- The USD/RUB is trading near the 91.3200 price as of this writing.

- The currency pair has been able to continue to display an ability to correlate to the global Forex market in a rather significant manner, this while some in the ‘West’ claim that sanctions against Russia are having a negative effect on all aspects of the Russian economy.

- The trend lower in the USD/RUB via technical charts can be seen easily via a six month perspective.

And the rather choppy conditions of the USD/RUB via a three month technical chart can also be seen. However, these mid-term results correlate to the global Forex market which has seen other major currencies struggle in choppy conditions versus the USD. And again, as U.S economic data came in lackluster towards the end of last week, the USD/RUB also showed an ability to move slightly lower.

USD/RUB Speculative Wagers and the Reality of Transaction Fees

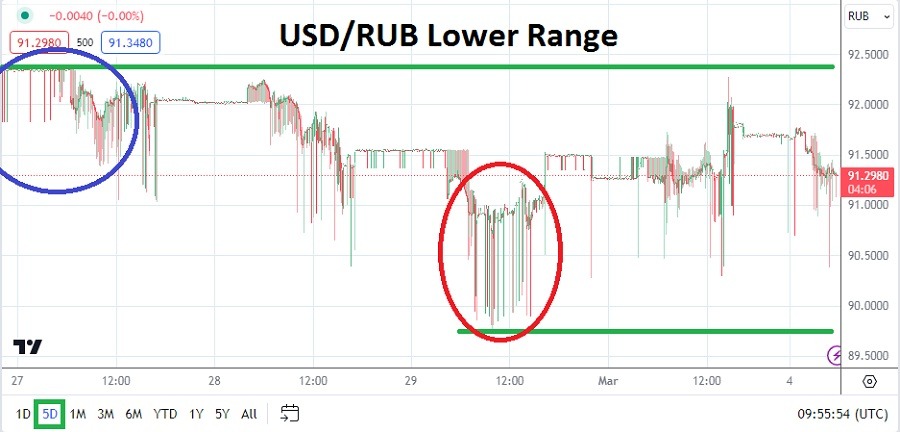

Traders trying to bet on the momentum of the USD/RUB face challenges. The spread via the bid and ask in the USD/RUB can be wide. This makes it very important for speculators of the USD/RUB to use entry price orders as they pursue their chosen direction in the currency pair. Also, the USD/RUB remains a lightly traded currency pair, meaning its thin volumes cause rapid fire spikes in a rather tight price range. The use of take profit targets when trading the USD/RUB is important. Overnight charges can be high too for holding the currency pair into the next day of trading.

The potential of the sudden changes of value also make it dangerous for USD/RUB traders when they are using stop losses, because while it is important to protect trades against lightning quick changes of value that go against a chosen trading direction, it is creates a rather vulnerable method of getting knocked out of a trade too quickly. Speculators within the USD/RUB are likely experienced traders, and hopefully they already know that the use of conservative leverage and a slightly wider stop loss may help them achieve better results.

Short-Term Considerations in the USD/RUB

Since spiking to a high of nearly 95.5100 on the 23rd of February, the USD/RUB has achieved a solid downturn. Last Thursday saw the USD/RUB fall momentarily below the 90.0000 and test the 89.8070 level.

- Traders may still want to look for downside movement in the USD/RUB, but they should not bet blindly.

- Price movement lower last week which was pronounced and being affected by behavioral sentiment from U.S data, is also certainly being affected by large players.

USD/RUB Short Term Outlook:

Current Resistance: 91.6090

Current Support: 90.9050

High Target: 92.0940

Low Target: 89.8910

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.