- I just don't see that changing anytime soon because of the idea of loosening monetary policy and the fact that momentum tends to feed upon itself.

- The S&P 500 finds buyers every time it dips. This will continue to be the case going forward.

- This is a situation where the momentum continues to be a big deal, and possibly the biggest driver.

The S&P 500

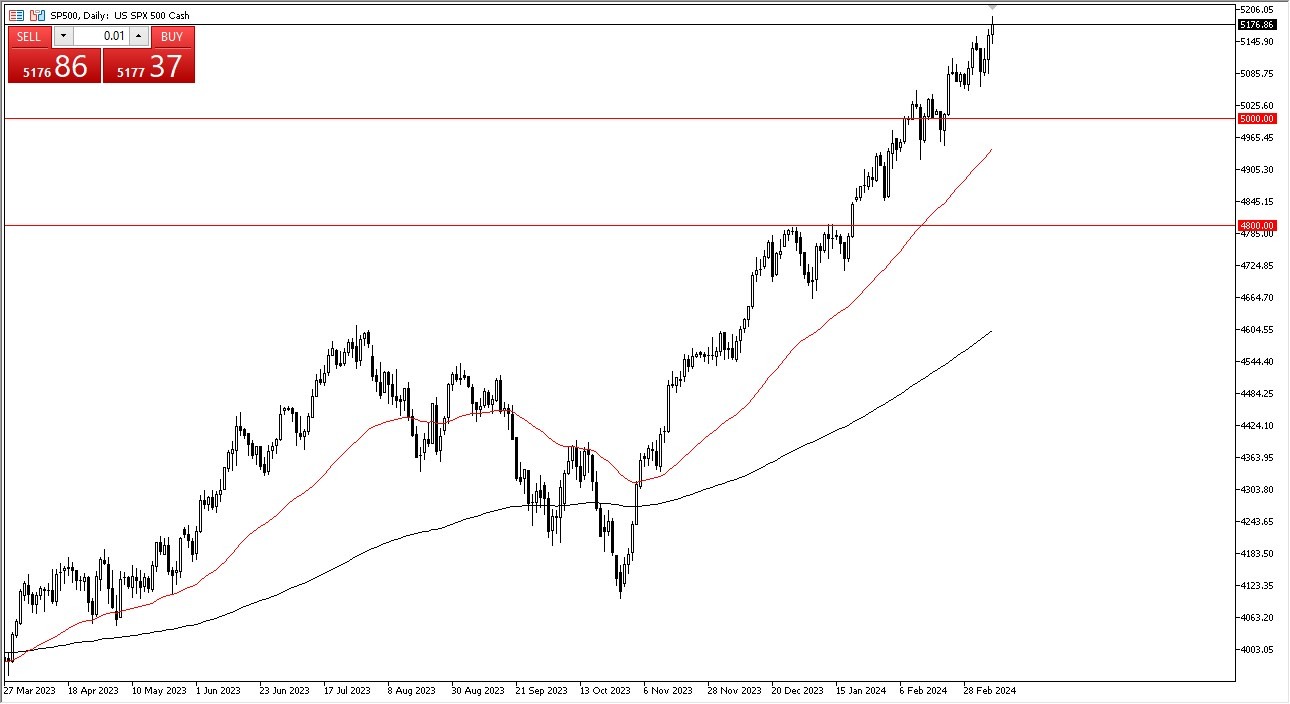

The S&P 500 gave up during Friday's trading session, but it soon recovered and began to rise as we learned from the jobs report. In the end, this is a market that I believe we will continue to rise in, so every time it declines, I believe we should just look for value every day and try to take advantage of it. I am not interested in shorting the S&P 500, and the fact that the jobs report appears to be slightly declining suggests that Wall Street will likely keep hooting about the prospect of lower interest rates in the future. The 5100 level is a possible support level that is below. The 5000 level comes next, and in my opinion, it represents a hard floor in the market.

The 50-day exponential moving average is rapidly approaching that region; however, in the end, there will be individuals eager to pursue us whenever we decline. The stock market doesn't start to weaken until there is a significant change in monetary policy, possibly as a result of panic. I do believe that this market will continue to rise and become somewhat trapped in a feedback loop given enough time.

Until we at the very least break below the 50-day EMA, I have no interest in shorting. Naturally, we would need a compelling reason before taking that action. As of right now, Wall Street continues to revel in the prospect of loose money at year's end, even though we don't have it. Right now, the question is whether or not the Federal Reserve will deliver it eventually. However, as Jerome Powell said this week in front of Congress, it appears that they will be sending lower rates down the pipe later this year. Once more, I enjoy purchasing dips to acquire value.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.