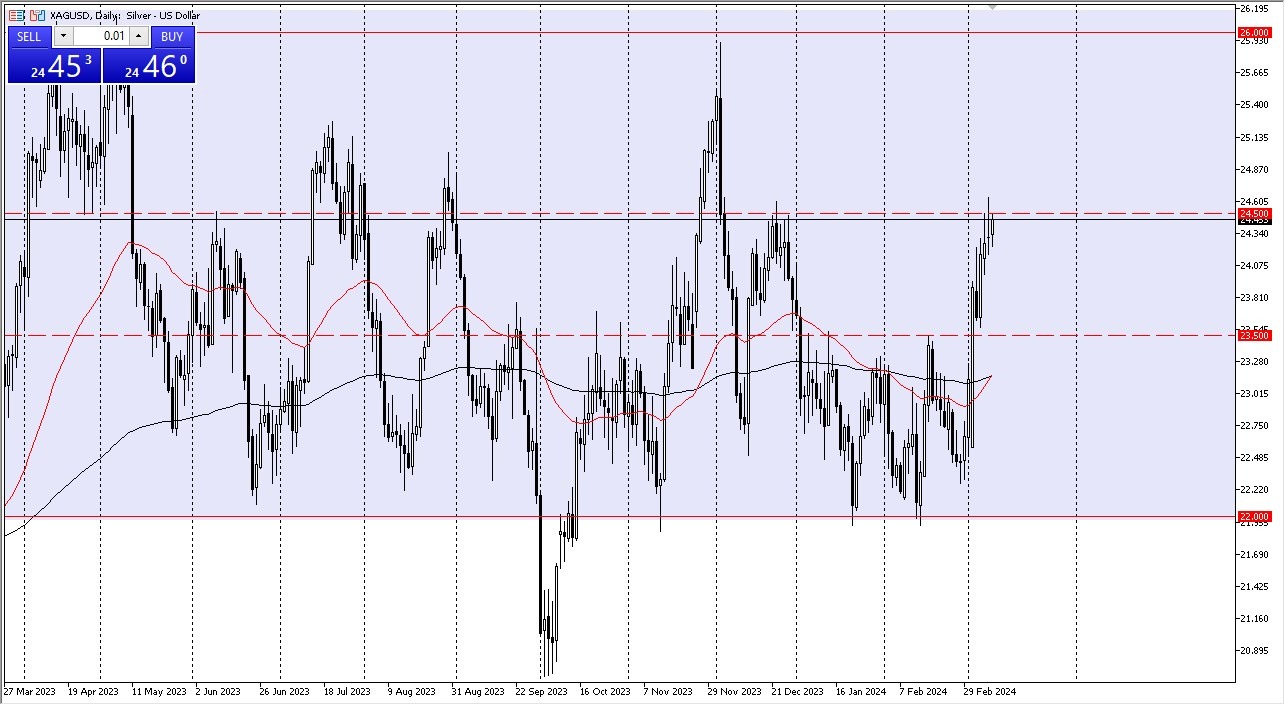

- Silver is still making a lot of noise, and right now, I believe this will be one of your more interesting "buy on the dips" opportunities because we are pressing up against significant resistance at $24.50.

- This is an area that I have been watching for some time.

Silver Looking at a Major Level

As you can see, during this early Monday trading session, the silver market has experienced a small rally. However, I believe that traders will continue to find that the $24.50 level offers a substantial amount of resistance in this scenario. It will be intriguing to watch how this turns out. I believe it will only be a matter of time before we break out, but everything that is showing us right now points to a pullback, and that pullback is probably going to continue to be viewed by traders as a value opportunity, especially in the vicinity of the $23.50 level.

For that reason, I believe I will wait for a small amount of a pullback. Remember that because silver is usually far more volatile than gold, it's a bit of a beast in and of itself. While it's true that gold has reached record highs, they also appear a little worn out, so I'm going to wait for it to recover before I start purchasing.

I believe the $26 level is accessible if we manage to break the shooting star on Friday. I believe there will be a lot of noise in this market overall. As usual, I believe you need to exercise extreme caution when sizing your positions. The 50-day EMA breaking above the 200-day EMA indicates that we do have a slight "Golden Cross" down here, which is probably worth mentioning. I don't usually give that much thought, but in this rash decision, it might have some significance. Only silver for now, but I'd really like to find a better deal. In the end, I do believe that silver has a lot of momentum going forward, but there will likely be a lot of volatility in the near term.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.