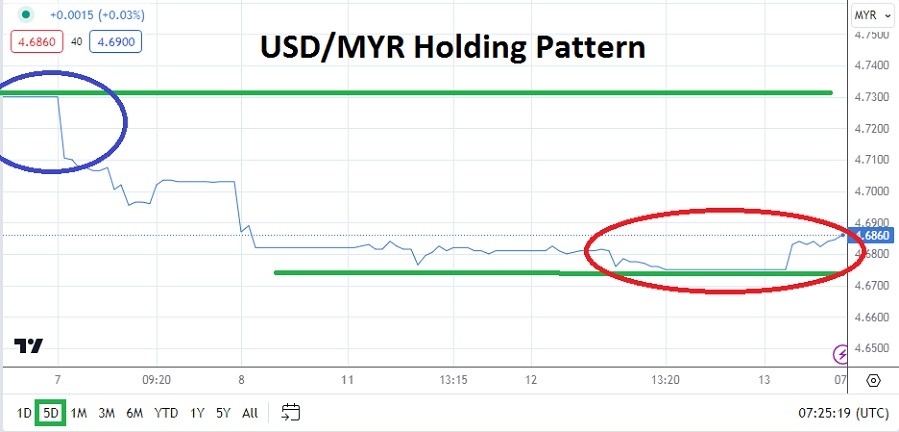

- As of this writing the USD/MYR is priced near the 4.6854 vicinity which is a lower value than the currency pair had traversed most of the last week.

- Yesterday saw the USD/MYR touch the 4.6750 ratio, and then in early trading today the currency pair ebbed slightly higher.

- Intriguingly the lower value produced yesterday broke below important mid-term support momentarily.

The USD/MYR is not a heavily traded currency pair. It hours are strictly limited by Malaysia in the open market, none the less it is a currency pair which has a rather well received amount of credibility. While definite domestic fiscal and debt issues are part of the Malaysian USD/MYR value, the currency pair also trades in correlation to the broad Forex market.

Reaction to Yesterday’s U.S Inflation Data Feels Muted

While the USD/MYR traded to important mid-term lows yesterday, the values produced essentially occurred before yesterday’s U.S CPI inflation report was published. Upon the release of the slightly higher than expected inflation numbers from the Consumer Price Index, the USD got stronger against many major currencies. It could be argued this morning’s slight climb higher in the USD/MYR happened because of yesterday’s U.S CPI results, but the move was small.

Speculatively the question is if the jump higher in the USD/MYR was quite enough? Is it possible an additional move higher may play out over the near-term and resistance levels may be tested? Tomorrow the U.S will release additional inflation data via the Producer Price Index, also Retail Sales numbers will be brought forth. While many financial institutions suspect the U.S Federal Reserve is going to become more dovish over the mid-term, yesterday’s stubborn inflation data is a clear sign the road to interest rate cuts may not be easily achieved, meaning Forex values could remain choppy for many currency pairs.

USD/MYR Movement Looking Forward

Since the 20th of February the USD/MYR has seen a definite bearish trend emerge and the question is if this momentum can continue to be generated without a reversal of some sort being demonstrated? Speculators should be careful while betting against trends in the Malaysian Ringgit, because the government is certainly involved in the management of the MYR’s value and has the ability to intervene when it deems important.

- Support for the USD/MYR ran into a rather durable number yesterday, which has seen a slight reversal being demonstrated.

- Some traders may be tempted to continue looking for a slight move higher in the USD/MYR in the near-term, based on the notion that financial institutions may feel the currency pair is within a rather ‘fair market’ equilibrium and that some buying could develop temporarily.

USD/MYR Short Term Outlook:

Current Resistance: 4.6880

Current Support: 4.6820

High Target: 4.6950

Low Target: 4.6775

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Malaysia to choose from.