Fundamental Analysis & Market Sentiment

I wrote on 3rd March that the best trade opportunities for the week were likely to be:

- Long of the NASDAQ 100 Index. The price fell by 1.37% over the week.

- Long of the S&P 500 Index. The price fell by 0.14% over the week.

- Long of Bitcoin following a daily close above $62,314. This set up on Sunday, and the price has risen by 9.93% since then.

- Long of Cocoa Futures following a daily close above 6557. This set up on Monday, and the price has fallen by 0.94% since then.

The overall result was a net win of 7.48%, resulting in a gain of 1.87% per asset.

Last week saw higher directional volatility in the Forex market. Volatility has been relatively low ever since 2024 started but has risen over the past few weeks. There was important action in stock markets, Bitcoin, and the British Pound. Last week again saw new all-time high prices reached by the benchmark S&P 500 Index and the Nasdaq 100 Index.

This rise in stock markets occurred as the CME’s FedWatch tool shows increasing expectations of a May rate cut by the Federal Reserve, although only 24% expect such a cut. However, the prospect of a rate cut must be seen in the light of last Friday’s unexpectedly strong US jobs data, with US non-farm payrolls numbers showing that a net 275k new jobs were created, when the expectation was that only a little less than 200k would be. The data initially sent US stock market indices to new record highs before a sharp selloff later in the day left them lower over the week.

The persistent buoyancy of the US economy and the fact that inflation has shown signs it is not falling further have generated increased speculation that the Fed is simply not going to be able to cut rates until late this year, and maybe not even until 2025. If this sentiment gains traction, it will likely weigh on stock markets. It is perhaps supported by the line that Fed Chair Powell continues to take and that he reiterated in his testimony during the week before Congress: that progress has been made on bringing down inflation, but further progress needs to be made and is not assured.

Another important item last week was the European Central Bank’s policy meeting. As expected, the ECB kept rates unchanged, but it lowered its inflation forecast, giving a little more hope to the prospect of a rate cut.

There were a few other important economic data releases last week:

- Swiss CPI (inflation) data – this came in slightly higher than expected, showing a month-on-month increase of 0.6% when only a 0.5% increase was expected.

- Speech from the Governor of the Bank of Japan, Ueda – this strengthened the Yen as the Bank is increasingly seeing enough wage inflation to finally begin to pivot away from its ultra-loose monetary policy.

- US ISM Services PMI – this was roughly as expected.

- Australian GDP – as expected.

- US JOLTS Job Openings – this was roughly as expected.

- US Unemployment Claims – exactly as expected.

- Canadian Unemployment Rate – exactly as expected, a small increase to 5.8%.

The Week Ahead: 11th – 15th March

The most important item by far over the coming week will be the release of US CPI (inflation) data, which is expected to remain unchanged at an annualized rate of 3.1%. Apart from this, the coming week has a relatively light data schedule, although there are a few other important items:

- US PPI

- US Retail Sales

- US 10-Year Bond Auction

- US 30-Year Bond Auction

- UK GDP

- US Unemployment Claims

- US Empire State Manufacturing Index

- UK Claimant Count Change (Unemployment Claims)

- US Preliminary UoM Consumer Sentiment

Monthly Forecast March 2024

I made no monthly forecast for March, as no obvious long-term trend in the US Dollar could be relied upon at the start of the month.

Weekly Forecast 10th March 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy.

I again give no forecast this week.

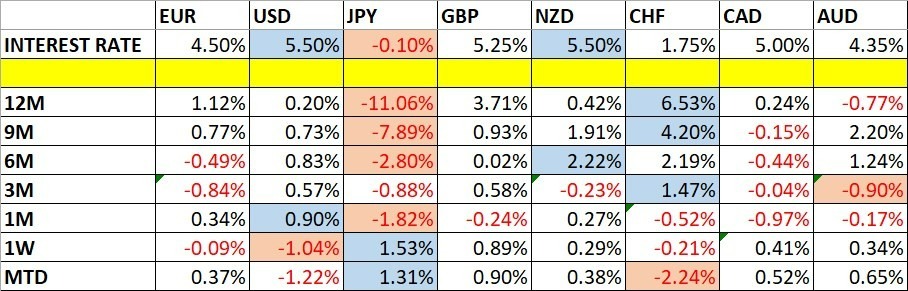

Directional volatility in the Forex market rose last week, with one third of the most important currency pairs fluctuating by more than 1%. If the US CPI data release surprises, volatility will likely increase further over the coming week.

