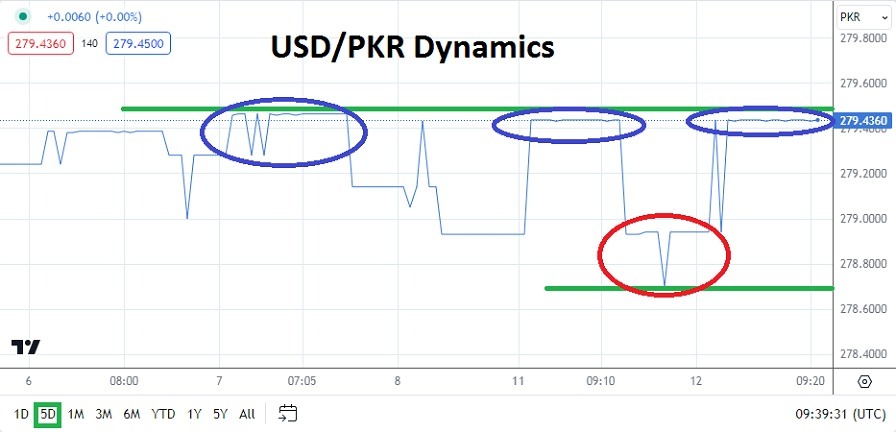

- The current price of the USD/PKR is near the 279.4360 level which has essentially proven to be the upper limit for the currency pair the past handful of days.

- Trading in the USD/PKR remains the realm of specialists who have extensive knowledge about the potential of the Pakistan Rupee and direction due to defined insights, or for those who like betting on highly unknown variables.

Yes, the USD/PKR has traded in a rather solid pattern for the past month and a half; support has also proven to be rather strong near the 279.0000 realm since the 30th of January. The upper band of value for the USD/PKR since the end of January has been near the 279.6000 mark. And yes there have been outliers higher and lower, but the well-defined range demonstrates that speculators operating in the USD/PKR sphere need patience, solid entry orders and the use of brokers who allow for positions to be held overnight without substantial transaction fees for the privilege of trading the currency pair.

Correlations to the Broad Forex Market Show Little Signs of Life

The USD/PKR shows almost no signs of correlation to the broad Forex market for the moment. Last week the U.S announced jobs numbers, in the middle of February the U.S released rather surprising CPI results, but neither last week’s data, nor February’s inflation statistics had a direct effect on the value of the currency pair. This means traders of the USD/PKR need to know something about the inner workings of Pakistan and its financial institutions, which is not easy information to gather.

Economically conditions in Pakistan remain challenging. The ability of the USD/PKR to move substantially lower from November of 2023 until the end of January this year is certainly of interest, but since making this move the currency pair has seemingly run into a brick wall as its value remains within an extremely tight range.

Today’s Inflation Numbers from the U.S and Little Affect

The U.S will release Consumer Price Index data today and traders of the USD/PKR are unlikely to see the results affect the value of the currency pair. Instead traders of the USD/PKR need to be able to technically decide on direction using support and resistance levels and hoping no vicious spikes are suddenly produced. And if a spike is produced speculators obviously want the USD/PKR to move in their chosen direction.

- The USD/PKR has shown a fractionally higher resistance level the past week, which may be a sign of potential weakness being felt in the Pakistan Rupee.

- Tactical support and resistance level trading is likely the best technique for the USD/PKR in the near-term. Speculators should be cautious.

Pakistani Rupee Short Term Outlook:

Current Resistance: 279.4410

Current Support: 278.9540

High Target: 279.4500

Low Target: 278.7150

Ready to trade our Forex daily analysis and predictions? Here are the best Pakistan trading brokers to choose from.