This week has a busier data schedule.

Other major economic data releases this week will be, in likely order of importance:

- Swiss CPI (inflation) data

- Speech from the Governor of the Bank of Japan, Ueda

- US ISM Services PMI

- Australian GDP

- US JOLTS JOB OPENINGS

- US Unemployment Claims

- Canadian Unemployment Rate

Monthly Forecast March 2024

I made no monthly forecast for February, as no obvious long-term trend in the US Dollar could be relied upon at the start of the month.

I make no monthly forecast for March for the same reason.

Weekly Forecast 25th February 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy.

I again give no forecast this week.

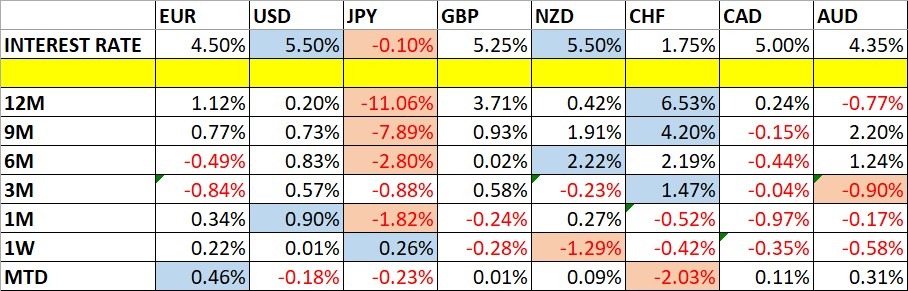

Directional volatility in the Forex market rose last week, with 15% of the most important currency pairs fluctuating by more than 1%. Due to the busier economic data release schedule, volatility will likely increase further over the coming week.

Last week saw relative strength in the Japanese Yen and relative weakness in the New Zealand Dollar.

You can trade these forecasts in a real or demo Forex brokerage account.

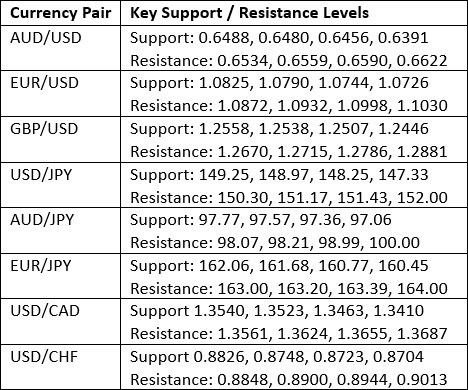

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed an unusually small candlestick that is both an inside bar and a doji, signifying consolidation. The weekly close presented a mixed long-term trend, as it was up on the price of 3 months ago but down compared to the price of 6 months ago.

Zooming out to look at the long-term price action shows that the US Dollar is not just consolidating; it is losing volatility and settling increasingly into the middle of a range.

The direction looks very uncertain here. It may be wise to trade currency crosses not involving the greenback, or other asset classes away from Forex.

NASDAQ 100 Index

The NASDAQ 100 Index rose firmly last week to trade at a new record high price, ending very near the high end of its range. These are bullish signs.

Although the expectation that the Fed will cut rates soon continues to decline, which would logically drag US stock markets, the long-term bullish momentum in stocks cannot be ignored.

I am very comfortable being long of the NASDAQ 100 Index right now.

S&P 500 Index

The S&P 500 Index closed higher last week after making a new record high, printing a normal-sized bullish candlestick. The price closed very near the range's high, which is bullish.

I see the S&P 500 Index as a buy, as it continues to advance firmly into bullish blue sky, despite the growing expectation the Fed will not cut rates in May.

Another reason the long-term outlook is bullish is that its first break to a fresh all-time high, as happened just a few weeks ago, has historically generated an advance of a median of 13% over the following year. Traders and investors should seriously consider going long here.

Bitcoin

Bitcoin made a firm bullish breakout four weeks ago, and after subsequently consolidating just below $53,000, it rose very strongly last week by more than 10% to make a new 2-year high. However, the past few days have seen Bitcoin give up some of its gains due to resistance.

I see Bitcoin as a buy, given legs by the recent approval of Bitcoin ETFs, which attracts more retail investment, although it will probably be best to wait for a new bullish breakout or a bounce at a key support level before doing so.

I would wait until we get a daily close above the resistance at $62,314 before entering a new long trade here.

USD/JPY

I had expected the level of ¥150.08 might act as support in the USD/JPY currency pair. The H1 price chart below shows how this level was rejected right at the start of last Tuesday’s New York session, marked by the up arrow in the price chart below, signalling the timing of this bullish rejection. The beginning of the New York session can be a great time to trade major currency pairs such as this one, which is also part of the overlap of the London/New York session.

This trade was profitable, giving a maximum reward-to-risk ratio of about 2 to 1 based on the size of the entry candlestick.

Cocoa Futures

Cocoa futures were in a strong bullish trend for well over a year, and last week; the price made another new multi-year high price yet again before falling to close the weekly candlestick as an indecisive doji. The price chart below applies linear regression analysis to the past 76 weeks and shows graphically what a great opportunity this has been on the long side over the long term. The price is up by about one-third in less than two months and has doubled since last June!

There are two things especially worth noticing here:

- The price is quite far above the linear regression channel.

- Volatility is extremely high, and Cocoa is getting much media attention.

These factors suggest a strong dip may likely happen soon, making it dangerous to enter a long trade unthinkingly here.

Trading commodities long on breakouts to new 6-month highs has been a profitable strategy over recent years, so I see this as a buy when we get a daily close above 6557. The price action ended the week with bullish momentum.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index.

- Long of the S&P 500 Index.

- Long of Bitcoin following a daily close above $62,314.

- Long of Cocoa Futures following a daily close above 6557.

Ready to trade our weekly Forex analysis? We've listed the best brokers to trade Forex worth using.