- The markets are currently attempting to price in geopolitical risk, central bank behavior, and a plethora of other issues, which is why silver is still quite noisy.

- In the end, position sizing will be critical, and your top priority will be safeguarding your account in this violent market, and because of this you have to make sure you don’t get overly excited about any one particular move.

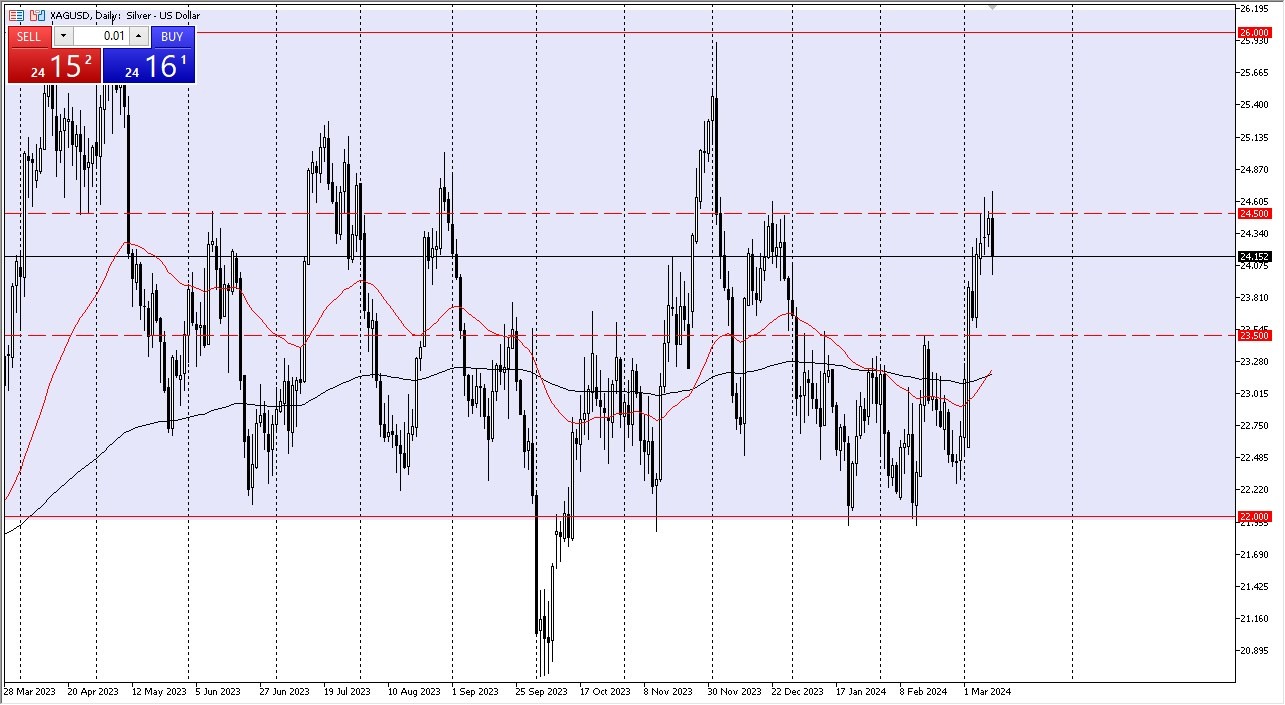

Silver Continues to Offer Value on Dips

Tuesday's trading session saw a brief decline in the silver market, but since then, it appears that things are improving. The CPI data were slightly hotter than expected, but not significantly, so there may be some recovery. It appears that we are attempting to pull out the highs here as a result. And it's highly likely that silver will try to reach the twenty-six dollar level if we can remove the Friday wick.

We'll have to wait and see how that turns out, but ultimately, precious metals have been on fire lately, so that would make some sense anyhow. My money continues to be invested in short-term pullbacks because there are clearly a lot of buyers out there in the first place. I believe you should keep a careful eye on the $23.50 level underneath, which was previously resistance and is now likely support for buyers at this point in time.

Having said that, I do think it is a good idea to profit from any value that arises, but I also understand that silver is highly volatile, so you should exercise caution right now as silver can be extremely dangerous. We'll probably eventually aim for the $26 mark, in my opinion. Most likely, the market will peak at that point. We are a bit over the top right now, but in the end, momentum will matter more than anything else.

Thus, watch out for temporary declines, but those ought to present a great deal of opportunity. Right now, I'm not interested in shorting metals. Overall, it seems as though the US dollar will continue to suffer. Anticipate volatility, and don't forget that PPI is on Thursday, which may lead to some problems. However, as of right now, it appears that we will keep moving higher.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.