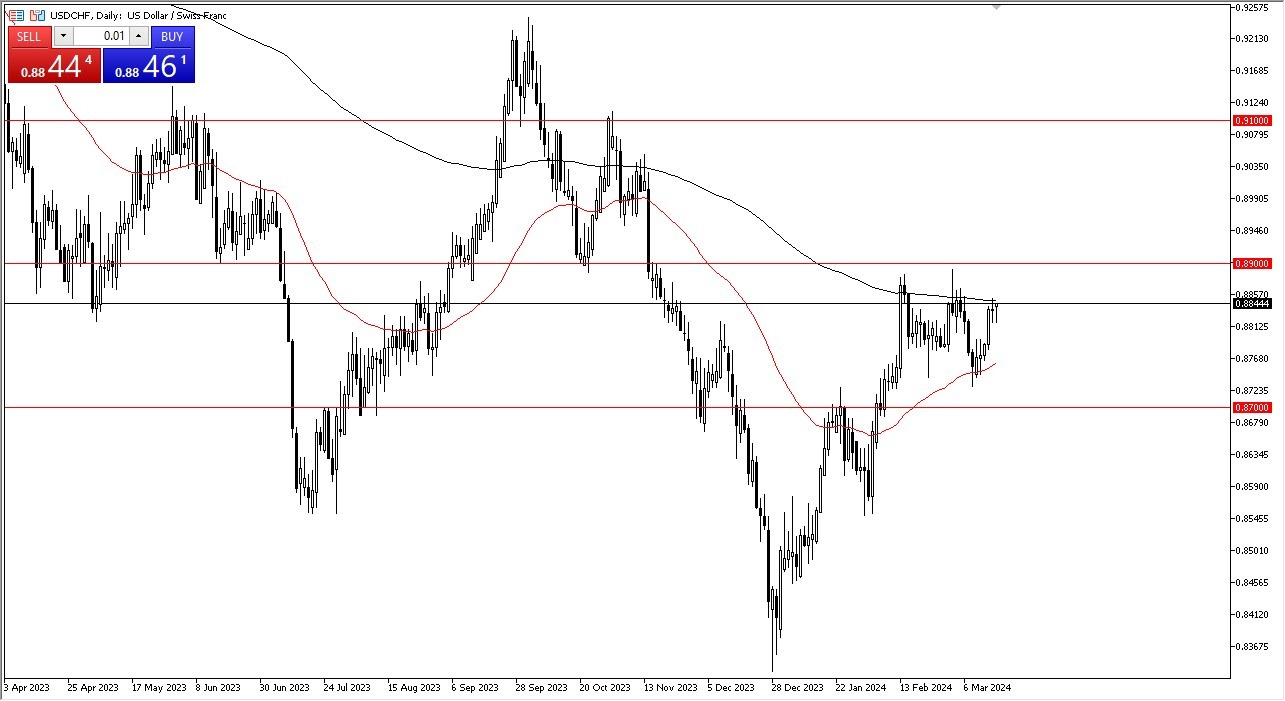

- The dollar initially pulled back against the Swiss franc in trading on Monday as we continue to see a lot of noisy behavior.

- This week will be particularly interesting due to the fact that we have the Federal Reserve and the Swiss National Bank both giving interest rate decisions and therefore, this is likely to be a very volatile pair.

This Pair Should Be Important This Week

That being said, you should be paying close attention to it because it may be one of the places where we have the most opportunity. The 200 day EMA sitting just above, of course, has its own influence. But if we can break above there, then the 0.89 level is your next target. Ultimately, I do think this is a situation where you continue to buy dibs based on interest rate differential and the fact that it's very likely the Swiss National Bank cuts interest rates much quicker than the Federal Reserve does. If we can break above the 0.89 level, then I think it does open up the possibility of a much bigger move, perhaps to the 0.91 level.

Underneath, not only do we have the 50-day EMA offering potential support, but I also believe that the 0.8750 level is an area that you'll be watching for potential support. So, with that, I do think that we've somewhat made a bottom. The Swiss National Bank certainly looks quite a bit more dovish than the Fed does right now. And as long as that's the case, I just don't see how this pair breaks down other than some type of risk off situation. But even then, you're going to see the US dollar hold its own. After all, it is also a safety currency, so if the Franc were to rally, it will do so with more momentum against riskier currencies around the world and although the Franc could strengthen against the greenback, it won’t do it as rapidly.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.