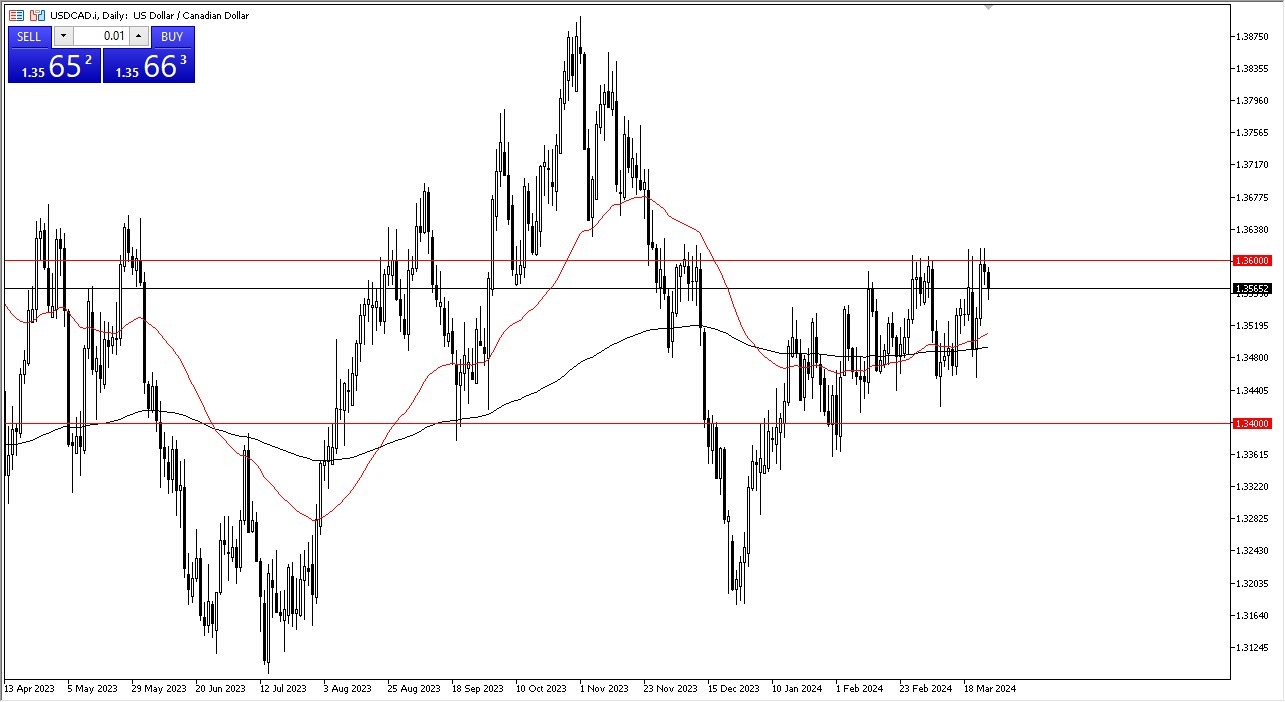

- The US dollar has fallen a bit against the Canadian dollar during the trading session on Tuesday.

- Ultimately, this is a market that I think eventually does try to break out to the upside, but the 1.36 level is an area that obviously has been major resistance.

- If we can break above that area, then I think it frees the US dollar to go much higher, which of course could be bad news for a lot of other risk assets, but at this point in time it looks like this currency pair was still facing quite a bit of noise in this general vicinity.

Crude oil

Crude oil seemingly has nothing to do with this pair at the moment, which does happen from time to time. Keep in mind that the Americans produce more crude oil than they ever have, so when it comes to the Canadian dollar, perhaps the influence of crude is in a strong against the greenback as it once was. Canada is currently facing a significant amount of economic grinding away, and therefore it makes a certain amount of sense that we would see the Canadian dollar on the back foot to its southern neighbor.

Ultimately, it looks like there is a significant amount of support underneath, especially near the 50-Day EMA and the 200-Day EMA, presently sitting around the psychologically significant 1.35 level. If we were to break down below there for some reason, then the market will almost certainly look at the 1.34 level as support based on “market memory.” This is an area that we seen a lot of support previously, so it does make quite a bit of sense that we see this as a situation where you continue to buy the dips, and of course get much more aggressive above the 1.36 level. Between now and then, it could be a little bit noisy, but that’s nothing new for this pair as there is a lot of business conducted between the United States and Canada, and therefore the currency pair does tend to be choppy due to all of that volume.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform Canada to choose from.