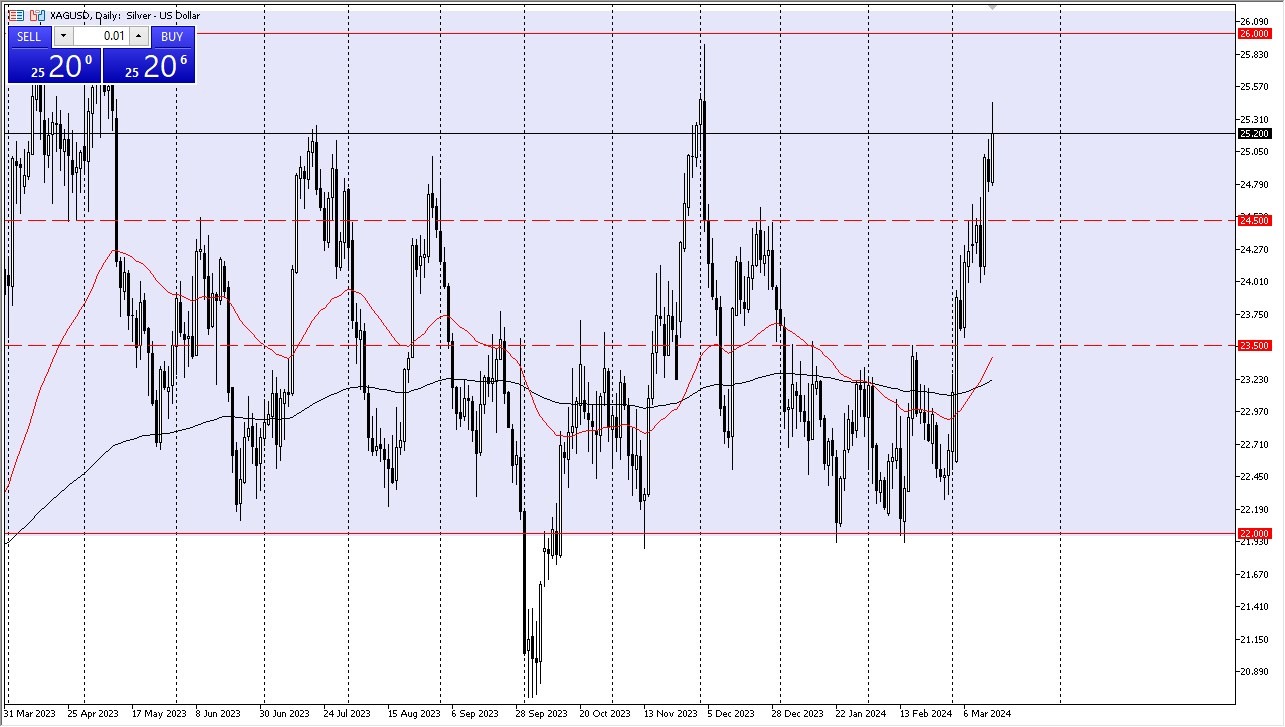

- Silver rallied significantly during the trading session on Friday, reaching well above the $25 level.

- All things being equal, the market has tried to continue to rally toward the $26 level, and therefore I think you have got a situation where every time we get a short-term pullback, buyers will be willing to step in and pick this market.

- After all, silver has been extraordinarily bullish as of late, and I just don’t see that changing anytime soon.

Silver likely heading to $26

The $26 level above has been a significant resistance barrier multiple times over the longer-term, and therefore I think a lot of people will be paying close attention to it. If we can continue to plow higher, eventually we will have to come to terms with this level. This is a level that has been very difficult to deal with for some time, therefore if we can break above it I think it will truly unleash quite a bit of FOMO trading onto the market. That being said, I don’t think it’s that easily done and I think a lot of people will continue to look at this through the prism of a huge range bound type of scenario.

Underneath, we have the $24.50 level offering a significant amount of support, as it previously had been significant resistance. The “market memory” in this area certainly should have a large amount of influence on what happens next, but right now I don’t think that is something that you need to be overly concerned about other than it makes for a nice entry price and of course people will continue to pay close attention to it. If we were to break down below there, then it could send the market down even further, perhaps down to the 50 day EMA.

In general, silver continues to rally due to central banks around the world cutting interest rates later this year, and of course we have a lot of geopolitical concerns that have people running into precious metals. With that being the case, I think it’s probably only a matter time before we see traders continue to find value on each and every drop.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.