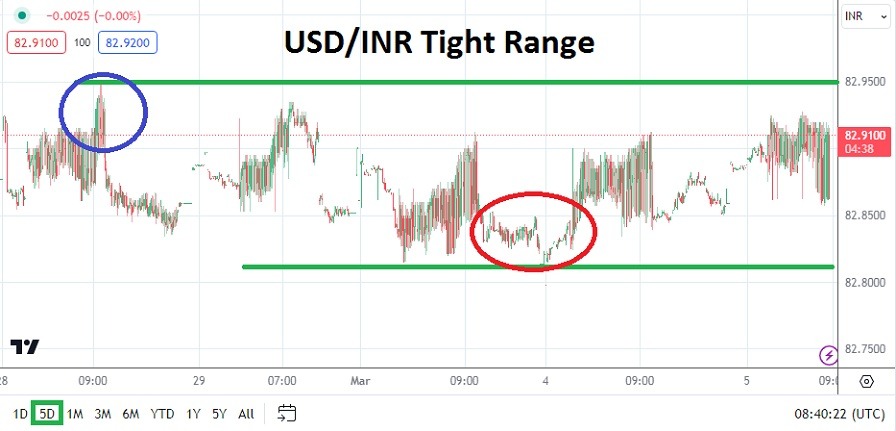

- As of this writing the price of the USD/INR is near the 82.8800 level depending on the current bid and asks ratios within the currency pair.

- The USD/INR has provided the public of India with a steady and known value range which is a good thing and one that the Indian government likely wants to continue leading up to the national elections.

- There has been an incremental downwards trend emerging, but it is likely being controlled with a strong hand.

Day traders in the USD/INR who want to speculate on the currency pair will certainly need to consider the use of different tactics as opposed to ones they would usually practice when pursuing a currency pair. The consistency of the price range in the USD/INR over the past two weeks is rather dramatic. While there are certainly price changes being exhibited in the USD/INR, to take advantage of them a trader needs to be very tactical via their speculative approach because of fast fluctuations.

Entry Orders and Price Targets to Profit in the USD/INR

The USD/INR should be looked at as a currency pair that is quiet, but always has the ability to become volatile. The slow pace of current price movement evaporates at certain moment and traders need to understand this point. The use of entry price orders to get into a USD/INR is important, because of the differential of the bid and ask values, which gives brokers the opportunity to hand you a rather ‘unkind’ price fill that is unexpected.

If a trader can enter the USD/INR with a price fill that they expect, then the next tactic is to make sure a solid take profit order is entered. The USD/INR is fluctuating in a constant state, but it moves quickly and having a working order that targets a goal is important regarding direction. As for picking a trend, the past few months of trading in the USD/INR has been downward, but price velocity has not been quick which means pursuing fast trades may not be easy.

U.S Economic Data and Reserve Bank of India

Recent economic data in the U.S has been weaker than expected, this has created the notion among financial institutions the USD should trend in a weaker manner over the mid-term. However, due to the considerations USD/INR traders need to give regarding the potential of Reserve Bank of India ‘oversight’, speculators need to remain cautious in their outlooks.

- If prices for the USD/INR can be sustained below the 82.9000 level and the 82.8700 mark is challenged in the short and near-term this could be of interest regarding bearish sentiment.

- The ability of the USD/INR to test lower depths yesterday near the 82.8200 mark certainly caused a reversal higher, traders may be tempted to wager on downside momentum on prices above the 82.9000 vicinity and then reverse with buying when known support is challenged. The use of take profit and stop loss orders is urged in the near-term.

USD/INR Short Term Outlook:

Current Resistance: 82.9160

Current Support: 82.8710

High Target: 82.9290

Low Target: 82.8210

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.