Last week saw relative strength in the Japanese Yen and relative weakness in the US Dollar.

You can trade these forecasts in a real or demo Forex brokerage account.

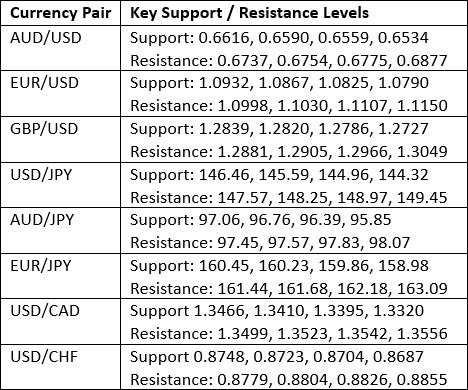

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed a fairly large bearish candlestick last week. The weekly close presented a renewed bearish long-term trend, as it was lower than the prices of both 3 and 6 months ago.

Zooming out to look at the long-term price action shows that the US Dollar is still trading within a consolidative long-term pattern, although there is certainly short-term bearish momentum.

I think it makes sense to trade the US Dollar short over the coming week. However, if the release of US CPI data comes in considerably higher than the expected 3.1%, that would likely see the Dollar strengthen regardless of its bearish technical considerations.

NASDAQ 100 Index

The NASDAQ 100 Index printed a bearish candlestick last week after briefly trading at a new record high price. This looks like a normal bearish retracement within a long-term bullish trend, although Friday’s fall was quite sharp.

The expectation that the Fed will cut rates in May has increased, but it is still very much a minority opinion. It makes sense that this rally might run out of steam.

I am very comfortable being long of the NASDAQ 100 Index right now, but before entering a new long trade, I want to see a new record high daily close above 18288.

S&P 500 Index

The S&P 500 Index printed a doji candlestick last week after making a new record high.

The expectation that the Fed will cut rates in May has increased, but it is still very much a minority opinion. It makes sense that this rally might run out of steam.

I am very comfortable being long of the S&P 500 Index right now, but before entering a new long trade, I want to see a new record high daily close above 5157.

Another reason the long-term outlook is bullish is that its first break to a fresh all-time high, as happened just a few weeks ago, has historically generated an advance of a median of 13% over the following year. Traders and investors should seriously consider looking to go long here once the price is breaking to new highs.

Bitcoin

Bitcoin made a firm bullish breakout five weeks ago, and after rising very strongly last week, it rose again last week by almost 10% to make a new 2-year high. The price is right now just under the high of the range, which is a bullish sign.

I see Bitcoin as a buy, given legs by the recent approval of Bitcoin ETFs, which attracts more retail investment.

As Bitcoin is trading right at its all-time high, it can be bought right now as a breakout, although there is always a risk of a sudden bearish reversal. It is important to use a trailing stop in this kind of trade.

GBP/USD

The GBP/USD currency pair made a strong bullish breakout above its range on Thursday, making its highest daily closing price since July 2023. This was followed by an up day on Friday after Thursday saw the close right at the top of that day’s range.

The US Dollar is weaker again, but the British Pound is the only currency that has really benefited from this technically by breaking to a significant new high.

Looking for long trades here makes sense, but with the Pound it usually makes sense to use a trailing stop loss no larger than 1 daily ATR at a long-term setting such as 100 days. I would not enter a new long trade here unless we see a daily close on Monday above $1.2854.

AUD/JPY

I had expected the level of ¥98.21 might act as resistance in the AUD/JPY currency pair. The H1 price chart below shows how this level was rejected right at the start of last Wednesday’s London session by an inside bar, marked by the down arrow in the price chart below, signalling the timing of this bearish rejection.

This trade was profitable, giving a maximum reward-to-risk ratio of more than 3 to 1 based on the size of the entry candlestick structure.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index following a daily close above 18288.

- Long of the S&P 500 Index following a daily close above 5157.

- Long of Bitcoin.

- Long of the GBP/USD currency pair following a daily close above $1.2854.

Ready to trade our weekly Forex forecast? Here are the best Forex brokers to choose from.