- The US dollar has rallied slightly during the trading session on Tuesday, and midday has gained four basis points.

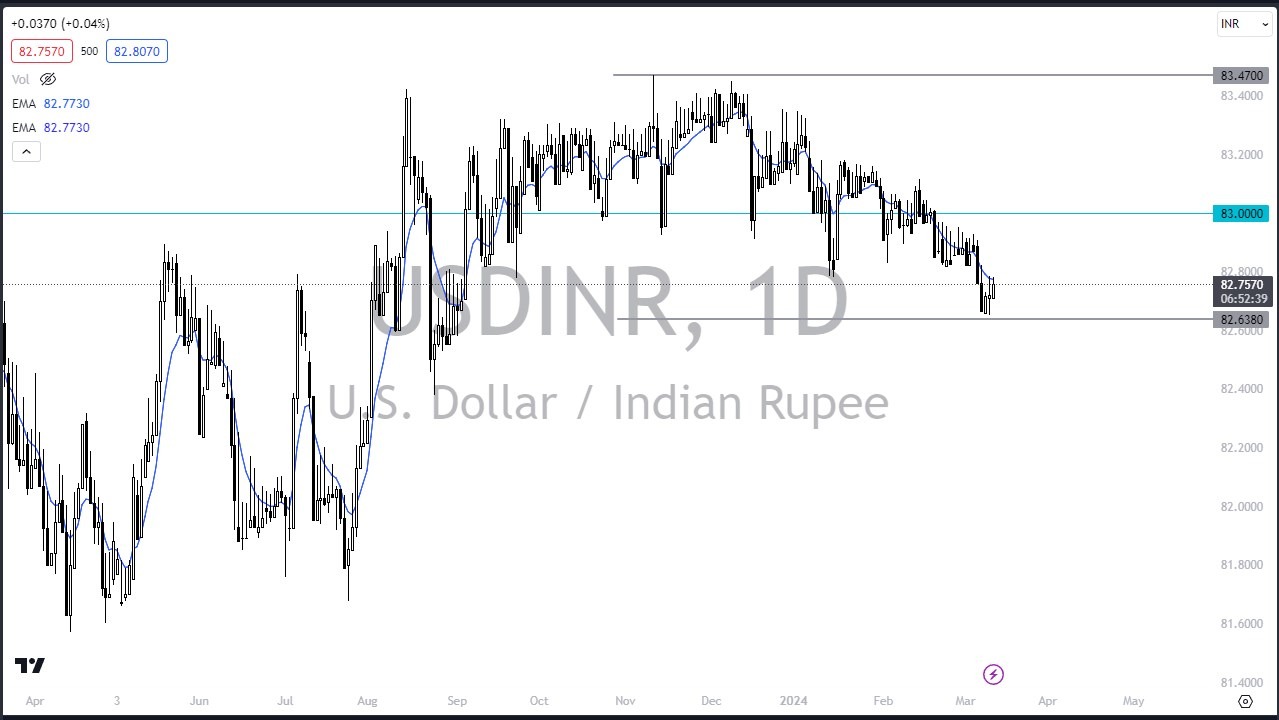

- Really, at this point in time, it looks like the nine EMA is going to offer a bit of resistance.

- And then after that, we have 83 rupee.

- Keep in mind that this is a market that tends to be very choppy so while it does make for longer term moves that you can be quite comfortable hanging on to, the reality is that the pair is a very minor one, and therefore it is heavily influenced by other external factors.

This is a market that's very difficult to trade due to the fact that it is heavily influenced by the Reserve Bank of India. It is not a free flowing currency, so typically what you will have is some type of range bound trading going forward. Right now, that looks to me like we are trying to set a range between 83.50 and 82.50, which is quite typical for the RBI to get involved. Remember, the Federal Reserve doesn't care about the Indian rupee, it's not that big of a currency, so it really doesn't affect the Americans, and therefore this all comes back to Central Bank's actions out of India. If we break down below 82.50, then that could open up another full rupee to the downside.

While I do like the US dollar, the Indian central bank has the ability to work its magic against the pair due to the fact that it is so thinly traded. Furthermore, I think that with the Federal Reserve likely to cut rates later this year, it means that traders will be possibly trying to short the dollar against multiple currencies, and in a slightly manipulated pair, it becomes more or less a simple investment that you can take advantage of.

Ultimately, I think this is a market that will eventually find buyers underneath but right now it doesn't look like we have that momentum or stability to get things moving in the other direction. Pay close attention to the Federal Reserve, because that could be the one wild card in this pair.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out